Herc Rentals: Swinging a Big Bat

Herc Rentals will buy H&E in a cash and stock deal (75%-25%) while United Rentals walks away from its all-cash deal.

Herc Rentals: Hoping for Ted Williams and not Cerrano…

H&E Equipment Rental (HEES) received a better bid from Herc Rentals (HRI) and United Rentals decided it would not counter. The 75%-25% cash stock deal will leave pro forma leverage at 3.8x with a plan to hit 3.0x within 2 years That is much higher leverage than the pre-deal HEES posted with its high B tier composite rating.

The pro forma balance sheet for HRI + HEES would be a single B tier level initially, so the ratings action comes down to the layers in the cash portion of the deal and HRI making its case with the rating agencies on the path to lower leverage in 24-months and what a 3.0x target will entail for capital structure mix.

Consolidation has been a recurring equipment rental industry theme, so there is little mystery in the underlying motivations to grow share, improve synergies, support EV multiples vs. peers, and ride the remainder of the megaproject demand while diversifying and cross-selling and the usual checklist. Taking on materially higher leverage is the price of entry. At least the URI integration success stories offer some templates for HRI to execute.

For URI, it will be a return to stock buybacks with no reason for a continued “pause.” For HRI, bondholders and stockholders will ponder and try to price in the execution risk on this scale of deal. HRI stock is off by -7.3% as we go to print.

The above stock price chart looks at United Rentals (no longer in the deal but the #1 player) vs. HRI and HEES since just before the tightening cycle kicked into gear in March 2022. We see URI pulling away from the pack during that time (see links at bottom for more URI commentaries). The industry has not missed the reality that M&A – if well executed at the right price – has been handsomely rewarded across the cycles in an industry experiencing secular growth and which offers a lot of room for small and mid-sized bolt-ons. Big bang deals have been handled more by URI.

The pro forma leverage of 3.8x and the relative size of the target vs. the acquirer is somewhat of a throwback. HRI is really tipping the scales with this one.

Leverage and debt will hit new highs…

The next M&A refinancing by HRI will be a bit further down the credit tiers but with many of the same core motivations that drove so many URI deals over the years. This move and the supply and rating risk will reprice the two HRI bonds wider to gear up for ratings uncertainty and a murkier cyclical outlook ahead.

HRI indicated they will refinance the HEES debt and fund the cash consideration for the deal to the tune of $4.5 bn in issuance. The nature of the cap structure mix across ABL and the bond layers was not disclosed from 1L to 2L to unsecured. We have seen the full range of bond layers over the years from the post-acquisition refinancing and new money issuance. We will see soon enough what the HRI plan will be on the debt mix. That will have significance for the final ratings tier outcome for pro forma Herc unsecured bond supply.

The above chart plots a longer-term journey since the HRI spin-off date. We look at price returns up through the middle of trading today. We again frame the equipment leasing names that were in the picture on this current deal, but we add the S&P 500 as a reminder that even where HRI and HEES have been underperforming the explosive rise of URI, they both still beat the broad market benchmarks.

For a wider range of comps vs. Herc with more time horizons, the above includes the equipment leasing companies as well as some notable capital goods players and equipment manufacturers. Today’s deal puts HEES at the top of the 1-year returns, but URI trounced the S&P 500 over 3, 5, and 10 years. That secular growth allows for high capex and M&A to both bring rewards as long as fleet management in total across the industry is well managed and pricing is not undermined.

New consolidator on the block?

Herc Rentals (HRI) is getting aggressive in this deal as it looks to close the gap with the Big Two of equipment rentals. Those two offer ample lessons on how to pull it off. United Rentals (see Credit Crib Note: United Rentals (URI) 11-14-24) and Ashtead (see Credit Crib Note: Ashtead Group plc (AHT) 11-21-24) have been the class of the group over 5 to 10 years, but the opportunities in a fragmented industry are still available. This deal is so outsized for HRI that they will be mired in this one for a few years cleaning up the balance sheet.

Herc conducted a conference call with slides this morning on its game plan for the deal, and many of the same motivations are similar to what drove URI and Ashtead into heavy growth mode and turbocharged their consolidation appetites. HRI is just later to the party after having a parent company (Hertz Car Rental) that had more than a few “issues” until the 2016 spin-off freed up Herc.

We have depreciated a lot of keyboards over the years and in prior research lines on Hertz research (see Credit Crib Note: Hertz (HTZ) 5-14-24). That is a separate story for other days, but it is safe to say the old consolidated Hertz entity kept Herc Rentals from doing many of the things it should have been doing even though it had been in the business much longer than United Rentals or Ashtead. That bad Hertz Car Rental influence led to a list of missed opportunities for Herc Rentals.

HRI thus had a lot of catching up to do, was inefficient and posted much lower margins than its peers as it went off on its own in 2016. HRI had an encumbered balance sheet and a fair amount of historical neglect and weak numbers to get past. HRI has now graduated from being a 2L bond issuer to an unsecured bond issuer. Ashtead moved on from 2L and moved to IG. HRI is a long way off from that. URI also has layers.

A few good reasons for the deal…

Valuation: The stock incentives are clear enough in a consolidating business if you don’t want to be left behind and be fodder for the Big Two. EV multiples at HRI lag the leaders but had closed the gap with the strong recent rally and ability to execute once unshackled from Hertz Car Rental. Using FactSet data, HRI cited EV multiples in its presentation (based on the next twelve months) of 6.0x for HRI. The multiple was lagging vs. 7.3x at Ashtead and 8.0x for URI.

Cash flow and synergies: HRI ran through their story line for revenue and cost rationalization synergies. The ability of old HEES shareholders to participate in those realized synergies is what tipped the balance toward HRI’s bid being a higher value.

On most equipment leasing conference calls the term “cross-selling” is a recurring catchphrase, but it has been proven in this industry and notably with the rise of specialty equipment vs. “genrent.” HRI has 453 locations and HEES has 160, and the advantages of clustering and market density echoed what you hear on other leasing company calls. The “clear line of sight” to an incremental $300 million of EBITDA was cited from top line and cost benefits.

Capital allocation flexibility over time: Equipment leasing companies have been big repurchasers of shares, and the leasing operators typically tap the brakes on buybacks after big deals. HRI can fund this deal now using some stock and point at the well-worn path of buying back shares later. They are just getting a late start on the URI model. URI reached a scale where acquisitions now are cash bids that are easily financed with debt.

Industry fundamentals set a good backdrop for confidence…

We recently updated our view on HRI (see Credit Crib Note: Herc Rentals (HRI) 12-6-24) after URI struck a deal to buy HEES. We have always been fans of industry fundamentals and saw URI as underrated in credit.

For HRI, this starts the test of their ability to successfully integrate a large-scale deal. URI has been a big bang dealmaker since its late 1990s IPO while Ashtead has been more of a sustained roll-up player in recent years with a small and midsized deal flavor in an industry that lacks numerous major players to buy at this point.

HRI financial highlights…

Below we update the Herc Rentals line item collection as food for thought. Then we drop in an H&E Equipment box for a little history.

Above and below we provide a few 4Q24 updated financial highlight charts on HRI for convenience. We were waiting for more filings to do a HEES report update, but that got shelved after the URI deal news. The most notable trend at HRI since 2019 was the steady rise in EBITDA margins closer to the industry leaders.

When looking at those lofty EBITDA margins, it is always important to keep in mind that the company must maintain a high rate of capex to sustain revenues and cash flows. So that mid-40% EBITDA has a lot of reinvestment capex on the other side. That is a loose parallel to the E&P sector. The ability to shrink the fleet in downturns is also readily available and one of the cash flow resilience attributes that makes equipment leasing a lot less risky.

The balance sheet at Herc at 2.5x does not leave a lot of room in the BB tier ratings range for a deal the scale of H&E and the leap to 3.8x and a goal of 3.0x in 24 months. That may be playing the long game, but the higher leverage will entail some repricing into the B tier on unsecured and perhaps an incremental haircut if more layers (1L, 2L) fold in as well. HRI cited $4.5 bn in newly issued debt on the investor call as it also refinances the HEES bonds.

The moving parts of the cash flow detailed above also remind HRI bondholders what a big bite this latest deal will be in the context of their acquisition history. The level of stock buybacks have been disproportionately lower for HRI relative to the more aggressive capital allocation mix for URI. This deal is a major bet on growth and executing on a very effective integration and reinvestment program at the new combined entity.

Summary of H&E highlights…

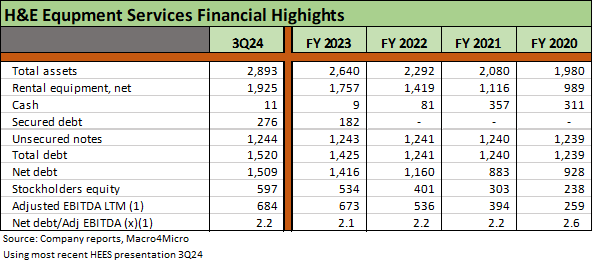

The above offers a summary set of metrics and line items for H&E since 2020. HEES has had more than a few moving parts and discontinued operations that made for some changes along the way, so we used the most recent 3Q24 presentation from HEES for the leverage and EBITDA lines.

We take the balance sheet items from the 3Q24 and 10Ks going back across time. One item that jumps out is that we see low 2 handle leverage on a name that has a high B tier composite rating. That leverage will now be moving materially higher on the newly combined entity to 3.8x with a plan to get to 3.0x.

We will be curious to see how the rating agencies will roll up these moving parts, and that outcome will depend on what layers and lines and timing of deleveraging they pitch. If the agencies are consistent with past criteria, there will be a long stretch in the single B tier for unsecured. That could shift the buyer base somewhat and pressure market clearing spreads. That does not change the fact that HRI would be a very solid HY Classic core holding, but that would not fit into a crossover label.

See also:

United Rentals 4Q24: Strong Numbers Set the Table 2-2-25

United Rentals: Bigger Meal, Same Recipe 1-14-25

Credit Crib Note: Herc Rentals (HRI) 12-6-24

Credit Crib Note: Ashtead Group plc (AHT) 11-21-24

Credit Crib Note: United Rentals (URI) 11-14-24

United Rentals: Finetuning Strong Run Rates on Equipment Demand 4-27-24

United Rentals: In the Market, Right on Cue 3-7-24

United Rentals: Another Billion Out of the Gate 3-4-24

United Rentals: Another Bellwether Supporting the Macro Health Story 1-31-24