Durable Goods June 25: Air Pocket N+1

We look at another month of major distortions to the headline durable goods print as the underlying trend reflects stability.

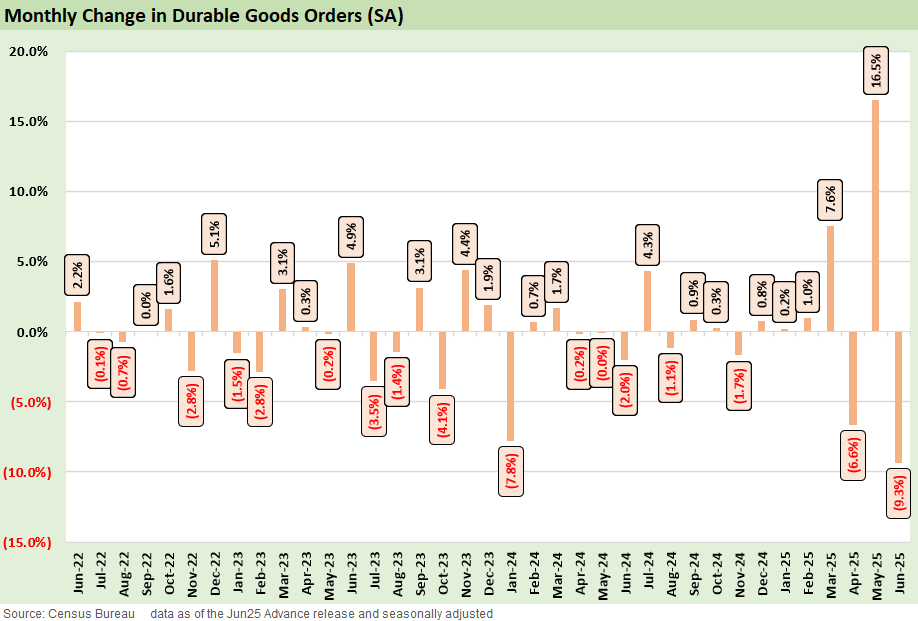

Headline durable goods orders fell -9.3% in June, reversing the +16.5% aircraft-driven surge in May. This is typical for months following large aircraft orders, though usually not on such a scale.

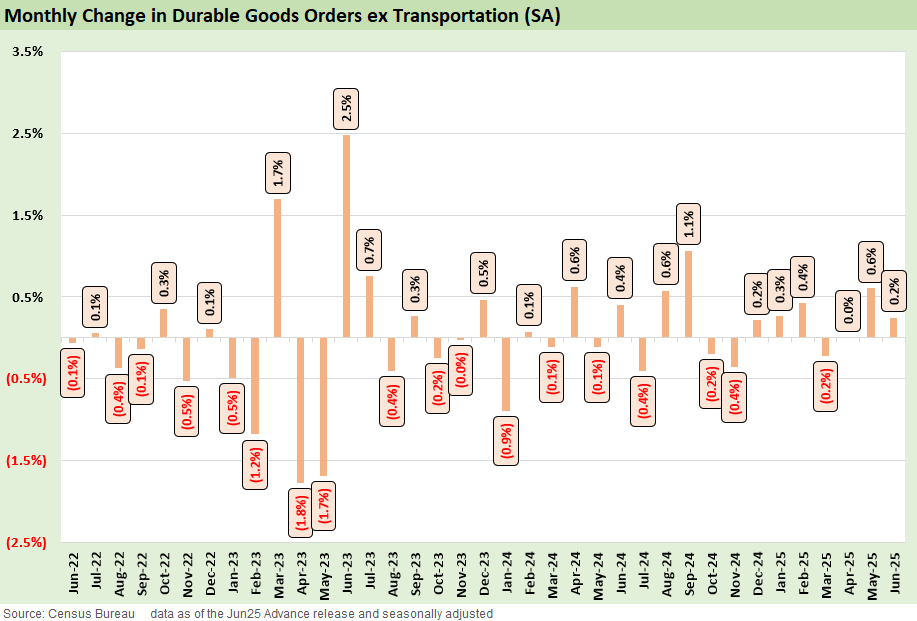

Ex-Transportation, durable goods orders rose +0.2% as the underlying data still shows signs of moderate growth in metals, computers, and electronics. Policy limbo around further trade deals may see more clarity as August 1st approaches (or is extended for some), but for now the flexible nature of tariff and uncertain cyclical trends does not provide much incentive for additional ambitious capex spend.

The recency bias on how high the reciprocal tariffs could have been leaves the 15% deal with Japan as a target for more trade partners. The EU has a focal point for what constitutes fair play as the #1 trade partner.

Even the 15% is a significant cost for importers and has major implications for the economics of capex decisions where those costs and adjustments can derail the viability of some projects. The potential for retaliation by trade partners still lurks but the ability of the EU and/or Canada to get to that point has been a surprise. Japan’s details need more complete transparency, but the Trump tariffs have been much harder on Canada, Mexico, and the EU. As we go to print, Trump has voiced doubt on a Canada deal happening by the deadline. Canada is a very high value added export market for the US (see US-Canada Trade: 35% Tariff Warning 7-11-25).

The headline drop of -9.3% for headline orders is the other side of the surge in May that was driven by the massive Boeing orders after Trump’s visit to Qatar last month. Those orders drove nondefense aircraft spending to surge +231% last month, and the normalization this month saw that sector see orders drop off to the tune of -52%. Headline swings like these months are a reminder of the size and influence of Boeing on the national picture, who now faces an enormous backlog at a time when production capability is still limited.

The ex-Transportation cut above peels away the most volatile aircraft layer for a read on core ordering trends. The positive momentum in May continued this month at a slow pace at +0.2%. Orders this year have grown modestly but at a steady pace as the incremental demand driven by IP capacity needs (e.g. power, data centers, etc.) have kept the ball rolling. The takeaway so far this year remains positive so far given macro uncertainty and muted growth expectations, even modest capex growth is a meaningful signal of resilience.

The need for a resolution on trade policy is still key for capital spending growth as there is still little reason to move now when the situation remains in flux. With easing from the Fed still expected in the coming months, many firms appear to be waiting for more certain cost structures and timing advantages before committing to large equipment outlays.

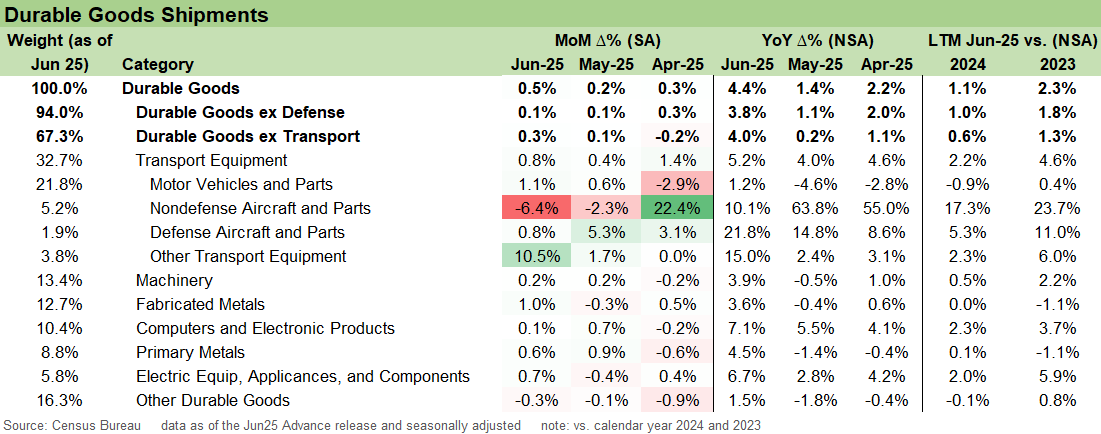

The above chart covers the underlying details and the ‘ex-defense’ and ‘ex-transport’ lines. Within the massive transport swing from +48.5% in May to -22.4% this month, there is still some positive news on motor vehicles recovery seeing two strong months after a poor April. However, the overall spend this year still leaves the trailing motor vehicle capex spend worse than 2024 with YTD numbers down 1.8% as tariff pressures mount in the industry. The auto production chain from the tiers of suppliers (Tier 1, 2, 3) to the OEMs still have a lot of moving parts to sort through in terms of the US vs. Mexico vs. EU production chain. The same is true for non-US transplants from Asia and the EU.

Below the transport lines, the core areas were broadly positive this month with only the Other goods category showing up negative. It is a very diverse grouping comprising almost 16% of the overall new orders and it covers more of the consumer discretionary items (small appliances, furniture, toys, etc.). Weakness here may reflect the softer housing data and lower housing turnover as the need for discretionary consumer durables has faded in kind. That mirrors the most recent retail sales prints as many of the larger purchase categories have flagged even as spending on everyday goods has stayed intact.

Shipments rose +0.5%, feeding directly into GDP. This lagging measure confirms that real activity trails order momentum, and its pace continues to mirror the anemic ex-transport growth.

Markets:

Taylor Morrison 2Q25: Resilient but Feeling the Same Macro Pressure 7-25-25

New Home Sales June 2025: Mixed Bag 7-24-25

Existing Home Sales June 2025: The Math Still Doesn’t Work 7-23-25

Housing Starts June 2025: Single Family Slips, Multifamily Bounces 7-18-25

Footnotes & Flashbacks: State of Yields 7-20-25

Footnotes & Flashbacks: Asset Returns 7-20-25

Mini Market Lookback: Macro Muddle, Political Spin 7-19-25

Housing Starts June 2025: Single Family Slips, Multifamily Bounces 7-18-25

Retail Sales Jun25: Staying Afloat 7-17-25

June 2025 Industrial Production: 2Q25 Growth, June Steady 7-16-25

CPI June 2025: Slow Flowthrough but Starting 7-15-25

Footnotes & Flashbacks: Credit Markets 7-14-25

Mini Market Lookback: Tariffs Run Amok, Part Deux 7-12-25

Mini Market Lookback: Bracing for Tariff Impact 7-5-25

Payrolls June 2025: Into the Weeds 7-3-25

Employment June 2025: A State and Local World 7-3-25

Asset Return Quilts for 2H24/1H25 7-1-25

JOLTS May 2025: Job Openings vs. Filling Openings 7-1-25

Midyear Excess Returns: Too little or just not losing? 7-1-25

Recent Tariff commentary:

US-Italy Trade: Top 15 Deficit, Smaller Stakes 7-18-25

US-France Trade: Tariff Trigger Points 7-17-25

Germany: Class of its own in EU Trade 7-16-24

US-Canada Trade: 35% Tariff Warning 7-11-25

India Tariffs: Changing the Music? 7-11-25

Taiwan: Tariffs and “What is an ally?” 7-10-25

US-Trade: The 50% Solution? 7-10-25

Tariff Man Meets Lord Jim 7-8-25

South Korea Tariffs: Just Don’t Hit Back? 7-8-25

Japan: Ally Attack? Risk Free? 7-7-25

US-Vietnam Trade: History has its Moments 7-5-25

US Trade in Goods April 2025: Imports Be Damned 6-5-25

Tariffs: Testing Trade Partner Mettle 6-3-25

US-UK Trade: Small Progress, Big Extrapolation 5-8-25

Tariffs: A Painful Bessent Moment on “Buyer Pays” 5-7-25

Trade: Uphill Battle for Facts and Concepts 5-6-25

Ships, Fees, Freight & Logistics Pain: More Inflation? 4-18-25

Tariffs, Pauses, and Piling On: Helter Skelter 4-11-25