US-France Trade: Tariff Trigger Points

We look at the US-France trade numbers from the top down and detail the import and export mix.

Seriously? Perfumes at #3? Wines at #4?

With France one of the dynamic duo of EU leading nations with Germany, we look at the leading import/export mix in US-France trade after the 30% tariff threat. France does not make the top 15 in total trade (imports + exports) with the US or in total trade deficits or total imports. France did make the top 15 in US exports at #12.

While we could not resist the French Connection image above, the bigger economic stakes for France are in commercial aircraft/parts (Airbus and suppliers) as the #1 import line to the US with the pharma sector at #2. Trump still has Section 232 plans percolating on those two product lines, and that could be enough for France to draw a line.

Making America safe from Chanel or Cartier is presumably not on the priority list. In contrast, France has always prided itself on its aerospace and defense prowess while numerous EU nations including France are major factors in pharma. Pharma and medicines is by far the #1 import from the total EU (see US-EU Trade: The Final Import/Export Mix 2024 2-11-25). With Trump talking about 200% tariffs in pharma, that one would be a bridge too far with enough already in process at a 30% blanket tariff.

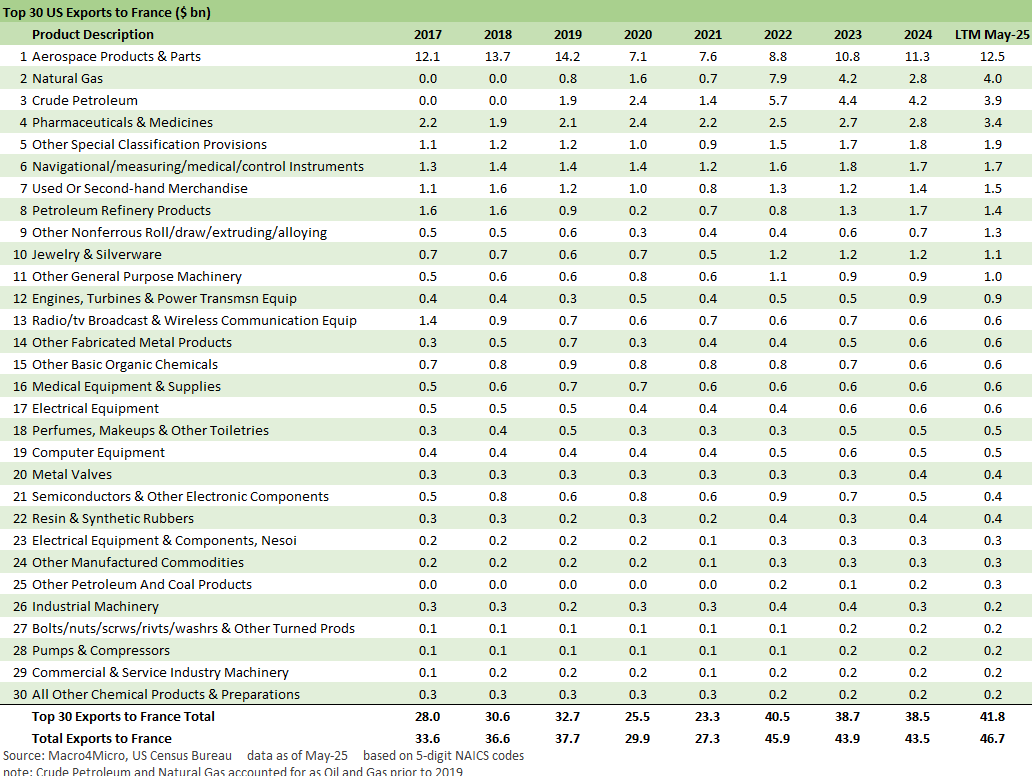

The lead exports to France from the US include Aerospace at #1 and natural gas and crude oil at #2 and #3, respectively. France can find alternatives for energy while the US has a small surplus in Aerospace on an LTM basis. The two are somewhat evenly matched on Boeing vs. Airbus. France has plenty of risk in a trade war but less than Germany (see Germany: Class of its own in EU Trade 7-16-24).

The above chart shows the timeline for the US-France goods trade deficit. The trade deficit between the US and France is dramatically smaller than what we see in Ireland, Germany, and Switzerland and even Italy. The fact remains, however, that US trade policy will be attacking aerospace, one of the most important industries in France. France has a very big target to aim at in Boeing and the extended supplier chain.

Airbus is also now operating and manufacturing in the US in Alabama, so the issues there are complicated for supplier chain tariffs. That offers a parallel to what Germany has with its BMW and Mercedes transplants in the US. The same is true for Japan and South Korea in auto manufacturing in the US. The high tariffs and attacking supplier chain costs can bring “human nature” (anger, betrayal) and domestic politics into the trade partner picture if their trade leaders are seen as weak and engaged in a mildly negotiated surrender. Trump is accustomed to people surrendering unconditionally (it is called Congress).

The fleet mix across major carriers in the EU and other targeted trade partners is a topic for another day. For example, Air France is heavy on Airbus for narrowbodies but has a hefty mix of Boeing widebodies. Those issues will be heating up and the same for defense procurement planning as the EU and other trade partners are being treated like “not allies” even in NATO. They will need to offer support to the “home team” EU manufacturers.

The above chart is an interesting list in terms of how much it contrasts with what we see in the Germany list with its much larger and more manufacturing-intensive mix. Our take on the German list is that outsized tariffs on the German imports would take a massive economic toll on the US buyers who made rational business line decisions to invest in such a wide range of products designed for their needs.

If the policy goal is to beef up the US industrial base, slamming the buyers of German equipment with tariff costs (“buyer pays”) and doing so without any idea of the effects or existence of substitutes sends signals that the US is in fact unfriendly to manufacturing by making unilateral, poorly researched decisions that are one layer deep. We also saw that dubious governance in the false use of the term “reciprocal” in tariffs that set the market off on Liberation Day (see links at bottom). The “formula” used to set tariffs overall was broadly lampooned.

The “reciprocal” tariffs were about eliminating trade deficits. They had nothing to do with any well-researched attempt to match the trade partners’ tariffs. The lack of analysis or any concrete conceptual or factual foundation unnerved the markets even away from the outsized tariffs assigned. The material differences in mix across Germany, France, Ireland, and Switzerland in the import mix just make Trump’s blanket tariffs seem like unilateral aggression with little homework behind it.

The export list from the US to France has the usual outsized energy concentration at #2 (natural gas) and #3 (crude oil) and #8 (refined products). The list is led by Aerospace at #1 and Pharma at #4. Overall, France could get oil and LNG from other trade partners over time (wake up Canada) while the Aerospace battle brings the global duopoly into the picture with Brazil (Embraer), Canada (Bombardier) and China (Comac) watching closely. A major trade war between the US and the EU as its #1 trade partner could shake up some of the flows between the EU and other trade partners under intensive attack.

The above chart plots the time series for US -France imports and exports since the early 1990s. That timeline starts with the European currency crisis, runs across the 1999 euro launch, and then across the financial systemic crisis of 2008-2009, the sovereign crisis of 2010-2012 (2011 peak) and COVID in 2020. The theme has been one of growth in total trade but at a slower rate of growth than in most other Top 10 GDP nations.

Markets:

June 2025 Industrial Production: 2Q25 Growth, June Steady 7-16-25

CPI June 2025: Slow Flowthrough but Starting 7-15-25

Footnotes & Flashbacks: Credit Markets 7-14-25

Footnotes & Flashbacks: State of Yields 7-13-25

Footnotes & Flashbacks: Asset Returns 7-12-25

Mini Market Lookback: Tariffs Run Amok, Part Deux 7-12-25

Mini Market Lookback: Bracing for Tariff Impact 7-5-25

Payrolls June 2025: Into the Weeds 7-3-25

Employment June 2025: A State and Local World 7-3-25

Asset Return Quilts for 2H24/1H25 7-1-25

JOLTS May 2025: Job Openings vs. Filling Openings 7-1-25

Midyear Excess Returns: Too little or just not losing? 7-1-25

Recent Tariff commentary:

Germany: Class of its own in EU Trade 7-16-24

US-Canada Trade: 35% Tariff Warning 7-11-25

India Tariffs: Changing the Music? 7-11-25

Taiwan: Tariffs and “What is an ally?” 7-10-25

US-Trade: The 50% Solution? 7-10-25

Tariff Man Meets Lord Jim 7-8-25

South Korea Tariffs: Just Don’t Hit Back? 7-8-25

Japan: Ally Attack? Risk Free? 7-7-25

US-Vietnam Trade: History has its Moments 7-5-25

US Trade in Goods April 2025: Imports Be Damned 6-5-25

Tariffs: Testing Trade Partner Mettle 6-3-25

US-UK Trade: Small Progress, Big Extrapolation 5-8-25

Tariffs: A Painful Bessent Moment on “Buyer Pays” 5-7-25

Trade: Uphill Battle for Facts and Concepts 5-6-25

Ships, Fees, Freight & Logistics Pain: More Inflation? 4-18-25

Tariffs, Pauses, and Piling On: Helter Skelter 4-11-25

Tariffs: Some Asian Bystanders Hit in the Crossfire 4-8-25

Tariffs: Diminished Capacity…for Trade Volume that is…4-3-25

Reciprocal Tariff Math: Hocus Pocus 4-3-25

Reciprocal Tariffs: Weird Science Blows up the Lab 4-2-25