June 2025 Industrial Production: 2Q25 Growth, June steady

For 2Q25, Manufacturing grew at a +2.1 annual rate with June capacity utilization seeing a slight uptick.

Don’t tell me! More tariffs?

Industrial production and capacity utilization hang tough in June and 2Q25, but we see unit costs heading into a rough stretch unless utilization remains high.

The moving parts of breakeven volumes (pricing, product mix, unit costs) will feel some strain on tariffed supplier chains with a lot of decisions ahead to make on unwinding established supplier relationships (many with dedicated tooling and product specs and contracts, etc.).

For many manufacturers and numerous industries, global low-cost sourcing was the passport to sustaining high margins despite below average capacity utilization. Now the goalposts are moving, and the margin pressure will be a challenge to relieve with an economic expansion still in process. Profit recession in 2026 for many?

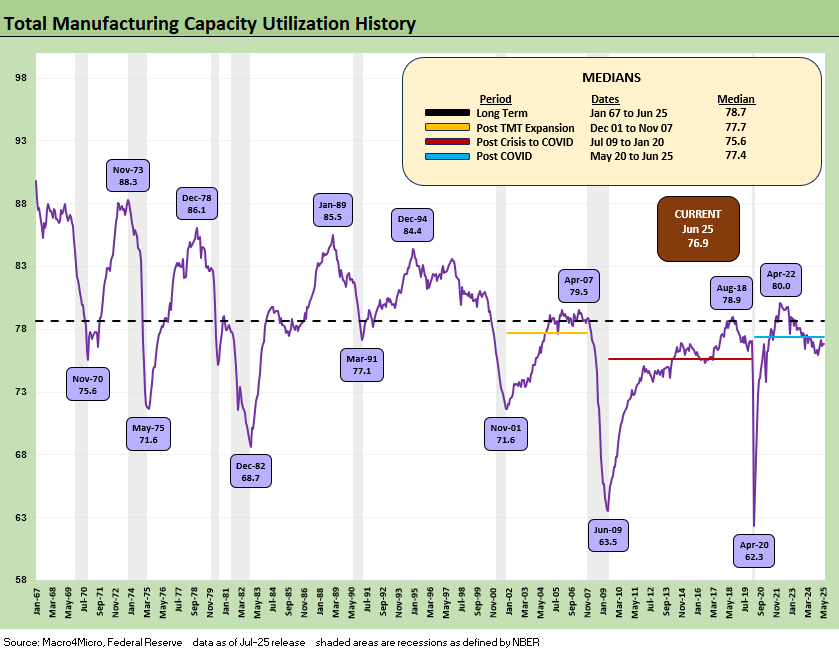

The above chart updates the time series for total manufacturing capacity utilization. We see total manufacturing tick slightly higher sequentially from 76.8% to 76.9%. That level is still below the long-term average of 78.2% (from 1972 per the G.17 release). The 76.9% rate is slightly above the 1Q25 run rate (76.6%) and modestly above the 4Q24 numbers (76.2%). The peak utilization was seen in April 2022 at 80.0% ahead of the tightening cycle impacts.

An important question from here ties into breakeven volume levels in the manufacturing sector and how corporate cost structures will stand up in the face of rising supplier chain costs. The negative tariff impact runs from raw materials (steel, aluminum, copper) and components to higher labor costs for many. The ability of many manufacturing operations to generate solid margins at below-historical utilization levels was tied in part (notably in autos and cap goods) to low-cost global sourcing. Tariffs now create a challenge to that relationship.

The sourcing practices tag teamed with intensive restructuring actions after the credit crisis (longest recession in post-Depression history) to “get lean” and get efficient. Entire companies built businesses that were dedicated to finding low-cost sourcing solutions (“MROs”).

At the very least, the need to pay high cash tariff costs to customs as buyers/importers (regardless of the false White House claims on “who pays”) will create a challenge for unit costs and the ability to generate solid margins at lower utilization. That means less profit, pricing actions (higher?), mix shifts, or more cost mitigation steps (layoffs?).

Execution risk also rises in getting steps in place with tariffs phasing in slowly and steadily into working capital after the latest Aug 1 date with more Section 232 tariffs coming. The difference across variable cost of sales via inventory vs. the impact on capex and fixed costs (machinery, plant & equipment, construction etc.) makes for tricky breakeven math with so many moving targets.

The above table updates the high-level categories including Total Industry (slight uptick), Total Manufacturing (another slight uptick), Durables (down slightly) and Nondurables (higher). We break out the sequential deltas in the right column.

The above table updates the largest 5 industry groups under Durables and the Big 2 of Nondurables. The utilization deltas move up and down and are fairly minimal with the exception of the decline in Motor Vehicles and Parts by -2.0 points. Motor vehicles will be experiencing no shortage of turmoil in coming quarters on tariff-related disruptions and financial stress along the supplier chain. The 1.2 point increase in Aerospace is higher on the back of progress at Boeing and thus along the BA supplier chain.

The above table updates the capacity utilization history for expansions and recessions. As noted earlier, the ability of more companies to generate solid profits at lower capacity utilization in today’s markets is tied in part to automation and in part to the development of low-cost supplier chains. As noted above, low-cost supplier chains are now fatally threatened by tariffs.

The current utilization level of 76.9% is below the long-term median from 1967 of 78.7%. That is below half the recession averages from earlier recession periods as noted in the chart. The pressure will be high on manufacturers as we move into 4Q25 and then into 2026.

We are likely to see a lot of adjustments to the economics of numerous industries as the 2H25 period unfolds. Team Trump never addresses any of these issues since Trump is incoherent on the manufacturing sector, Navarro repeats the same soundbites over and over again, and manufacturing is way outside the Hassett strike zone (Hassett does not seem to know where home plate is on “who pays” the tariff).

Those supply chains were risk mitigating structural advantages of global sourcing that are about to be shredded by Trump tariffs. The new tariff policies are based on a highly speculative concept of how tariffs will translate into mass investment in the US to reshore and expand as customers scrap their offshore asset base. The way the tariffs are structured is that the supplier base and manufacturers of finished goods need to be set up and fully integrated on day 1 to be free of tariffs. All you need is a genie to work the magic.

The above chart details expansion and recession averages and lines them up by height as a frame of reference. We see the current level on the left.

The trick will be avoiding a recession and showing up on the right side of this chart.

Markets:

CPI June 2025: Slow Flowthrough but Starting 7-15-25

Footnotes & Flashbacks: Credit Markets 7-14-25

Footnotes & Flashbacks: State of Yields 7-13-25

Footnotes & Flashbacks: Asset Returns 7-12-25

Mini Market Lookback: Tariffs Run Amok, Part Deux 7-12-25

Mini Market Lookback: Bracing for Tariff Impact 7-5-25

Payrolls June 2025: Into the Weeds 7-3-25

Employment June 2025: A State and Local World 7-3-25

Asset Return Quilts for 2H24/1H25 7-1-25

JOLTS May 2025: Job Openings vs. Filling Openings 7-1-25

Midyear Excess Returns: Too little or just not losing? 7-1-25

Recent Tariff commentary:

Germany: Class of its own in EU Trade 7-16-25

US-Canada Trade: 35% Tariff Warning 7-11-25

India Tariffs: Changing the Music? 7-11-25

Taiwan: Tariffs and “What is an ally?” 7-10-25

US-Trade: The 50% Solution? 7-10-25

Tariff Man Meets Lord Jim 7-8-25

South Korea Tariffs: Just Don’t Hit Back? 7-8-25

Japan: Ally Attack? Risk Free? 7-7-25

US-Vietnam Trade: History has its Moments 7-5-25

US Trade in Goods April 2025: Imports Be Damned 6-5-25

Tariffs: Testing Trade Partner Mettle 6-3-25

US-UK Trade: Small Progress, Big Extrapolation 5-8-25

Tariffs: A Painful Bessent Moment on “Buyer Pays” 5-7-25

Trade: Uphill Battle for Facts and Concepts 5-6-25

Ships, Fees, Freight & Logistics Pain: More Inflation? 4-18-25

Tariffs, Pauses, and Piling On: Helter Skelter 4-11-25

Tariffs: Some Asian Bystanders Hit in the Crossfire 4-8-25

Tariffs: Diminished Capacity…for Trade Volume that is…4-3-25