Mini Market Lookback: Tariffs Run Amok, Part Deux

The tariff tally keeps on rising with Trump still falsely saying the selling country pays and trade partners are the ones being “charged” tariffs.

I guess they can all retaliate at the same time! Did not see that coming.

The tariff tally keeps rising as “the tariff cash payable by the buyer” remains the first step of the analysis. Try as he may by repetition, Trump cannot change the fact that the buyer/importer “writes the check” to customs. Trump was at it again with today’s posts (dated on Friday but not posted until Saturday) that “we will charge the European Union” and “we will charge Mexico” a tariff of 30%. That comes after the 35% threat on Canada Friday (see US-Canada Trade: 35% Tariff Warning 7-11-25).

The next steps for the market involve analyzing where the economic costs are absorbed across sellers (price cuts) and buyers (absorb the higher expenses, pass on some or all tariff cost through prices, adjust product mix, cut other costs). Many products are part of supplier chains (e.g. Tier 1,2,3 in autos) where more cost sharing can flow into the economic trail.

For the week, equities faltered and credit spreads widened with IG holding up well. Duration had mild setbacks with a bear steepener, and the 30Y UST is back to dancing around the 5.0% line. The national level “reciprocal” update was joined by 50% tariffs on copper as Trump slowly winds down his full sweep of painful material cost adjustments for US buyers (steel, aluminum, copper) with the Lumber Section 232 in process. In case anyone was at risk of relaxing, Trump also threatened “very, very high” pharma tariffs while citing “200%.” The reality is that even a 50% tariff on pharma would be a catastrophe and will certainly trigger a trade war with the EU with its massive volume of pharma imports into the US (see US-EU Trade: The Final Import/Export Mix 2024 2-11-25).

It is still quite early in the working capital cycle for many of these latest tariff increases slated to start Aug 1, so the tariff apologists, advocates, and disinformation spinners (“sellers pay tariffs”) will play games with the CPI and PPI numbers slated for this week regardless of how they come out. The bulk of the tariff hikes are not even in effect yet and the worst (by far) lies ahead subject to timing of the next Section 232 actions (notably semis and pharma).

The punishing tariffs slapped on goods from low-cost Asian partners will show up in force in apparel and footwear later with other household items during the holiday shipments and perhaps be reflected in some front running by retailers in the back-to-school season. Slamming thin-margin business lines with very high tariffs sounds like a bad idea to start, but tariffs will mean financial trouble for businesses large to small. That could flow into strains in trade credit. That runs from retailers to branded consumer products companies and notably in small and midsized businesses.

The above weekly chart updates the clash of the big 4 trade partners (ex-Mexico), and the US benchmark we use (S&P 500 ETF) is still bringing up the rear with Europe at #1, China #2, and Canada #3. The Golden Age is still getting polished.

Tariff detail chores….

We spent time this week demystifying the import vs. export product mix of some targeted countries since it helps give some context to which US industries/customers on the US importer/buyer side will be vulnerable. Trump keeps up his charade (Disinformation? Lies? Jedi Mind Tricks for the MAGA 2+2=5 loyalists?) with his “seller nation pays” misinformation, and he repeats it every week with this week busier than most.

For more details see the following:

US-Canada Trade: 35% Tariff Warning 7-11-25

India Tariffs: Changing the Music? 7-11-25

Taiwan: Tariffs and “What is an ally?” 7-10-25

US-Trade: The 50% Solution? 7-10-25

Tariff Man Meets Lord Jim 7-8-25

South Korea Tariffs: Just Don’t Hit Back? 7-8-25

The Asia focus this past week included onerous tariffs on Indonesia (32%), Bangladesh (35%), and Cambodia (36%). Those show up on the apparel leading indicator list, so the news there is unfriendly for CPI prospects as the fall and holiday season orders get placed.

Brazil at 50% has some disturbing extrapolation potential…

As we covered in US-Trade: The 50% Solution? (7-10-25), the move to slap 50% on Brazil is much more significant than just the tariff rates that the US buyers will need to pay customs. We have a healthy trade surplus with Brazil and exports to Brazil were rising faster than imports YTD. That makes it all the more bizarre as an economic concept. As covered in our commentary, the rationale was tied to Trump’s “coup bro” Bolsonaro being on trial for planning to overthrow a free and fair election. Brazil was slated back in April for only a 10% baseline tariff given the material trade surplus (see Reciprocal Tariff Math: Hocus Pocus 4-3-25). Then this week happened.

The takeaway is that Trump seeks to use the global trade position to satisfy his geopolitical and personal political preferences. He is using supplier chains, the US consumer, US financial system funding the economy, and US corporate sector interests to deploy his own personal blank check to challenge the laws and political preferences of other nations’ citizens in free and fair elections. For Trump, this is like riding a bike. He can coerce at will with no Congressional checks from the bleating sheep of Congress. That could extend to non-US elections where he can interfere if he does not like the outcome.

Some might see this as a gift and an economic opportunity for China with any left-of-center nation on the planet. On the flip side, does a left of center US President later get to do the same in the future? That can only raise questions about the political stability of the US and that in turn could factor into international UST demand – whether for good or bad reasons.

Brazil could also face some more heat from Trump for being part of the BRICS group seeking to undermine the US dollar as the global currency. As a game plan, attacking countries verbally (he insulted Mexico again this weekend) and targeting their exports with high tariffs is not a good way to dissuade countries with a high mix of dollar-denominated products from pressing ahead with their BRICS de-dollarization plans.

The fact is that Trump is attacking the EU and other major G7 and NATO allies along with key Asian trade partners. UST owners should consider that such actions could end up being a recruiting poster for embracing or tacitly supporting the BRICS plan. Working with these trade partners constructively might be a better idea. We already see some EU advocates saying “make the euro the global currency.”

The BRICS topic and dollar defense will get noisier at a time when the dollar could ill afford to lose the added demand advantage when the UST will shatter UST issuance records in coming years and thus need record demand for UST every year. That is a story for another day.

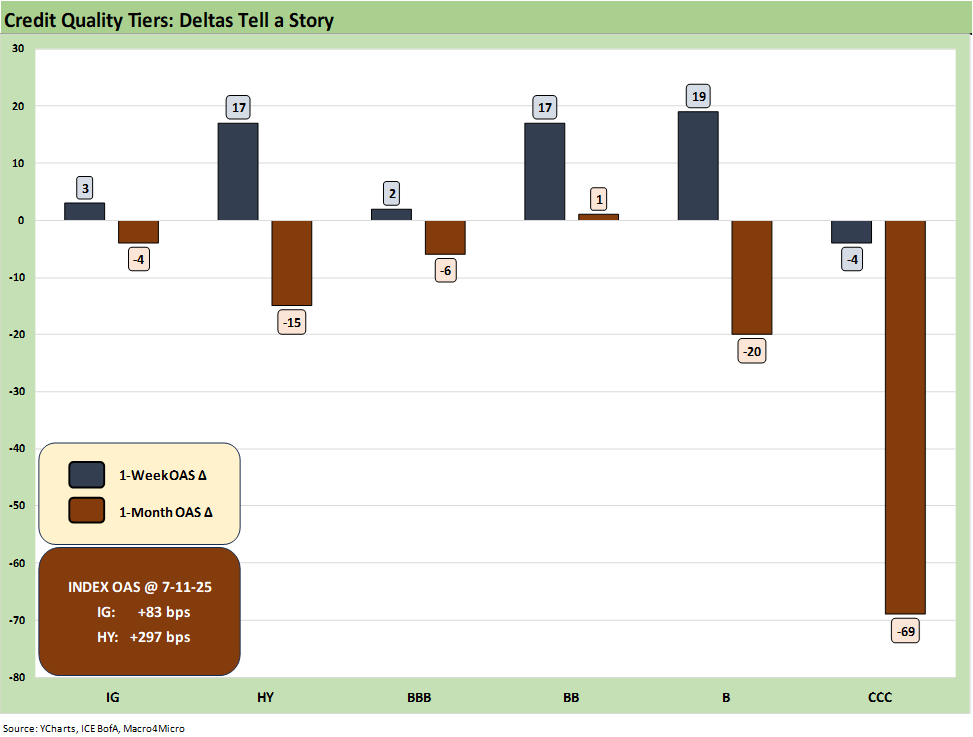

The above chart updates the spread deltas for the trailing 1-week and 1-month periods. Despite this week’s backup in HY OAS, the recent risk pricing trend has seen a very solid rolling 1-month that sent HY OAS back into the range of June 2007. This past week in HY saw the week end only 1 bps inside where June 2007 ended, so these spreads are still very tight in any historical context.

We also see credit peak level pricing in IG OAS as we will review in our weekly credit markets recap to be posted later (for last week, see Footnotes & Flashbacks: Credit Markets 7-7-25). The +83 bps OAS to end the week is not far from the multi-decades lows of late 2024 when +77 bps marked the lows.

The above chart updates the 32 benchmarks and ETFs, and we see a score of 10-22 for positive vs. negative this week. We see 6 of 7 bond ETFs in the red with only the short UST 1-3Y ETF (SHY) barely positive. Within the top quartile, we see Energy related ETFs (XOP, XLE) at #1 and #2. The bottom quartile has a mix of financials (XLF), a Mag 7 heavy ETF (XLC) and the QQEW, and duration punished (TLT, LQD) while the sleepy, dividend Consumer Staples ETF (XLP) also faded with the curve.

We see some surprises in that mix including Homebuilders (XHB) as investors debate whether the sector has been too beaten up. XHB has generated a return of around -15% since late September. For the YTD 2025 period, XHB is back to running around a 0% return as the market awaits a lot more color in earnings season. Transports (XTN) were back in the top quartile on airlines rebounding with Delta earnings/guidance and not based on the freight and logistics players in the face of the tariff chaos. We also see the BDC ETF (BIZD) in the top quartile for the week as that income heavy ETF has held up well YTD and has a supportive credit cycle helping confidence.

The above chart updates the tech bellwethers with the names and asset lines in descending order. We see a soft week for this list with 4 of the Mag 7 positive but only one (NVDA) above +1.0%. NVIDIA was impressive as it crossed the $4 trillion line in market cap.

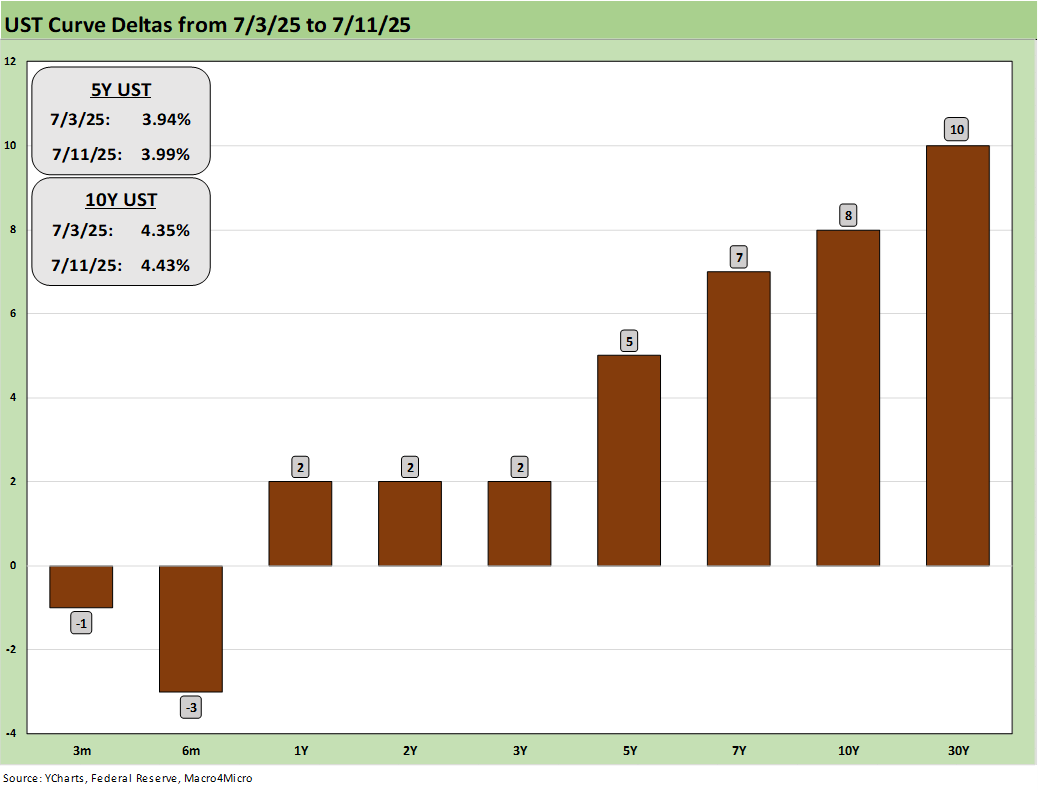

The above chart details the 1-week deltas for the UST curve. We see an mildly adverse UST bear steepener. This coming week will be interesting to keep an eye on the UST slope with CPI and PPI teed up along with Retail Sales, Industrial Production, and Housing Starts. We will also see 2Q25 earnings season kicking into higher gear with the major banks bringing a lot of useful color on loan demand and provisioning. We also will see a wide range of industrial bellwethers in the queue.

The mixed bull steepener YTD is getting noisy out in the 30Y area and is now up +18 bps for 30Y vs. -15 bps for 10Y and -39 bps for 5Y UST and -35 bps for 2Y UST.

The above chart updates the historical timeline for the 10Y UST vs. the Freddie Mac 30Y Mortgage benchmarks. The political lapdogs were loose and barking even louder this week to support Powell resigning, including one of the Project 2025 architects/authors and a newly hired mascot at the FHFA. Many of the “echo chamber red hats” still live in a world where the FOMC sets the 30Y fixed mortgage rates based on fed funds. They clearly did not “get the memo” after the sharp bear steepening that followed the fall easing of 100 bps starting with the -50 bps in mid-September.

The FHFA head, Bill Pulte (grandson of Pulte Homes icon) is even attacking Powell on FHFA letterhead. As a Broadcast Journalism major, he is more familiar with messaging than economics. He was confirmed in March 2025 (we assume he interviewed well and checked the blind obedience box along with everyone else). It is good to be born rich.

We were hoping someone would get the FHFA head on record as confirming that the buyer/importer pays the tariff and not the selling country. Then we could say he understands what 19 forecasters in the Fed June SEP report and dot plot might be thinking when they collectively raised the median for PCE and Core PCE yet again (see FOMC Day: PCE Outlook Negative, GDP Expectations Grim 6-18-25, PCE May 2025: Personal Income and Outlays 6-27-25, CPI May 2025: The Slow Tariff Policy Grind 6-11-25). Otherwise, the jury is out on someone who might be steering a GSE privatization at some point.

The chart above updates HY OAS across the timeline from early June with the current HY OAS sitting just under where the bubble month of June 2007 ended. We see the spread spike in Aug 2024 and early April 2025. Sub-300 HY OAS vs. the long-term median of +460 bps is clearly a sign of higher confidence that the HY bond index with its BB heavy mix is resilient given the current macro backdrop.

The favorable issuer and industry mix issue relative to past cycles is in no small way attributable to the migration of so many leveraged transactions over to the private credit markets and the evolution of how such deals are funded. The tradition of “late credit cycle crazy leveraged deal flow” seen in so many past HY cycles has not been a major factor in the HY bond index mix.

The HY OAS minus IG quality spread differential widened to +214 bps from +200 bps last week. Anything at or below the +200 bps line is exceptionally compressed by historical standards as evident in the +323 bps median.

The chart above shows the BB vs. BBB quality spread differential widening out from +59 bps last week to +74 bps on the widening by BBs of +17 bps vs. +2 bps of widening in the BBB tier.

Recent Tariff commentary:

US-Canada Trade: 35% Tariff Warning 7-11-25

India Tariffs: Changing the Music? 7-11-25

Taiwan: Tariffs and “What is an ally?” 7-10-25

US-Trade: The 50% Solution? 7-10-25

Tariff Man Meets Lord Jim 7-8-25

South Korea Tariffs: Just Don’t Hit Back? 7-8-25

Japan: Ally Attack? Risk Free? 7-7-25

US-Vietnam Trade: History has its Moments 7-5-25

US Trade in Goods April 2025: Imports Be Damned 6-5-25

Tariffs: Testing Trade Partner Mettle 6-3-25

US-UK Trade: Small Progress, Big Extrapolation 5-8-25

Tariffs: A Painful Bessent Moment on “Buyer Pays” 5-7-25

Trade: Uphill Battle for Facts and Concepts 5-6-25

Ships, Fees, Freight & Logistics Pain: More Inflation? 4-18-25

Tariffs, Pauses, and Piling On: Helter Skelter 4-11-25

Tariffs: Some Asian Bystanders Hit in the Crossfire 4-8-25

Tariffs: Diminished Capacity…for Trade Volume that is…4-3-25

Reciprocal Tariff Math: Hocus Pocus 4-3-25

Reciprocal Tariffs: Weird Science Blows up the Lab 4-2-25

Markets:

Footnotes & Flashbacks: Credit Markets 7-7-25

Footnotes & Flashbacks: State of Yields 7-6-25