Taiwan: Tariffs and “What is an ally?”

Taiwan offers a reality check on Trump “consistency” if you view a trade deficit with Taiwan as a national security risk.

A toast to US trade surpluses!

Taiwan is a top 10 trade partner nation in total trade (imports + exports), in the top 10 in trade deficits, in the top 10 in imports, and in the top 10 in exports. That clearly makes it one of the critical trade relationships, but Taiwan also gets swept up in some potentially world changing (literally) geopolitical factors. The picture above showing Mao and Chiang (after the surrender of Japan in Aug 1945) offers a reminder of a troubled history with the US usually close by in the dialogue.

We break out the US-Taiwan import and export details below and give some top-down context on the trade volume history. The high value-added trade flows up the ante on trade policy risks with Taiwan. The list shows a lot of imports that so far are slated to come with very high tariffs attached as the market awaits Trump’s final tariff number. The US buyer will need to write tariff checks to customs. The dollars come from the US side despite the recurring Trumpian lie that the “seller pays” and the US “takes in money” from the trade partner selling nation.

Given all the saber rattling by Hegseth this year on supporting Taiwan, one has to wonder how high tariffs based on the “national emergency” or “national security” grounds (Section 232) is consistent in this case. High tariffs on Taiwan can be seen as another example of unilateral national security rationalization to call all the shots on trade from the White House and use existing laws to cut out Congress. The Taiwan stakes could be tectonic when Section 232 for semis gets put in place.

There is a lot of historical whirlpools under the bridge on Taiwan (“Red Star over China”, China civil war, rise of Mao, the postwar “China Lobby” and active role of Time Magazine/Henry Luce, Taiwan (then Republic of China = ROC = Taiwan) losing its UN seat under Nixon, and Carter fully embracing the One China rule, etc.).

The unique situation would seem to call for a “tariff light” approach if the grounds of “national security” are the main event. That was not in evidence on Liberation Day before “the pause.” High tariffs on national security grounds would imply Taiwan is not an ally, which would put Taiwan in good company with many other US allies (notably, all NATO allies).

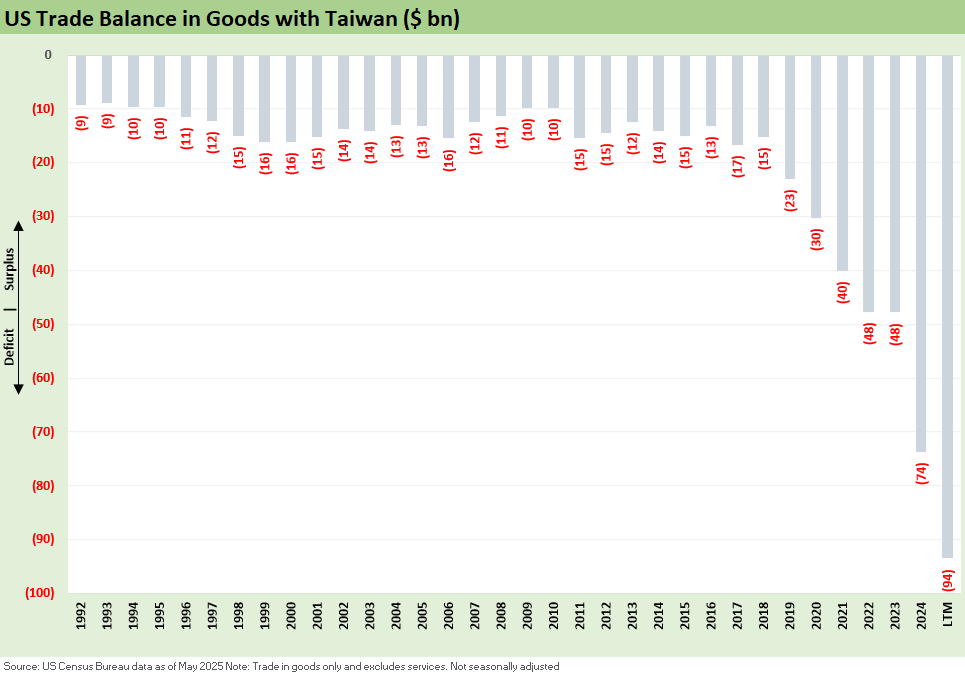

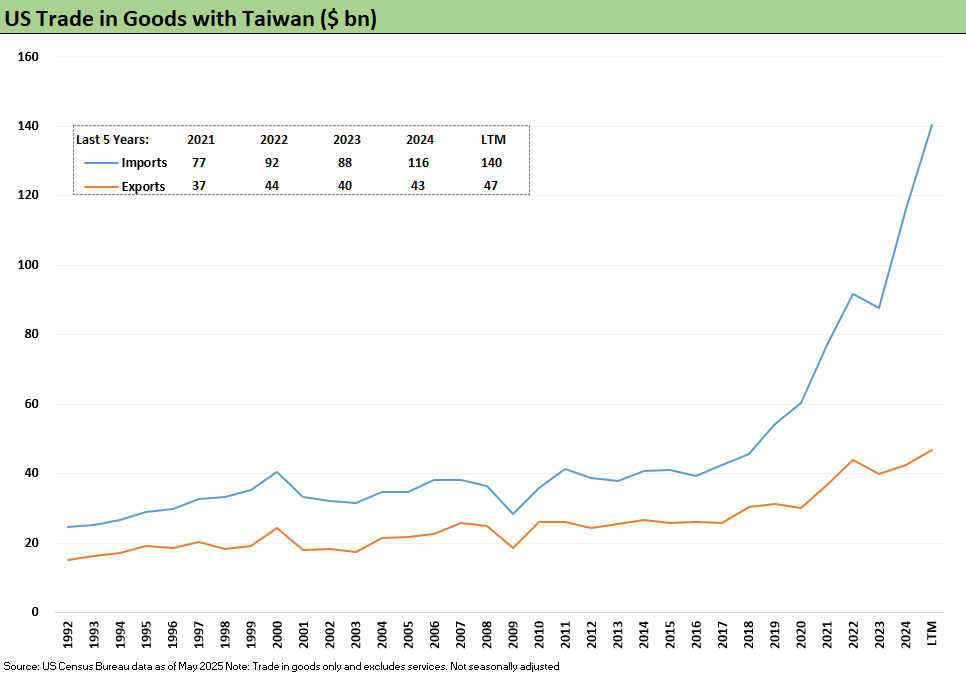

The above chart updates the timeline for the US-Taiwan trade deficit. The tech sector capex boom has driven a rapid rise in the US-Taiwan deficit since 2017. The trade deficit started its climb across Trump 1.0 as it doubled and then another doubling during Biden. Demand for the items on the product checklist clearly remains high, and that usually translates into pricing power and passing on the costs.

The trade deficit has continued to climb sharply YTD 2025 (May YTD) with imports at almost +59% and exports +25%. The trade deficits for the 5 months climbed to -$43.6 bn YTD May 2025 from -$23.8 bn YTD May 2024. A booming tech sector and heavy investment in tech must be a national disaster and in need of immediate corrective policy actions (sarcasm warning). One solution is to apply a heavy “tax” (tariff) paid by the US buyer. We see that as a buyer funded subsidy of the government UST coffers in the form of higher cost imports that will be an expense or something to recover in price.

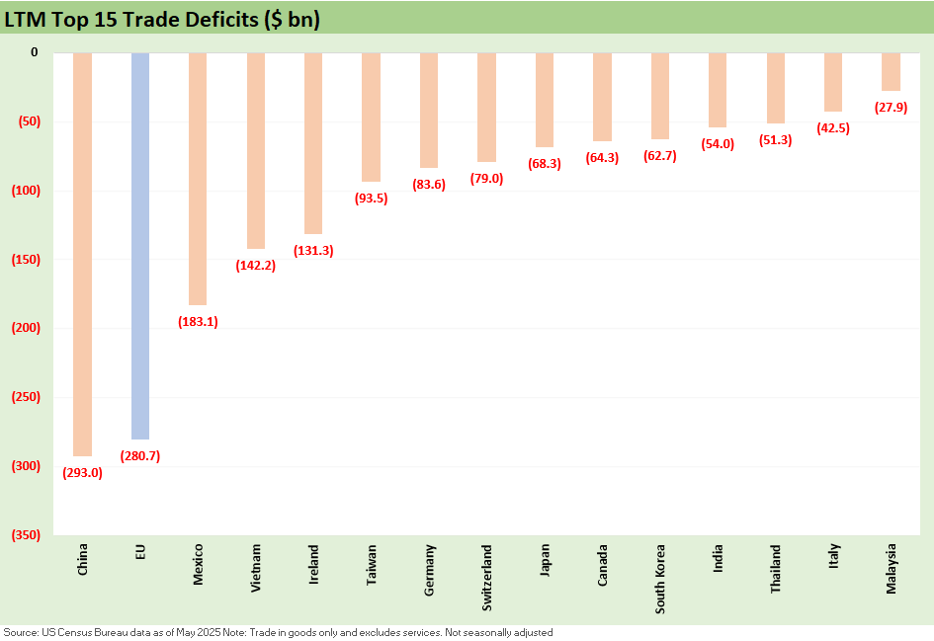

The above chart shows the rankings of trade deficits using annual rates and the most recent LTM. We see Taiwan at #6 (#5 by nation excluding EU as a bloc). That is two notches below Vietnam (see US-Vietnam Trade: History has its Moments 7-5-25). Taiwan was hit with a 32% assigned tariff on Liberation Day but Trump’s famous chart showed them as deserving a 64% tariff. That 64% starting point included a very strange equation to get there. The decision to haircut that level to 32% does not alter the fact that such a number is still an unprecedented rate in the modern capital markets era (see Reciprocal Tariff Math: Hocus Pocus 4-3-25, Reciprocal Tariffs: Weird Science Blows up the Lab 4-2-25).

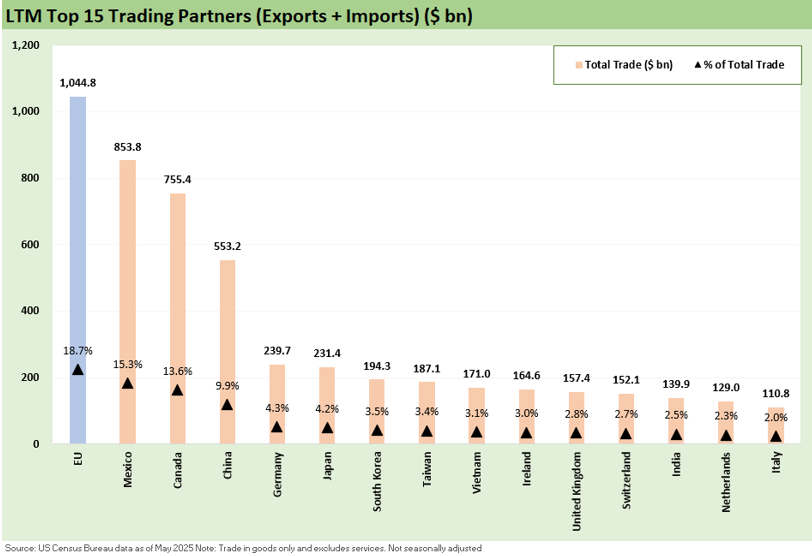

The above chart ranks Taiwan as the #8 total trade partner (#7 nation ex-EU) based on total trade (imports + exports). In Asia, only China, Japan, and South Korea are bigger than Taiwan.

Taiwan assigned 64%, marked down to 32% on Liberation Day, awaits their “number.”

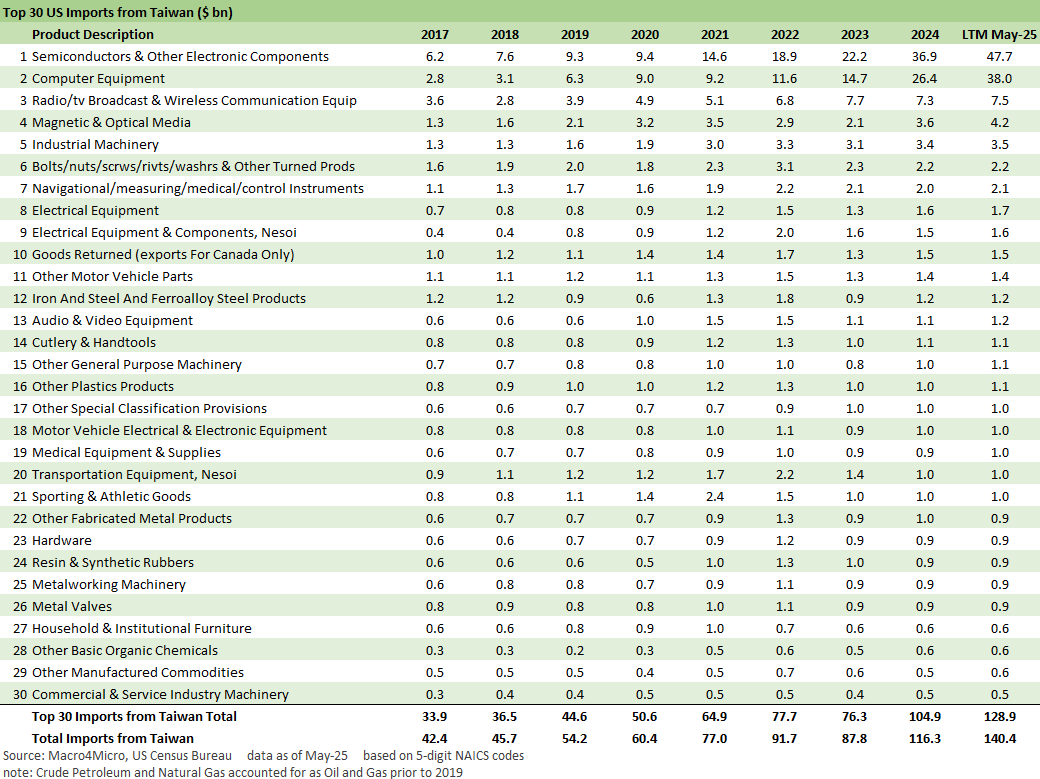

The table below breaks out the lead imports by product groups coming out of Taiwan to the US. The tariff rates back on Liberation Day basically said “I should charge 64% but will only charge 32%” (see Reciprocal Tariff Math: Hocus Pocus 4-3-25, Reciprocal Tariffs: Weird Science Blows up the Lab 4-2-25). That was before the pause and slow grind to the Aug 1 deadline that the market is waiting for.

As the tariffs dribbled out this past week, most eyes await Taiwan as one of the more important trade partner. Taiwan and India are the remaining major Asian trade partner groups.

What Trump did not say (as always) is that tariff expense on the Taiwan import list below is paid by the buyer to customs. It is not paid by the selling nation even if Trump again clearly stated that in the Vietnam trade announcement (see US-Vietnam Trade: History has its Moments 7-5-25). He was at it again in his live Q&A from the cabinet meeting this past week. Trump will keep telling the lie, and we will keep repeating the fact. The media does a terrible job by not raising the visibility on this constant falsehood. Even CNBC has gone soft on facts as they need to keep the GOP guest flow high.

The above chart details a very tech-centric, high value-added mix of products in the top import list. We look at that list and we see a very high expense exposure to any new “buyer pays” tariff costs that will hit the cost of sales lines or need to be mitigated by other actions that flow into revenue. That is where the questions come in around how pricing across these lines will evolve. Many will assume pricing power will be exercised by the importers who pay those tariffs. Demand remains high as highlighted by the very impressive import growth from Taiwan (+58.7% increase May YTD). Tack more tariffs onto that growth and you have some cost and price pressure.

The worry for Taiwan longer term is volume risk, but there is no questioning the volume demand in many of these product groups. Of course, Taiwan faces no shortage of intermediate term risks on China’s game plan. If Taiwan imports to the US get hit with high tariffs, Taiwan and China alike will see that the recent Hegseth saber rattling about Taiwan in some of those recent speeches is just talk. That said, Taiwan is not paying those tariffs. The US buyer is.

The above chart details the export product mix from the US to Taiwan. It is a well-diversified mix from the US side, and there is very little reason to expect any retaliation from the Taiwan side given their geopolitical dependence on the US. The defense spending decisions by Taiwan on US weapons systems will likely loom larger in the grand Trump plan, but it will be the US buyer paying the tariffs on imports – not Taiwan – regardless of what Trump says. (Yes, we will keep repeating that).

We wrap with the time series since 1992 for Taiwan imports and exports, and the steep moves in imports got a notable start during Trump 1.0 and never really looked back.

Tariff related:

Tariff Man Meets Lord Jim 7-8-25

South Korea Tariffs: Just Don’t Hit Back? 7-8-25

Japan: Ally Attack? Risk Free? 7-7-25

US-Vietnam Trade: History has its Moments 7-5-25

US Trade in Goods April 2025: Imports Be Damned 6-5-25

Tariffs: Testing Trade Partner Mettle 6-3-25

US-UK Trade: Small Progress, Big Extrapolation 5-8-25

Tariffs: A Painful Bessent Moment on “Buyer Pays” 5-7-25

Trade: Uphill Battle for Facts and Concepts 5-6-25

Tariffs: Amazon and Canada Add to the Drama 4-29-25

Ships, Fees, Freight & Logistics Pain: More Inflation? 4-18-25

Tariffs, Pauses, and Piling On: Helter Skelter 4-11-25

Tariffs: Some Asian Bystanders Hit in the Crossfire 4-8-25

Tariffs: Diminished Capacity…for Trade Volume that is…4-3-25

Reciprocal Tariff Math: Hocus Pocus 4-3-25

Reciprocal Tariffs: Weird Science Blows up the Lab 4-2-25

See also:

Footnotes & Flashbacks: Credit Markets 7-7-25

Footnotes & Flashbacks: State of Yields 7-6-25