South Korea Tariffs: Just Don’t Hit Back?

We look at the tariff targeting of South Korea with some context around the import/export product mix and deficit history.

Just remember Joe, only I get to punch.

As we enter the next stage of damage reports on trade, we look at the import/export mix for South Korea and give some headline number context across time to US-South Korea trade deficits. The 25% tariff reportedly does not stack, but it does serve to front run what lies ahead in other Section 232 plans on semis and electronics and pharma (unless those end up even higher).

The coming Section 232 wave will only escalate the targeting of South Korea, but the main event is autos and the auto supplier chain. The tariff attack on autos can severely disrupt and undermine the heavy investment in transplant assembly operations by Hyundai/Kia. Unit costs by definition move higher, and that means less capacity expansion or higher prices on imports or on US-assembled vehicles. That will take time to show up, but the economics logically will continue the trend of inevitably higher post-COVID auto prices. It is just a matter of “When?”

Even if one buys into the “tariff = higher investment in US” theme, the timeline lags can slam unit costs ahead of a final plan that can also prompt reconsideration and delay of future plans for another day (and another White House) given the years it takes to build out such a US-only integrated supplier chain. A “zero sum game” with South Korean investment and jobs can be politically hazardous on the home front.

South Korea has some commonality with Japan in that both reached trade deals (or updates on past deals) with the US during Trump 1.0 and have made massive investments in the US and brought parts of the supplier chains with them along the way. At this point the updated “KORUS” trade deal of 2018 in Trump 1.0 is old news. South Koreas is leading “a deal is no longer a deal” when it comes to the US these days – as Canada and Mexico have experienced.” The qualification is all three made deals with Trump in his first term.

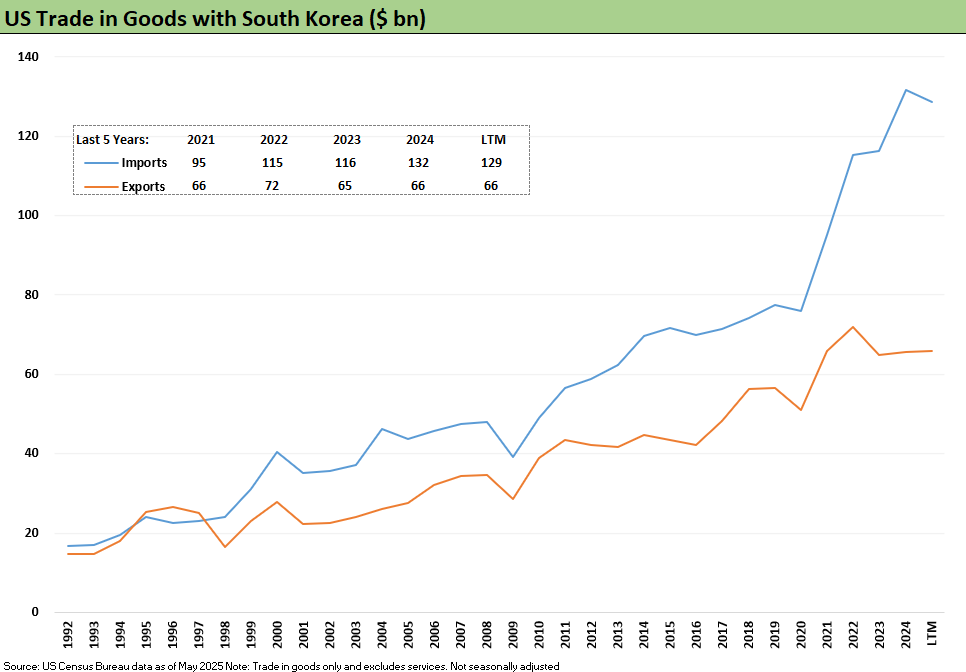

The success of South Korean autos in the US (imported and transplants) along with a range of tech and electronics products have driven the trade deficit materially higher over the past decade with a pronounced move in the post-COVID cycle. Hyundai/Kia and Samsung are obviously well-established brands.

The above chart visually highlights the material lift that South Korea saw in its export volumes in recent years as broken out in the product groups detailed below. It shows a much more pronounced lift in the post-COVID cycle.

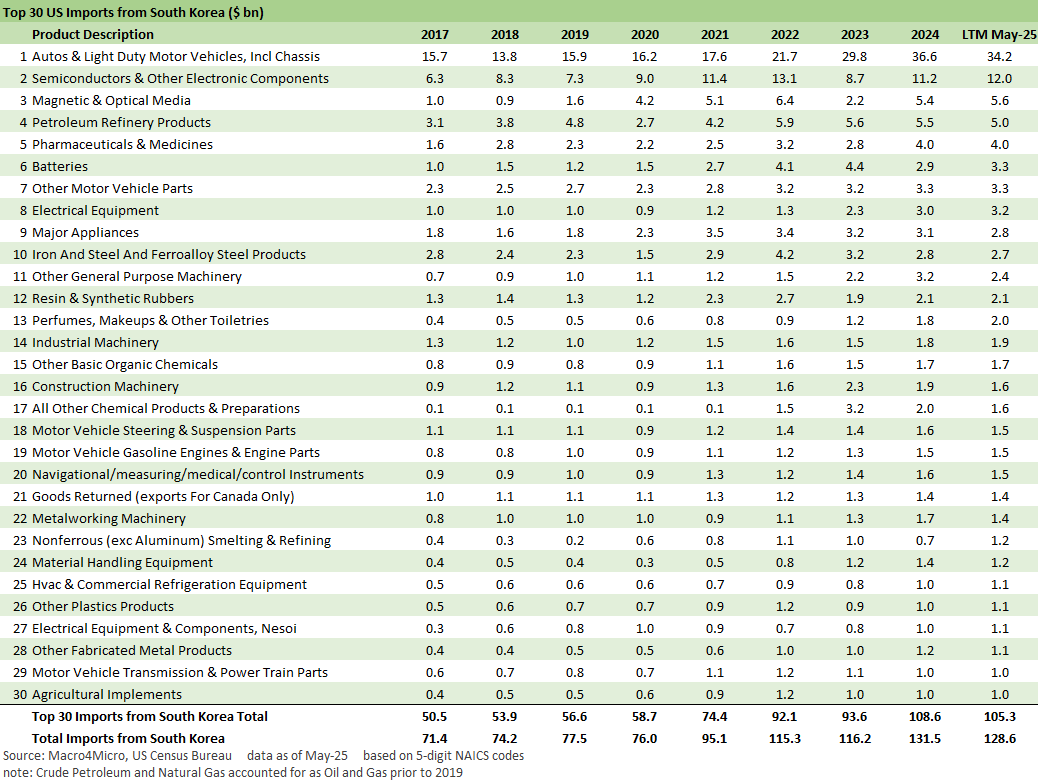

The above chart highlights the import mix. We see light duty vehicles, a wider range of auto components and related materials, semis/electronics, and pharma among the leaders. At least two major groups – semis/electronics and pharma – are also slated for Section 232. Since the White House claims there will not be “stacking” (as quoted by the press and not in the letter), the “reciprocal tariff” (which is actually not reciprocal) has the effect of “keeping the seat warm.”

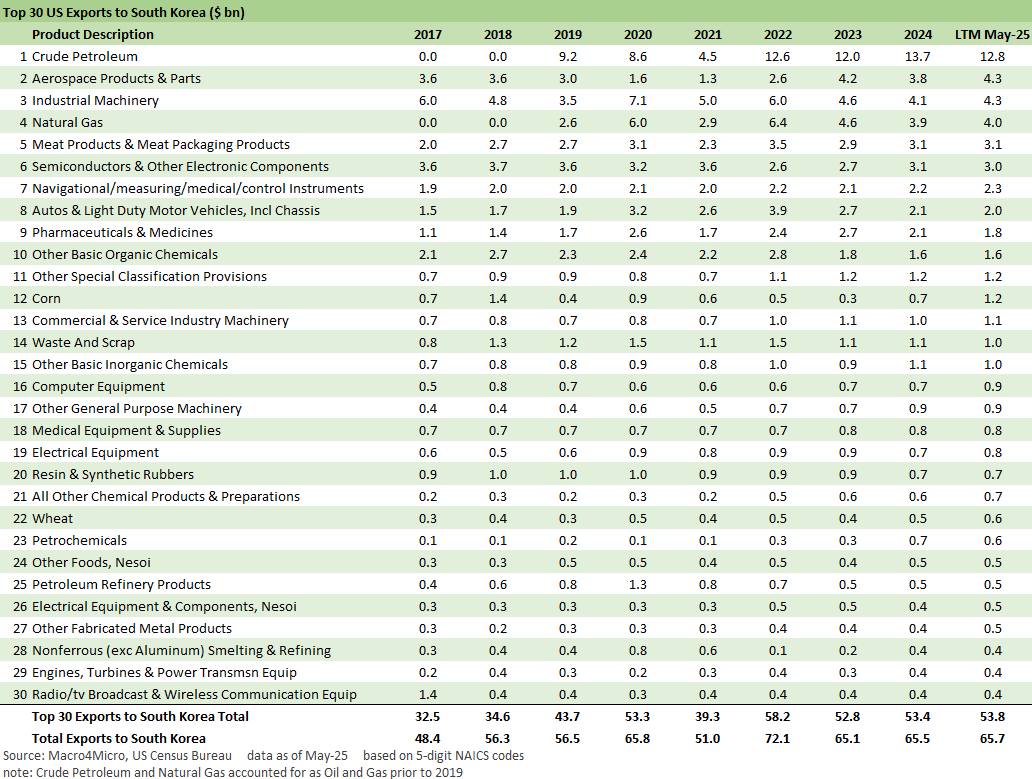

The above chart shows the theoretical “target list” of US exports to South Korea, and the main event as usual is energy (crude oil, LNG) and agriculture. These are the moments where Canada is supposed to be planning on upping energy investment and infrastructure for export to “steal more customers” in Asia with China, Japan, and South Korea at the top of the list and perhaps attract some offshore capital at the same time. Then again, Canada has its own problems with the US and such aggressive actions might await a more severe break with the Trump and his annexation ambitions. A Canada-US trade war is still a risk.

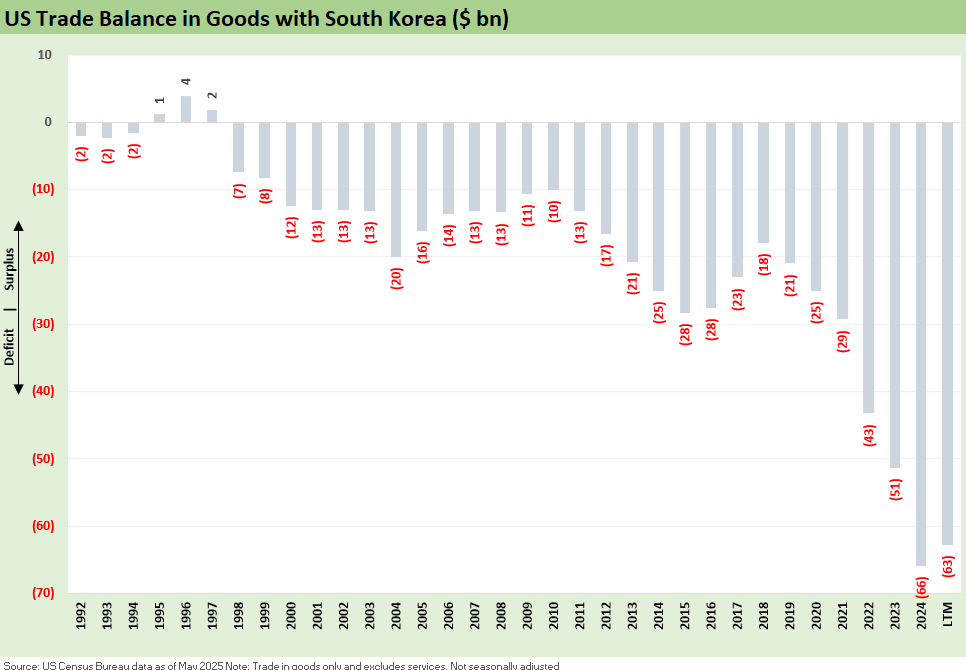

The above chart updates the timeline of the US-South Korea trade deficit. We see the effects of many successful product groups being sold into the US (vehicles) and the expansion of US-based assembly with a lot of components and material coming from South Korea to support that US transplant expansion. The South Korean auto operations will be worth a closer look in a separate commentary since the production volumes (and investment and jobs added) have shown impressive growth in the US. That brings higher trade deficits in components as well. South Korea can surrender or punch back.

Tariff related:

Japan: Ally Attack? Risk Free? 7-7-25

US-Vietnam Trade: History has its Moments 7-5-25

US Trade in Goods April 2025: Imports Be Damned 6-5-25

Tariffs: Testing Trade Partner Mettle 6-3-25

US-UK Trade: Small Progress, Big Extrapolation 5-8-25

Tariffs: A Painful Bessent Moment on “Buyer Pays” 5-7-25

Trade: Uphill Battle for Facts and Concepts 5-6-25

Tariffs: Amazon and Canada Add to the Drama 4-29-25

Ships, Fees, Freight & Logistics Pain: More Inflation? 4-18-25

Tariffs, Pauses, and Piling On: Helter Skelter 4-11-25

Tariffs: Some Asian Bystanders Hit in the Crossfire 4-8-25

Tariffs: Diminished Capacity…for Trade Volume that is…4-3-25

Reciprocal Tariff Math: Hocus Pocus 4-3-25

Reciprocal Tariffs: Weird Science Blows up the Lab 4-2-25

See also:

Footnotes & Flashbacks: Credit Markets 7-7-25

Footnotes & Flashbacks: State of Yields 7-6-25