US-Italy Trade: Top 15 Deficit, Smaller Stakes

We look at the US-Italy trade picture and the import export mix as Trump’s EU fill-or-kill tariff deal clock ticks off.

We thought we should round out the trade partner details after covering the rest of the G7, so in this note we add Italy. Italy is in the lower end of the top 15 trade partners in total trade (imports + exports), in goods trade deficits, and in total imports into the US. It did not make the top 15 in exports from the US.

Italy has an important role in EU leadership with Meloni seen as a “bridge” to Trump. In addition, cementing unity in the EU is essential to any legitimate attempt to counter Trump’s aggressive tariff attack. Trump has helped EU unity with his Russia bonding and erratic Ukraine policy, but viable negotiating leverage requires “all hands on deck.”

For Italy and the US, the trade deficit has not been a headline item on the scale of what is evident with Germany and how Trump attacks European countries broadly. The relationship between Meloni and Trump has been perceived as relatively constructive, but the real test is now here.

When considering Trump’s tariff sales pitch targeting the EU, somehow the “artful and dishonest” Stromboli came to mind (see image above). Per Disney, Stromboli is “a puppeteer and showman with an ambition to make good money even if it's at the expense of others.” Trump’s phrase “seller pays the tariff” made the connection.

The above chart tracks the US-Italy trade deficit across time from the early 1990s during the European currency crisis (1992), across the launch of the euro (1999), the credit crisis (2008-2009), the sovereign crisis (2010-2012), and later COVID (2020-2021). Currently, we see the trade deficit just off the highs of 2023-2024.

The above table ranks the import product groups in order, and we see pharma/medicines and autos/parts in the top tier as we often do with major EU trade partners. Pharma is by far #1, so the Trump section 232 tariff plan for that import line and his recent citation of 200% tariff potential is not going to help Italian trade relations. Meloni has domestic political risk just like what we see in other EU trade partner nations, so she can’t be a pushover.

The top 10 of the import mix is eclectic with footwear and apparel in the upper tiers of the mix with wines and spirits. With autos, we will need to see clarity around the Stellantis connections to Fiat/Chrysler along the supplier chain. Wines and spirits trade is reminiscent of France, but a material mix of machinery and equipment has some shades of Germany. In other words, there are plenty of line items for the Big 3 of the EU (Germany, France, Italy) to bond over.

Italian defense interests want to be in the top tier of defense planning with Germany and France in the remake of NATO budget priorities and pan-European defense planning. Presumably, the EU will be seeking some limited distance from the US and look to build up its own defense industrial base where it can do so. That requires unity. Outside of BAE, no European operation makes the top 10 of defense contractors (it is all US and China in the top 10 ex-BAE). Below the top 10 global defense contractors, we see Airbus ahead of Leonardo of Italy. Within the EU, that puts Italy right up near the top with France a clear leader.

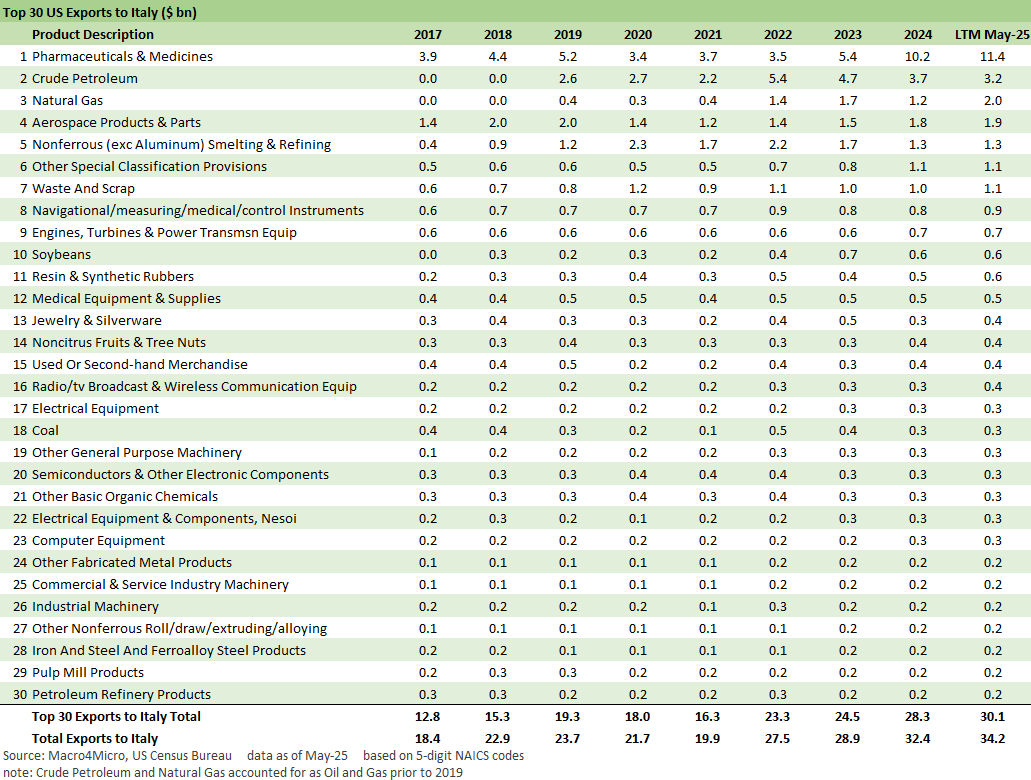

The above table breaks out the US export mix to Italy, and we again see pharma at #1 well ahead of the other product lines. We see energy products at #2 (crude oil) and #3 (natural gas) with aerospace at #4. Overall, low export volumes from the US to Italy is the main feature of the list except for pharma and medicines.

The above chart captures the trend line for imports and exports. Pharma has been the main story, and that will raise the stakes in the recent Trump fixation on pharma. Pharma will also color the views of other EU nations such as Ireland where pharma has become a major trade partner concentration risk.

Markets:

Retail Sales Jun25: Staying Afloat 7-17-25

June 2025 Industrial Production: 2Q25 Growth, June Steady 7-16-25

CPI June 2025: Slow Flowthrough but Starting 7-15-25

Footnotes & Flashbacks: Credit Markets 7-14-25

Footnotes & Flashbacks: State of Yields 7-13-25

Footnotes & Flashbacks: Asset Returns 7-12-25

Mini Market Lookback: Tariffs Run Amok, Part Deux 7-12-25

Mini Market Lookback: Bracing for Tariff Impact 7-5-25

Payrolls June 2025: Into the Weeds 7-3-25

Employment June 2025: A State and Local World 7-3-25

Asset Return Quilts for 2H24/1H25 7-1-25

JOLTS May 2025: Job Openings vs. Filling Openings 7-1-25

Midyear Excess Returns: Too little or just not losing? 7-1-25

Recent Tariff commentary:

US-France Trade: Tariff Trigger Points 7-17-25

Germany: Class of its own in EU Trade 7-16-24

US-Canada Trade: 35% Tariff Warning 7-11-25

India Tariffs: Changing the Music? 7-11-25

Taiwan: Tariffs and “What is an ally?” 7-10-25

US-Trade: The 50% Solution? 7-10-25

Tariff Man Meets Lord Jim 7-8-25

South Korea Tariffs: Just Don’t Hit Back? 7-8-25

Japan: Ally Attack? Risk Free? 7-7-25

US-Vietnam Trade: History has its Moments 7-5-25

US Trade in Goods April 2025: Imports Be Damned 6-5-25

Tariffs: Testing Trade Partner Mettle 6-3-25

US-UK Trade: Small Progress, Big Extrapolation 5-8-25

Tariffs: A Painful Bessent Moment on “Buyer Pays” 5-7-25

Trade: Uphill Battle for Facts and Concepts 5-6-25

Ships, Fees, Freight & Logistics Pain: More Inflation? 4-18-25

Tariffs, Pauses, and Piling On: Helter Skelter 4-11-25

Tariffs: Some Asian Bystanders Hit in the Crossfire 4-8-25

Tariffs: Diminished Capacity…for Trade Volume that is…4-3-25