US Trade in Goods April 2025: Imports Be Damned

We highlight some fallout in US trade as tariffs send imports cratering in April with pharma, autos, and metal products among notable decliners.

Bringing some nuance to trade policy.

The monthly US goods trade deficit declined over $64 bn in April 2025 (Exhibit 14 in trade release for country details) as import volumes experienced a staggering $67 bn drop. The April 2nd Liberation Day tariffs (paused, pending or otherwise) and myriad Section 232 tariffs had the expected immediate effect of driving down imports after the massive import and inventory frontloading of 1Q25.

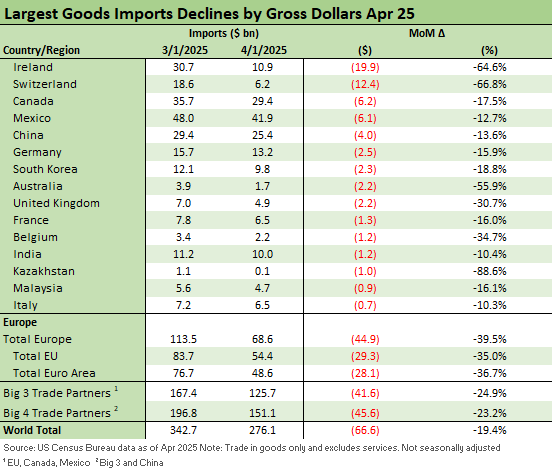

This morning’s data gives some insight to the country and sector level moving parts with Ireland and Switzerland leading the way in import decline deltas followed by the USMCA trade partners and China before a tightly packed cluster of trade partners including Germany, South Korea, Australia, and the UK comprising the remainder of the trade partners with import declines over $2 bn.

Pharmaceuticals (and pharma preparations) were the hardest hit in import volumes, declining over $26 bn on the month with Ireland and Switzerland as the largest single month declines by country given the concentration of pharma in their import mix.

The tariff and trade policy headwinds will keep swirling and affect a broader range of countries as tariff talks start, pause, stop, and start again, but the tectonic shifts are clearly underway as the market awaits more data across working capital cycles and repricing of import costs (inventory liquidation/restocking, contracts).

The troubling part is that Trump’s White House policy sees the plunge in imports as a cash receipt (the opposite of a subsidy) as opposed to a corporate expense (the importing party “cuts the check” to customs to pay the tariff) and supplier chain disruptions that will eventually get paid for by a US party as an expense or a consumer facing a price increase.

The above chart shows the main event this month and details the largest declines in monthly import volumes. We line up the declines from highest to lowest. Import volumes in April declined $66.6 bn (19.4%) as the initial reciprocal tariff structure SNAFU was announced and the trade policy roller coaster began with other nations and with the courts.

We see the most immediate responses from Ireland and Switzerland where the concentration of pharmaceuticals led to rapid import declines. Overall, pharmaceuticals declined $26 bn on the month and are one of the targeted industries in the Section 232 queue while also facing national tariffs that are in flux with the reciprocal process. Like many of the other targeted items, the facilities to improve domestic pharma manufacturing are multi-year projects, so the short-term pain for such essential goods will be felt in wallets and personal health (whether individual health on a lack of affordability or in healthcare costs and related insurance). These pressures could be compounded further with potential Medicaid cuts in the Big Beautiful Bill making the Senate rounds.

The next group of countries are more mixed, but most share in the Autos pain that saw a $9 bn decline in Motor Vehicle imports on the month. Metal products used in manufacturing were also cited as big decliners in a manufacturing sector that is in theory the priority for growth via reshoring or new capacity.

Those US capacity initiatives downstream will face high costs of imports to the extent the US lacks an upstream supplier chain in place. There is no magical way to set everything up at the same time. That can also promote delays until everything is clear – including trade partner retaliation and a better sense of currency turmoil and the weaker dollar.

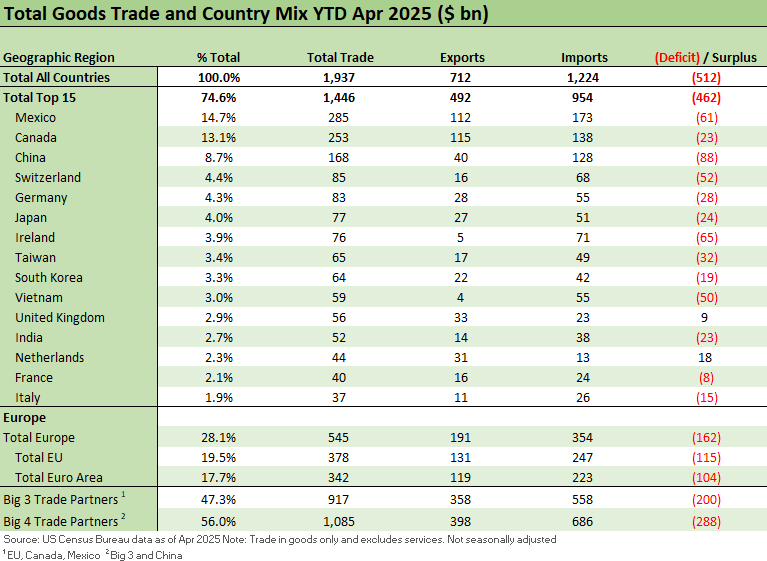

The above chart updates the trade picture on a YTD basis for a look at the bigger picture around where the trade partner rankings based on total trade (imports + exports).

We still see a $(513) bn goods trade deficit YTD 2025 vs. $(353) bn YTD 2024. With the impact of tariffs just beginning, uncertainty in planning and pricing will remain a major challenge for buyers and a purchasing manager. Contract terms will be challenging and established relationships strained.

The long-established efficient history of importing cheap goods for consumers and lower input costs for manufacturers and services companies does not simply disappear. The disruptions could cause demand destruction, pressure earnings via higher expenses, or drive rising prices. Economic reality and double entry accounting will prevail.

Recent Tariff Commentaries:

Tariffs: Testing Trade Partner Mettle 6-3-25

US-UK Trade: Small Progress, Big Extrapolation 5-8-25

Tariffs: A Painful Bessent Moment on “Buyer Pays” 5-7-25

Trade: Uphill Battle for Facts and Concepts 5-6-25

Tariffs: Amazon and Canada Add to the Drama 4-29-25

Ships, Fees, Freight & Logistics Pain: More Inflation? 4-18-25

Tariffs, Pauses, and Piling On: Helter Skelter 4-11-25

Tariffs: Some Asian Bystanders Hit in the Crossfire 4-8-25

Tariffs: Diminished Capacity…for Trade Volume that is…4-3-25

Reciprocal Tariff Math: Hocus Pocus 4-3-25

Reciprocal Tariffs: Weird Science Blows up the Lab 4-2-25