Tariffs: Testing Trade Partner Mettle

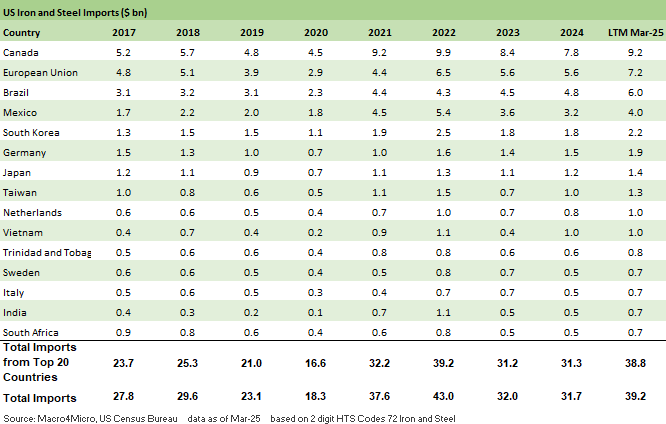

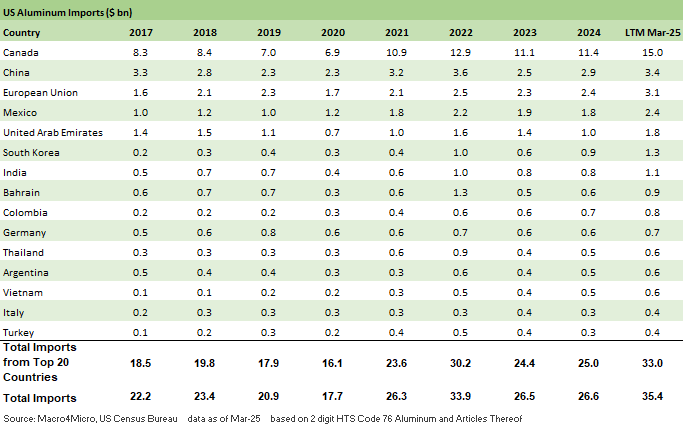

We detail some of the major steel and aluminum import numbers to highlight trade partner exposure.

Trade partners feeling a fresh round of heat

The 25% to 50% jump in steel and aluminum tariffs hits allies and antagonists alike but with Canada at #1 in both categories and disproportionately so in aluminum. With the exception of steel from Brazil, the lists are dominated by the usual top trade partners. China a minimal factor in steel imports but higher up in the leaderboard for aluminum.

The protectionism around steel is a great American political tradition in the interests of carrying states like Ohio (no longer a swing state) and Pennsylvania (still the 1000-pound gorilla of Presidential elections), but 50% tariffs are in a different universe. The political motive is still there but the steel and auto industries have been a recurring Trump theme for decades.

The steel and aluminum users will feel major expense pressure as complaints from the Chamber of Commerce and National Association of Manufacturers echo. Steel trade groups understandably applaud the tariff move.

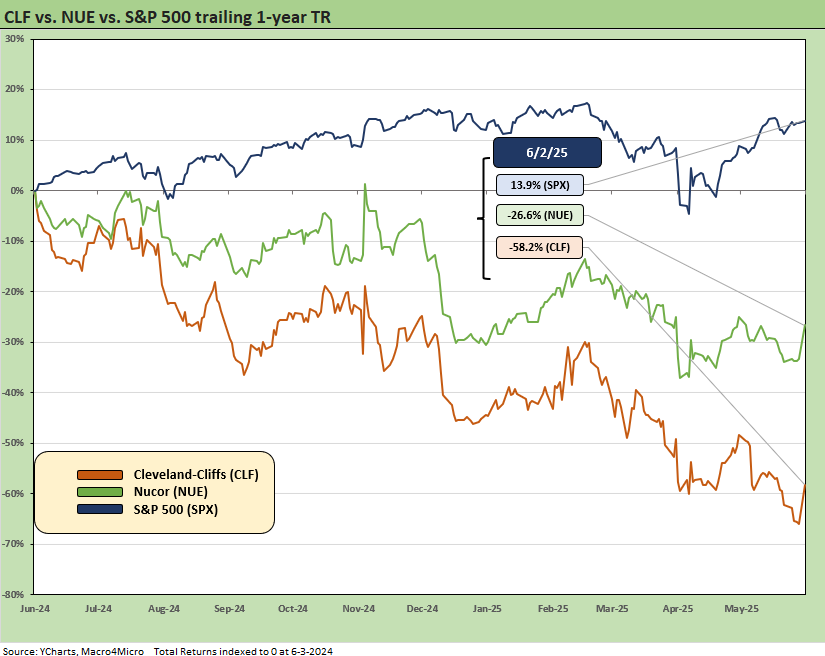

Monday saw the bellwether steel stocks of Cleveland Cliffs (CLF), Nucor (NUE), and Steel Dynamics (STLD) soar as revenue and earnings projections will get a major lift. The opposite economic impact will be felt by business lines and consumers at the end of these material chains as basic economic realities. Someone gets charged more and the expense line and price changes will mean economic damage “for someone somewhere.”

Below we break out some of the steel and aluminum import ranking by trade partner as some food for thought. There will be plenty of reactions to gauge from both sellers and users of steel. We include some stock return details in the chart above that underscores how the steel companies will be big winners. Steel operators will see more volume (with higher utilization and operating leverage benefits) and/or higher prices.

Yesterday saw Cleveland-Cliffs (CLF) rise by +23%, Nucor (NUE) by over +10%, and Steel Dynamics (STLD) by over 10%. On a separate more over in aluminum, Century Aluminum (CENX) rose by over +21%. CENX is the other leading player in US smelting capacity with Alcoa (AA), which ticked lower on the day. Alcoa has more capacity and a major stake in Canadian aluminum along with Rio Tinto. The tariffs raise costs for the US consumer and take the consumer further away from the benefits of low-cost power and notably hydroelectric power in Quebec.

The good news for steel producers is that the steel and aluminum tariffs fall under the Section 232 mandate that has already been well covered in terms of legislative clout. This is not caught up in the reciprocal IEEPA courtroom action.

Steel and aluminum import league tables

The above chart highlights the exposure of Canada and EU to steel import tariff and what that in turn could mean to the US buyers. The buyer pays the tariff, and we will keep highlighting that until Trump, Bessent, and Lutnick say those very noncontroversial factual words (see Tariffs: A Painful Bessent Moment on “Buyer Pays” 5-7-25). At the border, the buyer pays. Where the economic impacts will get felt is the more analytical and subjective and assumption-driven part of the analysis.

We like to look at trade group commentary for a cleaner story than you get from Washington. Looking at commentary from those who live in the manufacturing trenches such as the National Association of Manufacturers, Chamber of Commerce, and just about any auto trade publication or trade group will drive home how damaging material costs tariffs will be to their businesses.

Many of these sources include color from the bottom up. That is more reliable than political or top-down economic commentary given its specificity and production and purchasing level color. The National Association of Manufacturers made a good point in that the question should be refine to “Who write the check for the tariff?” NAM flags how their members do. That is a direct cash flow item.

The cost sharing assumptions from the seller of the product (steel and aluminum countries operating in the countries on the above list) across the supplier chain (e.g. auto and capital goods component suppliers), for construction firms, and for finished goods OEMs (auto, ag equipment, construction and mining equipment etc.) only plays out at a lag (inventory, contracts, project terms etc.).

The above chart highlights Aluminum imports, and the easy takeaway is that Trump once again is taking aim at Canada. That is line with statement that he would use economic coercion to get Canada to be the 51st state.

For a sense of what lofty aluminum tariffs mean Alcoa, the #1 US player, just read through some of the Alcoa earnings transcript for color on this topic, and it is clear the collateral damage to downstream buyers will be material. Small businesses will suffer and the flow-through of input costs will translate into higher auto retail prices or, alternatively, eat into profit margins per vehicle. Auto supplier chains are often the victims in lopsided negotiations with their OEM customers, and they also tend to be more fragile in financial profile. That can negatively impact their credit quality in trade credit or bank credit.

The idea behind the tariffs is that more aluminum smelters will be built, and those are massive multiyear projects that also need the right infrastructure. The fact that electricity is a major expense then gets back into the challenges to the US power grid at a time when the markets are seeing massive growth in demand from such markets as data centers.

The aluminum tariffs make much less economic sense than steel since companies will not “reshore” or meaningful expand such projects out of fear these tariffs will be reversed in some election cycle in the future. The power problem will still be there.

See also:

Footnotes & Flashbacks: Credit Markets 6-2-25

Footnotes & Flashbacks: State of Yields 6-1-25

Footnotes & Flashbacks: Asset Returns 6-1-25

Mini Market Lookback: Out of Tacos, Tariff Man Returns 5-31-25

PCE April 2025: Personal Income and Outlays 5-30-25

Credit Snapshot: Meritage Homes (MTH) 5-30-24

1Q25 GDP 2nd Estimate: Tariff and Courthouse Waiting Game 5-29-25

Homebuilder Rankings: Volumes, Market Caps, ASPs 5-28-25

Durable Goods Apr25: Hitting an Air Pocket 5-27-25

Mini Market Lookback: Tariff Excess N+1 5-24-25

New Home Sales April 2025: Waiting Game Does Not Help 5-23-25

Existing Home Sales April 2025: Soft but Steady 5-22-25

Credit Snapshot: Lithia Motors (LAD) 5-20-25

Home Starts April 2025: Metrics Show Wear and Tear 5-19-25

Footnotes & Flashbacks: Credit Markets 5-19-25

Industrial Production April 2025: CapUte Mixed but Time Will Tell 5-15-25

Retail Sales April 25: Shopping Spree Hangover 5-15-25

Credit Spreads: The Bounce is Back 5-13-25