US-Canada Trade: 35% Tariff Warning

US-Canada trade tension rises as Trump pursues a targeted destruction of key Canadian industries.

Time for Canada to go old school.

The slow and steady process of rolling Auto, Steel, Aluminum, and now Copper tariffs into the US working capital cycles now sees the threat of a newly raised 35% blanket tariff and fresh 50% on copper. Canada is the #1 export nation LTM for the US with EU #1 as a bloc. These two trade partners for the US show trade relations at an all-time low (NATO allies all).

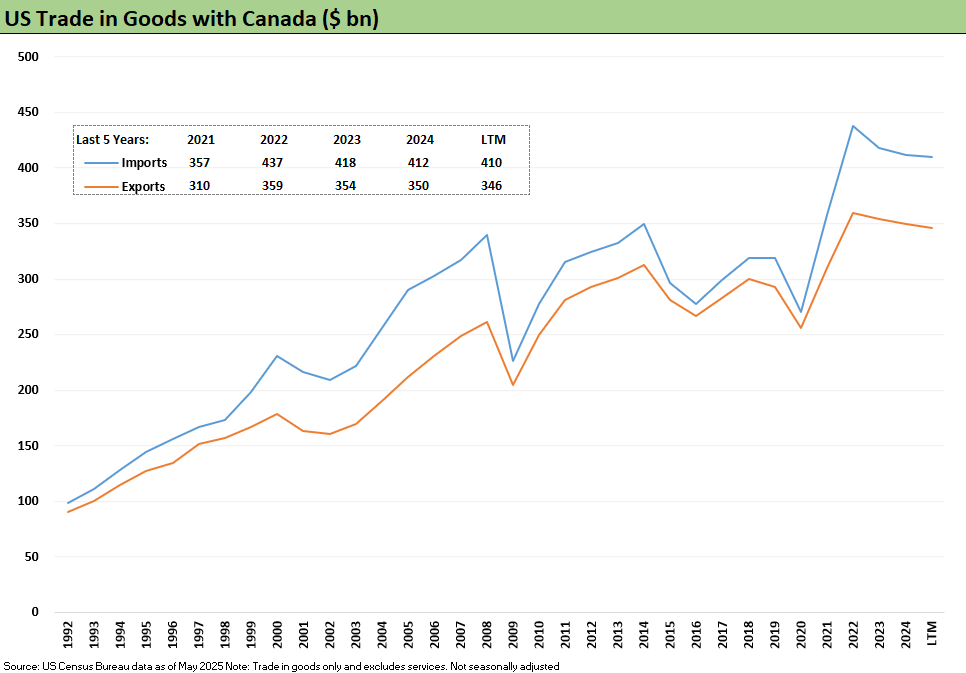

We update the running import-export flows between the US and Canada below as food for thought as investors ponder high tariffs. The risk of a combination of Canada, the EU, Japan, and South Korea all taking limited action on target US exports (typically the ag sector and select manufacturing) would be tough medicine on the US when the retaliation cycles kick into gear. Mexico has been MIA. The short-term pain equation and what macro backdrop lurks on the other side of a trade war is tough to gauge unless more than one major trade partner retaliates. That would be a problem for the US. It could happen.

The view of the Trump trade approach to Canada does not take much imagination to see Team Trump’s plan as a tactical attempt to drive higher Canadian bankruptcies and mass downsizing of industry capacity. It is not subtle. An unprecedented attack begs an unprecedented response. National unity in Canada is needed for an aggressive response while it is not a variable in the US. Inflation scares Trump with his cornerstone economic policy at risk (tariffs) and GOP control of the House in 2026. Meanwhile, a major economic contraction scares Canada.

The divided provincial interests and perennial disputes within Canada are only exceeded in political dysfunction by the US. The big difference is that one person (Trump) drives the entire trade process in the US while Canada needs to work with provinces who may not allow their major export lines to the US to be weaponized. That includes oil, potash, fertilizer, and uranium among other resources that need to be “aimed” for maximum value.

As the tariff chaos and waves of new numbers hit the headlines this week – and with a lot more to go – the biggest risks remain with the big 4 trade partners of the EU, Canada, Mexico and China. EU and Canada are now on the front burner.

In this note, we update some Canada metrics as a memory jogger. We have picked over these issues in past commentaries on Canada (see links at bottom). Overall, it is important not to lose sight of the fact that the US has a goods trade surplus with Canada ex-crude. That means a lot of targets in the high value-added exports to Canada.

One of the mains risks for US assets and macro headwinds is that Canada and the EU retaliate in a separate but equal move against either US exports or through tactical weaponization of supply chains. Example: The US has a major surplus in dairy and that would be a retaliation target. That also gets caught up in the USMCA risks and whether that trade agreement even survives. Canada provides critical potash and fertilizer badly needed by the US ag sector. Supply actions could be a potential nightmare for ag sector expenses and ability to operate.

Canada could also marshal efforts to find new buyers (EU, China, etc.) for a wide range of goods currently purchased from the US. That is true for Goods and Services. They also could return to attacking tech services as the EU is pondering.

There are scenarios where the risks could get serious and that comes down to domestic political risk and endurance. The worst downside for the US is a few large trade partners lock in on the idea that an intense short-term fight is worth it for long term benefits after Trump is gone. After all, both sides (Canada and much of the US) will blame Trump and a cowed GOP for the economic fallout. The diehard MAGA 30% are a constant, but a trade war would force a political reality check. Who knows what the trade partners are kicking around in their game theory.

The above chart details the export list. No matter how you slice it, that is a high value-added list and also one that includes many critical materials that would be needed in any “manufacturing renaissance” or reshoring wave. The availability of materials and inputs (notably metals, energy, power, etc.) are part of any reshoring or relocation decision for the Trump end game of rebuilding manufacturing. The sequence of corporate decision making and framing the economics of multiyear projects is a tough call when you tariff everything in sight.

The above chart updates the trade deficit with Canada. The price of oil is a major swing factor but currently crude oil imports into the US exceed the trade deficit (see earlier import table). The crude volumes are low-cost, discounted heavy crudes that are very attractive to refiners. The infrastructure to serve those refining markets is not done on a whiteboard. There are supply constraint scenarios and outsized tariff responses (Trump has threatened that in the past) that would be assured to push inflation higher.

The above chart updates the timeline of import and export growth since the original NAFTA years. The 2022 pop ties into energy prices. No matter how you want to view trade deficits, there is a lot of economic activity and multiplier effects captured in this chart.

Canada Metals and Steel Information:

Minerals and Metals Facts: Canada

Canada Tariff Commentaries:

Tariffs: Amazon and Canada Add to the Drama 4-29-25

Trade Exposure: US-Canada Import/Export Mix 2024 2-7-25

Aluminum and Steel Tariffs: The Target is Canada 2-10-25

US Trade with the World: Import and Export Mix 2-6-25

The Trade Picture: Facts to Respect, Topics to Ponder 2-6-25

Tariffs: Questions to Ponder, Part 1 2-2-25

US-Canada: Tariffs Now More than a Negotiating Tactic 1-9-25

Tariff: Target Updates – Canada 11-26-24

Trump, Trade, and Tariffs: Northern Exposure, Canada Risk 10-25-24

Trump at Economic Club of Chicago: Thoughts on Autos 10-17-24

Other Recent Tariff commentary:

India Tariffs: Changing the Music? 7-11-25

Taiwan: Tariffs and “What is an ally?” 7-10-25

Tariff Man Meets Lord Jim 7-8-25

South Korea Tariffs: Just Don’t Hit Back? 7-8-25

Japan: Ally Attack? Risk Free? 7-7-25

US-Vietnam Trade: History has its Moments 7-5-25

US Trade in Goods April 2025: Imports Be Damned 6-5-25

Tariffs: Testing Trade Partner Mettle 6-3-25

US-UK Trade: Small Progress, Big Extrapolation 5-8-25

Tariffs: A Painful Bessent Moment on “Buyer Pays” 5-7-25

Trade: Uphill Battle for Facts and Concepts 5-6-25

Ships, Fees, Freight & Logistics Pain: More Inflation? 4-18-25

Tariffs, Pauses, and Piling On: Helter Skelter 4-11-25

Tariffs: Some Asian Bystanders Hit in the Crossfire 4-8-25

Tariffs: Diminished Capacity…for Trade Volume that is…4-3-25