Mini Market Lookback: Macro Muddle, Political Spin

A busy economic release week and decent start to June quarter earnings allowed a risk-happy market to hold serve.

Multipurpose chipper. Can also be used on tariff facts and concepts.

The most interesting trends this past week were some healthy signs from the consumer sector in retail sales, in the bank earnings reports, and the highest consumer sentiment (July prelim) in 5 months even if still 16 points below Dec 2024. Year ahead inflation expectations in the UMich survey declined to 4.4% (from 5.0%) while long term inflation expectations declined to 3.6% from 4.0%.

The monthly CPI exercise now locks in on the MoM sequential trends by product line to find inflation signals, and there was plenty of evidence of price pressure with much more to come as working capital cycles turn over, the Aug 1 date comes/goes, and more Section 232 “national security” tariffs roll in (see CPI June 2025: Slow Flowthrough but Starting 7-15-25).

The partisan spin of the factual and conceptual views on tariffs and links to pricing, the attacks on Powell by Trump, and the mixed economic releases (hard and soft data), usually end up as favorable takeaways unless there is clarity on more immediate downside. The market is on edge about Powell and Fed independence risk as the media is wheeling out the expected (and some unexpected) pedigreed wannabes who have done everything but stand in an Amsterdam window.

In tariffs, eyes are on the EU first and foremost for signs of lines being drawn on Trump’s assault on Europe’s industrial base. Canada and Mexico are not settled yet as the tariff clock ticks away toward Aug 1 when new working capital cycles will be underway and a new process of phasing in higher unit costs for the buyer arrives. Section 232 for Pharma, Semis, Aircraft/Parts, and Lumber still lurk in the tunnel. We saw clear signs of tariff impacts going line by line in the MoM CPI report. More will be coming.

The bank earnings season have been constructive so far with their news on provisioning, loan demand, consumer spending, and asset quality (C&I to credit cards). Amex also weighed in last week with solid quality numbers, and we will get more gut checks on consumer asset quality this week.

This week brings a massive earnings wave of bellwethers (homebuilders, rails, aero/airlines, GM, TSLA, GOOGL) along with a Powell speech, existing home sales, new homes sales, and durable goods.

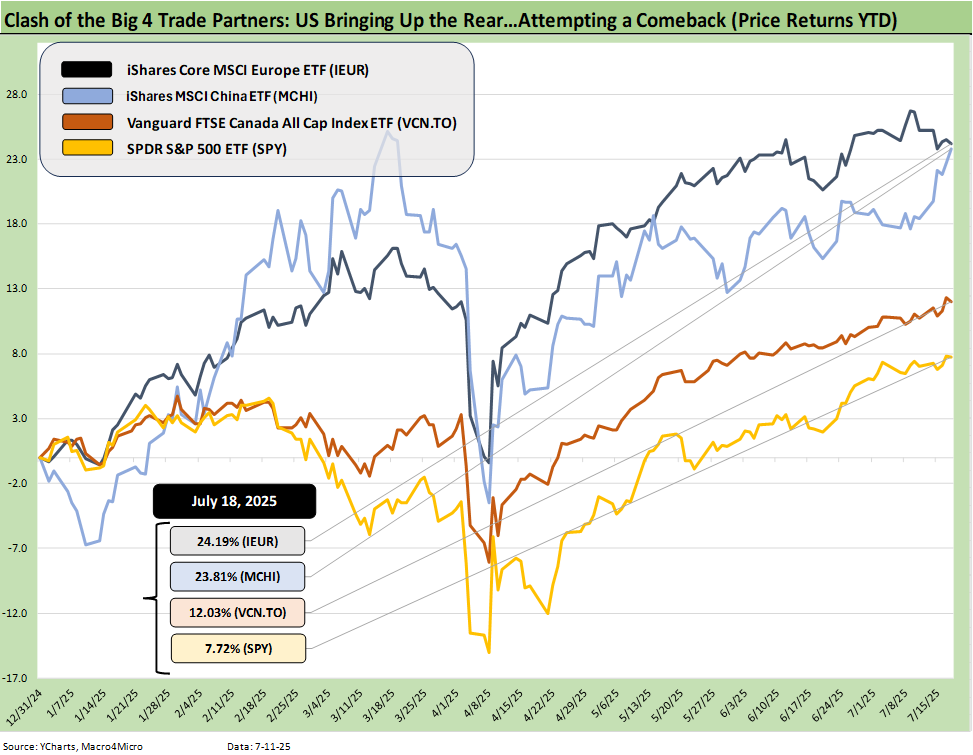

The above chart updates the running YTD performance of the Big 4 trade partners who have been clashing in trade – US, China, EU, and Canada. We leave out Mexico given its typical asterisk as an emerging market (that said, the Mexico ETF is way ahead of the S&P 500). As in prior weeks, the US continues to bring up the rear well behind China and Europe and behind Canada. The new Golden Age is still being poured into the tariff molds.

The above chart updates the running 1-week and 1-month credit spread deltas across IG, HY and the BBB tiers and below. We see steady compression with IG spreads inside numerous past credit cycle tights over the past 20 years (see Footnotes & Flashbacks: Credit Markets 7-14-25). HY spreads are back in the June 2007 zone.

The above chart lines up the 1-week returns across the benchmarks and ETFs we track. The positive-negative score of 24-8 is very solid. The winners are a reasonably diverse mix with Base Metals ETF (DBB) at #1, Tech (XLK) at #2, EM Equities (VWO) at #3, Utilities (XLU) at #4, and the NASDAQ rounding out the top 5. We see BDCs (BIZD), Industrials (XLI), and Financials (XLF) finishing in the top quartile. The overall mix across the 32 lines is showing less breadth on the week with the S&P 500 and small cap Russell 2000 in the second quartile and Midcaps near the bottom of the third quartile.

The negative mix includes energy (XLE, XOP), Homebuilders (XHB), Health Care (XLV), the cyclical Materials ETF (XLB), and Transports (XTN). Notably the Equal Weight S&P 500 ETF (RSP) is slightly negative.

The 7 bond ETFs posted a 6-1 score with the long duration UST ETF (TLT) showing the impact of the long end steepening as the 30Y UST bounces around the 5% line with the short-to-intermediate segment of the yield curve holding in and rallying this week (see charts below).

The above chart updates the tech bellwethers in descending order of 1-week returns. We see only 1 Mag 7 in the red (Meta) but Apple was essentially flat. We are back to seeing everything in the table in positive range for 1-month and 3-months with the latter being the post-Liberation Day period rebound. Looking back 6 months, we see 3 of the Mag 7 in the red with Tesla, Apple, and Alphabet negative and Amazon barely positive. Looking back 1-year, only Apple is in the red.

The above chart updates the UST deltas with slightly lower short to intermediate yields but the 30Y facing setbacks again as it jumps around on Powell-bashing headlines and inflation debates.

The above chart posts the YTD UST deltas with the UST bull steepener from 2Y to 10Y offsetting the long end damage in the bond ETF return mix.

The above chart updates the Freddie Mac 30Y mortgage benchmarks vs. the UST 10Y. The steepening anxiety remains high around any combination of tariff flowthrough into prices, UST supply pressures, and potential trade conflicts that could have a two-sided effect on inflation, economic growth and in turn raise stagflation risks.

The potential market reaction to Trump keeping the streak alive by putting yes men in the FOMC will not help inflation fears. There is no shortage of lapdog litters in Washington with power and title ambitions running around the Fed or the White House. The opportunistic usurpers have been on the speech and CNBC circuit the past week.

The above chart shows a minor -4 bps compression of HY spreads since last week. HY OAS remains extremely tight by any context although there is also the asterisk that the HY quality mix is more BB tier heavy than the June 2007 index mix when similar spreads were posted back in the peak of the 2007 credit bubble.

The above chart updates the quality spread differential between HY and IG with the above +213 bps down -1 bps since last week. The market had compressed to +178 bps to start the year in Jan 2025.

The BB vs. BBB quality spread differential tightened by -2 bps on the week to +72 bps. The 2025 lows in Feb 2025 of +56 bps highlights some room to maneuver, but the long-term median of +133 bps underscores the compression and tightness of pricing along the speculative grade divide.

Markets:

Housing Starts June 2025: Single Family Slips, Multifamily Bounces 7-18-25

Retail Sales Jun25: Staying Afloat 7-17-25

June 2025 Industrial Production: 2Q25 Growth, June Steady 7-16-25

CPI June 2025: Slow Flowthrough but Starting 7-15-25

Footnotes & Flashbacks: Credit Markets 7-14-25

Footnotes & Flashbacks: State of Yields 7-13-25

Footnotes & Flashbacks: Asset Returns 7-12-25

Mini Market Lookback: Tariffs Run Amok, Part Deux 7-12-25

Mini Market Lookback: Bracing for Tariff Impact 7-5-25

Payrolls June 2025: Into the Weeds 7-3-25

Employment June 2025: A State and Local World 7-3-25

Asset Return Quilts for 2H24/1H25 7-1-25

JOLTS May 2025: Job Openings vs. Filling Openings 7-1-25

Midyear Excess Returns: Too little or just not losing? 7-1-25

Recent Tariff commentary:

US-Italy Trade: Top 15 Deficit, Smaller Stakes 7-18-25

US-France Trade: Tariff Trigger Points 7-17-25

Germany: Class of its own in EU Trade 7-16-24

US-Canada Trade: 35% Tariff Warning 7-11-25

India Tariffs: Changing the Music? 7-11-25

Taiwan: Tariffs and “What is an ally?” 7-10-25

US-Trade: The 50% Solution? 7-10-25

Tariff Man Meets Lord Jim 7-8-25

South Korea Tariffs: Just Don’t Hit Back? 7-8-25

Japan: Ally Attack? Risk Free? 7-7-25

US-Vietnam Trade: History has its Moments 7-5-25

US Trade in Goods April 2025: Imports Be Damned 6-5-25

Tariffs: Testing Trade Partner Mettle 6-3-25

US-UK Trade: Small Progress, Big Extrapolation 5-8-25

Tariffs: A Painful Bessent Moment on “Buyer Pays” 5-7-25

Trade: Uphill Battle for Facts and Concepts 5-6-25

Ships, Fees, Freight & Logistics Pain: More Inflation? 4-18-25

Tariffs, Pauses, and Piling On: Helter Skelter 4-11-25

Tariffs: Some Asian Bystanders Hit in the Crossfire 4-8-25

Tariffs: Diminished Capacity…for Trade Volume that is…4-3-25