India Tariffs: Changing the Music?

As the tariff binge continues, we look at the US-India import-export mix and trade trends with a Top 15 trade partner.

A record trade surplus! And we dance better than Trump.

As the #13 US total trade partner (imports + exports), India offers a diverse import product mix from high to low value with a growing pharma presence, some tech-centric categories and a mix of “labor arb” heavy products such as apparel and curtains/linens.

Pharma at #1 might surprise some, and that is a line that is on the Section 232 launching pad with threats by Trump this week of “very, very high” tariffs with an off-the-cuff indication of potentially the 200% level.

As the market awaits the India “number,” the main data points coming out of Liberation Day was Trump’s “You should be charged 52% but I am only going to hit you with 26%.” (see Reciprocal Tariff Math: Hocus Pocus 4-3-25, Reciprocal Tariffs: Weird Science Blows up the Lab 4-2-25). The waiting game continues.

India also could get tagged with an additional 10% for the BRICS initiative, but that group has more reasons to consider alternative currencies beyond simply the economics of trade (sanctions protection, defense against unilateralism, transaction clearing risk with energy or defense suppliers, etc.). Not long ago, Trump threatened 100% tariffs on trade partners that support BRICS or the de-dollarization trend.

The above chart breaks out the top 15 trade deficits, and we see India at #12 (#11 by nation ex-EU) positioned between South Korea and Thailand.

The above chart details the top 15 importers into the US with India at #12 between Switzerland and Italy.

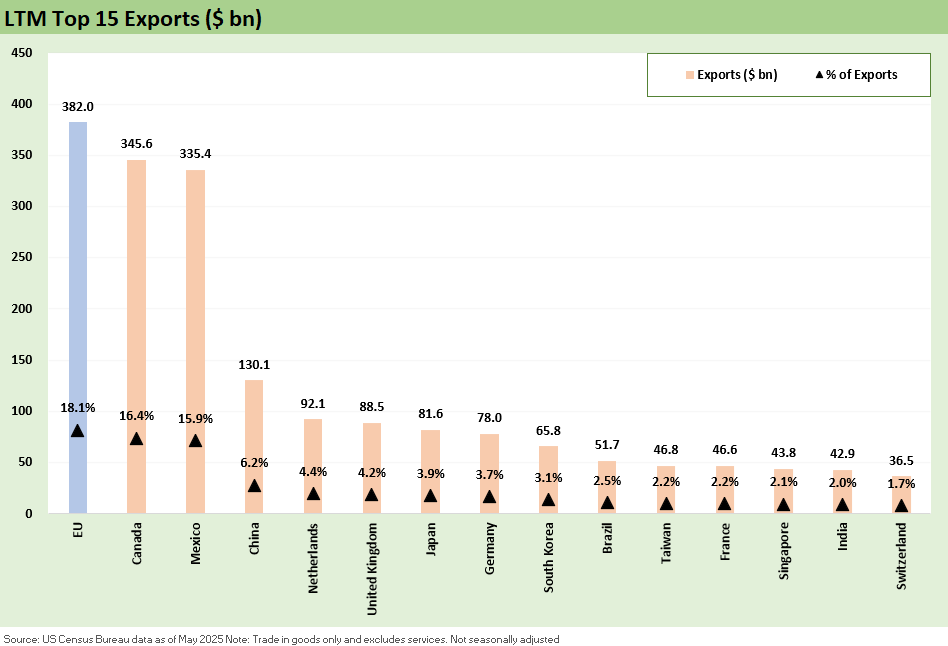

The above list of top export markets shows India at #14 behind Singapore and just ahead of Switzerland.

Using total trade (imports + exports) as the metric, we see India ranked at #13 behind Switzerland and ahead of the Netherlands.

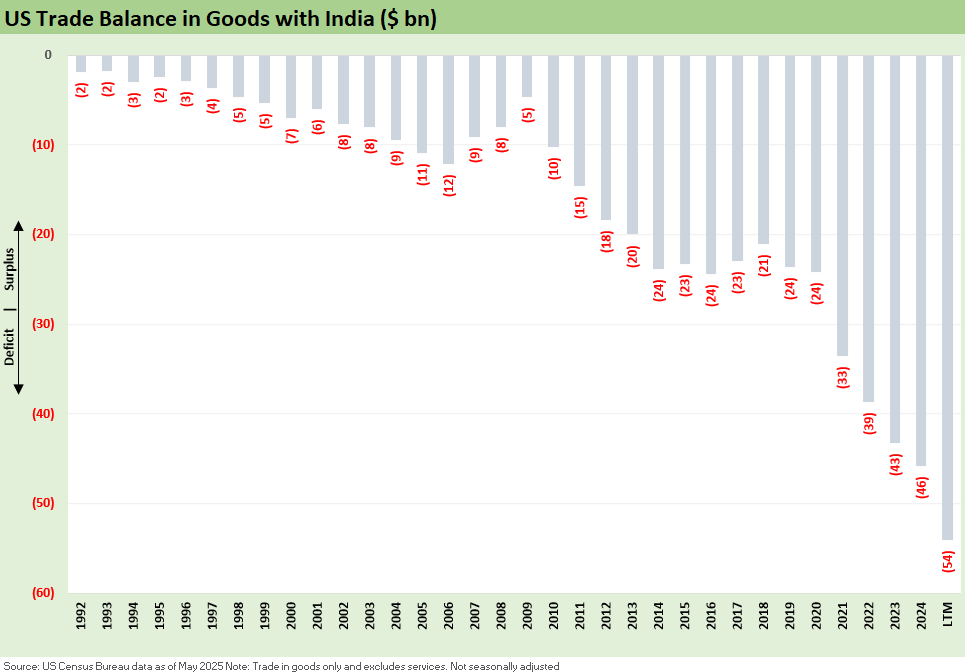

The trade deficit history of India is broken out above, and it is moving steadily higher. Team Trump will need to consider the geopolitical aspects of India relative to China and Russia, but India has always had a high tariff structure in its economy (weighted average around 12% vs. legacy 2% handle for the US before Trump). The historical India tariffs no longer look very high given the off-the-charts Trump numbers being generated on the US side.

The above chart frames the more eclectic mix of the Indian imports which look somewhat distinctive in the top 5 relative to other major Asian trade partners. The fact that Pharmaceuticals is #1 is a different look vs. other Asian trade partners with Jewelry & Silverware as well as Cut and Sew Apparel in the top 4. Pharma is targeted for a massive Section 232 tariff spike.

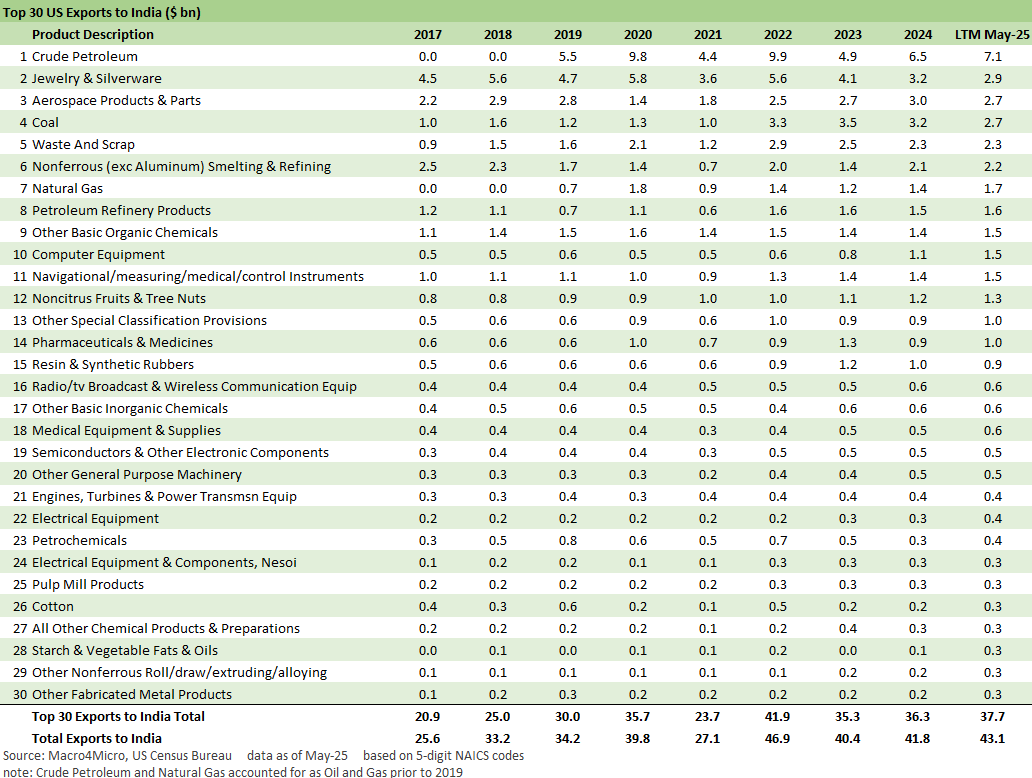

The export mix from the US to India is heavy on energy as we often see in Asia trade partners with crude oil at #1, coal at #4, natural gas at #7, and refined products at #8.

The above chart highlights the steady rise in total trade with India in a growing world economy but especially the rapid increase in import volumes in the post-COVID cycle. The potential for increased trade by India with other Asian economies, Latin America, Canada, or the EU to replace US export lines will be a trend to watch. That is a separate form of retaliation without actually being a “tariff retaliation.” There is plenty of room to look for substitutes from other partners to lower that US export list.

Tariff related:

Taiwan: Tariffs and “What is an ally?” 7-10-25

Tariff Man Meets Lord Jim 7-8-25

South Korea Tariffs: Just Don’t Hit Back? 7-8-25

Japan: Ally Attack? Risk Free? 7-7-25

US-Vietnam Trade: History has its Moments 7-5-25

US Trade in Goods April 2025: Imports Be Damned 6-5-25

Tariffs: Testing Trade Partner Mettle 6-3-25

US-UK Trade: Small Progress, Big Extrapolation 5-8-25

Tariffs: A Painful Bessent Moment on “Buyer Pays” 5-7-25

Trade: Uphill Battle for Facts and Concepts 5-6-25

Tariffs: Amazon and Canada Add to the Drama 4-29-25

Ships, Fees, Freight & Logistics Pain: More Inflation? 4-18-25

Tariffs, Pauses, and Piling On: Helter Skelter 4-11-25

Tariffs: Some Asian Bystanders Hit in the Crossfire 4-8-25

Tariffs: Diminished Capacity…for Trade Volume that is…4-3-25

Reciprocal Tariff Math: Hocus Pocus 4-3-25

Reciprocal Tariffs: Weird Science Blows up the Lab 4-2-25

See also:

Footnotes & Flashbacks: Credit Markets 7-7-25

Footnotes & Flashbacks: State of Yields 7-6-25