Retail Sales September 2025: Foot off the Gas

September retail sales inched higher but with signs of deceleration as core moved lower and consumer sentiment is not exactly reading holiday joy.

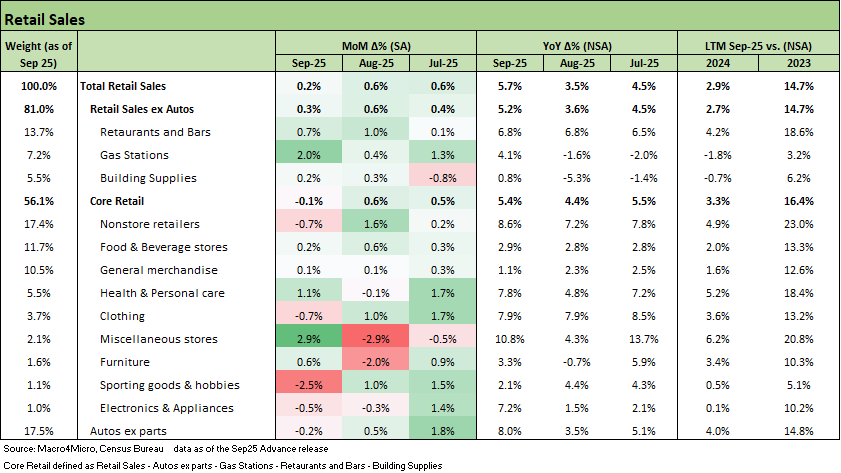

Headline retail sales rose 0.2% MoM in September which is a clear step down after a stronger summer period. Core retail sales were slightly negative, down 0.1% MoM, as Gas and Restaurant spending came in strong and buoyed the headline print. The National Retail Federation (NRF) is already seeing a pickup in demand again in their October data for a more mixed picture going into the holiday season.

Besides restaurant and gasoline spending, health and personal care (+1.1% MoM) and miscellaneous stores (+2.9% MoM) saw the largest increases on the month. The main drag on core sales was the decline in online sales, with nonstore retailers -0.7% after supporting a lot of the overall consumer demand picture as it had become a primary channel.

With payroll gains cooling and concentrated on services, unemployment drifting higher from the lows, and Michigan sentiment back in the mid-50s, the late-cycle signals are getting clearer. Consumers are still spending but are more price-sensitive and value-oriented, with overall credit health still strong but increasingly in a K-shaped economy.

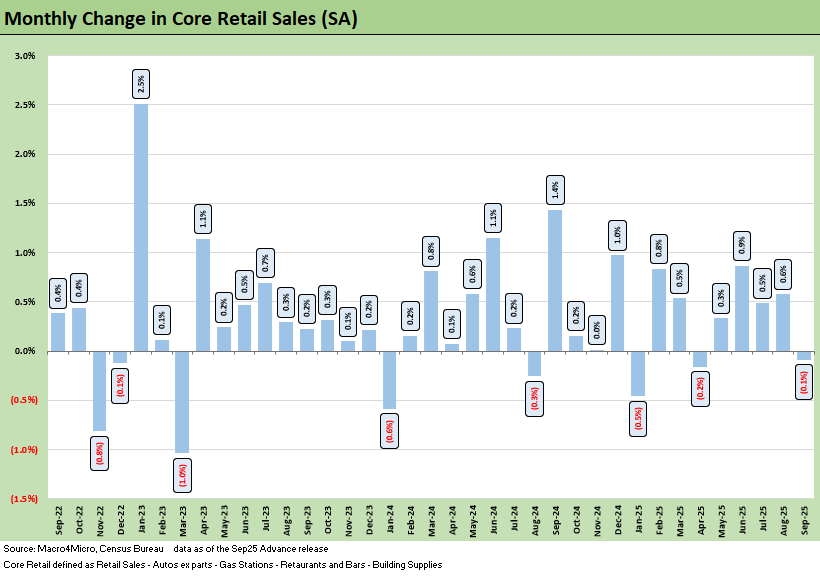

The above chart shows the core retail sales changes month to month which captures just over 56% of the basket and strips out some noisier categories. The decrease in September of 0.1% MoM comes after a run of solid gains through the summer. Core retail sales across that period provided strong underlying support for retail sales growth, with the negative this month a first since April that challenges the steady consumer spend story earlier in the year.

The current environment has labor-market worries intersecting with stubborn above-target inflation. Sustaining current spending levels still looks like the base case, but consumers at the median level are fragile. The UMich sentiment index is back in the low 50s on top of the all-time low and the Conference Board confidence metrics were in the tank today.

Households are signaling more concern about prices and job security. In that kind of environment, it would not be surprising to see core retail transitioning into somewhat of a drifting mode. With the holiday season here, whether discounts and value propositions can still drive growth will be a telling signal for the health of underlying demand. The usual Black Friday headlines will offer some important data points.

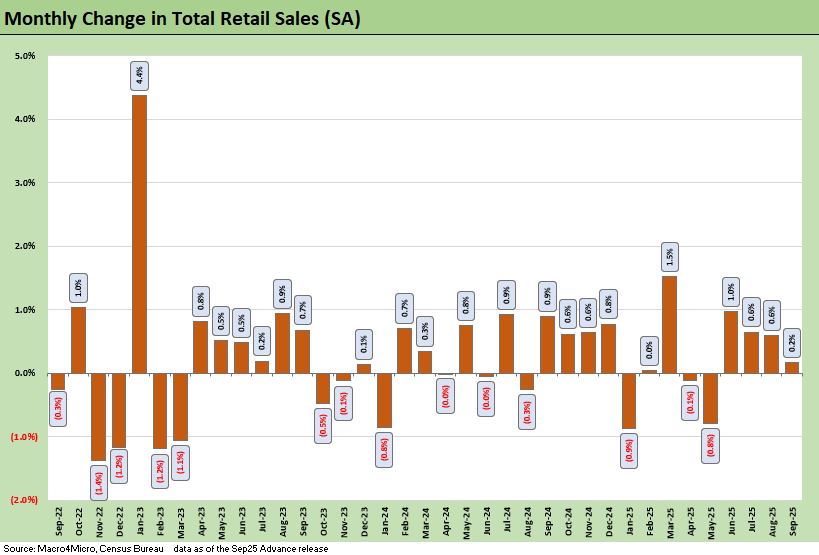

The above chart shows the history of headline swings as September reads as a cooling month after a strong summer. Retail sales are up 0.2% MoM, which shows consumer demand is still steady and resilient even if slowing. Zooming out further, we see 5.7% YoY against an inflation backdrop of roughly 3% YoY, as 2025 has been another slow grind up for retail spending.

The above breaks out the underlying categories alongside the ex-autos and core retail changes. We see Gas stations at +2.0% MoM echoing the pop in gasoline prices for the month. Gas station margins are booming with soft oil prices and good gasoline demand.

That gasoline demand did not result in a tradeoff for eating out, as Restaurants and bars were also up +0.7% MoM and a strong signal of where some households continue to prioritize spending. On the other side of headline categories, Autos ex parts declined 0.2% MoM in September, following two strong prints.

Down in the core categories, it is hard to move past the softness for Nonstore retailers, given its size and prominence in the report. The -0.7% MoM in context of the 8.6% YoY growth could turn out to be a temporary blip since the shift to online shopping channels only continues to pick up momentum. Other negatives were Clothing (-0.7%), Sporting Goods & Hobbies (-2.5%), and Electronics & Appliances (-0.5%). These are all categories where households can delay purchases, trade down, or respond more quickly to promotions when confidence is shaky.

The broader consumer signal supports a later cycle read but the household sector continues to spend steadily. Nominal spending is rising, yet the gains are less impressive given inflation and are increasingly anchored in select areas rather than broad-based goods demand. A weakening labor market and middling sentiment make that mix feel about right as prime and higher-income borrowers are still going out to eat and spending on wellness, while lower-income and goods-heavy households pull back more sharply and lean on credit at the margin.

With October’s jobs, inflation, and potentially retail releases delayed or missing, September’s composition will anchor the official narrative on the consumer with card networks, retailers, and private data filling in the blanks. For now, the US consumer is still there, but we will have to watch core closely into the holidays to understand where there is still a real demand growth impulse.

See Also:

The Curve: Flying Blind? 11-24-25

Market Commentary: Asset Returns 11-23-25

Mini Market Lookback: FOMC Countdown 11-23-25

Employment Sept 2025: In Data We Trust 11-20-25

Payrolls Sep25: Into the Weeds 11-20-25

Credit Markets: Show Me the Data 11-17-25

The Curve: Slopes Can Get Complicated 11-16-25

Mini Market Lookback: Tariff Policy Shift Tells an Obvious Story 11-15-25

Retail Gasoline Prices: Biblical Power to Control Global Commodities 11-13-25

Credit Markets: Budget Armistice or GOP Victory Day? 11-12-25

Simplifying the Affordability Question 11-11-25

The Curve: Back to the Future 11-9-25

Market Commetary: Asset Returns 11-9-25

Mini Market Lookback: All that Glitters… 11-8-25

Mini Market Lookback: Not Quite Magnificent Week 11-1-25

Synchrony: Credit Card Bellwether 10-30-25

Existing Home Sales Sept 2025: Staying in a Tight Range 10-26-25

Mini Market Lookback: Absence of Bad News Reigns 10-25-25

CPI September 2025: Headline Up, Core Down 10-24-25

General Motors Update: Same Ride, Smooth Enough 10-23-25

Mini Market Lookback: Healthy Banks, Mixed Economy, Poor Governance 10-18-25

Mini Market Lookback: Event Risk Revisited 10-11-25

Credit Profile: General Motors and GM Financial 10-9-25

Mini Market Lookback: Chess? Checkers? Set the game table on fire? 10-4-25

JOLTS Aug 2025: Tough math when “total unemployed > job openings” 9-30-25

Mini Market Lookback: Market Compartmentalization, Political Chaos 9-27-25

PCE August 2025: Very Slow Fuse 9-26-25

Durable Goods Aug 2025: Core Demand Stays Steady 9-25-25

2Q25 GDP Final Estimate: Big Upward Revision 9-25-25

New Homes Sales Aug 2025: Surprise Bounce, Revisions Ahead? 9-25-25

Mini Market Lookback: Easy Street 9-20-25

Home Starts August 2025: Bad News for Starts 9-17-25

Industrial Production Aug 2025: Capacity Utilization 9-16-25