Footnotes & Flashbacks: Credit Markets 7-7-25

Spreads return to levels below start of 2025 for all tiers but CCC with more tariff waves ahead across July.

Nothing to worry about except a few policy headwinds…

Spreads ended the holiday shortened week with US IG reaching +80 bps and US HY at +280 bps as spreads continue grinding towards levels last seen in June 2007. CCCs remain wider and the outlier this year as they provide at least some residual evidence of the 1H25 whipsaw.

With the main downside catalysts ahead being tariffs and potential trade retaliation with a dash of cyclical weakness in the consumer sector, the range of spread moves appear increasingly tied to the trade deal outcomes. The potential reversion to Liberation Day levels by Aug 1 will keep headlines on alert if the falling out is with the largest trade partners.

The realized impact of tariffs put in place will see more visibility as inventory costs reflect the higher levels and companies feel the need to get more specific in 2Q25 earnings season. The Vietnam trade deal gave the market more proof of concept on where key trade relationships may head, but the wave of disinformation on the costs (and even who pays the tariff to customs) remains here to stay.

The UST curve saw a mild move higher on the week and tempered the total returns in bonds. Most signs now point to minimal probability of cuts in July, as payroll and unemployment data pushed back on any need for Fed intervention (see Payrolls June 2025: Into the Weeds 7-3-25, Employment June 2025: A State and Local World 7-3-25). On the long end, the Big Beautiful Bill provides plenty of food for thought where rising systemic debt and slowing GDP growth will intersect with funding costs.

With spreads increasingly tight and back in the June 2007 range, a modestly softening macro picture and trade policy gambits still needing resolution, the challenge to remain at these compressed spread levels is growing. We see less UST curve relief in the cards and credit market performance from here looks to be more about carrying on through another stretch of risky asset volatility. The overall symmetry for further spread tightening continues to worsen and wider spreads would be a more rational outcome as the fall approaches.

Below we update our rolling weekly credit markets commentary and spread recap. We already addressed a range of moving parts in our earlier posts over the weekend:

Footnotes & Flashbacks: State of Yields 7-6-25

The above chart updates the credit spread deltas for 1-week and 1-month, and the trends remain positive for credit and IG and HY bonds. Spreads grind further towards the most recent lows (+77 US IG 12/24/24, +259 US HY 1/22/25) and closer to June 2007 levels (+241 to start June 2007 and ended at +298 bps).

The market quickly has been phasing out tariffs and trade volatility as the 1H25 roller coaster leaves the future moves smaller in comparison. The China trade war was arguably the most threatening given the range of products, retail dependence, and manufacturing supplier chain exposure (see Tariffs: Diminished Capacity…for Trade Volume that is… 4-3-25, Reciprocal Tariff Math: Hocus Pocus 4-3-25, Reciprocal Tariffs: Weird Science Blows up the Lab 4-2-25).

The game theory on a clash with the EU and/or Canada includes some mitigating elements such as those trade partners being democracies (Xi could do whatever he wanted for as long as he wanted). For the EU, they have a major challenge in retaliation and a trade war with the US given the divergent national interests across the members while Canada and provincial conflicts make Canada the second most politically dysfunctional Nation in North America.

For HY spreads, the rally back to +280 in HY is a vote of confidence in the balanced credit picture and the better positioning in higher income, shorter duration assets during a period of UST uncertainty. The BB heavy weighting of the HY index has been supportive of returns as noted in the next chart.

The above chart updates the YTD total return and excess return for IG and HY as well as the credit tiers. Excess returns are not impressive with little upside potential from spread compression, but IG and HY are at least solidly positive at this point. New issues in HY also have the “coupon edge” for income seekers. A 7% composite HY YTW tells a favorable story of cash income in new issue flows and refi-and-extension actions. There is a wide range coupons in the post-ZIRP world, so new issue holds a lot of allure.

Total returns show the benefits of the modest bull steepener that has supported the short to intermediate UST curve segment (see Footnotes & Flashbacks: State of Yields 7-6-25). That duration angle can support the trade-off along the BBB/BB divide for the now well-stablished HY Light strategy.

The double-digit IG spreads are back near prior cyclical lows but still just above the 4Q24 lows of +77 bps. The long-term IG OAS median of +129 bps leaves a lot of room but drives home how this market is priced in a rarefied spread range. With a 5.07% yield offered by the IG index, current coupon new issues whether “new money” or refinancing low coupon bonds bring a very solid base of demand after years or ZIRP and normalization coupon level in portfolios. Income is back in the picture this credit cycle.

At +280 bps, the HY OAS is in an increasingly rare territory with a 200-handle that only the June 2007 and recent 1Q25 lows share. These levels are inside the pre-COVID Jan 2020 levels and the prior cyclical lows of Oct 2018 and Jun 2014. The recent 2024 lows of +259 bps in Jan 2025 mean the uber-bulls will stay in the game, but the tariff clock is ticking, and the consumer is slowing down as noted in recent releases. That is a balancing act with the FOMC and the stagflation anxiety.

The “HY OAS minus IG OAS” quality spread differential at +200 bps remains wider to early 2025 but is back around Dec 2021 and early Oct 2018 levels. That allows little room for setbacks in fundamentals at the macro levels. Correlation to potential equity volatility is a constant companion for HY as seen in April, but the overall fundamentals are solid in the IG and HY issuer base with banks being healthy and the earnings expectations in nonfinancials steady.

The “BB OAS minus BBB OAS” quality spread differential is back to a 50-handle at +59 bps and only modestly above the +55 lows of summer 2024. That BB/BBB divide can swing around as we saw with the spike to +158 bps after Liberation Day. Autos and Energy will be important sectors to watch for potential volatility in those tiers.

The oil price story is always a tricky one with Iranian supply and Russian supply no small wildcards. OPEC actions also have been less than friendly to energy bulls in 2025. As just under $68 today (WTI) oil is below the Iran bombing highs but well above the late May $60 level.

For autos, it is very hard to see any good news coming out of the trade policies. There is only “degrees of bad” for the OEMs and potential catastrophe for some OE suppliers. Dealers and auto retail are the most resilient and the OEMs will need to take action to support their customer strategies. The Trump tariffs are unwinding global supplier chains it took decades to build. Japan and South Korea also remain in limbo for now. There will be much to sort through in the auto sector in 2H25.

The sub-200 BB tier OAS line is a rare one to cross and the BB composite is back to +160 bps. That is barely above the dazzling +157 bps low of Nov 2024 versus the long-term median at +296 bps. Oct 2018 lows of +203 bps is a notable comp for a frame of reference, given timing of the fresh sell-off in energy into Dec 2018. Though the current levels are vulnerable given the extraordinarily tight pricing, the higher quality index and low default rate leaves plenty of room for rationalization of these levels. For longer time horizons, the BB tier has been a great place to be.

The B tier is the sweet spot of legacy HY fund investors and the current +285 bps is well inside Oct 2018 and June 2014 lows and -179 bps below the long-term median.

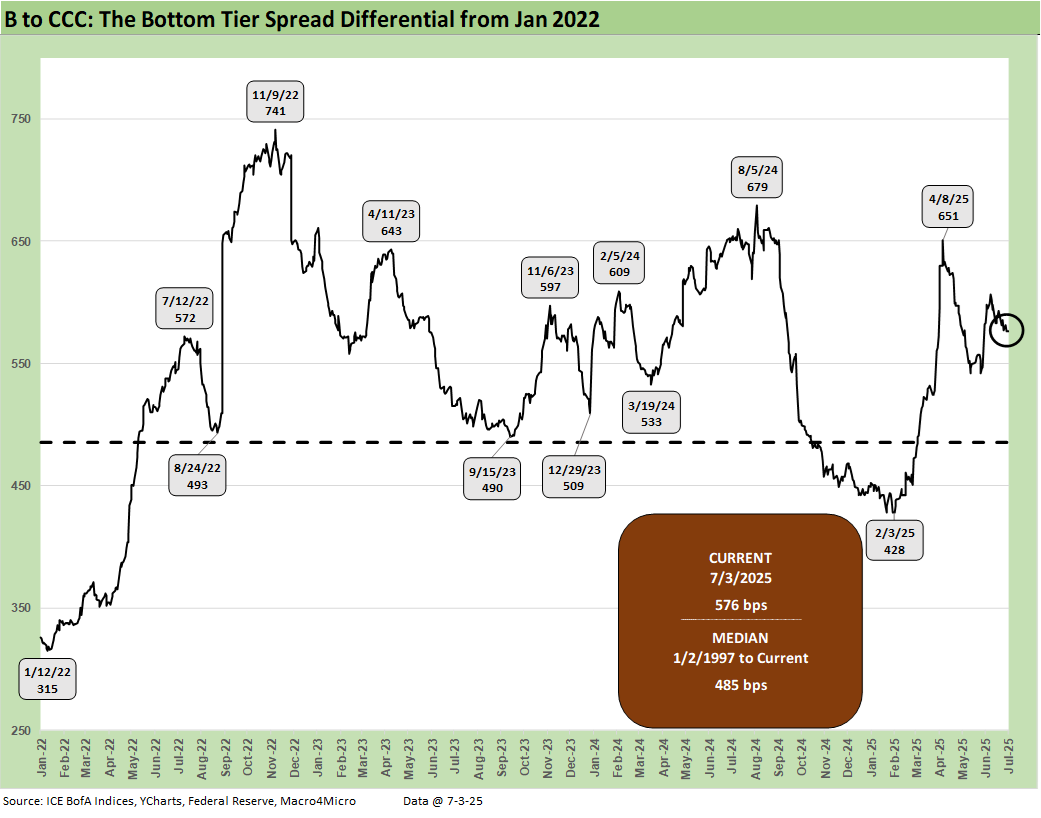

The B vs. CCC tier OAS time series is plotted above. The timeline for B and CCC spreads highlights the points of major divergence along the way (see The B vs. CCC Battle: Tough Neighborhood, Rough Players 7-7-24).

The current CCC tier OAS at +861 bps tightened by -27 bps the past week though remained under the long-term median of +952 bps. The CCC YTW stayed below 13% at 12.7% after being above 14% recently. The underlying constituents are widely dispersed across an 83.18 composite dollar price. The CCC tier is still in the pricing zone of equity risk-returns with such yields.

The shorter timeline from Jan 2022 just ahead of the end of ZIRP and start of the tightening cycle gives better granularity on the movements from a low for CCCs of +659 bps in Jan 2022 to a peak of +1226 bps in July 2022 and +1289 bps to end Sept 2022. Then spreads came down to the Jan 2025 tights of +690 bps ahead of the recent spike and whipsaw to current levels.

The B vs. CCC tier differential is broken out with the current +576 bps still higher than the long-term median of +485 bps and above the distinct market time horizons with the exception of the TMT HY credit cycle with its +702 bps median. The risks this year has seen CCC tier spreads remain wider by +115 bps YTD after the earlier whipsaw while the B tier is now -20 bps tighter YTD.

The above chart frames the “B vs. CCC tier” quality spread differential across the short timeline for better granularity. Quality spreads had widened with a vengeance since the low of Feb 2025 at +428 bps even if quality spreads recovered to +576 bps from the early April spike to +651 bps on April 8.

Moving away from spreads, which are well below long-term medians this week, yields for both IG and HY have a more complex story in historical context given the post-crisis distortions of ZIRP and “normalization.” The normalization period of Dec 2015 to Dec 2018 never really got on track with the economic weakness and Fed easing of 2019 followed by a COVID crisis and return to ZIRP in Mar 2020 (ZIRP ended March 2022). As a reminder, 2018-2019 was the “Greatest Economy in History” according to the current White House resident.

The current IG YTW at 5.07 % (vs. 5.06% last week) largely remained flat as the rising UST pushed yields and were largely offset by spread tightening. IG YTW remains below the 6.1% pre-ZIRP median on overall YTD UST curve moves.

The HY YTW decreased to 7.02% this week (from 7.11%) vs. a pre-ZIRP 9.3% median. We consider the pre-ZIRP years the most rational frame of reference in light of the post-crisis ZIRP and QE as well as the COVID Fed reactions.

Spreads will remain a key swing factor for reaching those yield medians of pre-ZIRP years, and we just saw material volatility in credit risk pricing in HY since early April. Then came a fresh rally after Iran and optimism on how the tariff pause will play out now with a Vietnam deal framework in hand. UST yields are a tougher call with the tariff backdrop that still threatens stagflation as well as the potential for a further technically driven upward UST curve shift on the supply-demand fears.

Stagflation risk remains in the debate. Away from stagnation + inflation, old fashioned recession risk would pressure UST rates lower and credit spreads higher, but this is no ordinary cyclical turn. We cover the UST shapeshifting in our separate Footnotes publication on the State of Yields as the UST curve bear flattened.

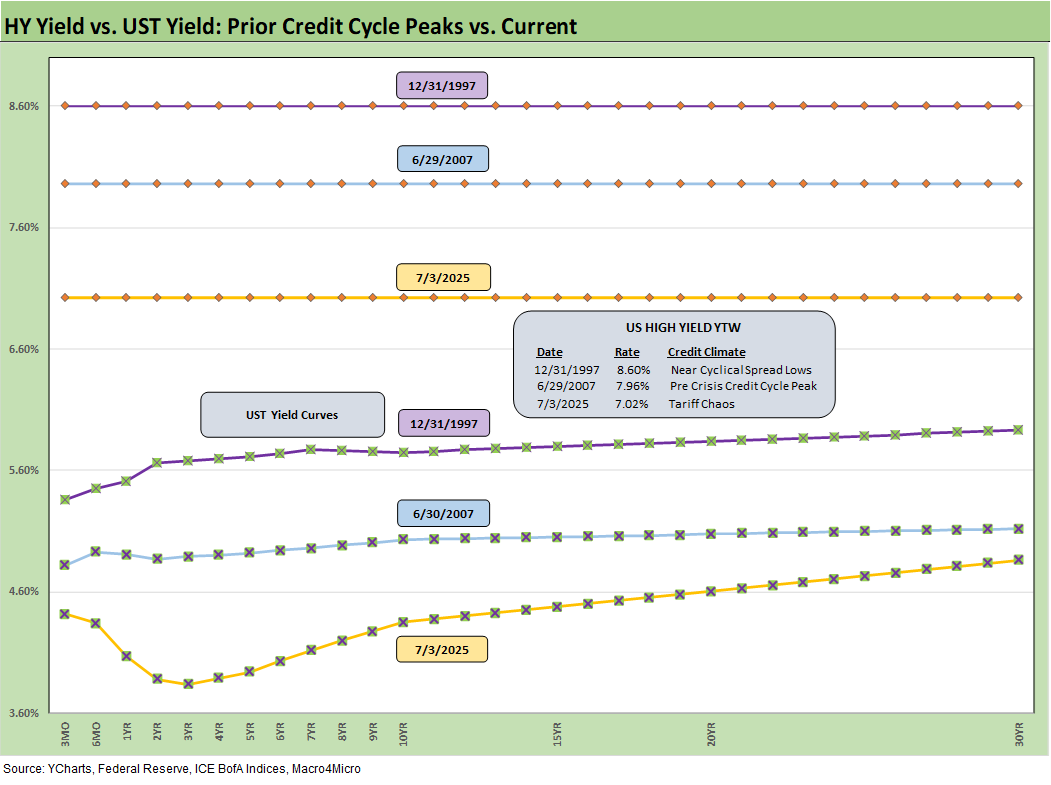

The above frames current IG index yields vs. previous credit peaks along with their respective UST curves. We include both prior credit peaks in June 2007 and Dec 1997 for context as prior peak credit cycles when high risk appetites saw investors chasing yields. Those 1997 and 2000 markets saw poor risk symmetry and low spreads.

Today’s UST curve is still low in the context of those historical credit peaks. We saw a recent glimpse of rising long yields along the timeline and the return pain that comes with it. The focus remains on the budget deficit and UST supply as the main driver for duration risk here as we get clarity on the size of the deficit increase. Expected revenues flowing into the US Treasury from tariffs come with the potentially conflicting impact of lowering imports and undermining domestic tax revenue if the cycle weakens. Reagan got a taste of disappointing tax revenues in the 1980s that caused him to reverse some tax policies (notably on the corporate side). The growth stimulus from the One Big Beautiful Bill may fall well short with few forecasts above 2% GDP growth in the markets. The Fed, OECD, World Bank, and many major banks are calling for 1% handle US GDP growth this year and next.

Stagflation risks will stay in the mix with the current market beyond the credit cycle peak after the tariffs, and long-dated yields still could go easily higher along with spreads widening again for another round of return pain. The weak dollar has had the effect of making tariffs even more expensive to US buyers. That is the exact opposite effect of what Ryan and Brady were promising back in 2017 with their Border Adjusted Tax proposals (aka BAT Tax or tariffs). That plan was supposed to replace corporate taxes. The GOP controlled Senate dissed their plan and did not even consider it. Times change.

The short to intermediate IG market is still the safest bond game for now. The funds that are asset class constrained to HY can take refuge in the higher quality layers. Overall corporate default risks in HY bonds remain in check (private credit is its own distinct story and mix).

The final chart does the same 1997 and 2007 drill but for HY index yields. This week’s UST move leaves HY index yields below prior peak credit cycles at 7.02% as of Thursday vs. 7.96% in June 2007 and 8.60% in Dec 1997. The recent spread widening had moved HY index yields higher, but the recent reversal and rolling UST moves leave the current HY index YTW well below both the 2007 peak and 1997 HY index levels.

The widening during April gave flashbacks to the volatility and major spread moves of the 1997-98 and 2007-08 periods that also posted triple-digit widening months. The sheer speed of risk repricing that has happened in earlier cycles and with the Liberation Day shock offers reminders even if those moves were for very different reasons.

We would highlight that the quality of the HY mix (industries and issuers) is superior today to those in 1997-1998 and 2007-2008. That is especially the case in the financial sector vs. 2008, where some securities firms and some banks were like a grenade with a loose pin.

Below we roll forward some updated commentary on the credit cycle…

The challenge is identifying a fundamental transmission mechanism to more trouble for financial metrics and relative risks of default. Identifying a catalyst for pain in the current market would highlight tariffs or trade wars hitting the macro drivers (the consumer) and micro drivers of corporate profitability and cost mitigation actions to offset the tariff expense. The oft misrepresented “buyer pays” reality will hit margins or requires higher prices.

The recent tariff strategy is both unpredictable and unprecedented in modern capital markets, but at least the banks are much healthier. US-China trade talks calmed some troubling trade nerves and put out a fire, but the most recent Section 232 hike to 50% on steel and aluminum is still a fresh wound with a lot more to come in areas such as pharma and semis among others. Those are fighting words with key allies (see US Trade in Goods April 2025: Imports Be Damned 6-5-25, Tariffs: Testing Trade Partner Mettle 6-3-25).

The next trigger starts this when “reciprocals” (which are not literally “reciprocal” but instead trade deficit management tools) get handed down. Discussions with the EU could still fail, and that is the #1 trade partner. Those risks elevate some as the threatened snapback to reciprocal date moves to August 1. Canada is walking a tightrope while Mexico is somewhat MIA. There is always a risk that one trade partner taking on the bully will lead to more. Japan and South Korea had not struck a deal and are likely to be assigned tariffs at this pace.

The overall uncertainty in getting trade deals over the line remains a threat to inflation, the economic cycle, and corporate profitability. Reciprocal tariffs are teed up to be “assigned” again rather than negotiated. The “90 days, 90 deals” mantra is gone. The clock is ticking with little to show so far. Headlines await.

We also see higher quality levels in the HY bond index as a starting point vs. 2007 and the late 1990s TMT bubble years. The reality is the tariff impacts and supply-side disruptions are only now just beginning in substance. It is hard to reflect forward-looking risks when so few know what those tariff numbers will be (including the White House with the coming Section 232 levels still a mystery).

China was a rough lesson for the markets. As we saw with Nike recently ($1 bn tariff costs), we should see more quantified tariff cost estimates from more companies in June and July quarter earnings reports (Nike was a May fiscal 4Q).

EU is on the pause clock that can be terminated or extended with ease (Trump makes all decisions on a moments notice), but Mexico and Canada have outstanding trade war risk as the effects of the tariffs roll in and domestic political pressure picks up for leaders to defend home front interests. It is useful for Trump to play his hand with pauses as the mood moves him in his own murky game theory plan, but corporate investment, big ticket purchase decisions by consumers, and FOMC policy setting can also take a protracted break beyond the pause.

The bad old days…

Looking back even more, the turn in the credit cycle always comes at some point and often with an external trigger or “assist” that can set it off. During 1990, securities firms started to collapse including Drexel’s Chapter 11 in Feb 1990 and bridge loan related bailouts of Shearson Lehman, First Boston, and Kidder Peabody. We do not face that type of financial intermediary meltdown risk here (at least not yet!). In a protracted stagflation bout, eyes will return to the regional banks.

The summer of 2007 was the start of major problems in the credit markets with asset risk and leveraged counterparty exposure and bank/broker interconnectedness risk soaring. Despite that backdrop that worsened in August 2007, the equity markets and S&P 500 and NASDAQ kept on rallying into Oct 2007. Later in the turmoil and well after the fact, the start of the recession was tagged as Dec 2007 (see Business Cycles: The Recession Dating Game 10-10-22).

The 2007 experience reminds the market that credit leads the economic cycle and equity lags. The same was true in 1999 with the HY default cycle underway and NASDAQ at +86% that year. This time around, the credit markets did not expect the tariff insanity. The initial spread wave in April quickly reversed but there could be fresh rounds. The China downside scenario was the worst and is now a lower risk. What is shocking was the poor White House grasp on the risks. China had a lot more tricks up its sleeve in supply strategies (e.g. pharma).

Buyer “writes the check” on tariffs. Facts matter.

The real economic effects are more geared to the periods ahead when tariffs will be rolling in at the transaction level. That will be the reality point. We expect HY to be unhappy again in the fall and spreads to average wider as the tariffs roll into actual corporate fundamentals.

There are no frictionless wheels in high tariffs. The buyer pays the tariff at customs (literally “writes the check”). How that gets spread around the economic chain from the seller to buyer to wholesale and end customer has a lot of moving parts.

The “seller pays” and “selling country pays” has been a clear falsehood from the Trump camp, and he admitted as much when he demanded that Walmart “eat” the tariff cost. Why would there be anything to eat if the seller pays? He again represented in Truth Social post that Vietnam will be paying the 20% tariff under the new deal (see US-Vietnam Trade: History has its Moments 7-5-25).

Shady and misleading discourse is never new to Washington. Substitute the question “who writes the check to customs” for the “who pays the tariff” and it is easier to corral those who play semantics and tweak key words. The reality is that Trump never “collected hundreds of billions” from selling countries.

Trump recently highlighted his mega collection process yet again, reiterating the hundreds of billions he “collected” from selling countries. He even cited a hard number in one live session ($600 billion). We cannot tell what Trump remembers as a fact and what he made up. Until the tariff deals are put to bed, outsized “surprise risk” in tariffs remains high on the list. Since Trump essentially breached the USMCA, even a deal is not a reliable deal.

See also:

Footnotes & Flashbacks: State of Yields 7-6-25

Footnotes & Flashbacks: Asset Returns 7-6-25

Mini Market Lookback: Bracing for Tariff Impact 7-5-25

US-Vietnam Trade: History has its Moments 7-5-25

Payrolls June 2025: Into the Weeds 7-3-25

Employment June 2025: A State and Local World 7-3-25

Asset Return Quilts for 2H24/1H25 7-1-25

JOLTS May 2025: Job Openings vs. Filling Openings 7-1-25

Midyear Excess Returns: Too little or just not losing? 7-1-25

Footnotes & Flashbacks: Credit Markets 6-30-25

Mini Market Lookback: Eye of the Beholder 6-28-25

PCE May 2025: Personal Income and Outlays 6-27-25

Durable Goods May25: Aircraft Surge, Core Orders Modest Positive 6-26-25

1Q25 GDP: Final Estimate, Consumer Fade 6-26-25

New Home Sales May 2025: Slip and Slide 6-25-25

KB Home 2Q25: Negative Industry Trends Keep Coming 6-25-25

Existing Homes Sales May 2025: Sequential Stronger, YoY Weaker 6-23-25

Mini Market Lookback: FOMC Spoke Clearly, Iran and Trump up next 6-21-25

Lennar 2Q25: Bellwether Blues 6-20-25

FOMC Day: PCE Outlook Negative, GDP Expectations Grim 6-18-25

Home Starts May 2025: The Fade Continues 6-18-25

May 2025 Industrial Production: Motor Vehicle Cushion? 6-17-25

Retail Sales May 25: Demand Sugar Crash 6-17-25

Mini Market Lookback: Deus Vult or Deus Nobis Auxilium 6-14-25

Credit Snapshot: Hertz Global Holdings 6-12-23

CPI May 2025: The Slow Tariff Policy Grind 6-11-25

Mini Market Lookback: Clash of the Titans 6-7-25

Past-Prologue Perspective for 2025: Memory Lane 2018 6-5-25