Retail Sales May 25: Demand Sugar Crash

We look at the negative May Retail Sales data as we start to see signs of a slowdown after a tariff fueled spending spree.

The slow slide following March’s tariff-driven pull-forward continued in May, with Retail Sales falling -0.9%. The combined effects of tariffs (whether based on economics or confidence) add up to largely flat with some of the major gainers in March contracting this month. A down month in May looks more like deceleration after a pull-forward effect. While not cause for panic yet, the underlying detail reveals growing cracks for the consumers for a still cautious consumer.

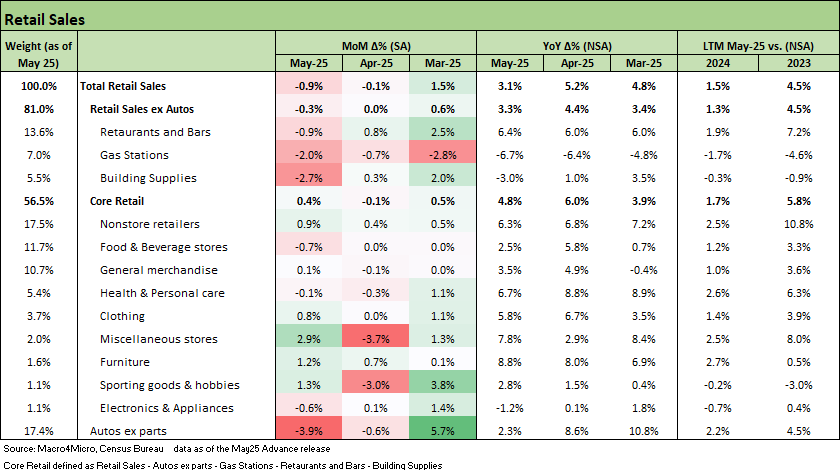

Core retail sales rose +0.4% in May with some continued rotation to more online shopping as the largest gainers in Core rebounded from some of the weakest April lines. While a positive core reading can sometimes offset a negative headline print, this month does not appear to fall into that category given the underlying mix.

The worst of the tariff scenarios have slowly been taken off the table with relative China peace, and trade generally was pushed into the background this week. The absence of deal frameworks leaves considerable execution risk on the table as the paused reciprocal tariffs structures with key trade partners still lack clarity. With 2H25 coming, how far stocked lower cost inventory layers will last is a mixed picture. At some point in the summer, more product price impacts will be experienced before leading to consumer prices getting marked higher. That in turn leaves a long tail of inflationary risks.

The year also sees low-cost labor arb that will be going away for apparel ahead of the back-to-school season. Steel, aluminum, lumber, and copper increases will also be slowly working their way into cost of sales and now we face a familiar pricing wildcard (freight and fuel surcharge, downstream material costs, etc.). The burden on consumer wallets is not getting lighter.

A fresh round of Middle East conflict could layers in an oil price shock risk heading into 2H25 where the decline in prices has been a boon to consumers in the past months. Gas Stations spending down -6.7% from last May has meant household budget can find ways to spend on other items and less fear of being priced out of necessities. Oil by definition adds to already heightened inflation fears for consumers. The Middle East has a wide range of outcomes subject to guesswork on a situation (Iran nukes and sustained bombing) not seen before.

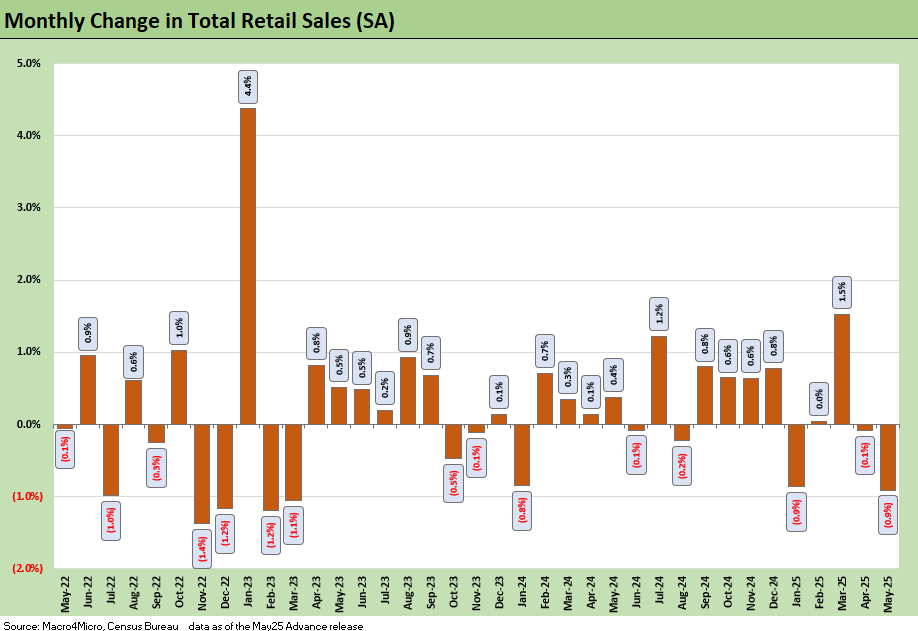

The above chart shows the monthly retail sales moves and -0.9% and the expected decline this month does not offer a strong signal on consumer spending and demand, but rather further confirmation of the pull-forward effect seen in March. With the latest CPI reading still reflecting that inventory building strategies have kept price increases at bay, it remains a 2H25 issue to track where consumer demand goes from here. Economic data still is very much in wait-and-see mode as the impacts of tariffs slowly filter down into the transactional data but that uncertainty, and the anticipation of future price impacts, is already visible in softening data.

Consumer sentiment may have ticked up from the lows on the back of the step back from the most draconian tariff scenarios, but still unlikely to receive much relief from tariff or stagflationary anxiety. That picture is now complicated by a reversal in recent gas price relief as the conflict in the Middle East this past week leaves severe risks to supply on the table. As the last few months of retail sales data show, the consumer is clearly reacting not just to current prices, but to where they expect them to go and the inflation expectations are still elevated (even if down a little per NY Fed). High levels of uncertainty for their budgeting processes can slow down the discretionary spending on its own as anxiety remains elevated and another layer of uncertainty is now added on.

The above shows the line item detail of the May print along with key ‘ex-Autos’ and Core aggregates. This month’s data shows sharp divergence beneath the surface, with weakness concentrated outside the Core group, as all non-Core categories declined. Autos is a microcosm of the pattern across the board as the -3.9% decline is a big swing after a +5.7% increase in March. It comes as little surprise given how direct the transmission mechanism to higher autos volumes and related pricing is with the tariff timing, but the magnitude helps illustrate the scale of consumer response ahead of expected pricing shifts.

This print does see some areas of rebound for discretionary spending growth in less-expected areas like Sporting goods & hobbies (+1.3%), Furniture (+1.2%), and Clothing (+0.8%). If the consumer outlook were truly weak, we wouldn’t expect to see categories like these bouncing back after April weakness, and that suggests some residual resilience.

On the other hand, the food spending and especially food away from home decreased even with gasoline prices continuing to decrease in May. That provides an alternative signal in the mix. One month does not make a trend, but the early takeaway points at durable goods rolling over, while essentials and discretionary categories are grinding forward with mixed results but not expanding overall.

See also:

May 2025 Industrial Production: Motor Vehicle Cushion? 6-17-25

Footnotes & Flashbacks: Credit Markets 6-16-25

Footnotes & Flashbacks: State of Yields 6-15-25

Footnotes & Flashbacks: Asset Returns 6-15-25

Mini Market Lookback: Deus Vult or Deus Nobis Auxilium 6-14-25

Credit Snapshot: Hertz Global Holdings 6-12-23

CPI May 2025: The Slow Tariff Policy Grind 6-11-25

Footnotes & Flashbacks: Credit Markets 6-9-25

Mini Market Lookback: Clash of the Titans 6-7-25

Payrolls May 2025: Into the Weeds 6-6-25

Employment May 2025: We’re Not There Yet 6-6-25

US Trade in Goods April 2025: Imports Be Damned 6-5-25

Past-Prologue Perspective for 2025: Memory Lane 2018 6-5-25

JOLTS April 2025: Slow Burn or Steady State? 6-3-25

Tariffs: Testing Trade Partner Mettle 6-3-25

Mini Market Lookback: Out of Tacos, Tariff Man Returns 5-31-25

PCE April 2025: Personal Income and Outlays 5-30-25

Credit Snapshot: Meritage Homes (MTH) 5-30-24

1Q25 GDP 2nd Estimate: Tariff and Courthouse Waiting Game 5-29-25

Homebuilder Rankings: Volumes, Market Caps, ASPs 5-28-25

Durable Goods Apr25: Hitting an Air Pocket 5-27-25

Mini Market Lookback: Tariff Excess N+1 5-24-25

New Home Sales April 2025: Waiting Game Does Not Help 5-23-25

Existing Home Sales April 2025: Soft but Steady 5-22-25

Credit Snapshot: Lithia Motors (LAD) 5-20-25

Home Starts April 2025: Metrics Show Wear and Tear 5-19-25

Industrial Production April 2025: CapUte Mixed but Time Will Tell 5-15-25

Retail Sales April 25: Shopping Spree Hangover 5-15-25

Credit Spreads: The Bounce is Back 5-13-25