Existing Homes Sales May 2025: Sequential Stronger, YoY Weaker

We update existing home sales with a record median price for May and the 23rd consecutive YoY price increase.

Brokers could use a lot more of these.

The price and pace for existing home sales told a constructive if mixed story in the context of recent monthly trends as mortgages rates, affordability pressure, and the bid-offer gap between seller and buyer remain a recurring theme.

The median price of $422.8K for existing homes was up by +1.3% YoY and up sequentially by +2.1%. Single family median prices were also up +1.3% from May 2024 at $427.8K but below the June 2024 high of $432.9K.

Trends for existing home sales continue to indicate affordability challenges, and now more homebuyer hesitation is evident in the higher price tiers with some negative deltas in YoY volume weakness.

The MoM +0.8% sequential increase in existing home sales and -0.7 decline YoY comes with another sharp increase in total inventory (+6.2% MoM and +20.3% YoY) alongside higher median sales prices.

Mortgage rates remain a transaction volume deterrent in entry level and move-up resales with 30Y rates continuing to hover in the high 6% area with the Freddie Mac 30Y benchmark of 6.81% (6-19-25) converging with the Mortgage News Daily survey, which came down from the low 7% high of last week.

The above chart shows the sales deltas by price tier, and we see broad weakness with 5 of the 6 tiers lower. We look at this mix from a different angle in the final chart in this collection.

Even the highest price tiers are posting weaker numbers and negative variances. More recent months showed relative weakness concentrated in lower tiers, but the softening volume trend has spread. The $250K to $500K tier, which accounts for just under 45% of the market, was down by -0.1% with the only positive bracket being the $750K to $1 million tier (7.6% of the market) at +1.0%. The $500K to $750K tier (almost 19% of the market) was down by -0.5%.

The $100K to $250K tier was weak given the exposure of that group to affordability hurdles. That tier can more logically get squeezed out based on mortgage qualifications and monthly payment stress. That is a pattern we have seen frequently over the past year and seems likely to remain a factor with mortgage rates getting back into the high 6% and low 7% zone lately. The price trends are not helping the monthly payment affordability challenge, but mortgage rates are a very important variable for monthly payments.

The barriers to selling to “move up,” downsize, and/or make an empty nester change still face the “locked in” problem and “Golden Handcuffs” headwind to sell a 3% mortgage house and take on a high 6% to 7% mortgage on the other side of the trade. That is not a new problem, but it gets harder for sellers/buyers to capitulate and transact when the mortgage market creeps back near 7%. Diminished cyclical confidence along with consumer sentiment is a factor as well.

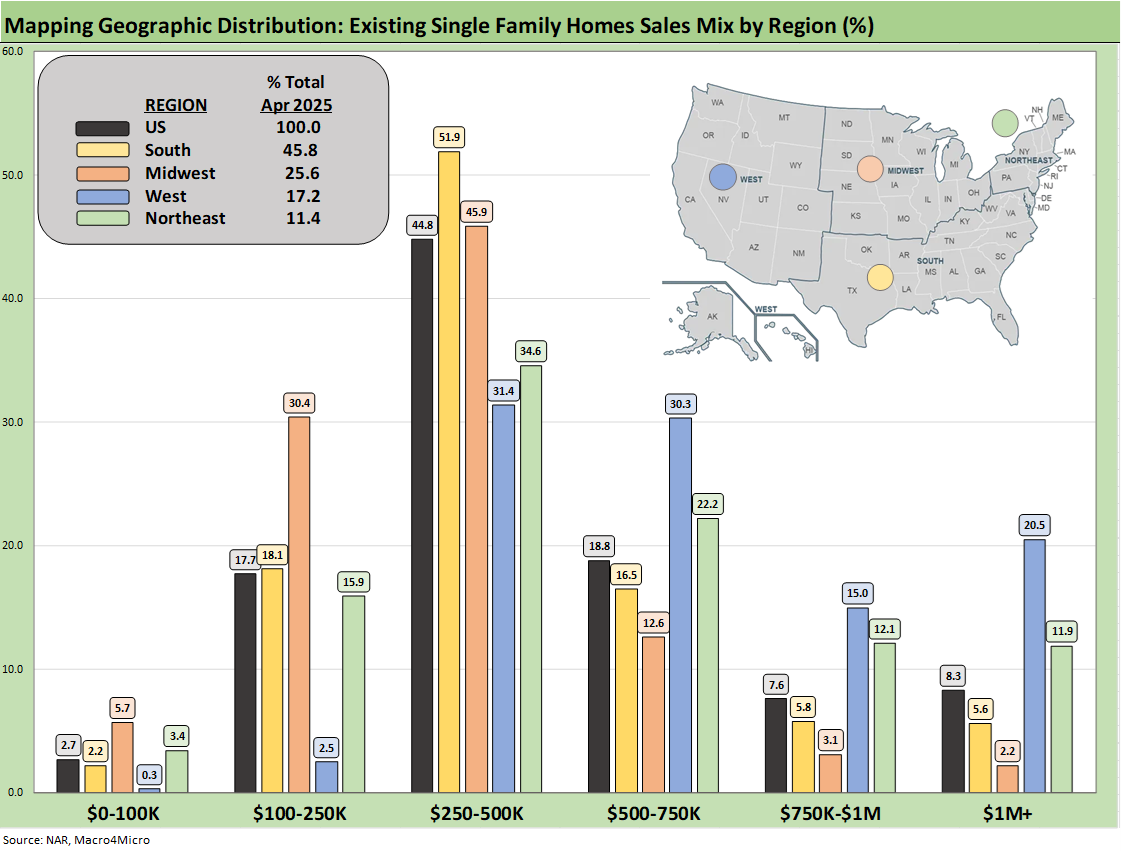

The above chart shows the geographic mix of volumes and details on price mix by region. The South is the main event in single family volumes whether new or used at almost 46% of volumes for single family existing.

For the bar chart, we break out the mix for each region by price tier. For example, the South shows almost 52% of its existing home sales volume in the $250k to $500K tier and over 16% of its sales in the $500 to $750K bucket. The bars for each region add up to 100% (occasionally a rounding miss!). The high cost of homes in the West (notably California) is clear enough in the West price mix just by glancing at the bar chart with almost 21% at prices over $1 million. The second highest in the $1 million club is the Northeast at almost 12%.

We see a big concentration in the $250K to $500K bracket for all regions at almost 45% of the total and a heavy weighting in the $100K to $250K bracket for the Midwest at over 30%. The map explains what states are in each Census region. There is a very wide range of home price profiles in the West and Midwest.

Inventory rose on the month by +6.2% sequentially to 1.54 million for total existing homes. The YoY increase is +20.3%. The existing home inventory balance has shown a steady rise off the sub-1 million lows of 2022-2023. Inventory had risen into the 1.3 million handle range in 2024 before dipping back down to a recent low of 1.14 million to close out 2024. We have bounced off those numbers to get back to the current 1.54 million. We see the Feb 2022 lows at 850K above when demand was very high just before the tightening cycle kicked into gear in March 2022. Separately, single family home inventory is up by +19.6% YoY and +6.3% sequentially. Condos and Co-op inventory is up by +24.2% YoY and +4.7% from April 2025.

The above two-sided chart updates the trend line in total existing home sales vs. new single family homes. We get the new home sales number for May on Wednesday, so we include the April 2025 new home number above. With mortgage rates in the high 6% range again and Freddie Mac’s benchmark at 6.81% this past Thursday, the affordability headwinds remain alive.

Color from the homebuilders in some recent earnings reports has been somewhat glum (see Lennar 2Q25: Bellwether Blues 6-20-25, Home Starts May 2025: The Fade Continues 6-18-25). The feedback from 1Q25 and recent 2Q25 reports (Lennar) is that the mortgage buydowns and incentives have not been as effective in the new home sales market even as the existing home sales markets are still seeing a gap between what the seller wants and how the buyer sees the world. The price expectation gap in turn continues to undermine transaction volume.

We see a continued rise in inventory and higher median prices, which shows that the existing home sales market remains in somewhat of a state of dysfunction. That reinforces the view that there are some expectation challenges in the buyer and seller ranks.

The above chart breaks out the timeline for single family alone of 3.67 million vs. total existing home sales of 4.03 million, which is well below the long-term median (from Jan 1999) of 5.23 million for total existing homes. Single family was +1.1% sequentially and +0.3% YoY. The lower line is ex-condo/ex-co-ops. We saw 360K in condos and co-ops in May 2025, down from 400K in May 2024 (revised) and down from 370K in April 2025.

The above chart updates the median price for existing single family homes at $427.8K. Though down from the June 2024 high of $432.9K, the median price remains well above the $308K back in Jan 2021 and $277K in Dec 2019 when mortgage rates were in a different zip code.

Potential sellers and buyers had some recent mortgage relief in the low 6% range in late Sept and early Oct 2024 before mortgage rates pushed back to the 7% area.

The above chart updates the monthly existing home sales across the timeline from Jan 2022 through May 2025. The market is a long way from the mid-6 and high 5 million handles of 2021 and then into early 2022 when many homeowners refinanced, and new buyers locked in low mortgages. ZIRP ended in March 2022 and then the UST migration began.

The May 2025 total of 4.03 million is below the May 2020 COVID trough of 4.07, so there are not too many bragging rights in current run rates. We had a few more sub-4 million handles along the way as noted in the chart, so this has been a brutal period for real estate brokers.

The above chart revisits the topical area addressed earlier on the existing home sales deltas by price tier. The largest tier is the $250K to $500K at almost 45% of sales volumes, and that was down slightly at -0.1% in a month that is in the peak spring selling season.

May 2025 existing home sales comes after March 2025 saw headlines such as the “lowest since spring 2009” tag. As a frame of reference, March 2009 was when the S&P 500 hit a low and GE Capital was trading in the credit markets like a high-risk name with major bankruptcies soon arriving in autos as the spring unfolded. The recession bottomed out in June 2009.

The challenge for the lower tier buyer is evident in the decline of -2.6% in the $100K to $250K tier that comprises 17.7 % of volume. The $500K to $750K tier is 18.8% of the market and was down by -0.5% for May. We see the $1+ million (8.3% of market) down by -0.6% for May. These higher tiers were outperforming before this current spring season, so the weakness is now cutting across the economic layers.

See also:

Footnotes & Flashbacks: Credit Markets 6-23-2025

Footnotes & Flashbacks: State of Yields 6-22-2025

Footnotes & Flashbacks: Asset Returns 6-22-2025

Mini Market Lookback: FOMC Spoke Clearly, Iran and Trump up next 6-21-25

Housing sector:

Home Starts May 2025: The Fade Continues 6-18-25

New Home Sales April 2025: Waiting Game Does Not Help 5-23-25

Existing Home Sales April 2025: Soft but Steady 5-22-25

Homebuilders:

Lennar 2Q25: Bellwether Blues 6-20-25

Credit Snapshot: Meritage Homes (MTH) 5-30-25

Homebuilder Rankings: Volumes, Market Caps, ASPs 5-28-25

Credit Snapshot: PulteGroup (PHM) 5-7-25

Credit Snapshot: Toll Brothers 5-5-25

Credit Snapshot: D.R. Horton (DHI) 4-28-25

Credit Snapshot: Lennar (LEN) 4-15-25

Credit Snapshot: Taylor Morrison Home Corp (TMHC) 4-2-25

KB Home 1Q25: The Consumer Theme Piles On 3-25-25

Lennar: Cash Flow and Balance Sheet > Gross Margins 3-24-25

Toll Brothers 1Q25: Performing with a Net 2-20-25

Credit Crib Note: Lennar Corp (LEN) 1-30-25

D.R. Horton: #1 Homebuilder as a Sector Proxy 1-28-25

KB Home 4Q24: Strong Finish Despite Mortgage Rates 1-14-25

Toll Brothers: Rich Get Richer 12-12-24