Footnotes & Flashbacks: Asset Returns 7-6-25

Another good week in equity returns with a mild setback in bonds sets the stage for another outsized tariff test ahead.

Tariffs are good for you. Embrace your role. I demand it.

Another round of new highs sees records for the S&P 500 and NASDAQ. The week saw even better news with the small cap Russell 2000 joining the rally and moving into our top quartile for the trailing 1-month timeline in our group of 32 benchmarks and ETFs. The US-centric small caps remain in the bottom quartile YTD but at least are now positive.

We try to temper enthusiasm around the term “all-time high” since the only President that hit all-time highs during their terms were “all of them” in the last 50 years. There is the memory of the March 2000 highs and the Oct 2007 highs as a reminder that forward-looking equities sometimes have handicapping setbacks. The best risk factors to contrast with those earlier mispriced peaks is the credit fundamentals and banks today are solid and steady even if credit spreads kick up with sharp equity moves.

An adverse UST curve move undermined bond ETFs this week as payroll beat expectations and the massive tax (less) and spend (more) bill did not shake equities but keeps the yield curve on alert as the market braces for the launch of reciprocal tariffs scheduled to start on Monday (see Mini Market Lookback: Bracing for Tariff Impact 7-5-25). We heard rumors of delays as we go to print, but every day is a new day in Trump tariff timing.

The symmetry of returns has been decidedly positive since just before the Liberation Day volatility as earning expectations remain solid even if the balance of economic measures are tilting negative in GDP growth and consumer metrics (notably income and PCE). Jobs were mixed with the deltas by major buckets with private sector too low, multiplier effect industries weak, and government additions too high (see Payrolls June 2025: Into the Weeds 7-3-25, Employment June 2025: A State and Local World 7-3-25).

We looked at the YTD June 30 midyear asset returns quilt and relative performance already during the week (see Asset Return Quilts for 2H24/1H25 7-1-25, Midyear Excess Returns: Too little or just not losing? 7-1-25).

The above chart updates the high-level debt and equity benchmarks we monitor and the rolling periods are heavily biased to the positive side with a few flies in the ointment such as duration for 3 months and Russell 2000 small caps for 6 months. A major yield curve debate looms as reciprocal tariffs roll into the market with this coming week’s headlines and Trump escalates his battle with Powell and the FOMC.

Trump is hedging his bets on inflation and the economic cycle. Trump wants to have an excuse for more economic weakness (notably the consumer and fixed investment) if the FOMC does not move. If Powell and the FOMC do in fact ease in July (odds heavily against) and inflation rises up, then Trump will have a “Plan B” to deflect blame (or muddy the cause-and-effect) around whether his tariffs were the cause.

On a more basic note, he wants to get control over one of the last institutions he cannot bully or dominate. Since Trump still insists the selling country pays the tariffs to the US (see US-Vietnam Trade: History has its Moments 7-5-25), he is probably not the best “go-to source” for what might influence goods pricing.

The rolling return visual

In the next section, we get into the details of the 32 ETFs and benchmarks for a mix of trailing periods. Below we offer a condensed 4-chart view for an easy visual on how the mix of positive vs. negative returns shape up. This is a useful exercise we do each week looking for signals across industry groups and asset classes.

The asset return symmetry above does not leave much room to debate on looking back across the time periods detailed above (note: we include a YTD chart further below). The mix has 7 bond ETFs and the rest broad equity benchmarks and industry equity ETFs. Base Metals (DBB) is an exception.

Overall, the markets are getting wagged by decent earnings trends and some faith that the consumer will hang in despite recent weakness. The tax bill and tariffs are supposed to provide a lift in big ticket spending and corporate sector planning, but the headwinds of uncertain tariff and supplier chain chaos are more likely to promote caution in coming months. Medicaid and health care fears also could color the household propensity to spend. This might be a time for higher savings rates.

The lead into earnings season has some one-off bellwethers this coming week, but the real action kicks in with the banks the week of July 14. The color will go a long way to giving investors a better sense of corporate and consumer asset quality and loan loss adjustments and how they might view key sectors and the response to tariffs (inflation, loan demand, industry risks etc.).

The Magnificent 7 heavy ETFs…

Some of the benchmarks and industry ETFs we include have issuer concentration elements that leave them wagged by a few names. When looking across some of the bellwether industry and subsector ETFs in the rankings, it is good to keep in mind which narrow ETFs (vs. broad market benchmarks) get wagged more by the “Magnificent 7” including Consumer Discretionary (XLY) with Amazon and Tesla, Tech (XLK) with Microsoft, Apple, and NVIDIA, and Communications Services (XLC) with Alphabet and Meta.

We already looked at the tech bellwethers in an earlier note (see Mini Market Lookback: Bracing for Tariff Impact 7-5-25), and we see tech has continued its comeback. Tesla is as wild and erratic as Elon’s headlines, but we still see the theme of more divergence across the Mag 7 with Apple and Alphabet lagging across longer time horizons back to 1 year.

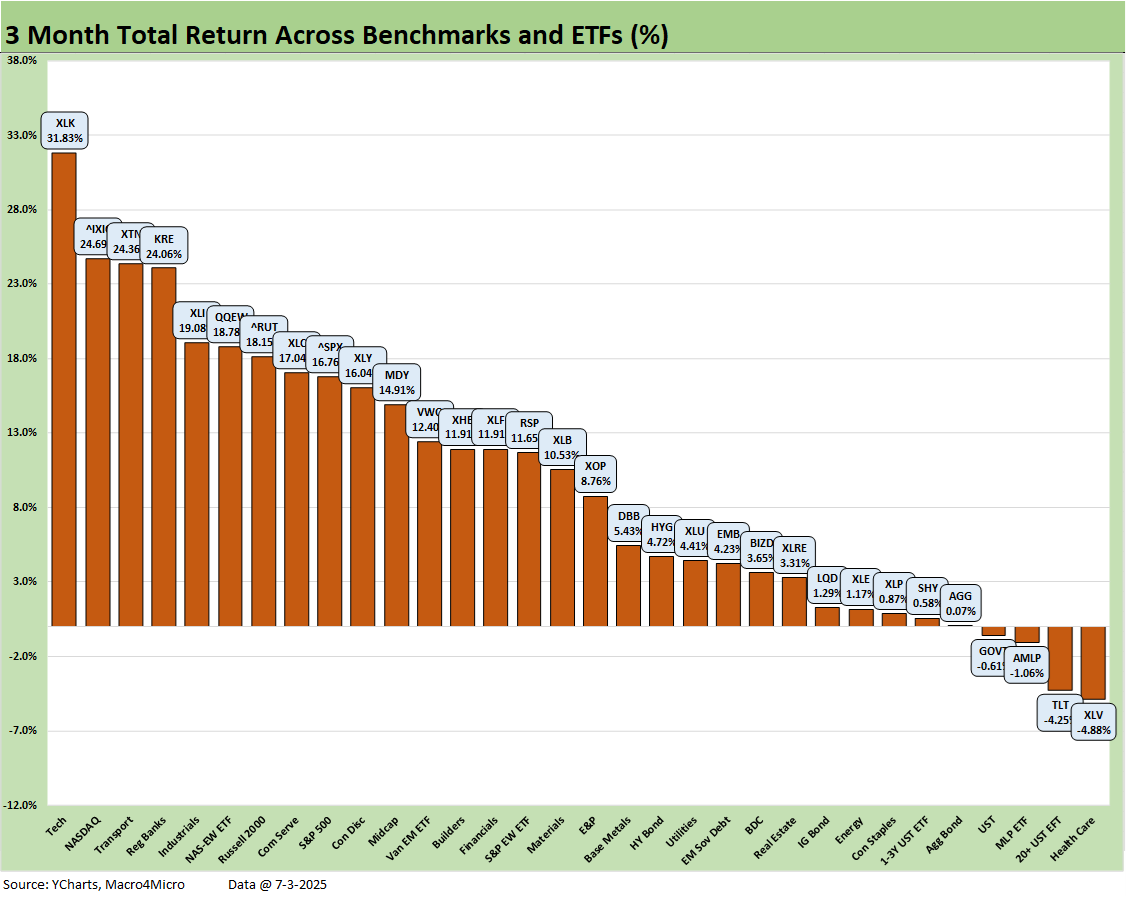

As we cover further below, the Tech ETF (XLK) is ranked #1 at +31.8% for the rolling 3 months with NASDAQ #2 at +24.7%. For the YTD period, XLK is in the middle of the top quartile with NASDAQ in the second quartile. The Equal Weight NASDAQ 100 (QQEW) is just ahead of XLK in YTD returns, and that means tech has seen a rally with some breadth. The Mag 7 heavy Communications Services ETF (XLC) came in at #3 YTD, but that was behind Industrials (XLI) and EM Equities (VWO). We see Financials and Utilities in the mix of the top tier YTD along with the cyclical Materials ETF (XLB), so the market is not a tech rally story.

We looked at the 1-week numbers in Mini Market Lookback: Bracing for Tariff Impact (7-5-25). With a score of 28-4 and only bond ETFs in the slightly red zone, the earnings expectations and a general “absence of disaster” on the screen now have kept the market hopeful. They await the verdicts on tariffs this week and the reactions from trade partners.

The erratic and on-off approach to tariffs with the peak confusion around Liberation Day must eventually take its toll. The timeline keeps dragging on into full implementation and the Section 232 tariffs are also easily forgotten by many until they get released.

As we saw in the announcement of Vietnam this week via Truth Social (“Vietnam will pay the United States a 20% tariff…”), policy confidence is hard to sustain when the “Who pays who what?” question gets a false policy pitch. The US buyer and importer of course is the party who pays Customs. We await the text of these letters and how they are conveyed to the public. Washington is fully on board with their usual “you lie and I’ll swear to it” template of “repeat the lie enough and it becomes truth.”

Meanwhile, the financial markets are in on the disinformation joke also – including the business media – but some stopped calling BS in the interest of getting a lot of GOP guests. The tariff information posts are for the hardcore base. As covered in the Nike situation with its $1 bn tariff cost, the companies that face the tariff bill and write the checks are waiting to see where the higher expenses shake out so they can plan. Retailers are most at risk in goods while Autos are threatened by supplier chain costs (components and materials).

The 1-month horizon is a clear winner at 30-1-1 with a single 0% return for Utilities (XLU). The bottom quartile includes 4 bond ETFs with the other 3 bond ETFs in the bottom half of the third quartile. Interest rate sensitive dividend stocks such as Real Estate (XLRE), Utilities (XLU), and Consumer Staples (XLP) lagged.

Big winners for the month include Regional Banks (KRE) at #1 and Transports (XTN) at #2 even as the XTN still sits in dead last YTD. We see the attempt at a comeback by Homebuilders (XHB) as mortgage rates edge very slowly lower, but Homebuilders (XHB) are second to last YTD.

The 3-month return picture is telling as it measures returns from the Liberation Day chaos (see Reciprocal Tariff Math: Hocus Pocus 4-3-25, Reciprocal Tariffs: Weird Science Blows up the Lab 4-2-25). The rebound is clear enough in the 28-4 score with the 4 in the red including the beaten-down Health Care (XLV) sector and the long duration UST 20+Y ETF (TLT), and UST index (GOVT).

The income-heavy AMLP is in the second quartile YTD, so that one has been more balanced across time with its high cash dividend yields (7.8% as we go to print) still an income investor favorite for cash flow and very low credit risk (by full spectrum portfolio credit risk standards).

The YTD scoresheet is 27-5 with the usual suspects such as Transports (XTN) and Homebuilders (XHB) in the bottom 2 positions. E&P had a tough year on oil prices with WTI around $60 to end May ahead of the Middle East excitement.

There is more than a little noise coming from the E&P sector on how policy and planning priorities are not great for oil prices and upstream economics. The upstream players would never bite the hand that feeds them (Trump) but Iranian supply and Russian supply could be the passport to lower headline inflation and the equivalent of a giant tax cut for all consumers at the gas pump. That would also help energy costs and the materials chain (petrochemicals) at a time of tariff shock in steel, aluminum, and soon copper.

The winners in the top quartile show Industrials (XLI) at #1 and EM Equities (VWO) at #2 along with 3 tech-centric ETFs across Communications Services (XLC), the Equal Weight NASDAQ 100 ETF (QQEW), and the Tech ETF (XLK). The top 5 are followed by Financials (XLF), Materials (XLB), and Utilities (XLU) in what is a healthy, diversified mix of industries.

The 27-5 score for the trailing 1-year period includes a big slice of the 2024 banner year in equities that was Part 2 of the best 2-year run in the S&P 500 since the late 1990s (see Footnotes & Flashbacks: Asset Returns for 2024 1-2-25).

The median LTM asset line return of around +10.3% in the chart above has converged with the median FY 2024 asset performance of about 10%. The 2024 calendar year saw +25% for the S&P 500 vs. the current LTM run rate of 14.9%. The YTD S&P 500 return (prior chart) of +7.5% is running at an annualized rate well below full year 2024. That in turn cut the broad market benchmark down to size for the LTM period.

We were watching a speech by Trump over the last week where he said the world saw the United States as a “dead country six months ago.” Someone should hand him a chart (which he will ignore anyway). The combined 2023-2024 return on the S&P 500 of +45% (+25% for 2024 alone) was a sign of life during and after death.

We appreciate that numbers and facts are going out of style in a world of bloviating adjective and insult supply, but every now and then they are worth a peek (see Gut Checking Trump GDP Record 3-5-25, Annual GDP Growth: Jimmy Carter v. Trump v. Biden…just for fun 1-6-25, The Politics of Objective GDP Numbers: “Flex Facts” on Growth 10-30-24).

When we hear “Greatest economy in history” as we did again this week, we have two words in response: Clinton, Reagan (see Presidential GDP Dance Off: Clinton vs. Trump 7-27-24, Presidential GDP Dance Off: Reagan vs. Trump 7-27-24). The comparison of them to any post-2000 President is like a young Mike Tyson vs. “Bum of the Week.”

For now, solid earnings, low rates in absolute context across the cycles, full employment by most historical standards, and an extremely well-diversified economy are keeping equities in the game. The main threat that could hold the market and economy back is a top-down massive tariff program that is unprecedented in modern capital markets history and dwarfs the disastrous precedent of 1930. The tariff “bill of goods being sold” as a policy will be tested as these tariffs roll out across the summer and more into the fall.

See also:

Mini Market Lookback: Bracing for Tariff Impact 7-5-25

US-Vietnam Trade: History has its Moments 7-5-25

Payrolls June 2025: Into the Weeds 7-3-25

Employment June 2025: A State and Local World 7-3-25

Asset Return Quilts for 2H24/1H25 7-1-25

JOLTS May 2025: Job Openings vs. Filling Openings 7-1-25

Midyear Excess Returns: Too little or just not losing? 7-1-25

Footnotes & Flashbacks: Credit Markets 6-30-25

Footnotes & Flashbacks: State of Yields 6-29-2025

Footnotes & Flashbacks: Asset Returns 6-29-2025

Mini Market Lookback: Eye of the Beholder 6-28-25

PCE May 2025: Personal Income and Outlays 6-27-25

Durable Goods May25: Aircraft Surge, Core Orders Modest Positive 6-26-25

1Q25 GDP: Final Estimate, Consumer Fade 6-26-25

New Home Sales May 2025: Slip and Slide 6-25-25

KB Home 2Q25: Negative Industry Trends Keep Coming 6-25-25

Existing Homes Sales May 2025: Sequential Stronger, YoY Weaker 6-23-25

Mini Market Lookback: FOMC Spoke Clearly, Iran and Trump up next 6-21-25

Lennar 2Q25: Bellwether Blues 6-20-25

FOMC Day: PCE Outlook Negative, GDP Expectations Grim 6-18-25

Home Starts May 2025: The Fade Continues 6-18-25

May 2025 Industrial Production: Motor Vehicle Cushion? 6-17-25

Retail Sales May 25: Demand Sugar Crash 6-17-25

Mini Market Lookback: Deus Vult or Deus Nobis Auxilium 6-14-25

Credit Snapshot: Hertz Global Holdings 6-12-23

CPI May 2025: The Slow Tariff Policy Grind 6-11-25