Home Starts May 2025: The Fade Continues

Housing starts decline again MoM and YoY but sequential numbers for single family were flat.

Housing units started in May were -9.8% MoM and -4.6% YoY with single family at +0.4% MoM and -7.3% YoY. The lumpy multifamily line was -30.4% MoM and +5.0% YoY. Not seasonally adjusted for YTD 2025 for single family was -7.1% while multifamily was +14.5%. Permits were down in total MoM and YoY and for single family while multifamily rose.

With mortgage rates stubborn and the UST curve facing an unpredictable summer and fall, and the consumer sector showing some wear and tear, the balancing act of deliveries vs. starts will remain vulnerable but quite manageable for builders in the context of financial risk management and healthy free cash flow generation.

With bellwether Lennar reporting 2Q25 numbers and margin compression this week along with the color of a steady softening for builders, it is hard to find signs of any tailwinds. Tariffs cited by the NAHB are more likely to cause rising costs that will need a range of responses including cost sharing with trade partners and adjustments in pricing/design strategy. We address those issues in our single name work.

The core strategy for most major builders focuses on the balancing act of prudently managing inventory levels and planning the pipeline with land banks, negotiating on lot option terms, and in some cases working with REIT partners (e.g., Lennar with Millrose Properties). The homebuilder cash flow resilience story remains intact.

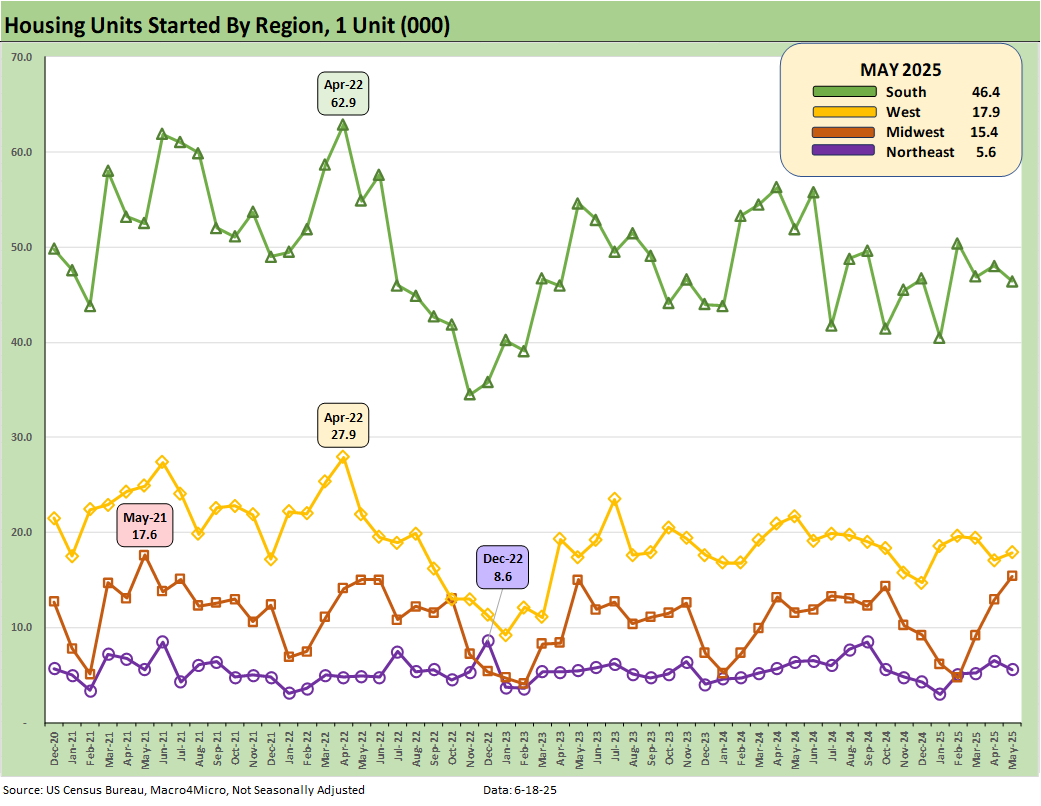

The above chart frames the current 924K for single family starts which was up by +0.4% MoM and down by -7.3% YoY. Total starts overall was -9.8% sequentially and -4.6% YoY with Multifamily down by -30.4% MoM but up by +5.0% YoY.

The South region at 57% of single family starts was -1.7% MoM and -10.4% YoY while the West as the #2 region was +10.2% MoM and -17.1% YoY. The YoY declines reflect the weakness in orders across many (not all) builders as reported in 1Q25 earnings.

The above chart plots total permits and total starts on a Not Seasonally Adjusted (NSA) basis, and we see total permits and single family permits down for May. NSA Year-to-Date permits were -4.7% for total permits and -5.9% for single family permits. NSA is viewed as closer to what is going on in the trenches without the SAAR model assumptions.

For total starts and single family starts on an NSA basis, we see total starts lower MoM and single family slightly higher. The YTD NSA starts is -1.5% for total and -7.1% for single family.

The above plots the single family starts by region on an NSA basis. The two largest regions (South and West) saw the South slightly lower and the West slightly higher. The Midwest moved higher, and the small Northeast market declined.

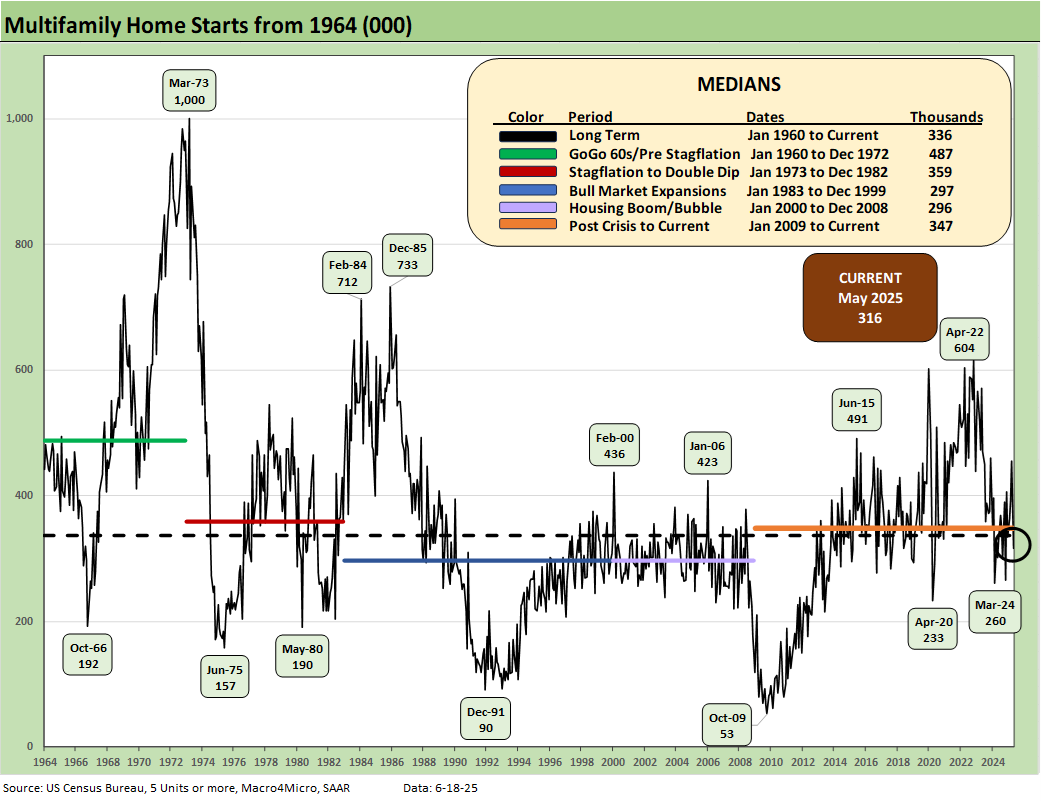

The above chart updates running multifamily starts. At +316K, May 2025 is down by -30.4% sequentially and up by +5.0% YoY. The 316K is below the long-term median of 336K, below the median from Jan 2009 to current (347K), and above the median from 2000 to 2008 (296K). The 1960s was a boom period for multifamily with the postwar explosion of urbanization and high racial migration from the south to the north.

On an NSA basis (not shown), the YTD multifamily starts is +14.5%.

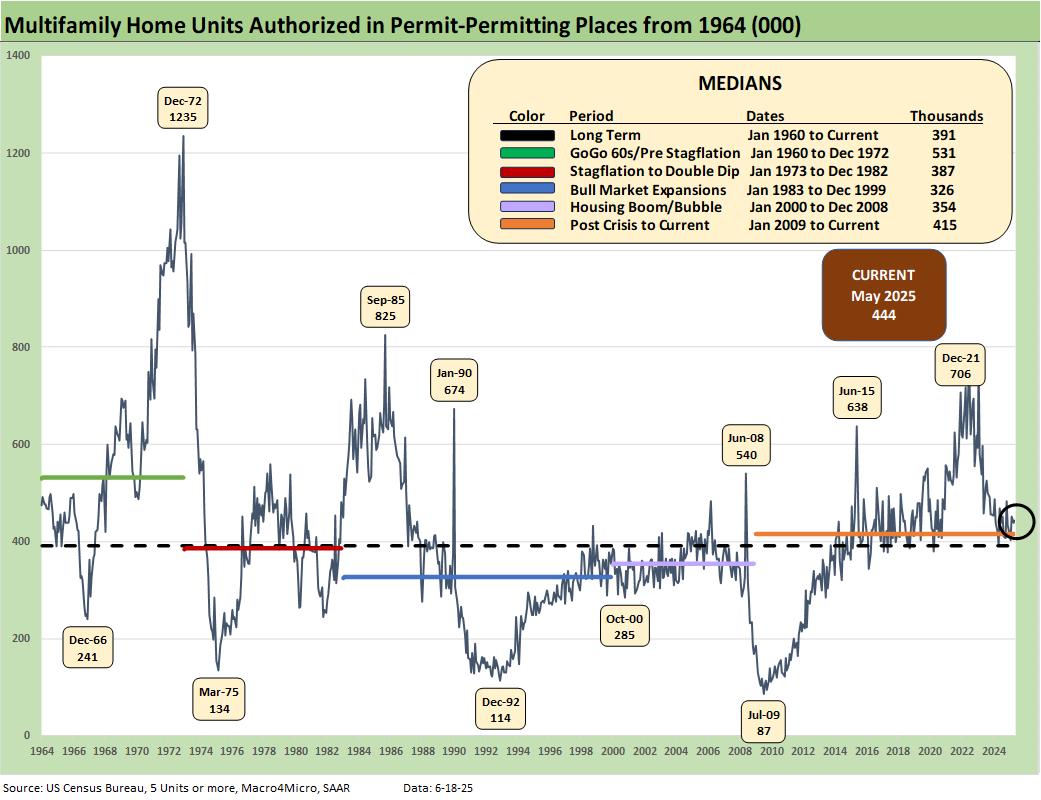

The above chart updates Multifamily permits. The 444K is up by +1.4% MoM for May and up by +13.0% YoY. The YTD change on an NSA basis (not shown) is -3.2%.

See also:

Housing sector:

New Home Sales April 2025: Waiting Game Does Not Help 5-23-25

Existing Home Sales April 2025: Soft but Steady 5-22-25

Home Starts April 2025: Metrics Show Wear and Tear 5-19-25

Homebuilders:

Credit Snapshot: Meritage Homes (MTH) 5-30-25

Homebuilder Rankings: Volumes, Market Caps, ASPs 5-28-25

Credit Snapshot: PulteGroup (PHM) 5-7-25

Credit Snapshot: Toll Brothers 5-5-25

Credit Snapshot: D.R. Horton (DHI) 4-28-25

Credit Snapshot: Lennar (LEN) 4-15-25

Credit Snapshot: Taylor Morrison Home Corp (TMHC) 4-2-25

KB Home 1Q25: The Consumer Theme Piles On 3-25-25

Lennar: Cash Flow and Balance Sheet > Gross Margins 3-24-25

Toll Brothers 1Q25: Performing with a Net 2-20-25

Credit Crib Note: Lennar Corp (LEN) 1-30-25

D.R. Horton: #1 Homebuilder as a Sector Proxy 1-28-25

KB Home 4Q24: Strong Finish Despite Mortgage Rates 1-14-25

Toll Brothers: Rich Get Richer 12-12-24