Credit Snapshot: Hertz Global Holdings (HTZ)

We summarize the credit fundamentals of Hertz.

Credit Trend: Negative

Summary credit profile:

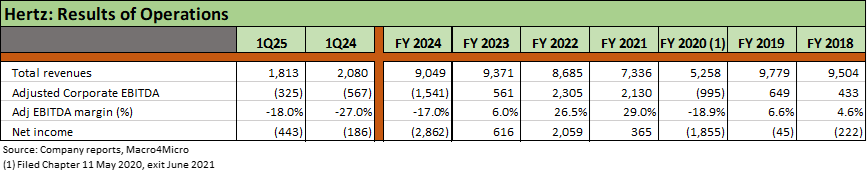

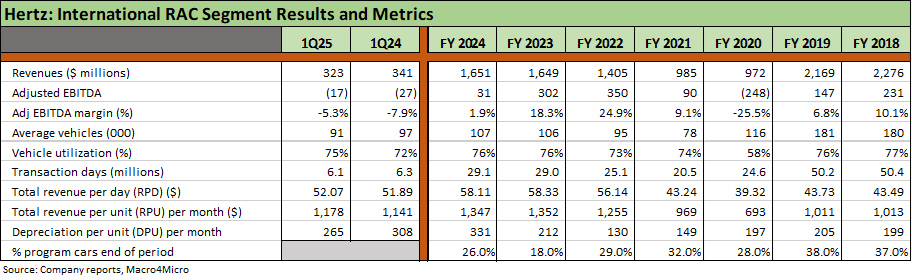

Hertz (HTZ) has always been a tough one, so it takes more words. The very weak and highly encumbered balance sheet of Hertz, the negative EBITDA run rate, and cash flow bleed leave HTZ as a CCC tier unsecured credit. A key variable, apart from the peak season travel period ahead, is where used car residual values will trend in 2025 to mitigate the run rate of losses. After a brutal 2024 for depreciation per unit per month (“DPU” is in substance a cash expense for car rental operators), HTZ needs relief and is targeting $300 DPU after $539 global DPU in FY 2024. This is no small challenge after $588 DPU in the Americas RAC segment in 2024 and International at $331 (note: International has more traditional program car exposure).

A challenging call at this point is how tariffs and seasonal fleet management downsizing will dovetail with used car values and better remarketing performance. The tariff pressures will push new vehicle prices higher, and the theory is the affordability challenge on prices and financing rates will in turn bolster used car demand on affordability. It is clear we will not see a replay of the post-COVID 2021-2022 residual windfall, so there is no easy solution ahead for the grim financial metrics at Hertz.

The seasonal fleet replacement cycle and purchasing process for the 2026 season promises to see fleet costs high as tariffs fully roll in. The electric vehicle overhang will at least be largely behind Hertz. Depreciation per unit (“DPU”) could remain stubbornly high with new car prices as HTZ strives to hit the $300 DPU mark (see Depreciation section below). Recovery of DPU and financing costs in rental rates determines EBITDA margins.

Hertz will require a banner summer to avoid more chatter around an inevitable realignment of its balance sheet and more distressed exchange risks. Historically, more than half of EBITDA gets generated in the peak summer travel 3Q period, so the stakes are high for a good travel season and steady upside scenarios in used vehicle residuals.

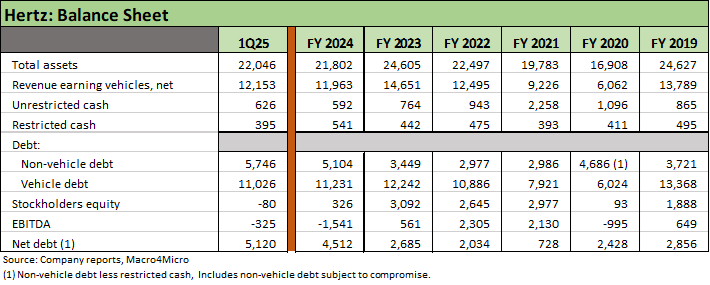

The downside scenario in credit quality is that HTZ bondholders could be exposed to a distressed bond exchange to salvage a functional financial profile for shareholders. The EV/EBITDA multiples are a challenge to make a case for meaningful equity value without less corporate debt (non-fleet debt) and a lot more EBITDA in positive range. As we detail in the tables below, non-vehicle debt has soared and EBITDA is deeply negative.

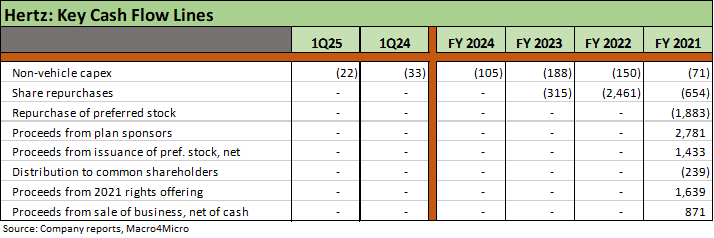

The dagger for Hertz credit quality was $2.5 billion in share repurchases ($3.1 bn in total repurchases 2021-2022) while also derisking the private equity investors. That restarted the game clock on a highly leveraged Hertz at a time of booming residuals and exceptionally low DPU. Unfortunately, Hertz once again made very aggressive moves in fleet mix that backfired (this time EVs). Fleet mix setbacks are part of a pattern seen in 2014-2016 during the first major bout of volatility of HTZ stock and bonds that included a shocking rate of senior management turnover with a high single digit CEO count including 4 before filing Ch 11 (see Credit Crib Note: Hertz (HTZ) 5-14-24, Not Your Father's Hertz 2-7-23).

The HTZ performance scores face the problem that Avis offers an easy comp to use as a frame of reference across the same market conditions. That comparison does not go well for HTZ, who failed to sustain its credit quality before and after the HTZ Chapter 11 while Avis navigated the chaos quite successfully (see Credit Snapshot: Avis Budget Group 4-9-25). That leaves the equity markets in a position where the shareholder can ask “If I want to play on car rental fundamentals, I can invest in Avis and not have to take the credit risk.” (Note: IG-rated industry leader Enterprise is private).

Relative value:

Hertz unsecured bonds are trading at quasi-distressed levels and have been volatile for a reason. We see HTZ unsecured as equity-like risk (as in high-risk equity) facing too many uncertain variables ahead. The good news for 1L bondholders (12.625% of July 2029) is that bond offer equity-like returns just in cash income at slightly over par. The 1L layer is protected from our vantage point. The 13%-15% area yields on unsecured include a discount from par of over 30 points on the unsecured 2029s. HTZ will need a very strong 3Q25 and some additional support from positive trends in used vehicle residuals to improve the symmetry for HTZ bondholders.

Buying Hertz unsecured has been a good strategy when matters are at their worst, and that is not the case at this point in the face of material uncertainty for the automotive production chain. Near term used vehicle residual upside is positive given auto affordability strains, but the 2026 and beyond story is much trickier for fleet replacement costs. The abysmal equity performance of HTZ since the end of 2021 and immediate reversal of its credit profile so soon after emerging from Chapter 11 tells us that unsecured debt exchange risk is material given the interest of fashioning a balance sheet that can restore rational EV multiples for stockholders.

The history of Hertz has been unkind at various points to both bears and bulls. The franchise has substantial value as the Chapter 11 process highlighted, but the strategic execution and financial risk management at Hertz across the past decade has been awful. M&A and fleet planning has seldom gone right since 2014 and external factors (notably COVID) and liability management (lien baskets, lender flexibility, distressed exchange risk) have underscored the volatility of Hertz.

As a reminder, the 2020 collapse of HTZ bonds saw a 26 area CDS auction on the way into a competitive bidding battle that brought bondholders a “par plus” recovery and a return to equity holders. In other words, history has some hard lessons on making the call on HTZ credit quality. A very successful Chapter 11 process (filed May 2020, exit June 2021) now sees HTZ yet again mired in semi-distressed status coming off a period of massive growth in debt, cash flow bleeding, another spike in structural subordination risk, some major fleet strategy setbacks, and a few more changes in senior management. That comes after a decade of such turmoil.

Rough history:

Addressing Hertz quality in today’s market without a look back would not be prudent. Many of the same operational themes get reiterated by a string of management teams with modest variations across a decade of remarkable management turnover before and after Chapter 11. The takeaway from that history is one of consistent fleet management setbacks when it deviated too much from industry norms, overpriced debt-financed acquisitions (notably Dollar Thrifty in 2012), and an inability to compete effectively against Enterprise and Avis.

The Big 3 of daily car rental are essentially in the same business of buying new vehicles, renting them, and managing a remarketing process that hopefully allows for resale yields in line with their residual value estimates. The goal is for DPU and interest costs to be built into car rental pricing along with a respectable margin. All three rental operators (not including the large German operator Sixt growing its US presence) buy cars from the same OEMs and operate in many of the same US daily rental markets and locations (on and off airport). Enterprise built its base of fleet operations in insurance replacement before embarking on a multi-decade growth plan in daily rental (including acquisitions of Alamo and National). Despite the similarity in services, asset base and operating profile, the performance across the three has been very different.

The asset protection and franchise value of HTZ is in the eye of the beholder and what various parties see as the future of integrated mobility (sounds fancier than “car rental”). The buzz around EV fleet management that was a topic in 2020-2021 has lost its luster at this point, and policy actions in Washington look to further dim prospects for such EV fleet management strategies and aspirations. Meanwhile, AV fleets of scale are a long way off.

The history of Hertz cuts across LBOs, IPOs, mixed ownership by OEMs (notably Ford), private equity, and activist investors driving shareholder enhancement pressure across time. In the case of Carl Icahn, he had dumped his holdings at a multi-billion-dollar loss. The history of the major car rental operators is that they always attract private equity capital and activist shareholders, and current times are no different. That at least says something about how investors see the potential of car rental. Private, family-owned Enterprise remains the envy of the industry with IG ratings and high margins.

Business risk:

As we covered in our Avis Credit Snapshot, Avis Credit Crib note, and Avis Credit Profile, the business risk in car rental is high with used car residuals quite volatile in recent years. The timing of new vehicle supply-demand imbalances create higher risks for both the cost of fleet and for residuals on the vehicles. Car rental operators need to get an economic return through prudent rental pricing that captures all the relevant costs. Avis (ticker CAR) has been a problem frame of reference for HTZ with CAR’s superior profitability performance and balance sheet management.

HTZ added to its problems with a major, heavily advertised bet on EVs and the high-risk residual profile in that product segment. That was clearly a failed strategy. Some past revenue talking points from various management teams sought to bolster equity valuation multiples with growth business line strategies such as EV and AV fleet management. Those have been wiped off the checklist – at least for now. HTZ gives a lot of air time to its fleet management and used car retail progress, but that is a very competitive business line as hammered home by Carvana, CarMax and the Big 6 public dealers such as #1 Lithia with its digital buildout (see Credit Snapshot: Lithia Motors (LAD) 3-20-25, Credit Crib Note: Lithia Motors 9-3-24).

Depreciation as a cash expense:

Depreciation of revenue earning vehicles jumped from $701mm in 2022 to $2.04 bn in 2023 and then $3.6 bn in 2024. The reality of vehicle depreciation as a cash expense for the car rental companies highlights the web of connections between supply-demand balance for new and used vehicles and what it means for rental car rates (pricing) and the cash expenses over fleet cycles from new vehicle purchase to remarketing of used fleet. The COVID collapse in travel volume, the post-COVID rebound in used cars, the spike in new vehicles costs and now the relative weakness in residual values seen in the plunge in used EVs all made for a wild ride that required balance sheet flexibility and financial resilience that HTZ lacked.

The idea of looking at DPU as a cash cost takes a shift in perspective since the car rental operation essentially “owes” the vehicle funding entities the cash costs of the vehicles and financing expenses. That is why vehicle depreciation gets deducted to arrive at Corporate EBITDA.

Profitability and tariffs:

It is almost impossible for forward EBITDA not to materially improve given the scale of the depreciation setbacks and vehicle impairment in 2023-2024. Those are behind HTZ. Hitting the $300 DPU target will not be easy, but the $1500 Revenue per Unit (RPU) goal is clearly doable (see tables).

The tariffs that are sufficiently damaging to the auto sector could actually benefit HTZ near term by bolstering used car demand and driving residual values higher. That said, HTZ will be paying a higher price in future vehicle replacement cycles when seasonal fleet cycle risks will again climb. Exceptionally poor results have set back HTZ dramatically since emerging from Chapter 11. That reality is evident in the charts below with -$1.54 billion EBITDA in FY 2024 and -$325 million in 1Q25 for EBITDA. That 1Q25 result follows negative EBITDA of -$567 million in 1Q24.

Balance sheet:

HTZ now takes great pains to call itself “asset-heavy” after years of billing itself as an “asset-light” tech-based service company before its COVID trip to Chapter 11. For purposes of asset protection, corporate-level bondholders are in fact lenders to an asset-light company while fleet funding entities are “asset heavy.” The vehicle funding entities function in substance as a “funding company within a car rental company.” Those various asset heavy entities lease the vehicles to an asset-lite car rental operator.

Negative EBITDA makes leverage metrics of little value in terms of financial risk assessment at this point while the funding vehicles and fleet facilities are heavily overcollateralized. As noted earlier, the layers of debt and liens and structural subordination create equity-like risk in HTZ unsecured bonds. The need to sustain RCF availability is critical for Letters of Credit (LOC) to meet the overcollateralization requirements (“credit enhancement”) in the ABS financings. As of 1Q25, those LOCs totaled $913 mn and used both the First Lien RCF and the Term Loan C.

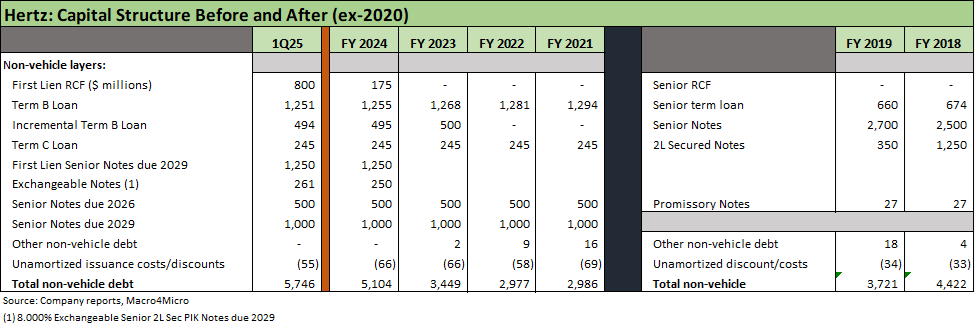

As detailed in the charts further below, HTZ is once again carrying an overleveraged balance sheet with negative EBITDA and high exposure to uncertain fleet dynamics in 2025-2026. Gross non-vehicle debt reached a high at 1Q25 with a highly encumbered balance sheet across the First Lien RCF, Term B loans, Term C loan, and First Lien Senior Notes as detailed in the cap structure charts.

During 2024, the First Lien RCF required a parent guarantee as HTZ was adding more 1L debt to its mix (e.g. First Lien Senior Notes, Exchangeable Notes). Changes in structure such as that are part of using what financial flexibility is available, but that is also a worrisome sign for the unsecured layers. The banks are the ones over the wall, so defensive actions matter. The RCF also has been drawn to the tune of $800 mn by the end of 1Q25 vs. $175 mn at 12-31-24.

The incremental obligation for a make-whole decision favoring some of the Chapter 11 bondholders adds another obligation of around $340 mn to settle the recent legal setback (including a potential 1st lien note that would add to the subordination risk profile). That was detailed in the 1Q25 10-Q and some recent 8-K filings in 1Q25. As of the publishing date for this note, we have not seen final terms. That court decision on bondholder claims against Hertz post-Chapter 11 received substantial attention in distressed debt circles and legal commentary. The post-Ch 11 bondholder settlement is smaller in overall context of the balance sheet story at Hertz but does add another source of strain on the financial profile

Vehicle funding debt:

Fleet ABS is a very well-established market. The structure was not designed for a pandemic, however. The requirements of the car rental operation to fund the auto ownership costs of the fleet funding entities (essentially depreciation + funding costs) during COVID turned the fleet into the “world’s most expensive parking lot” as travel shut down. The vehicle funding requirements would have crippled HTZ and bled out its cash and set off ABS amortization events and a cascading crisis in used car values and other loans structures for other entities. Reason and smart bankers/lawyers prevailed to prevent that.

The need to maintain certain ABS metrics (overcollateralization) and fleet funding requirements are supported by vehicle values and LOC lines from the corporate bank facilities. The failure of Hertz to have adequate lien room and LOC lines available in 2020 was one of the factors that sent HTZ into Chapter 11 while Avis survived on its financial flexibility.

The history of the HTZ descent into bankruptcy is a longer one and includes threats by HTZ to essentially challenge the foundation of ABS lease structures (car-by-car vs. master lease) in 2020 and potentially cause a collapse in the used car markets. That was a story in brinkmanship with lenders, but also reminds us to factor in the intertwined nature of the vehicle and non-vehicle debt. As covered in other commentaries, Hertz made too many mistakes along the way in debt-financed M&A, fleet decisions, and buybacks that left it unable to take the stress caused by COVID. That was in contrast with Avis, and that frame of reference is still unfavorable.

SELECT TABLES

The EBITDA run rate is still deep in the red after a brutal 2024.

Americas RAC segment haunted by ugly DPU in 2024 on EV problems.

International RAC segment downsized from pre-COVID but less fleet risk.

Balance sheet stretched by high non-vehicle debt facing negative cash flow.

HTZ is again heavily encumbered with inadequate unsecured alternatives.

Vehicle debt since before Ch.11 tells a complex story on funding range.

A hectic 2021 cap structure realignment and excessive shareholder rewards in 2021-2022 reflect overconfidence.

It’s a good history lesson but you are not weighing potential outcomes going forward. They got crushed the past two years due to ev and refreshing the entire fleet which they bought at high residuals and thus ran high DPUs as residuals fell. Going forward, DPU is normalized, ev issue is behind, residuals are likely increasing on the margin, demand is solid, and if they improve DOE it’s likely they hit breakeven sooner. I hate people look at this on an EBITDA and not fcf basis because interest is high and the fleet financing varies. Thanks for the article