Durable Goods May25: Aircraft Surge, Core Orders Modest Positive

We examine the surge in durable goods orders for May heavily driven by aircraft orders with otherwise mildly positive durables orders.

Consistent Plane Themes in the Middle East

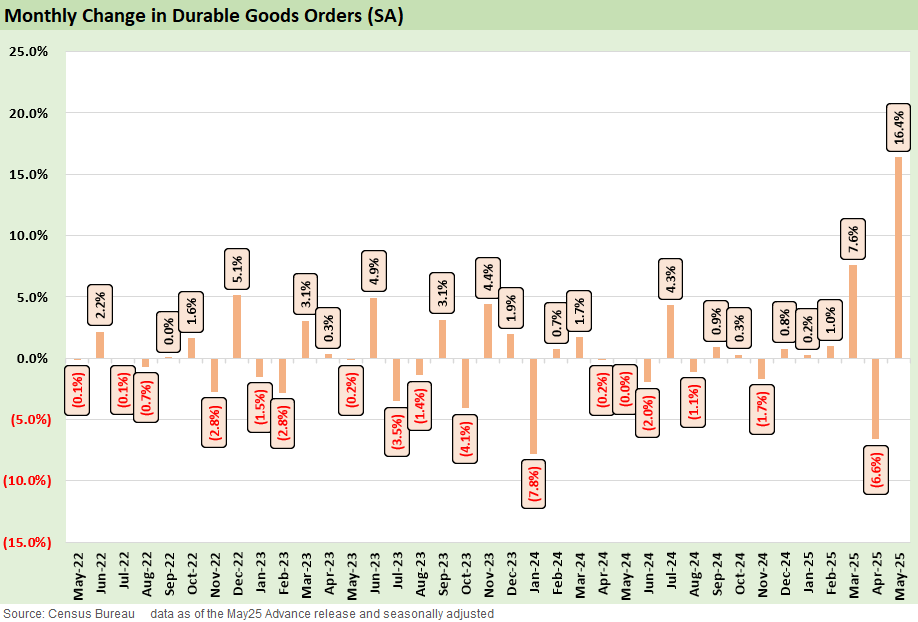

Headline durable goods rose an eye-popping +16.4% in May, the strongest print since July 2014 saw a similar transport related surge, driven by a +231% jump in nondefense aircraft orders.

Ex-Transportation, durable goods orders posted +0.5% in May after two months of low growth. The underlying data shows some pockets of strength in areas like computers and electronic products and machinery, though the release shows few indications of a stronger investment tailwind in line with tariff policy goals.

Overall, the modest positive in orders signal some stability, but this morning’s downward revision to 1Q GDP points to some earlier weakness on the consumer and fixed investment sides. There is little to read into for a growth story that would push back on a slowing real economy outside of some IP investments to be made.

The market has largely pushed tariffs out of daily volatility, but the real transaction flow and economic effects are still to come. Capex decisions are still held up at the margin due to the uncertainty on capital budgeting variables. A wide range of potential outcomes are intrinsic to the reciprocal tariff process and the potential for retaliation looms, especially with Pharma and Semis on Section 232. The largest trade partners ex-China (which is a short-term summary deal) remain in limbo at this point without clearly stated terms and a “real deal” that investment can rely on.

The +16.4% MoM jump in headline orders marks a return to headline volatility with the expectation that next month’s numbers will see an equal-but-opposite drop as the lumpy transportation ordering corrects itself. For context, the last similar bump in July 2014 saw exactly that with a 26.4% surge followed by a -21.2% drop in August. That aircraft ordering swing is a feature of this dataset, and the last few months have seen a few related to Boeing even if not as high as this one.

The move this month relates to a massive Boeing order after the Trump visit to Qatar resulted in a deal for up to 210 787 Dreamliner and 777x aircraft and a smaller British Airways order. These are multi-year commitments and options with several challenges already faced by Boeing that manages an enormous backlog and still has limited production capability.

For months like this one, the ex-transportation chart above helps peel back the core ordering trends for a read on capex. The recent trend in March and April saw a turnaround this month with ex-transport orders increasing +0.5%. We are cautiously positive about this given that the growth is fairly broad from the underlying and comes while rates are still elevated and tariff uncertainty remains high with deals still to be made. At the very least, this is a signal of capex not collapsing with some longer-cycle investments around automation and digital infrastructure still filtering in.

We still see that the resolution of many upcoming variables such as trade policy uncertainty, tax policy (in the headlines now), and the Fed path to easing are key factors in capital spending. These moving parts can keep decision makers in a ‘wait-and-see’ mode. That will mean longer-cycle spending is still vulnerable as rapid policy shifts remain a key constraint, even if there are obvious tech-related categories that will see investment continue to grow (e.g. power, data centers and related equipment).

Multiyear capex planning requires some predictability past the policy chaos into 2026 midterms and beyond. With global and US growth slowing and the real transaction effects of tariffs soon to be fleshed out and then realized, the need to be more defensive amidst cyclical pressures can also be a self-fulfilling driver of flagging capex.

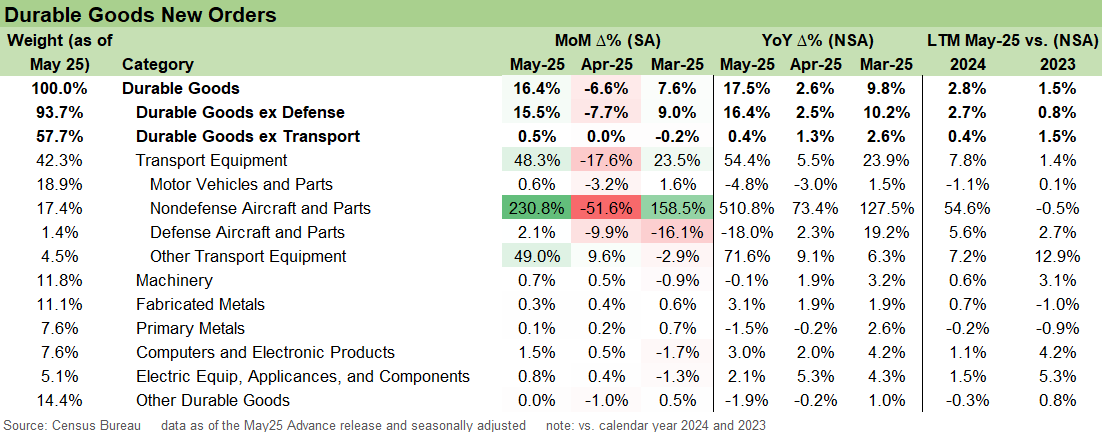

The above table frames the underlying details and the key “ex-defense” and “ex-transport” cuts. The Transport line at +48.3% this month is related to the +230.8% surge in Nondefense Aircraft and Parts related to Boeing orders covered earlier. Motor Vehicles and Parts staged a small turnaround from a very bad April at +0.6%, but the current run rate still sees order levels well below last year.

Below the transport lines, the core durable goods orders were broadly positive, though the strength was concentrated in Computers and Electronic products at +1.5% and Machinery at +0.7%, with the smaller Electric Equipment line also increasing +0.8%. This year has generally seen slow, somewhat consistent growth in these categories as there is little to indicate spending beyond maintenance levels outside of the IP related line.

The last chart here shows shipments activity at +0.2% that feeds into the GDP calculation. The real activity here lags the orders and shows anemic activity in the year.

See also:

1Q25 GDP: Final Estimate, Consumer Fade 6-26-2025

Footnotes & Flashbacks: State of Yields 6-22-2025

Footnotes & Flashbacks: Asset Returns 6-22-2025

Mini Market Lookback: FOMC Spoke Clearly, Iran and Trump up next 6-21-25

Lennar 2Q25: Bellwether Blues 6-20-25

FOMC Day: PCE Outlook Negative, GDP Expectations Grim 6-18-25

Home Starts May 2025: The Fade Continues 6-18-25

May 2025 Industrial Production: Motor Vehicle Cushion? 6-17-25

Retail Sales May 25: Demand Sugar Crash 6-17-25

Footnotes & Flashbacks: Credit Markets 6-16-25

Footnotes & Flashbacks: State of Yields 6-15-25

Footnotes & Flashbacks: Asset Returns 6-15-25

Mini Market Lookback: Deus Vult or Deus Nobis Auxilium 6-14-25

Credit Snapshot: Hertz Global Holdings 6-12-23

CPI May 2025: The Slow Tariff Policy Grind 6-11-25

Mini Market Lookback: Clash of the Titans 6-7-25

Payrolls May 2025: Into the Weeds 6-6-25

Employment May 2025: We’re Not There Yet 6-6-25

US Trade in Goods April 2025: Imports Be Damned 6-5-25

Past-Prologue Perspective for 2025: Memory Lane 2018 6-5-25

JOLTS April 2025: Slow Burn or Steady State? 6-3-25

Tariffs: Testing Trade Partner Mettle 6-3-25

Mini Market Lookback: Out of Tacos, Tariff Man Returns 5-31-25

PCE April 2025: Personal Income and Outlays 5-30-25

Credit Snapshot: Meritage Homes (MTH) 5-30-24

1Q25 GDP 2nd Estimate: Tariff and Courthouse Waiting Game 5-29-25