CPI May 2025: The Slow Tariff Policy Grind

CPI relief still faces a daunting backlog of pauses, court cases, high volume Section 232 targets, and working capital cycles.

Don’t you love tariff analysis!?

The 2.4% headline CPI (up a tick) and flat 2.8% Core CPI keep the waiting game going with Energy a great source of relief during peak driving season with double-digit deflation in gasoline YoY. That also flows into airline fares. We see some counterintuitive negative MoM CPI numbers in new/used vehicles with the combination of tariffs in autos, steel, and aluminum and other supplier chain inputs (semis) that will be heading higher as the world of tariffs unfolds into the fall.

The reciprocal court challenge looms large for low-cost labor arb in Asia (e.g., Apparel, see Tariffs: Some Asian Bystanders Hit in the Crossfire 4-8-25), but semis trade will be in the Section 232 queue one way or the other. Medical care commodities ticked higher MoM to +0.6% with pharma in the Section 232 crosshairs and by far the #1 import from the EU and in the top two US imports with autos (see US-EU Trade: The Final Import/Export Mix 2024 2-11-25, US Trade with the World: Import and Export Mix 2-6-25).

Among notable line items, Food at home ticked higher MoM (-0.4% to +0.3%) while watching Apparel (-0.2% to -0.4%) and Footwear (-0.5% to -0.4%) continue to deflate MoM might be the signal to start back-to-school shopping early before reciprocals get sorted out.

Before we get into the May CPI reconciliation below, it is worth pondering the latest US-China truce and consider what ends up being in the framework but more importantly what is not. Inflation is so politicized at this point, you need to go back to basics in how the mechanism will unfold after the buyer writes the tariff check to customs and then the margin, cost, and price reverberations unfold.

We also need to remember that China supply controls can be applied outside what we already saw with rare earths and strategic metals. That is a missing ingredient in the China “framework.” Pharma will remain at the top of that supply chain worry list unless there is some protective clause (we assume there is not).

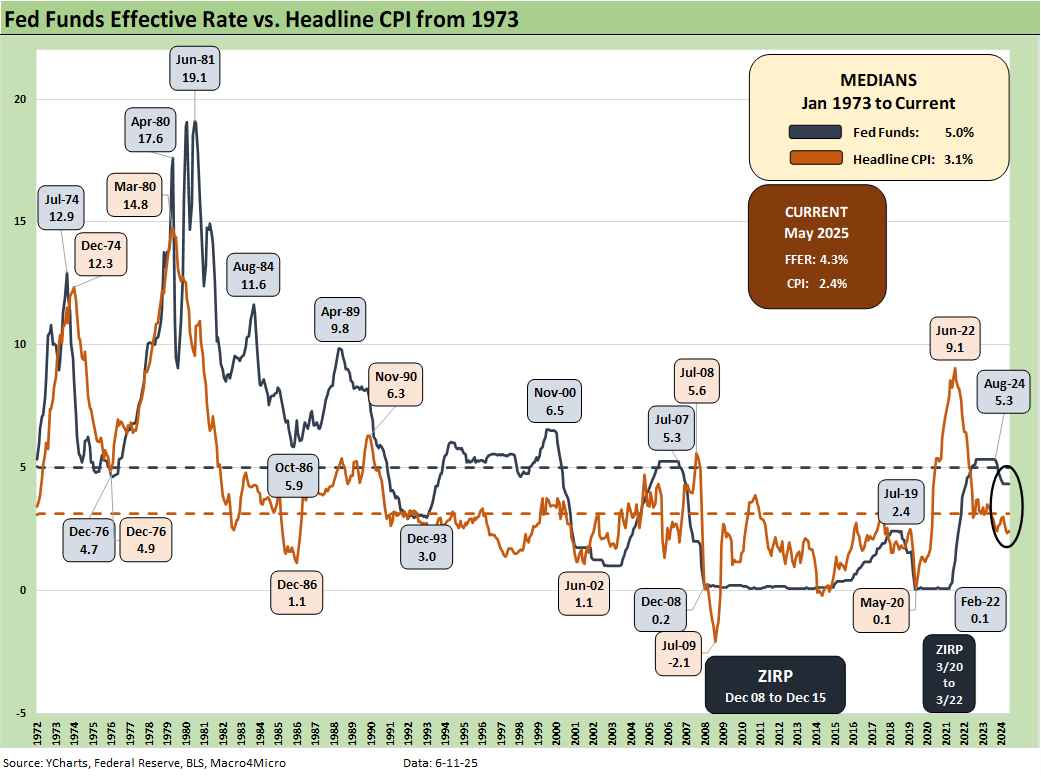

The above chart is our usual update of headline CPI across the cycles plotted against fed funds. Those of us who came of working age back in the 1970s stagflation years fully appreciate the caution of the FOMC. Those were ugly times for the economy, macro shocks, and industry restructurings exacerbated by a need to adapt strategies and cost structures to rapid deregulation across many sectors.

The chart offers a reminder that current headline CPI and fed funds are below the long-term medians even with all those ZIRP years and the very low UST normalization period from late 2008 to March 2022.

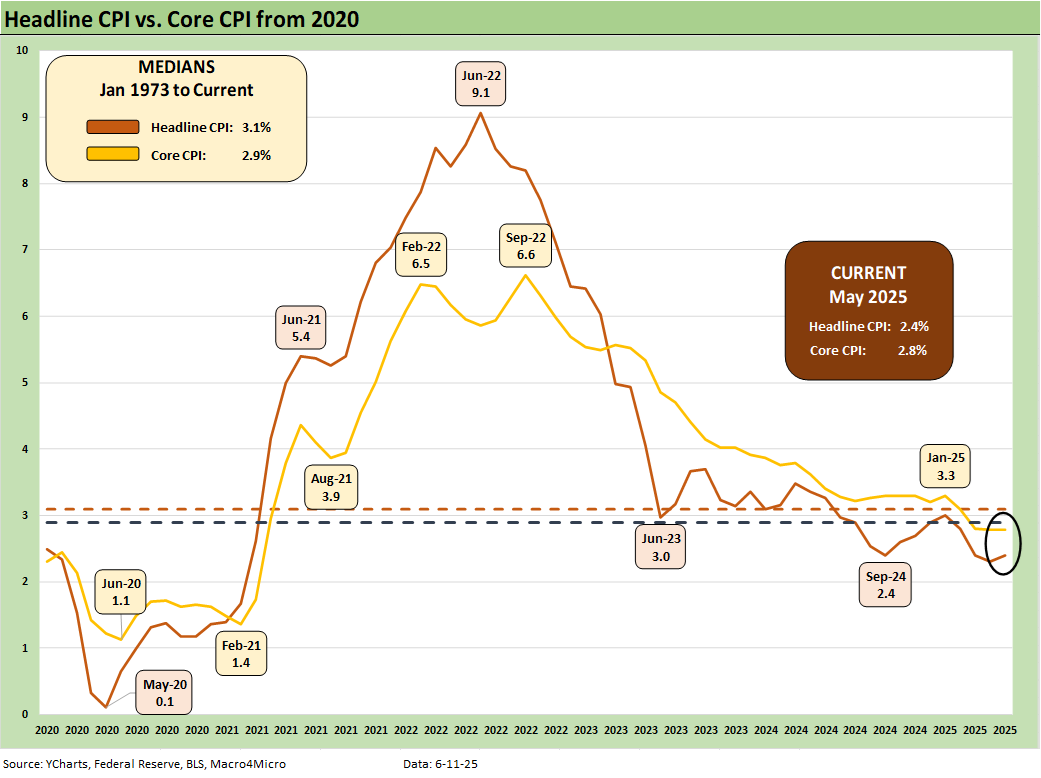

The above chart updates the running Headline CPI vs. Core CPI from 2020 for a frame of reference that gets heavily wagged by energy. We frame those recent numbers vs. the post-1973 medians in the box in the upper left. We are comfortably below the long-term headline median but the May Core of +2.8% is only slightly below the long term.

The heavy mix of Services in the current economy makes it a tough home stretch to get closer to 2.0% (we note that target is for PCE). As we note in the charts below, Services at 3.7% makes it tough to move the needle without sustained and material Goods deflation. Goods are the main target for tariffs, so that is challenging math.

The above chart updates the special aggregates CPI indexes from Table 3. The total Services line at 3.7% is well down from the highs but at almost 64% of the index it is hard to move that needle into the 2% handle range. The same is true of Shelter as we detail below, and the “Services less rent of shelter” CPI is still at 3.5%.

The above chart breaks out our Big 5. We detailed some of our main concerns around these groups last month (see CPI April 2025: 1st Inning for Tariffs and CPI 5-13-25), so we won’t replay that all again here. With so many line items on the consumer checklist or the cost inputs targeted for tariffs now or ahead (notably Section 232 autos now and pharma later) and the same tariff pressure for critical supplier chain and input costs (steel, aluminum, copper, and lumber in Section 232 regardless of the reciprocal IEEPA challenge), there has to be some give in the chain whether lower earnings or higher prices.

The slow rolling tariff impact on autos is a major wildcard with country tariffs and materials. The realities of global supplier chain distortions just schooled the White House with rare earth materials fallout that could have further impaired auto supply-demand imbalances. The household cost of autos is in a class by itself when you start rolling in all the related costs of auto ownership even ex-gasoline (which is included in Energy). We had framed our version of auto CPI to drive that theme home (see Automotive Inflation: More than Meets the Eye 10-17-22).

The next challenge for autos will come when semis start getting roiled by tariffs. The semiconductor-intensity of autos is well understood after the industry lost around 17 million units of production after COVID. We could also see similar disruptions in pharma as that Section 232 gets teed up and could flow into medical commodities and services alike.

Shelter at over 35% of the index always comes with asterisks for its derived, rent-based methodology, but 3.9% is a stubborn number and does not include the challenges on monthly payments tied to high 6% mortgage rates. The shelter inflation line will not directly capture the impact of tariffs on so many materials and critical imports from Canada and Mexico. For multifamily, steel will play a bigger role but gypsum from Mexico and lumber from Canada will make life a challenge for new entry level homes and tighter budgets for a large swath of the population.

For medical care, the issues in the Big Beautiful Bill are more about health care availability and a return of major threats to strained household budgets. Medicare and Medicaid will face fallout from pharma under most any scenario even if Trump jawbones regulating pharma costs. It will not happen and will not get legislated barring a miracle. The pharma tariffs will generate a battle with the EU at the same time the supplier base in China will be on the front burner for any additional threats from other areas such as semis.

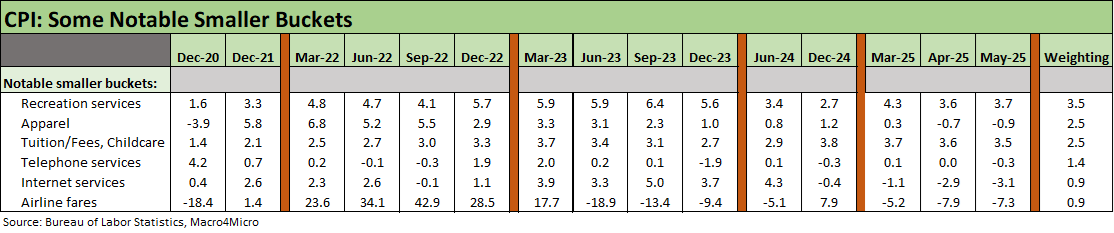

The above chart updates the usual on-the-run line items that are near and dear to households. The one worth watching is Apparel since it is in deflation mode and is right in the mix of reciprocal tariffs. Major importers from Mexico to Asia (see Tariffs: Some Asian Bystanders Hit in the Crossfire 4-8-25) should bias apparel costs higher.

Airline fares keep deflating with low oil prices. We also see some shaky consumer travel and mixed reports from airline trade groups and the media on how the peak summer travel season will play out for volumes and mix. That is another month of -7% handle deflation in airline fares.

See also:

Footnotes & Flashbacks: Credit Markets 6-9-25

Footnotes & Flashbacks: State of Yields 6-8-25

Footnotes & Flashbacks: Asset Returns 6-8-25

Mini Market Lookback: Clash of the Titans 6-7-25

Payrolls May 2025: Into the Weeds 6-6-25

Employment May 2025: We’re Not There Yet 6-6-25

Other Inflation Related:

PCE April 2025: Personal Income and Outlays 5-30-25

CPI April 2025: 1st Inning for Tariffs and CPI 5-13-25

Employment Cost Index 1Q25: Labor is Not the Main Worry 5-1-25

Inflation: The Grocery Price Thing vs. Energy 12-16-24

Inflation Timelines: Cyclical Histories, Key CPI Buckets11-20-23

Fed Funds – Inflation Differentials: Strange History 7-1-23

Fed Funds, CPI, and the Stairway to Where? 10-20-22

Automotive Inflation: More than Meets the Eye10-17-22

Inflation: Events ‘R’ Us Timeline 10-6-22

Select tariff links:

Tariffs: Testing Trade Partner Mettle 6-3-25

Tariffs: Some Asian Bystanders Hit in the Crossfire 4-8-25

Tariffs: Diminished Capacity…for Trade Volume that is…4-3-25

Reciprocal Tariff Math: Hocus Pocus 4-3-25

Reciprocal Tariffs: Weird Science Blows up the Lab 4-2-25

Tariffs: Stop Hey What’s That Sound? 4-1-25