Footnotes & Flashbacks: Asset Returns 8-31-25

The week saw equities leaning slightly more to the negative side with large caps in the red. Duration was mixed on the week.

We will now spice this up with some extreme tariff legal confusion.

The mix of macro releases this past week saw inflation fear get some relief while the picture of the consumer was less bearish in the revised 2Q25 GDP. The income and outlays number in the PCE release also was constructive on income and spending (see PCE July 2025: Prices, Income and Outlays 8-29-25, 2Q25 GDP: Second Estimate, Updated Distortion Lines 8-28-25).

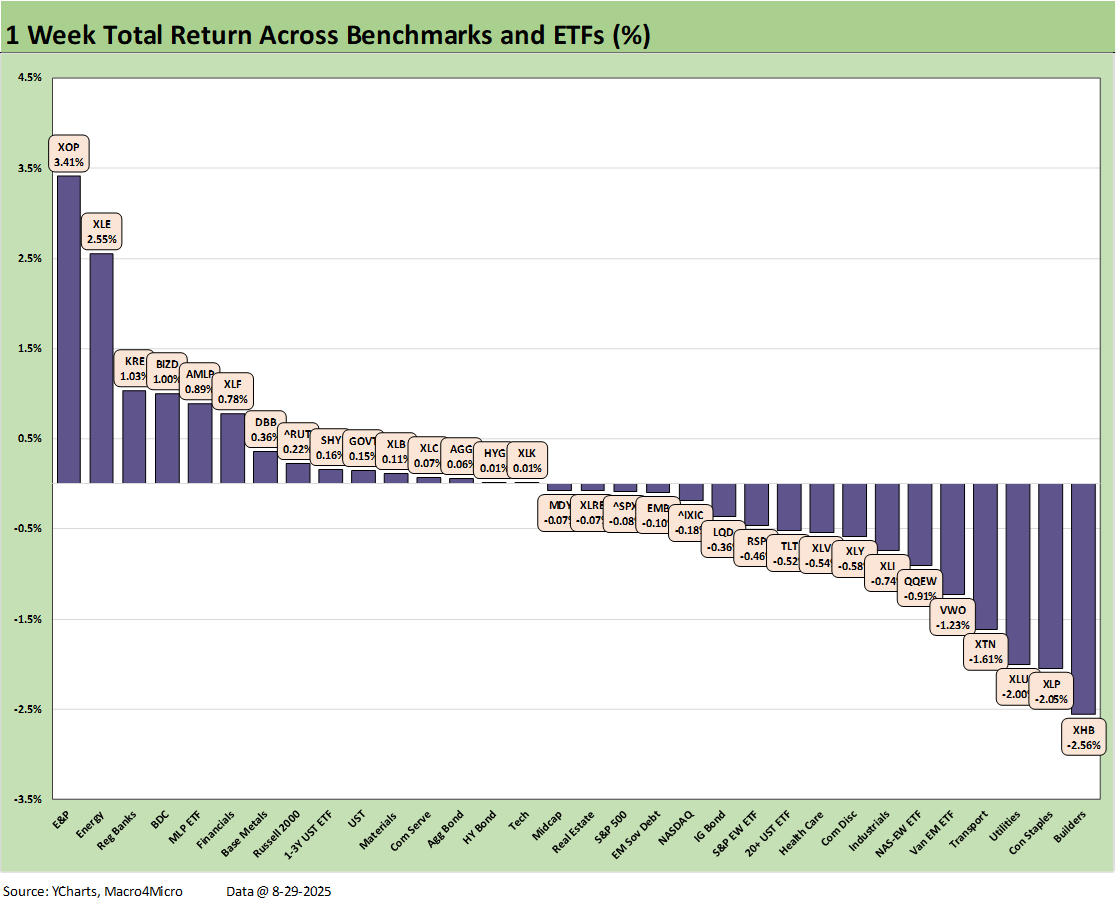

The market saw S&P 500, NASDAQ, and Midcaps on the negative side of the line, but the small cap Russell 2000 crept into the top quartile for the week in the 32 benchmarks and ETFs we track. The bond ETFs saw 4 of 7 in positive range but the long end of the curve pushed higher while short to intermediate rallied.

The major legal setback for Trump’s recurring abuse of IEEPA to deploy blank check tariff policies saw the Appeals Court shoot it down by 7-4. Trump has until mid-October to get SCOTUS to do what they usually do for him (whatever he wants). The idea of needing to go to Congress for legislative change is not an appealing one for Trump but would be the final test of courage for the Senate GOP. Trump immediately framed a false and nonsensical narrative on what the effects would be on the US (see Mini Market Lookback: Tariffs Back on Front Burner 8-30-25).

This holiday-shortened week brings a fresh payroll release and test of the ability of the BLS (and BEA) to fight off the rhetoric of a White House determined to take control of economic data releases (see Happiness is Doing Your Own Report Card 8-1-25).

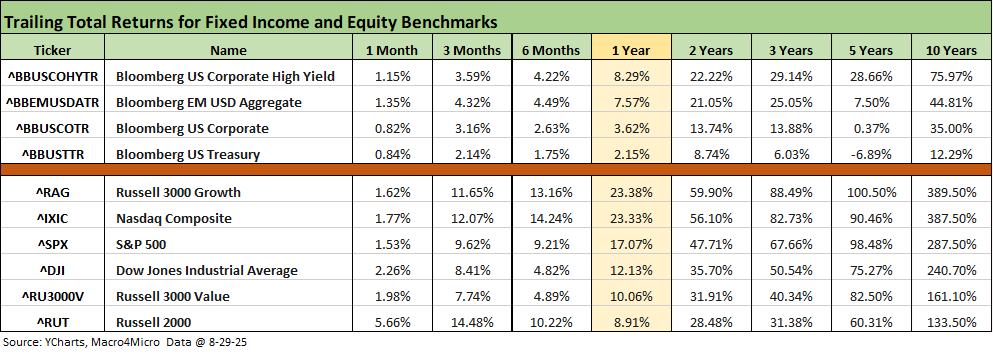

The above table breaks out the high-level debt and equity benchmarks we track. We do not see much change in the overall flavor relative to last week with everything positive. You need to go back to the UST over the trailing 5 years to find a number in the red. The 3-months from May after the early April chaos are especially impressive with Growth benchmarks and the Russell 2000 in double digits.

The rolling return visual

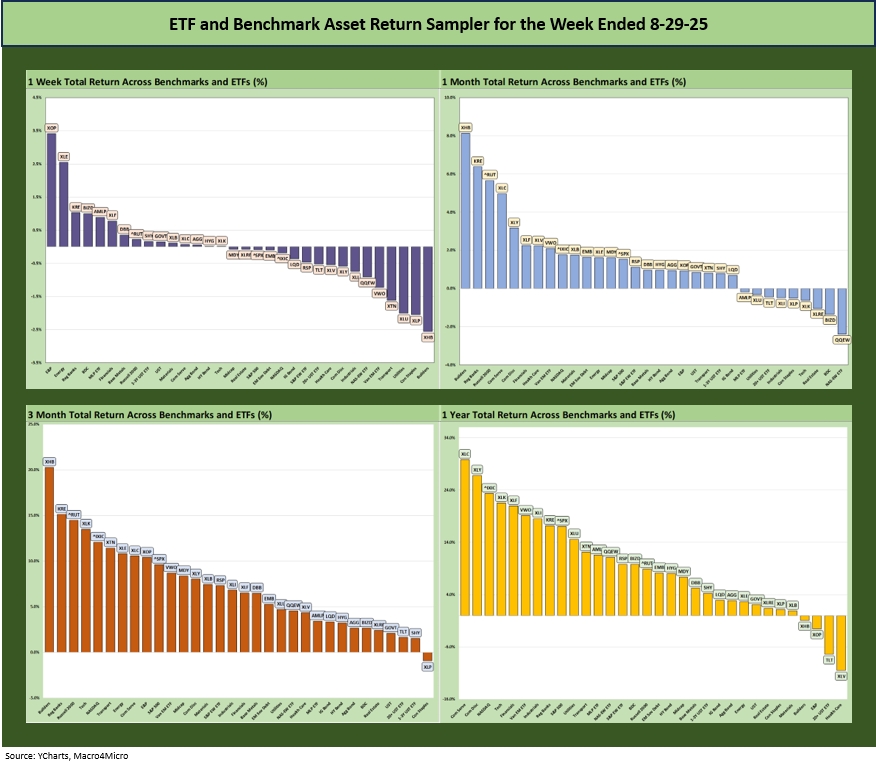

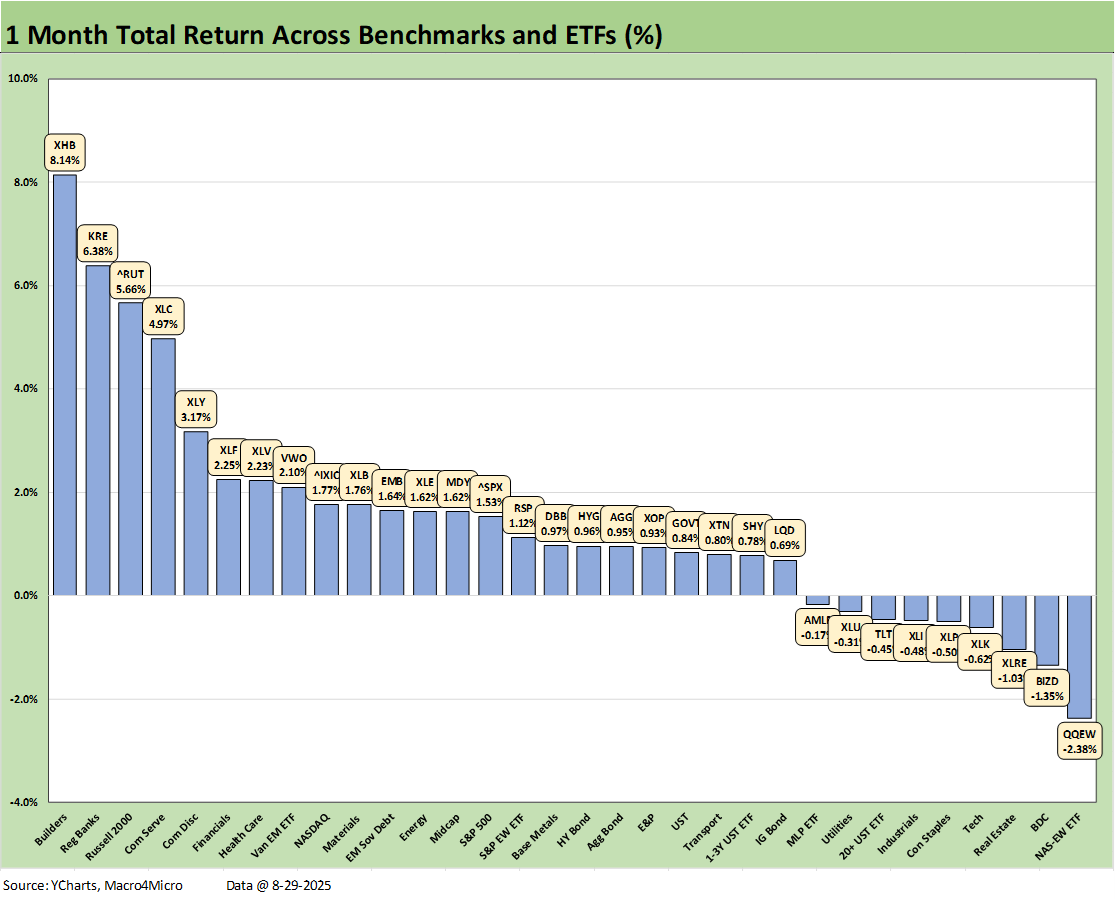

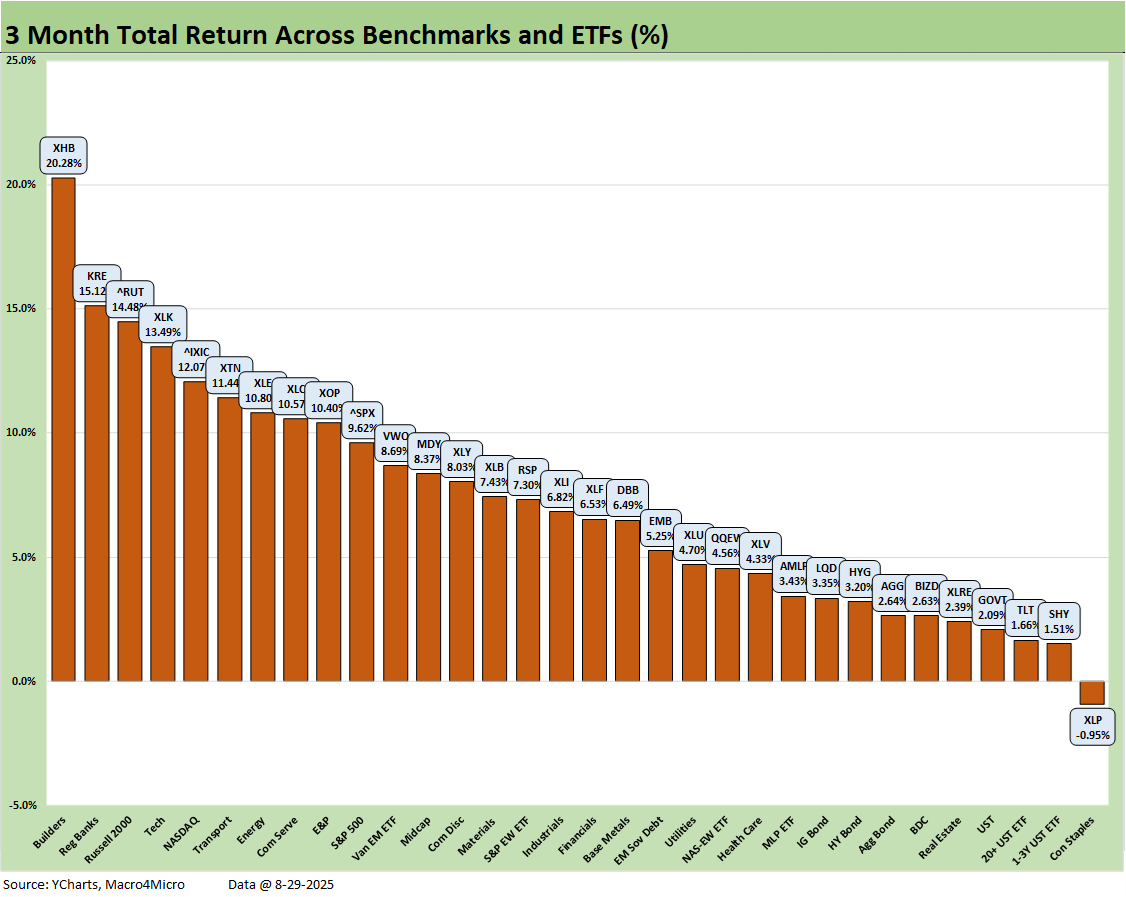

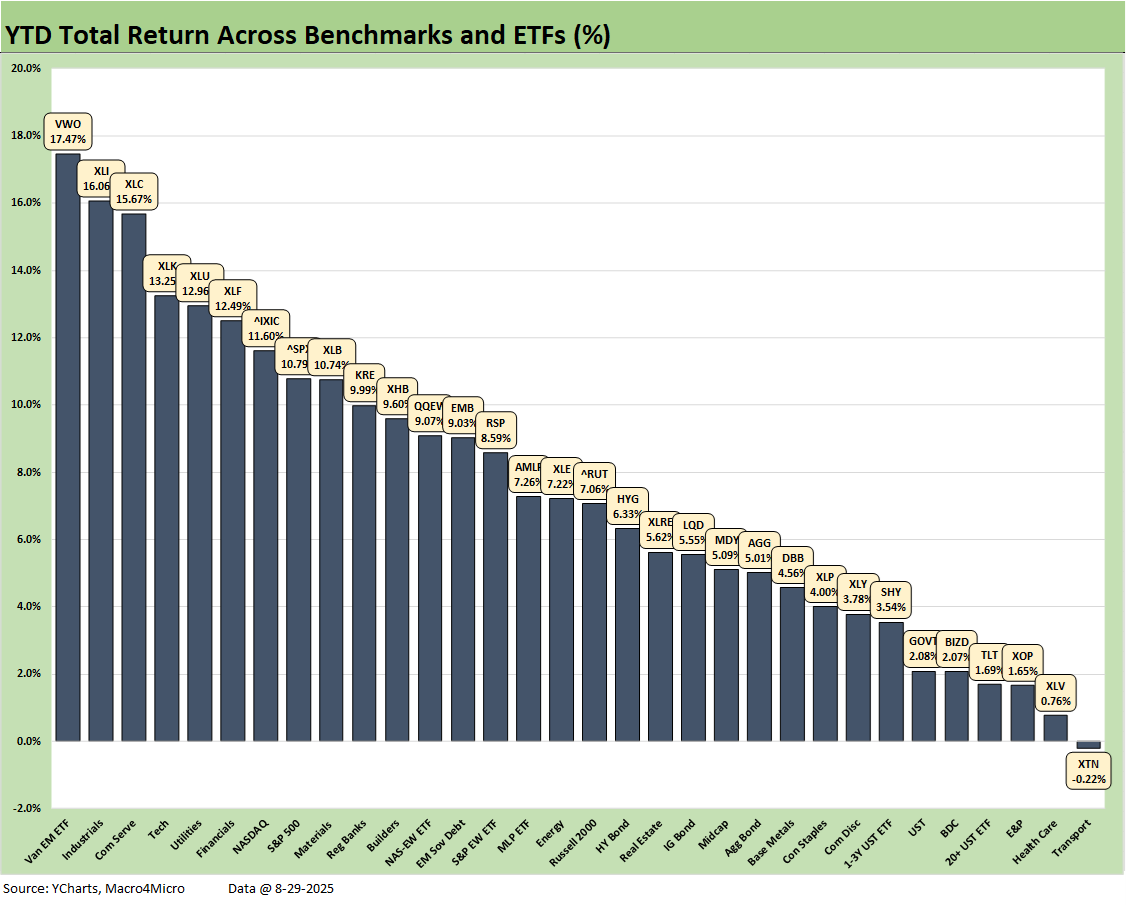

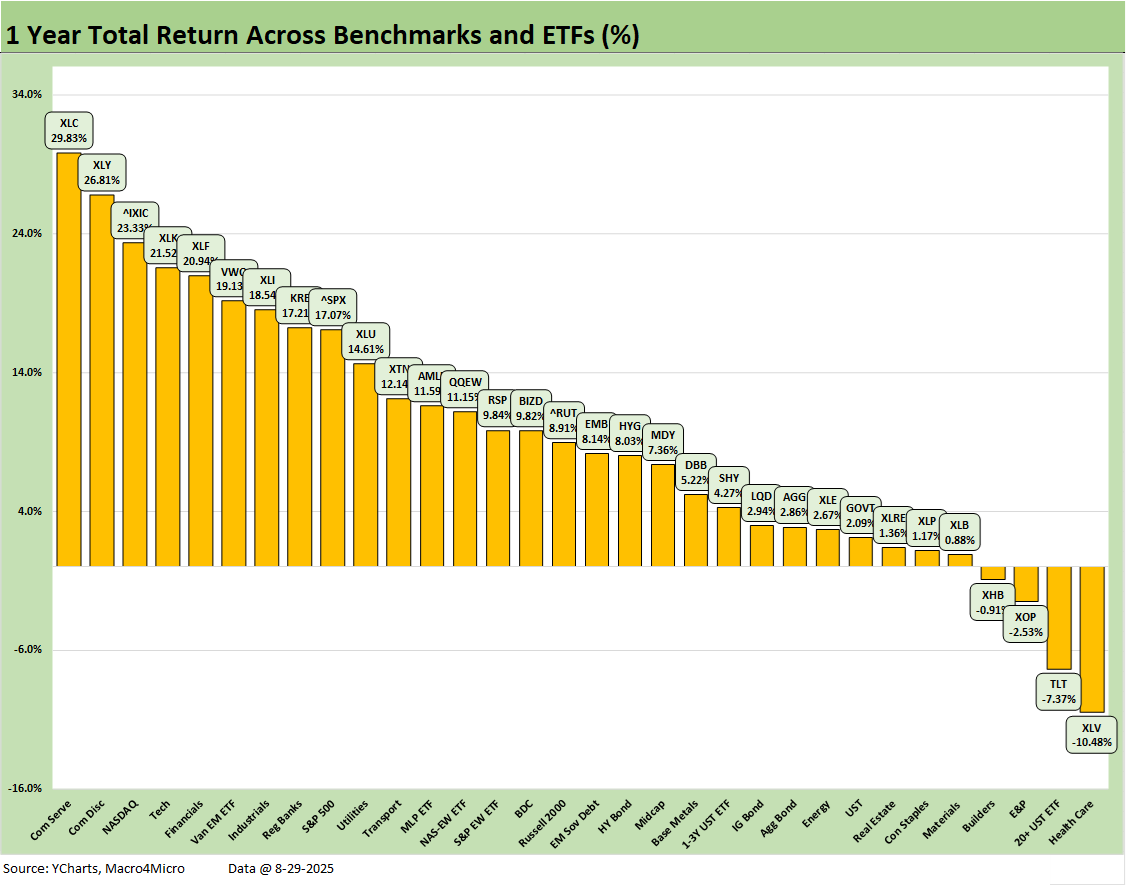

In the next section, we get into the details of the 32 ETFs and benchmarks for a mix of trailing periods. Below we offer a condensed 4-chart view for an easy visual on how the mix of positive vs. negative returns shape up. This is a useful exercise we do each week looking for signals across industry groups and asset classes.

The past week presents unusual negative symmetry since the Liberation Day chaos eased and the solid earnings season for the June quarter brought more relief. The ability to avoid severe trade clashes was a case study in good fortune, and we have to admit some surprise that so many trade partner leaders would “lie down.” That is not a great way to deter a bully.

That ability to revisit trade deals that are not detailed and ironclad is a story for another day. The question now on tariffs and the appeals court action on IEEPA is “Will SCOTUS abandon all pretense of defending the constitution and legislative checks and balances?”

SCOTUS may avoid putting permanent “christofascist” tattoos on their court and allow the Appeals Court decision stand on the IEEPA ruling. That is a discussion for another day as the mislabeled “reciprocal tariffs” would be sent into a twilight zone. Strange things can then happen.

One theory is that Congress will be “asked” by Trump to legislate him a blank check. That would also require “going nuclear” in the Senate (end filibuster). That process will play out against the backdrop of Trump staging a “Federal Reserve coup” by purging that group the way the purges played out across the military, the “intelligence” leadership under Gabbard, the DOJ/FBI, the CDC, the EPA, and the pro wrestling leadership of the DOE. There seems to be a pattern forming here.

In the case of the Fed, the process was even more diabolical with the broadcasting journalism major who runs the FHFA playing mortgage dirt hit man. We have met too many mortgage professionals to consider that guy remotely qualified to run the FHFA and oversee the potential privatization of the GSEs. In old Bogart movies, they were called “private dicks.” This one is more public.

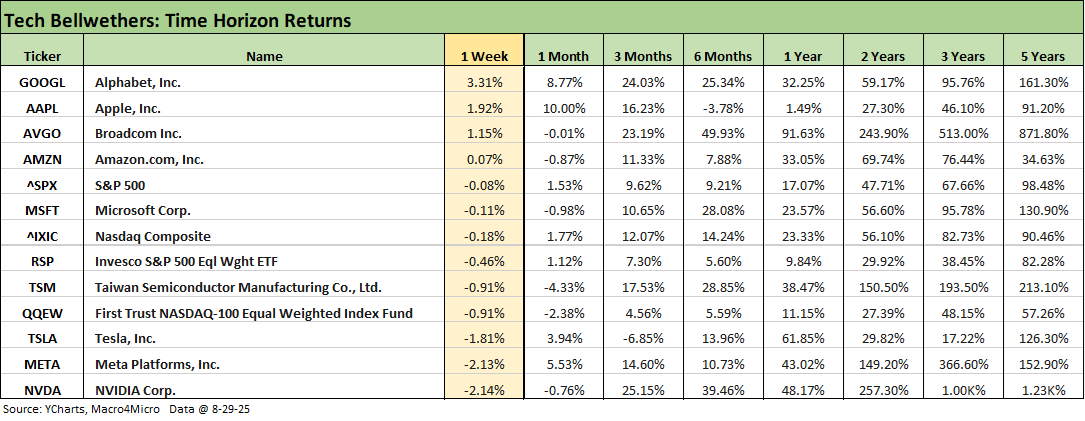

The Magnificent 7 heavy ETFs…

Some of the benchmarks and industry ETFs we include have issuer concentration elements that leave them wagged by a few names. When looking across some of the bellwether industry and subsector ETFs in the rankings, it is good to keep in mind which narrow ETFs (vs. broad market benchmarks) get wagged more by the “Magnificent 7” including Consumer Discretionary (XLY) with Amazon and Tesla, Tech (XLK) with Microsoft, Apple, and NVIDIA, and Communications Services (XLC) with Alphabet and Meta.

We already looked at the tech bellwether weekly results in our Mini Market Lookback: Tariffs Back on Front Burner (8-30-25). The week saw only 3 Mag 7 beat the S&P 500, which was in the red itself. The NVIDIA earnings were impressive but got a lukewarm reaction even with solid guidance. More market watchers seem to need very positive surprises and still ask themselves the question of how AI will play through to favorable revenue and profits for users of the products future. The crosscurrents with China and the question of whose AI can “stack the deck” on a global scale just means the market will have more to debate in the future in assigning multiples and over what time horizon.

The 1-week returns across our 32 benchmarks and ETFs was addressed in our Mini Market Lookback: Tariffs Back on Front Burner (8-30-25). As noted earlier, the symmetry of the short-term returns had a rare moment of “leans negative” since the post-Liberation Day rebound.

The 1-month period weighed in at a score of 23-9 for positive vs. negative with 6 of 7 bond ETFs positive. The long end of the curve has been tougher on the long duration UST (TLT) as the only bond ETF in the red.

We see the homebuilder ETF (XHB) well ahead for the month with Regional Banks (KRE) and Financial (XLF) in the top quartile with the small cap, US-centric Russell 2000 in the mix. We take those as favorable votes on where the FOMC and inflation will be headed. The appeals court killing the IEEPA tariffs will add more support for the FOMC if they can get it past the holy rollers and MAGA fans on SCOTUS.

Trump is in a position where he wants rates to be eased for good reason while only extolling the strength of his economy. The payroll numbers will be pivotal. If they are weak, rates definitely go lower while Trump will complain about the data being wrong. It’s the having your cake and eating it too thing….

The bottom of the 1-month ranks shows the Equal Weight NASDAQ 100 (QQEW) and Tech ETF (XLK) in the bottom ranks, but the idea of rotation out of tech gets set back by Real Estate (XLRE), Industrials (XLI), and Utilities (XLU) also in the bottom quartile. We are moving into a tricky crossroad with the FOMC, tariff legal issues, and steepening fears still looking for direction.

The 3-month time horizon continues to ride high as the Liberation Day chaos fades further into the rear view mirror. The score is 31-1 with only Consumer Staples (XLP) slightly in the red. We see Homebuilders (XHB) back on top with Regional Banks (KRE) at #2, the small Cap Russell 2000 (RUT) at #3, Tech (XLK) at #4, and NASDAQ at #5. The median range for the 32 benchmarks and ETFs over 3 months is around 6.7%, which is a good rolling 3 months by any standard.

The YTD numbers also weigh in at 31-1 in a solid year that has navigated many threats around inflation fears, a weaker consumer sector, tariff uncertainty, and trade war and retaliation risk.

The top quartile is well balanced and diversified with EM equities (VWO), Industrials (XLI), Communications Services (XLC), Tech (XLK), Utilities (XLU) and Financials (XLF) leading the top tier. The only ETF in the red is Transports (XTN) for reasons covered along the way with freight and logistics in relative chaos for much of 2025. Overall, Health Care (XLV), long duration assets (TLT), and E&P (XOP) struggled.

The 2025 risk checklist is a long one with a lot in the “fear of the unknown” bucket. The political backdrop and draconian scenarios are as bad as any in my life (and I was glued to the TV in 1968 and buried in newspapers). Parents would discuss the Depression and the WWII that followed. In those days, you would get to meet WWII and Korean War vets and those who fought tyranny around the globe, so this current political backdrop is disturbing. The potential damage will be self-inflicted today.

The 1-year returns stand at 28-4 with the Health Care ETF (XLV) on the bottom, the long duration UST ETF (TLT) still in the red zone, and oil prices still not working for E&P (XOP). The Homebuilder ETF (XHB) is slightly negative with LTM builder equities showing the effects of the beatdown that got under way in 4Q24.

Communications Services (XLC) holds down #1, Consumer Discretionary (XLY) is #2, NASDAQ is #3, the Tech ETF (XLK) is #4, Financials (XLF) is #5 in what is a reasonably diverse mix in the top quartile with EM Equities (VWO), Industrials (XLI), and Regional Banks (KRE) rounding out the quartile. That said, the overall profile of the high end of the leaderboard is tech biased.

The S&P 500 at a run rate of 17.1% over 1 year (10.8% YTD 2025) will need to finish 2025 strong to match the 2024 and 2023 S&P 500 returns. The year 2024 was Part 2 of the best 2-year run in the S&P 500 since the late 1990s, so that sets a high bar (see Footnotes & Flashbacks: Asset Returns for 2024 1-2-25). The S&P 500 return of +25% for 2024 (26% 2023) and more than double that for the cumulative 2 years (2023 through 2024) will be very hard to match in 2025-2026. That undermines Trump’s theme music of “the country was dead a year ago and 8 months ago.” Only an idiot would believe that (show of hands?)

Recession handicapping debates continue in the markets, but it is hard to see a recession unfolding in the fall. In our view, the US economy has not come close to a recession in the last few years despite the noise in the fall of 2022, when consumption was high (PCE) and unemployment low. In 2022, market participants were justifiably “freaking out” about the potential threat of inflation. Fortunately, the Fed moved fast (if late) and inflation came down quickly (it was not 1980-1982). That stretch came after a 2-month recession in early 2020 with COVID, which followed the longest economic expansion in US history.

As we have covered in earlier commentaries, it takes a lot to drive a recession (see Macro Menu: There is More Than “Recession” to Consider 8-5-25). Only two Presidents in the last 50 years have served out their terms without a recession period – Clinton and Biden. For those who oversaw economic contractions, the wild economic, capital markets, and banking system issues were stories unto themselves. And the same is true of the geopolitical and systemic events that contributed to those recessions. Some were extraordinary.

See also:

Mini Market Lookback: Tariffs Back on Front Burner 8-30-25

PCE July 2025: Prices, Income and Outlays 8-29-25

2Q25 GDP: Second Estimate, Updated Distortion Lines 8-28-25

Avis Update: Peak Travel Season is Here 8-27-25

Durable Goods July 2025: Signs of Underlying Stability 8-26-25

Toll Brothers Update: The Million Dollar Club Rolls On 8-26-25

New Home Sales July 2025: Next Leg of the Fed Relay? 8-25-25

Credit Markets: Dull Week for Spreads 8-25-25

The Curve: Powell’s Relief Pitch 8-24-25

Footnotes & Flashbacks: Asset Returns 8-24-25

Mini Market Lookback: The Popeye Powell Effect 8-23-25

Existing Home Sales July 2025: Rays of Hope Brighter on Rates? 8-21-25

Home Starts July 2025: Favorable Growth YoY Driven by South 8-19-25

Footnotes & Flashbacks: Credit Markets 8-18-25

Herc Holdings Update: Playing Catchup 8-17-25

Footnotes & Flashbacks: State of Yields 8-17-25

Mini Market Lookback: Rising Inflation, Steady Low Growth? 8-16-25

Industrial Production July 2025: Capacity Utilization 8-15-25

Retail Sales Jul25: Cautious Optimism in the Aisles 8-15-25

PPI: A Snapshot of the Moving Parts 8-14-25

CPI July 2025: Slow Erosion of Purchasing Power 8-12-25

Iron Mountain Update: Records ‘R’ Us 8-11-25

Mini Market Lookback: Ghosts of Economics Past 8-9-25

Macro Menu: There is More Than “Recession” to Consider 8-5-25

Mini Market Lookback: Welcome To the New World of Data 8-2-25

Happiness is Doing Your Own Report Card 8-1-25

Payrolls July 2025: Into the Occupation Weeds 8-1-25

Employment July 2025: Negative Revisions Make a Statement 8-1-25

Employment Cost Index 2Q25: Labor in Quiet Mode 7-31-25

2Q25 GDP: Into the Investment Weeds 7-30-25

2Q25 GDP: First Cut of Another Distorted Quarter 7-30-25

United Rentals: Cyclical Bellwether Votes for a Steady Cycle 7-29-25