Mini Market Lookback: Ghosts of Economics Past

A solid week for equities, soft for bonds, but major releases ahead with CPI and more macro inputs.

Inflation, Payroll, and Fed Politics haunting the market…

The week was a solid one for risk despite the overhang of tariff debates (facts and concepts), assaults on Fed independence, a new target on the back of the professional economic data providers, and the usual array of toxic political hate mongering that just rolls off most backs these days.

Equities had a good week with the major benchmarks all positive and 8 of 11 S&P 500 sectors positive. Bond ETFs felt another mild setback with the adverse curve move as 5 of 7 were negative in our group of 32 benchmarks/ETFs. Credit spread tightening helped HYG land in positive range.

The 32 benchmarks and ETFs posted a score of 21-11 favoring positive returns with homebuilders notching another infrequent #1 since the fall with a modestly favorable move in mortgages bucking the UST curve trend. The Mortgage News Daily survey dipped to 6.57% by Friday in what was a stable range after last Friday’s payroll noise and all the BLS headlines (see Happiness is Doing Your Own Report Card 8-1-25).

This week brings CPI and PPI for a fresh round of headlines ahead of Retail Sales and Industrial Production to end the week along with another Consumer Sentiment release and a look at Import Prices.

The above chart updates the running YTD returns for 4 ETFs that are useful proxies for the 4 major trade partners battling it out. China and European market ETFs are still well ahead of Canada, who is comfortably ahead of the US. They don’t make Golden Ages like they used to. That said, we still are of the school that it takes a lot more than what we see today to drive a US recession even if we remain bearish on the economy.

Low growth and higher inflation would be bad news, but we still are dubious on the excessive use of the “R” word and high odds being bandied about on recession risk. We looked back at how ugly life had to get and what sort of macro shocks we went through to drive the last 4 recessions (see Macro Menu: There is More Than “Recession” to Consider 8-5-25).

Low to minimal growth and higher inflation is a reasonable scenario. What makes for a recession by itself is a bit of a debate. As we have covered in the past (see Business Cycles: The Recession Dating Game 10-10-22), sitting around waiting for NBER to weigh in can be less than useful. NBER’s Cambridge MA address and founder lineage is bound to bring a smile to Trump’s face if we get to that point.

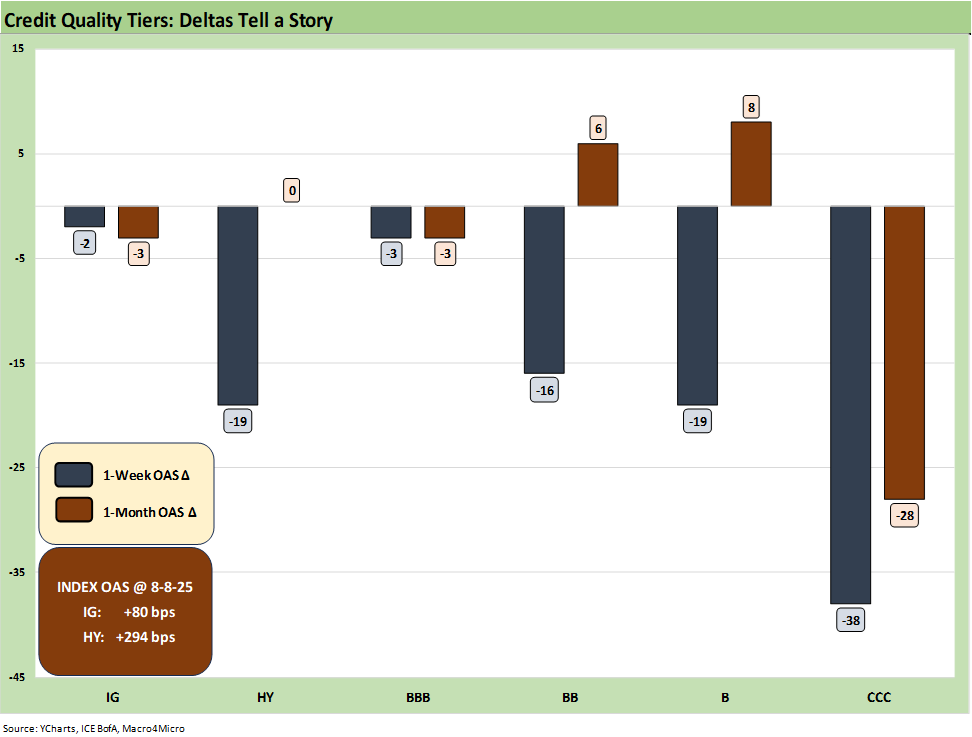

The above chart updates the 1-week and 1-month credit spread deltas for IG and HY and for the tiers from BBB to CCC. Spreads compressed on the week with 1-month deltas still mixed overall. The CCC tier has also narrowed on some “dropouts” over the past month with the usual rebalancing adjustments that come with that.

The score of 21-11 for the week shows some of the usual stragglers in Energy (XLE, XOP) and Health Care (XLV). We also see 5 bond ETFs in negative range on the UST shift with HY and EMB in positive range. Duration felt the sting even though credit spreads tightened. Banks were soft toward the middle of the pack for Regional Banks (KRE) and Financials (XLF).

The good news for breadth is that the NASDAQ and S&P 500 were joined in the top tier by the Russell 2000 small caps and EM Equities (VWO). We see the Tech ETF (XLK) and Consumer Discretionary (XLY) had solid weeks. The surprise winner on the week was Homebuilders (XHB). We saw rebounds in homebuilder equities from the largest to the smaller public names with few exceptions.

Tech bellwethers had a good week with 4 of the Mag 7 ahead of the NASDAQ and 6 of the 7 ahead of the S&P 500. Apple saw good news with the capex plans that would ease tariff risks while Tesla offered some favorable headlines in autonomous vehicles including robotaxis. We note that Tesla remains negative for the trailing 6 months and Apple is barely positive.

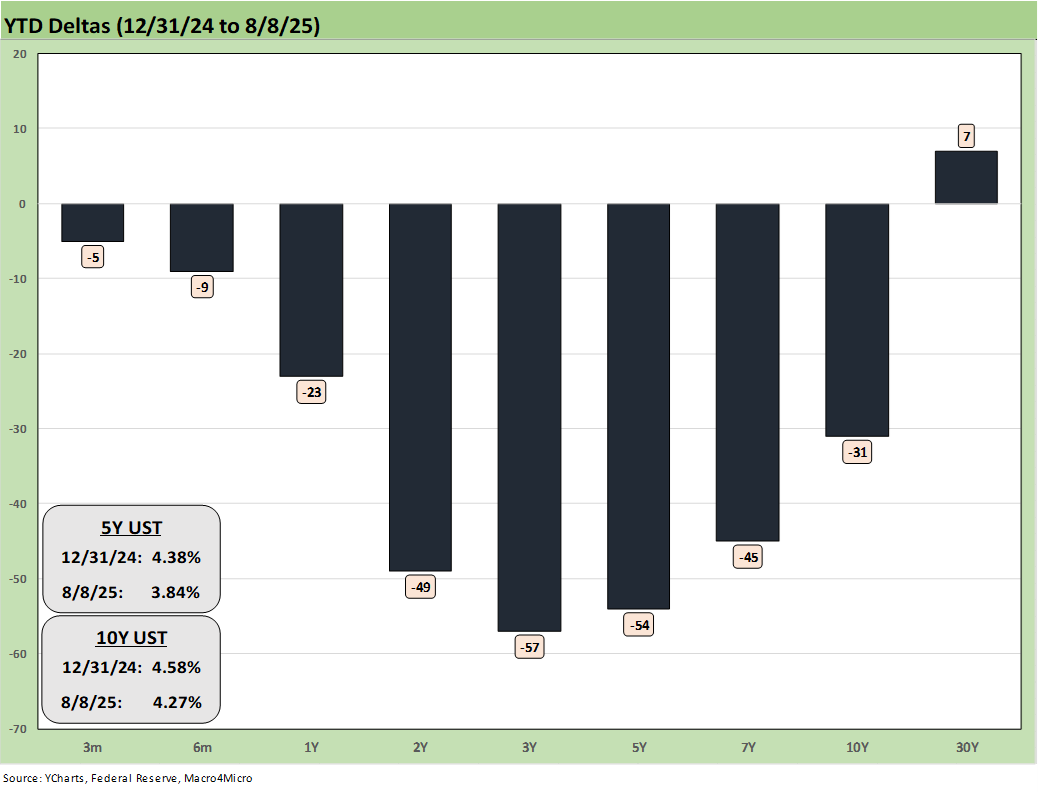

The 1-week UST deltas showed some weakness as the questions will continue to swirl around inflation, payroll, the Fed chair and other personnel dramas, and the dollar. We get CPI and PPI numbers this week, so the disinformation will get cranked up with the only certainty being the vocal support of multiple “conflicting certainties.” We will be locking in in the MoM numbers by product group to look for sequential inflation signals.

It is a sign of the times when headlines were made by the fact that Eugene Robinson of the Washington Post on “Morning Joe” got Sec of Treasury Bessent to admit that the buyer/importer writes the check to customs for the tariff. It took multiple attempts and very exacting and specific repeated questions to get Bessent to grudgingly admit that the buyer pays customs. That made the social media rounds even though it was the equivalent of saying 2+2=4. It reflects the level of dishonesty in Washington.

The above chart updates the YTD UST deltas with the bull steepener pattern still a source of support for bond returns.

The above time series updates the 10Y UST vs. the Freddie Mac 30Y benchmark that gets released on Thursday at noon. Some modest progress in mortgage rates is a start. The big tests still lie ahead on economic data from payroll to inflation as that publicized battle rages on and has now sucked in the BLS (and soon the BEA) into the maelstrom with the FOMC.

HY OAS tightened by -19 bps on the week to +294 bps as HY once again moved back below the 300 bps line into the “June 2007 zone.”

The “HY OAS minus IG OAS” quality spread differential narrowed to +214 bps from +231 bps or by -17 bps with HY -19 bps tighter and IG -2 bps tighter.

The “BB OAS minus BBB OAS” quality spread differential narrowed by -13 bps to +80 bps as BB tightened by -16 bps and BBB by -3 bps.

See also:

Macro Menu: There is More Than “Recession” to Consider 8-5-25

Footnotes & Flashbacks: Credit Markets 8-4-25

Footnotes & Flashbacks: State of Yields 8-3-25

Footnotes & Flashbacks: Asset Returns 8-3-25

Mini Market Lookback: Welcome To the New World of Data 8-2-25

Happiness is Doing Your Own Report Card 8-1-25

Payrolls July 2025: Into the Occupation Weeds 8-1-25

Employment July 2025: Negative Revisions Make a Statement 8-1-25

Employment Cost Index 2Q25: Labor in Quiet Mode 7-31-25

PCE June 2025: Prices, Income, and Outlays 7-31-25

2Q25 GDP: Into the Investment Weeds 7-30-25

2Q25 GDP: First Cut of Another Distorted Quarter 7-30-25

United Rentals: Cyclical Bellwether Votes for a Steady Cycle 7-29-25

JOLTS June 2025: Lower Openings and Hires, Higher Layoffs YoY and Flat MoM 7-29-25

Mini Market Lookback: Mixed Week Behind, Big Week Coming 7-26-25

Durable Goods Jun25: Air Pocket N+1 7-25-25

Taylor Morrison 2Q25: Resilient but Feeling the Same Macro Pressure 7-25-25

New Home Sales June 2025: Mixed Bag 7-24-25

Existing Home Sales June 2025: The Math Still Doesn’t Work 7-23-25

PulteGroup 2Q25: Still-Lofty Margins see a Mild Fade 7-23-25

D.R. Horton 3Q25: Material Slowdown Still Good Enough 7-22-25

Housing Starts June 2025: Single Family Slips, Multifamily Bounces 7-18-25

Mini Market Lookback: Macro Muddle, Political Spin 7-19-25

Housing Starts June 2025: Single Family Slips, Multifamily Bounces 7-18-25

Retail Sales Jun25: Staying Afloat 7-17-25

June 2025 Industrial Production: 2Q25 Growth, June Steady 7-16-25

CPI June 2025: Slow Flowthrough but Starting 7-15-25

Mini Market Lookback: Tariffs Run Amok, Part Deux 7-12-25

Mini Market Lookback: Bracing for Tariff Impact 7-5-25

Asset Return Quilts for 2H24/1H25 7-1-25

JOLTS May 2025: Job Openings vs. Filling Openings 7-1-25

Midyear Excess Returns: Too little or just not losing? 7-1-25

Thank you Glenn.

For anyone interested, here are my Jul CPI estimates:

https://arkominaresearch.substack.com/p/jul-2025-cpi-estimate?r=1r1n6n