2Q25 GDP: Second Estimate, Updated Distortion Lines

The 2Q25 2nd estimate lifted numerous lines but with similar distortions (+4.95% net exports, -3.29% inventories). PCE remained weak.

“Numbers like we’ve never seen before!” Trump sees a grove of trees.

The major distortion numbers were similar to the advance estimate with net exports of goods and services adding +4.95% and change in private inventories shaving off -3.29%. The net effect of the two added 1.66% to the headline number of 3.3%. Real final sales to private domestic purchases was revised from +1.2% to +1.9%.

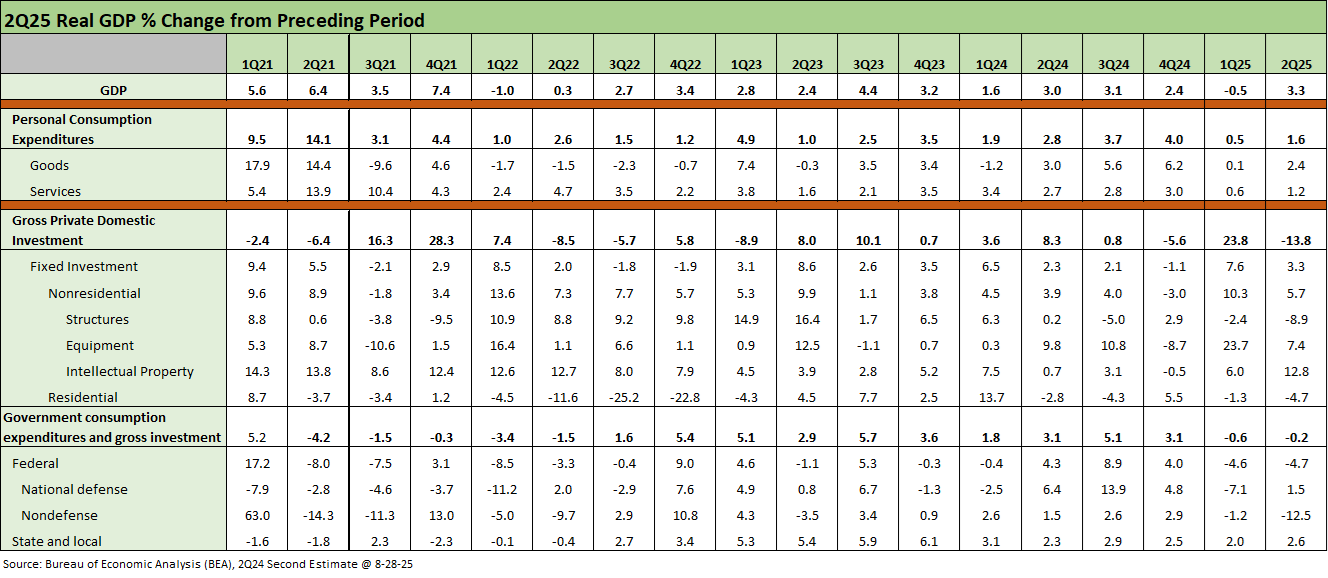

The bump in GDP for the second estimate saw PCE up by +0.2 to a still weak 1.6%, which beat the 1Q25 +0.5% but is still the lowest since 2Q23. Lower interest rates and bonus depreciation in the tax bill (equipment) should drive some recovery subject to tariff impacts.

Goods (+2.4%) rallied off a weak 1Q25 (+0.1%), but goods growth remains below 2Q24, 3Q24, and 4Q24. Durables bounced to +2.6% from -3.7% in 1Q25 while nondurables moved slightly from +2.1% to +2.3%.

The services growth line in 1Q25 and 2Q25 are the lowest since Trump 1.0. Services at +1.2% climbed off the +0.6% of 1Q25, but growth in services remains at multiyear lows with only 2Q23 (+1.6%) below a 2% handle. In a services economy, annual service growth in 2024 was 2.9%, 2023 was 2.9%, and 2022 at the inflation peak was +5.0%.

Gross Private Domestic Investment (GPDI) stayed weak at -13.8% with a lower negative than the advance estimate. Structures (-8.9%) and Residential (-4.7%) remain mired in the red while Equipment is rolling along at +7.4% and IP products at +12.8%.

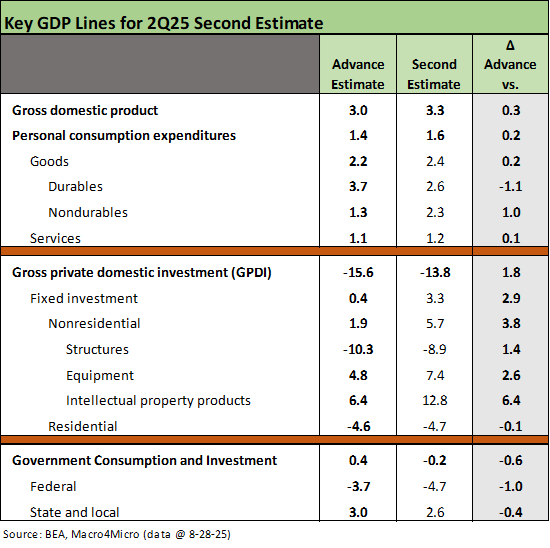

The above table updates the GDP line deltas from the advance estimate (see 2Q25 GDP: First Cut of Another Distorted Quarter 7-30-25). The fresh round of line items are mostly favorable variances. The biggest delta move of +6.4% in Intellectual Property Products is intuitive given the run in tech asset classes. The IP line is just ahead of Equipment in size among the GDP accounts of GPDI. In other words, it is larger than Structures and Residential investment in the 2Q25 lines.

The above table updates the GDP line items across PCE and GPDI as well as some important Government lines (defense, non-defense, State and Local). We start the timeline in 1Q21. The “follow the bouncing ball” scan tells the story. Adjectives are fun in Washington, but numbers are facts and that literally counts. As a reminder, PCE is 68% of GDP with 18% for GPDI, Government at 17%, and the net Imports (trade deficit) line is -3%.

We always highlight that those negative GDP numbers tied to “imports > exports” can also be interpreted as demand for low-cost sourcing that drives corporate profitability (stock markets, services company expansion) and allows many small businesses to exist. At the same time, low-cost sourcing supports household budgets and purchasing power.

Trade deficits have been painted as “death of American jobs” and subsidies of foreign nations. That is where politics depart from economics. According to the Constitution, it is a choice for legislators (and voters), but it has become the decision process of one man.

The nature of the tariff adjustments to pricing and expenses is a part of an ongoing process and will not be clear until well into 2026. Anyone who tells you the effects are clear at this point is selling a bridge they don’t own.

See also:

GDP comments:

2Q25 GDP: First Cut of Another Distorted Quarter 7-30-25

Q25 GDP: Into the Investment Weeds 7-30-25

1Q25 GDP: Final Estimate, Consumer Fade 6-26-25

1Q25 GDP 2nd Estimate: Tariff and Courthouse Waiting Game 5-29-25

1Q25 GDP Advance Estimate: Roll Your Own Distortions 4-30-25

1Q25 GDP: Into the Investment Weeds 4-30-25

Trump's “Greatest Economy in History”: Not Even Close 3-5-25

Gut Checking Trump GDP Record 3-5-25

Presidential GDP Dance Off: Clinton vs. Trump 7-27-24

Presidential GDP Dance Off: Reagan vs. Trump 7-27-24

2024:

4Q24 GDP: The Final Cut 3-27-25

4Q24 GDP: Inventory Liquidation Rules 1-30-25

GDP 3Q24: Final Number at +3.1% 12-19-24

2Q24 GDP: Final Estimate and Revision Deltas 9-26-24

State Unemployment: A Sum-of-the-Parts BS Detector 6-30-24

1Q24 GDP: Final Cut Moving Parts 6-27-24