Durable Goods July 2025: Signs of Underlying Stability

Core Durable Goods orders signal potential stability underneath the headline decline as business investment flashes some cautious optimism.

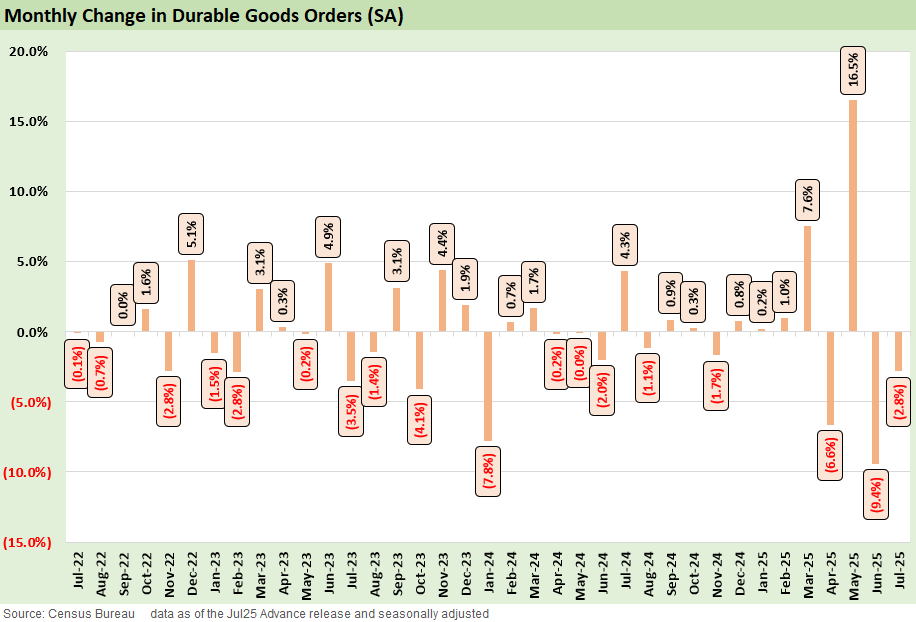

Headline durable goods orders declined again in July, down -2.8%. The contraction is still after a historic spike in May with the subsequent normalization working its way through the data.

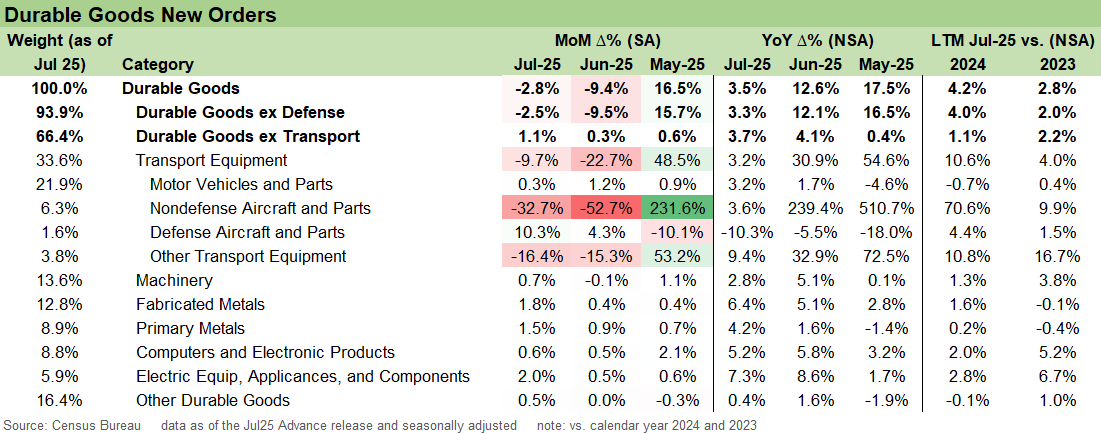

Excluding the transport line where the nondefense aircraft orders cause severe distortions, July comes in at +1.1% with solid gains in fabricated metals (+1.8%), primary metals (+1.5%) and electrical equipment (+2.0%). This suggests that core demand remains intact but the split as to how capital is concentrated across data and AI infrastructure buildout vs. more traditional manufacturing capacity remains an important consideration in the larger picture.

Earning season commentary has still shown broad resilience across investment appetite and even some optimism, but signals hesitancy around larger projects. Equipment rental operators’ guidance remains positive but they have noted slowdowns in more general construction projects (see URI: Cyclical Bellwether Votes for a Steady Cycle 7-29-25, Herc Holdings Update: Playing Catchup 8-17-25).

The signal appears clear enough that planners are still facing uncertainty in the longer-term policy environment as the tariff clarity has only improved modestly recently with months of impact handicapping and new tariffs ahead. The bonus depreciation part of the tax bill has been cited by some as a tailwind, but the economics of projects and expansion still have to be there to grow total capex in the “replacement vs. growth” trade-off.

Tariffs, price impacts, and soft labor markets remain the priorities towards resolving the Fed’s direction. A modest growth in core durable goods demand as seen today contributes positively to modest GDP growth, but the reality is that the tariff expense impacts and cost-mitigation actions are a challenge to frame.

The above chart looks at the monthly swings in headline Durable Goods orders with the recent volatility on full display. The decline this morning extends the post-aircraft boom and leaves room for some positive spin given how large the May distortion was at +16.5%. As a reminder, that month included more than a tripling of the nondefense aircraft line the month before as Boeing received a flurry of orders that included massive volume from the UAE (see Durable Goods May25: Aircraft Surge, Core Orders Modest Positive 6-26-25).

The forward-looking picture from here cuts across where mega-project and infrastructure build-out intersects with softer demand across other manufacturing areas. Durable goods ex-transportation at +1.1% this morning is a positive signal for where more traditional industries are spending but this is just one month. The payroll and inflation headlines have provided some signals to understand the extent of damage caused by tariffs thus far.

For now, we see a signal that capex is not collapsing under the weight of policy. The growth outlook in some capex plans remain positive. That said, the payroll plan could change as we saw with Deere. The multiyear story requires some predictability with cyclical pressure mounting, and this kicks the can down the road another month as we await some key inflation releases, a new set of payroll numbers, and the Fed reaction. August durable goods could read positive with a rebound to aircraft orders, but the core signal will be key to understanding reshoring potential and overall manufacturing activity.

The above chart covers the underlying details and the ‘ex-defense’ and ‘ex-transport’ lines. The massive transport equipment swing continued after +48.5% in May with a smaller -9.7% correction this month as nondefense aircraft dropped back to normal levels. Within that larger negative in transport equipment, the motor vehicles and parts had another positive month at +0.3% as the auto production chain has borne a major brunt of the early tariff impacts.

Key to the core manufacturing story this month are the lines below transport, which read positive across the board. Strength is concentrated in Fabricated metals, Primary Metals, and Electrical Equipment. The broad base of gains is positive for areas that had seen some slow but consistent growth this year though the LTM numbers do not paint pictures of a manufacturing renaissance.

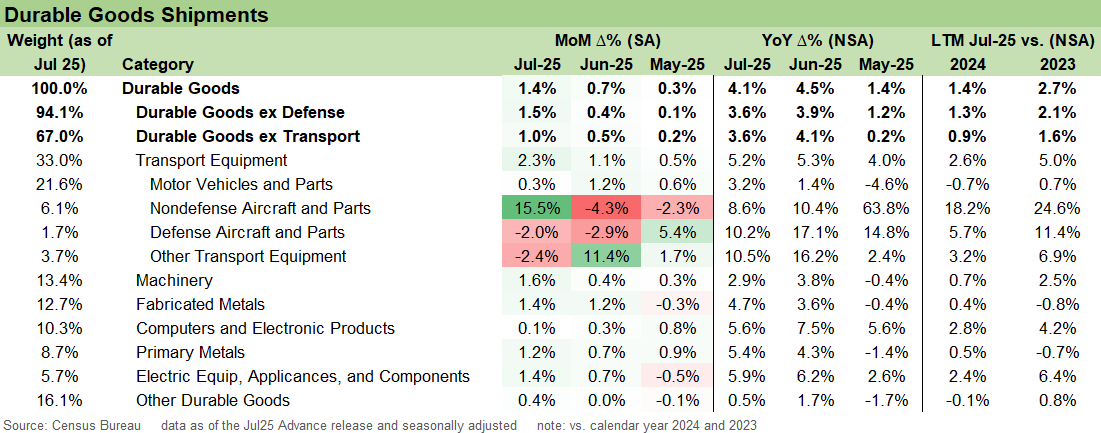

The last chart here shows shipments activity at +1.4% that feeds into the GDP calculation. The real activity here lags the orders with the shipments in transport starting to pick up. The shipments remain broadly steady as they picked up the pace this month.

See also:

New Home Sales July 2025: Next Leg of the Fed Relay? 8-25-25

Credit Markets: Dull Week for Spreads 8-25-25

The Curve: Powell’s Relief Pitch 8-24-25

Footnotes & Flashbacks: Asset Returns 8-24-25

Mini Market Lookback: The Popeye Powell Effect 8-23-25

Existing Home Sales July 2025: Rays of Hope Brighter on Rates? 8-21-25

Home Starts July 2025: Favorable Growth YoY Driven by South 8-19-25

Footnotes & Flashbacks: Credit Markets 8-18-25

Herc Holdings Update: Playing Catchup 8-17-25

Footnotes & Flashbacks: State of Yields 8-17-25

Mini Market Lookback: Rising Inflation, Steady Low Growth? 8-16-25

Industrial Production July 2025: Capacity Utilization 8-15-25

Retail Sales Jul25: Cautious Optimism in the Aisles 8-15-25

PPI: A Snapshot of the Moving Parts 8-14-25

CPI July 2025: Slow Erosion of Purchasing Power 8-12-25

Iron Mountain Update: Records ‘R’ Us 8-11-25

Mini Market Lookback: Ghosts of Economics Past 8-9-25

Macro Menu: There is More Than “Recession” to Consider 8-5-25

Mini Market Lookback: Welcome To the New World of Data 8-2-25

Happiness is Doing Your Own Report Card 8-1-25

Payrolls July 2025: Into the Occupation Weeds 8-1-25

Employment July 2025: Negative Revisions Make a Statement 8-1-25

Employment Cost Index 2Q25: Labor in Quiet Mode 7-31-25

PCE June 2025: Prices, Income, and Outlays 7-31-25

2Q25 GDP: Into the Investment Weeds 7-30-25

2Q25 GDP: First Cut of Another Distorted Quarter 7-30-25

United Rentals: Cyclical Bellwether Votes for a Steady Cycle 7-29-25