Producer Price Index: A Snapshot of the Moving Parts

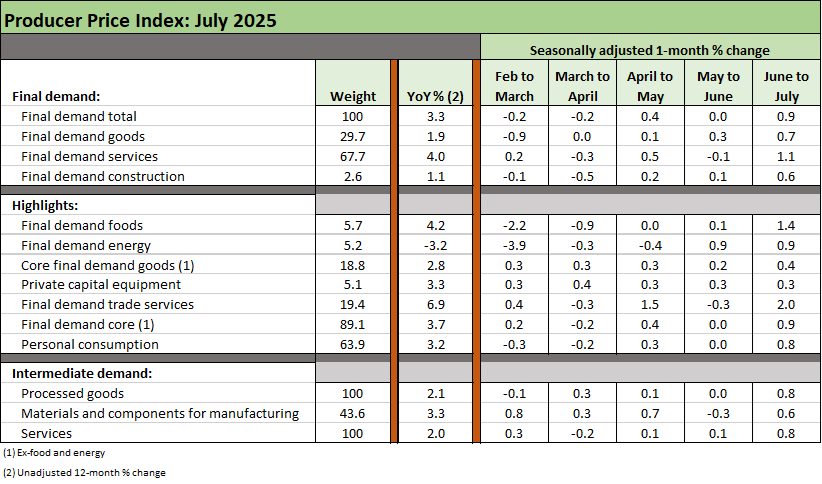

We frame some PPI MoM and YoY stats for the final demand and intermediate demand metrics.

Inflation trends seem clear enough…

As we plot some high-level metrics for PPI, it is clear enough that something is happening here, but the signals can get confusing.

Final demand and intermediate demand showed materially higher sequential MoM moves in July. The higher numbers make sense given the tariff backdrop even if a 1-month move does not make a trend.

How these latest numbers will flow into PCE at the end of the month is a task for the econometric commandos (as in not us), but a clearly rising set of sequential PPI lines was bad news.

PPI might be one more thing for the next BLS stat head to sweep under the rug or “pause.” Otherwise, the news was not good.

The PPI indicators show inflation pressures…

The above chart breaks out a cross-section of PPI lines for final demand and intermediate demand. We detail it as food for thought. Just follow the bouncing ball from left to right and the move from June to July make a statement about prices and costs going the wrong way and inflation moving away from the Fed target. We detail the relative weighting and YoY % changes in the left two columns.

We admit that reviewing the PPI data is a complicated exercise with an uncertain menu, but the MoM moves this month were stark (to say the least) and will take some time to decipher across August and Sept CPI and PPI numbers. We will get July PCE on Aug 29th the day after we get the second estimate of 2Q25 GDP.

If the markets get a bad 2Q25 GDP revision and a bad PCE inflation metric, the political noise and fed stress will get worse. We have some notable retailer earnings coming up for the July quarter that will also give some valuable input on the fallout from tariffs.

Inflation and tariff expenses are intertwined…

Inflation data and the pace of change is hard to get nailed down for a clear interpretation in the inflation vs. expense trade-off. The partisans tend to just focus on the inflation debate, but they often forget that an absence of inflation means an abundance of tariff expense. The small business community is taking that on the chin while many major companies are eating the costs for now as they assess their game plan.

We do not usually break out a chart for PPI as we do for CPI and PCE, but the stakes keep getting higher and PPI is a natural indicator as to what lies ahead. We decided it was time to dig in on these moving parts for a table to track as more tariffs find their way into the transaction flows. The MoM moves will be the main event.

The tariffs rolling into place are accompanied by waves of disinformation and the attempt to redefine the timeline of how these trade policies will actually flow into expense lines, pricing, strategic execution and reactions by the buyers “writing the check” to customs. Tariff fans want to treat it like a game clock since that serves their purposes. The reality is that this will play out over months into 2026.

We see the cash economic events are being turned into partisan loyalty tests as opposed to an analysis of uncertain multi-variable impacts that will vary widely by product segment and end market. Autos will be especially interesting as the OEMs and suppliers need to figure out how to operate with so many supplier chains getting hammered by the new policies. These supplier chain and assembly plans took decades to build out.

Much has to play out in coming months. We don’t have Mexico or Canada set, and we have many tariffs that have only recently been made effective. China as a critical supplier across all value-added tiers is not settled. Mexico, as the #1 trade partner nation (vs. trading bloc) won’t be settled until well into the fall. Canada is a work-in-process at best and an increasingly toxic relationship given the behavior of Trump this year (annexation threats, insults, punitive tariffs on resources, etc.).

The holiday season working capital cycle will not have a full impact yet and especially for product groups such as apparel. Those will be coming eventually, however, given how Trump dropped the hammer on low-cost suppliers out of Asia. High tariffs on low margin retailers is not a good concept.

See other Inflation Related:

CPI July 2025: Slow Erosion of Purchasing Power 8-12-25

PCE June 2025: Prices, Income, and Outlays 7-31-25

CPI June 2025: Slow Flowthrough but Starting 7-15-25

PCE May 2025: Personal Income and Outlays 6-27-25

CPI May 2025: The Slow Tariff Policy Grind 6-11-25

Employment Cost Index 1Q25: Labor is Not the Main Worry 5-1-25