Mini Market Lookback: The Popeye Powell Effect

The week saw the Powell Speech bolster market confidence even though it was a “finessed” multi-tiered message.

"I yam what I yam, and that's all that I yam. I'm Powell the easing man?"

You had me at “…the baseline outlook and the shifting balance of risks may warrant adjusting our policy stance.” Trump has been very tough on Powell, but Powell had a bull friendly week just by a minor tweak in language and a subtle shift wrapped in a crowd of economic caveats and hedging. It might take Trump a few weeks to read and understand the Powell speech. (Of course, Trump won’t read it).

Powell was willing to accept the BLS data on weaker payrolls but still dubbed it in balance (“curious kind of balance”). He also cited weak GDP growth (“1.2%...first half of this year”) and a “slowdown in consumer spending.” He flagged the PCE of 2.6% as of July LTM and core PCE at 2.9%. That is well above the 2.0% target (PCE June 2025: Prices, Income, and Outlays 7-31-25), but we will get fresh line items on Friday with what lies under the July PCE numbers.

The array of inflation data and economic trends cited by Powell was a classic 3 -handed economist, so he left himself more wiggle room than Elvis. It is worth a close reread for those wondering how dovish he is now. The market voted as it wanted, and it had enough for a strong equity market reaction.

The bulk of tariff impacts are still ahead over the next few quarters with more infill from companies on their strategies and the trade-off of tariff expenses vs. product pricing. The market can keep watching the earnings action and explanations into the 3Q25 and 4Q25 numbers and the steady stream of new Section 232 actions. Anyone who says the debate is over is selling something for political purposes. The latest tariff headline is a more aggressive move on the import-heavy furniture markets. Nothing says national security like a pullout couch.

This coming week brings another round of data on the PCE price index as well as the personal income and outlays trends along with the second estimate of 2Q25 GDP, which is likely to offer some more clarity on consumption and fixed investment in the June quarter. It has been a slow growth 1H25 even if Trump has dubbed his first 6-7 months the “greatest in Presidential History” this week. Powell cited 1H25 GDP growth at half 1H24. There once again is some confusion around “greatest.” The Fed could very well ease on the poor growth and questionable health of the jobs market. The market will like lower rates either way.

The above chart updates the YTD return clash of the Big 4 trading partners (ex-Mexico) that we lead off with each week. The US is still #4 out of 4. The ETFs offer a snapshot of benchmark ETFs across China, Europe, and Canada with the S&P 500 in the US. The relative performance is supposed to restrain Trump from doing a Schwarzenegger crab pose in the mirror. Currency issues across markets have been a major variable YTD and factor into asset allocation decisions as well. A weaker dollar speaks to a laundry list of other risk factors.

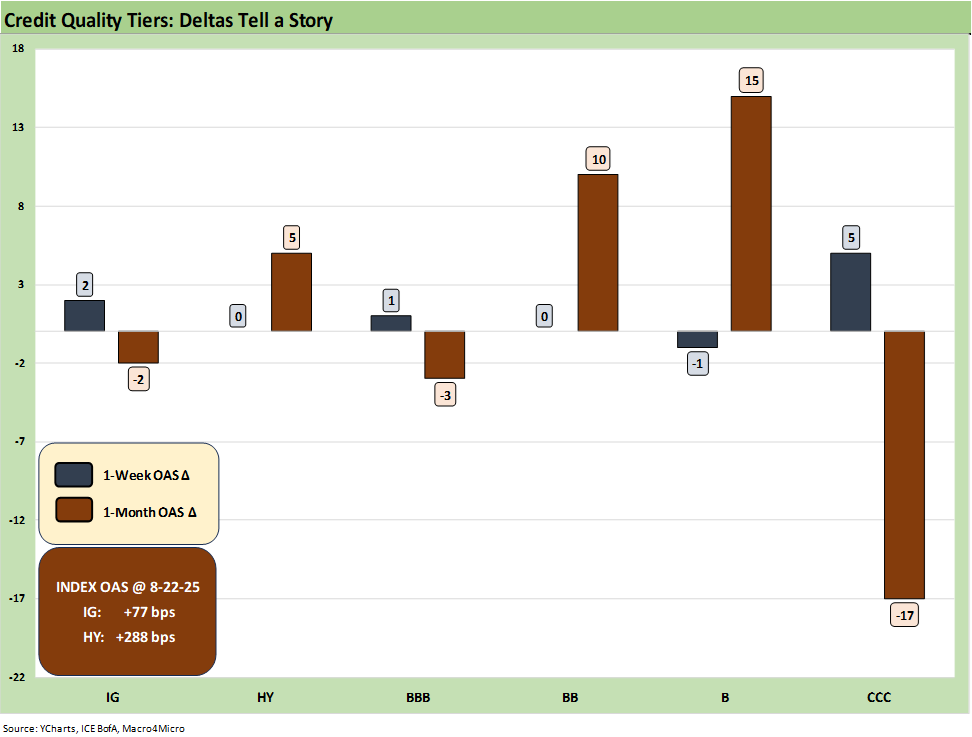

The chart above frames the 1-week and 1-month spread deltas for IG and HY and the credit tiers from BBB to CCC. The week was uneventful in IG and very mild in HY after a Friday tightening wiped out the small widening through Thursday. The 1-month overall move also lacked excitement even if the CCC tier included some rebalancing effects across the 30 days.

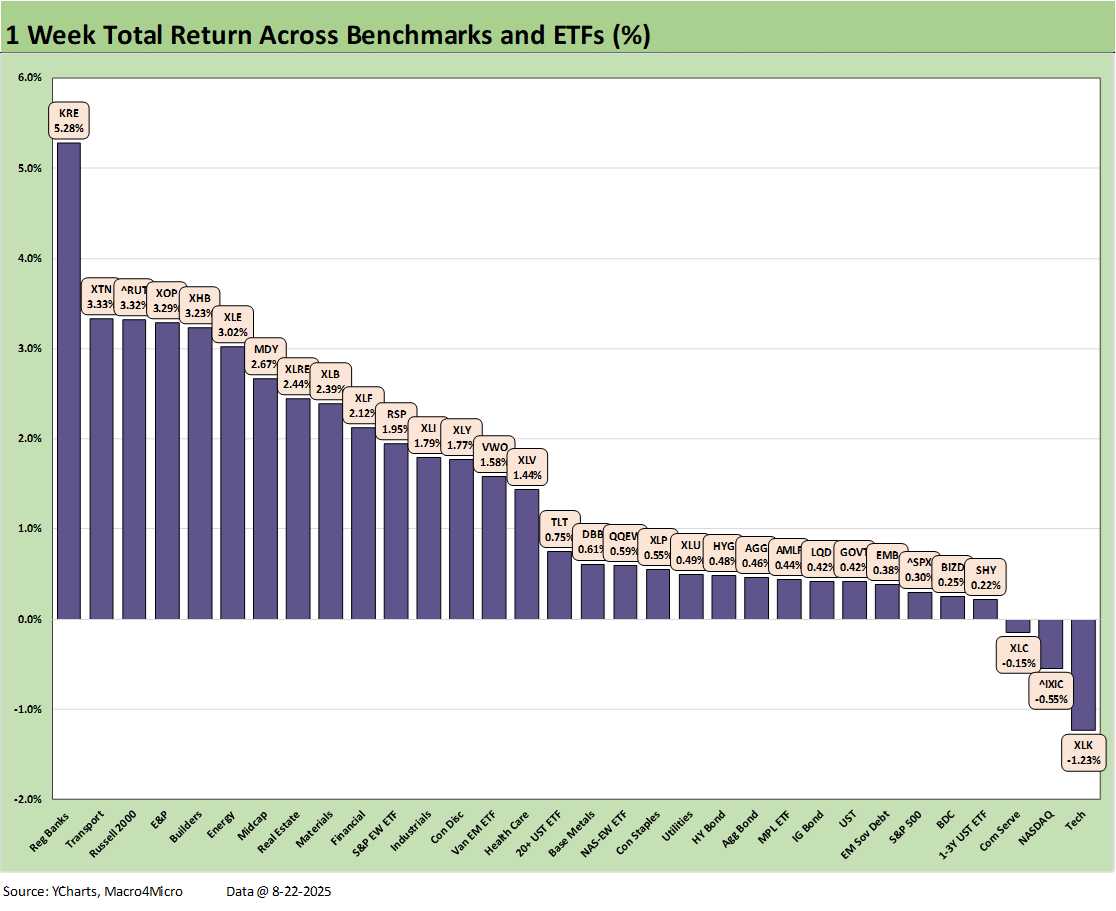

The 1-week returns across the 32 benchmarks and ETFs we watch each week were heavily positive. The asset returns weighed in at 29-3 with bonds and equities all doing well and some of the habitual laggards of 2025 rising to the top tier.

We see Regional Banks (KRE) the runaway winner at #1 for the week with Transports (XTN), energy related (XOP, XLE) and interest sensitive Homebuilders (XHB) and Real Estate (XLRE) in the top quartile. We see Russell 2000 and Midcaps in the top quartile while NASDAQ was negative and joined in the bottom quartile by the S&P 500. The bottom performers were tech-centric, and we see the Tech ETF (XLK) on the bottom with NASDAQ and Communications Services (XLC) comprising the 3 lines in the red.

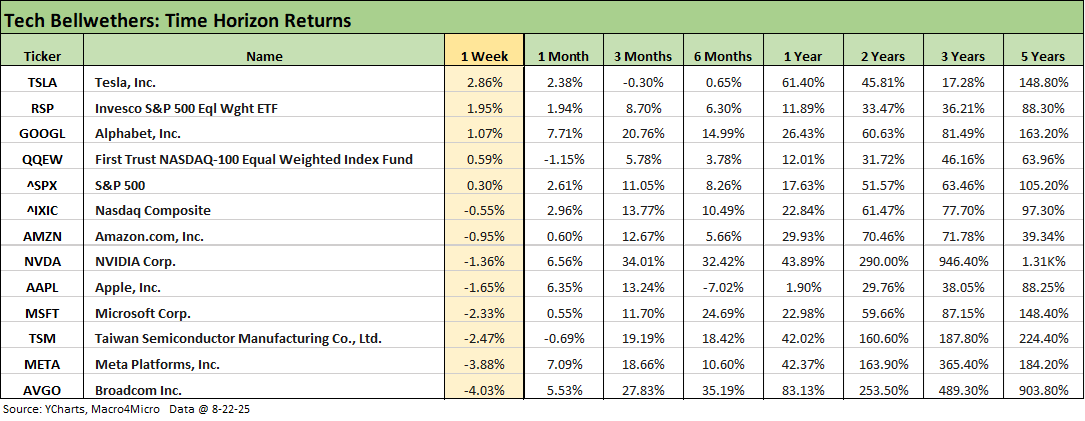

Powell could only do so much for the tech bellwethers with 5 of the Mag 7 in the red for the week and Tesla and Alphabet in the top tier. Broadcom and Meta were the worst performers, but they have put up a banner 3 months. Taiwan Semi rounded out the bottom 3.

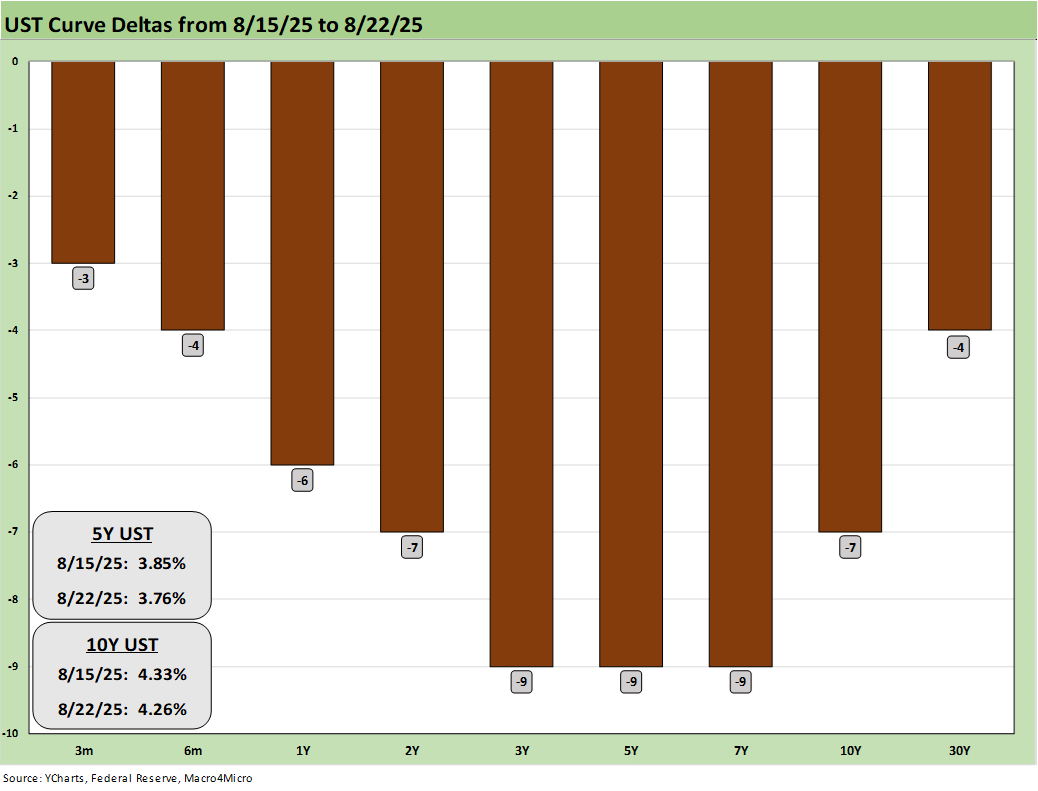

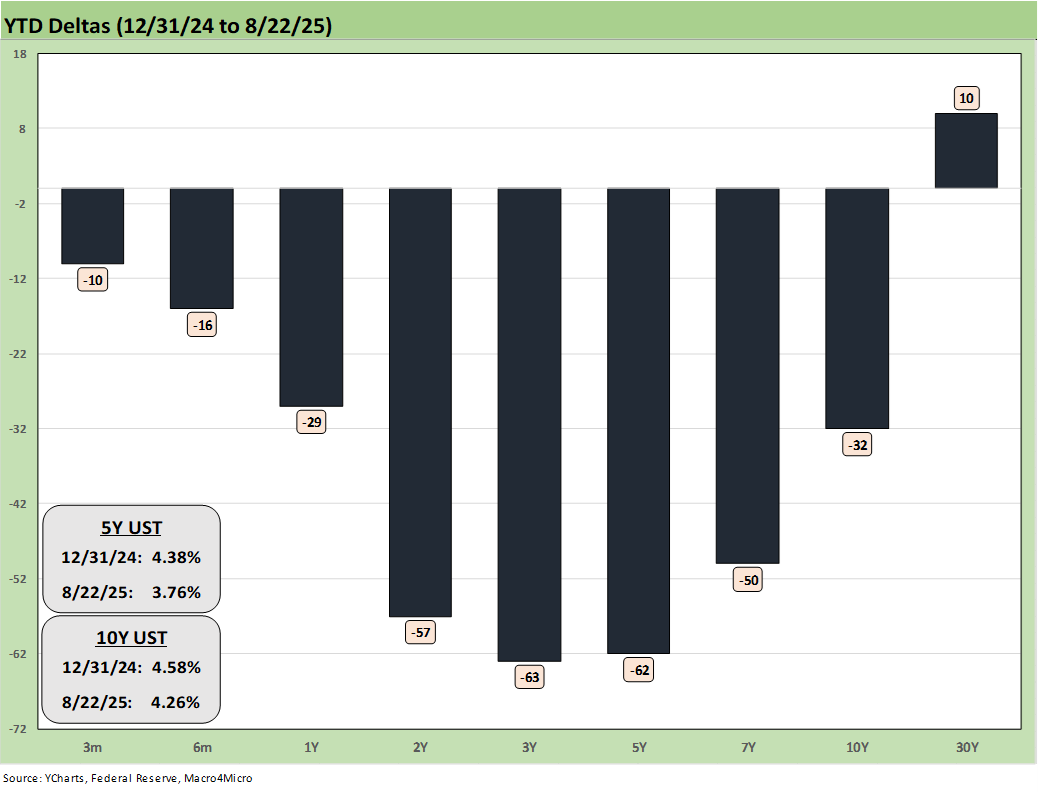

The 1-week UST deltas show a shift lower from1Y to 10Y with the big move on Friday. Considering the Friday “easing” sentiment, the short end was somewhat muted.

The YTD bull steepener trend on the UST curve that has supported bond ETFs is alive and well. Mortgages have been firming, and the housing stocks have been rallying.

The above chart updates the UST 10Y UST vs. the Freddie Mac 30Y Mortgage. The Freddie Mac 30Y moving down into a 6.5% handle is good news for housing even if the rate is not quite down to that 6.0% focal point so many discuss. At the very least, the room for homebuilders to offer a 5% handle incentive mortgage rate should help into the fall as the market awaits more inflation and jobs data.

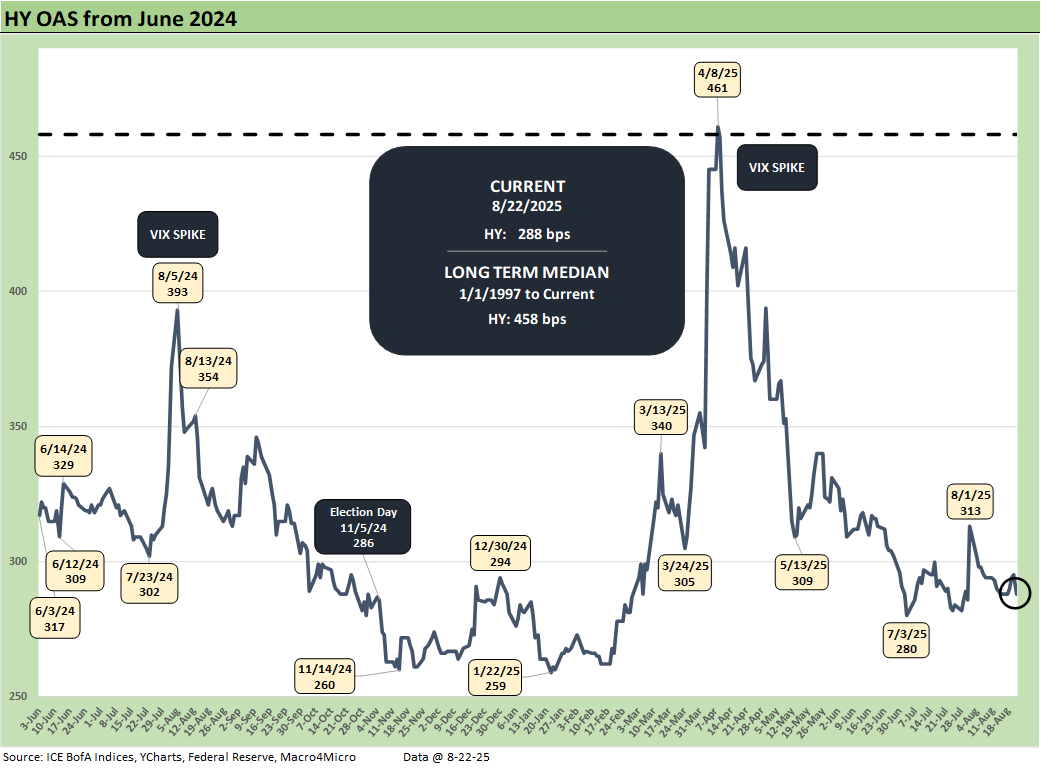

HY spreads were flat on the week at +288 bps with the Friday -7 bps rally taking it back to a zero delta in HY OAS for the week.

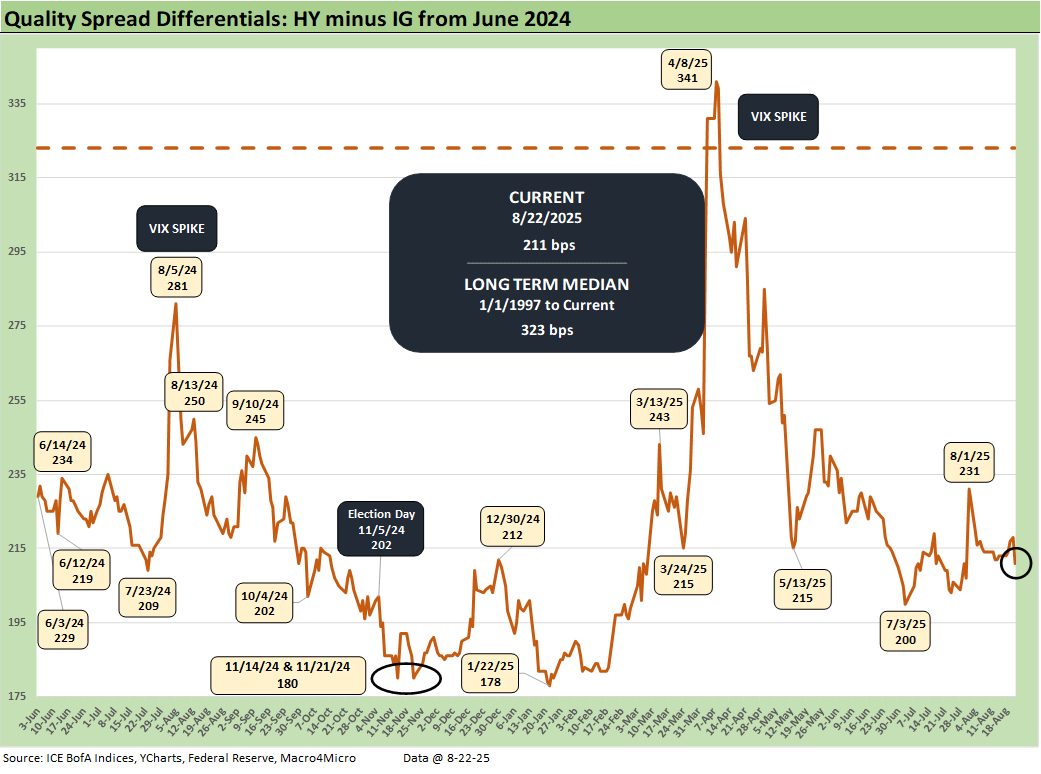

The “HY minus IG OAS” quality spread differential moved -2 bps tighter as HY was flat and IG 2 bps wider.

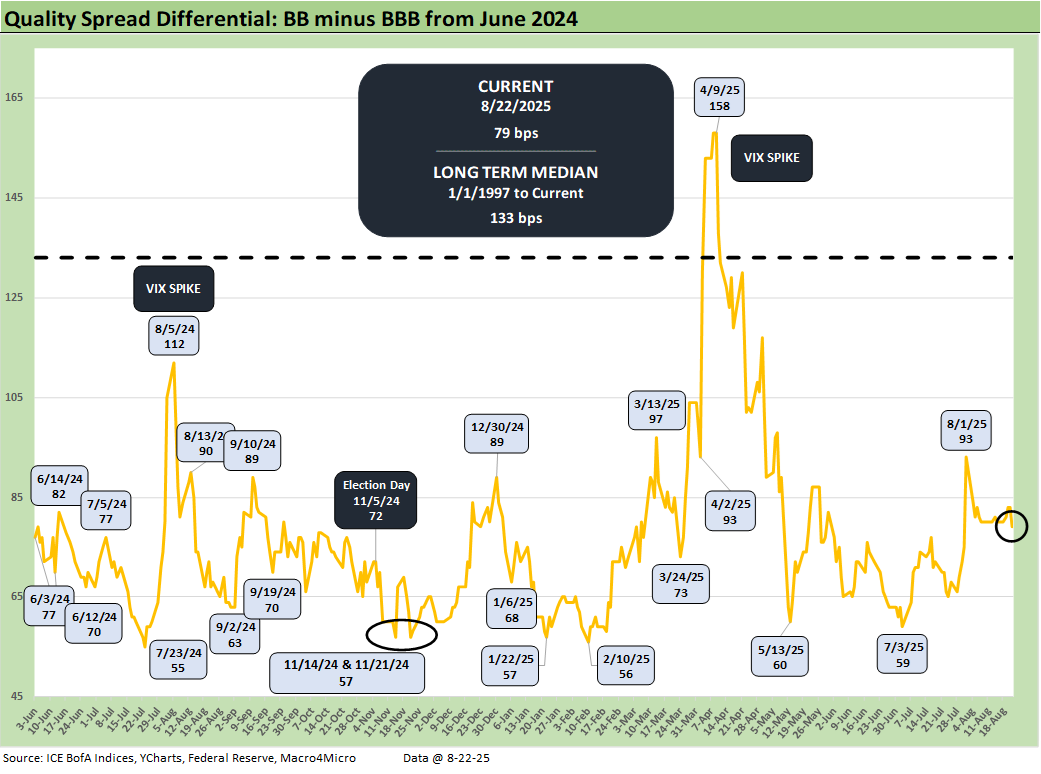

The BB minus BBB quality spread differential ticked -1 bps tighter as BBs were flat and BBBs +1 bps wider.

See also:

Existing Home Sales July 2025: Rays of Hope Brighter on Rates? 8-21-25

Home Starts July 2025: Favorable Growth YoY Driven by South 8-19-25

Footnotes & Flashbacks: Credit Markets 8-18-25

Herc Holdings Update: Playing Catchup 8-17-25

Footnotes & Flashbacks: State of Yields 8-17-25

Footnotes and Flashbacks: Asset Returns 8-16-25

Mini Market Lookback: Rising Inflation, Steady Low Growth? 8-16-25

Industrial Production July 2025: Capacity Utilization 8-15-25

Retail Sales Jul25: Cautious Optimism in the Aisles 8-15-25

PPI: A Snapshot of the Moving Parts 8-14-25

CPI July 2025: Slow Erosion of Purchasing Power 8-12-25

Iron Mountain Update: Records ‘R’ Us 8-11-25

Mini Market Lookback: Ghosts of Economics Past 8-9-25

Macro Menu: There is More Than “Recession” to Consider 8-5-25

Mini Market Lookback: Welcome To the New World of Data 8-2-25

Happiness is Doing Your Own Report Card 8-1-25

Payrolls July 2025: Into the Occupation Weeds 8-1-25

Employment July 2025: Negative Revisions Make a Statement 8-1-25

Employment Cost Index 2Q25: Labor in Quiet Mode 7-31-25

PCE June 2025: Prices, Income, and Outlays 7-31-25

2Q25 GDP: Into the Investment Weeds 7-30-252Q25 GDP: First Cut of Another

Distorted Quarter 7-30-25

United Rentals: Cyclical Bellwether Votes for a Steady Cycle 7-29-25

Thank you.

Here are my Jul PCE estimates:

https://arkominaresearch.substack.com/p/jul-2025-pce-inflation-estimate?r=1r1n6n