Herc Holdings Update: Playing Catchup

We update the Herc Rentals story as it moves into heavy integration mode for the H&E deal and the need to deleverage.

The H&E Equipment Services (HEES) deal closed in early June, and HRI needs to prove the higher financial risk can be easily navigated along with the integration of this transformative acquisition (see Credit Crib Note: Herc Rentals 12-6-24).

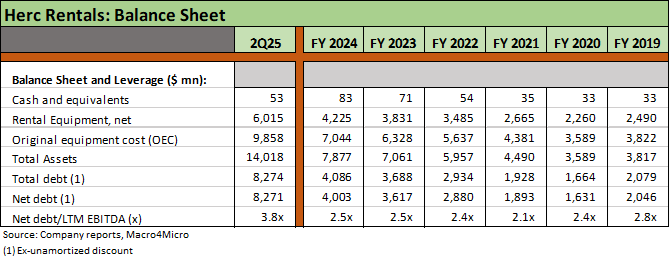

The HEES deal sent leverage to 3.8x, and that is well above the range we see for the traditional BB tier balance sheet for this business with 2 handles more the norm in the BB tier. (Herc Rentals: Swinging a Big Bat 2-18-25)

The cyclical questions will loom large into the tail end of 2025 in terms of how capital allocation will play out into 2026 with this healthy free cash flow generating business.

We assigned a “negative credit trend” on Herc since the HEES deal (see Credit Snapshot: Herc Holdings 4-23-25) given the high leverage and execution risk. We still see the financial risk profile ahead of its credit ratings, but the history of this industry in sustaining credit quality is favorable with cash flow resilience and capex flexibility a feature.

The good news for Herc bondholders is HRI credit quality is “performing with a net” with United Rentals posting a market cap almost 14x HRI and Ashtead 7x HRI in a consolidating industry. This is positive event risk symmetry.

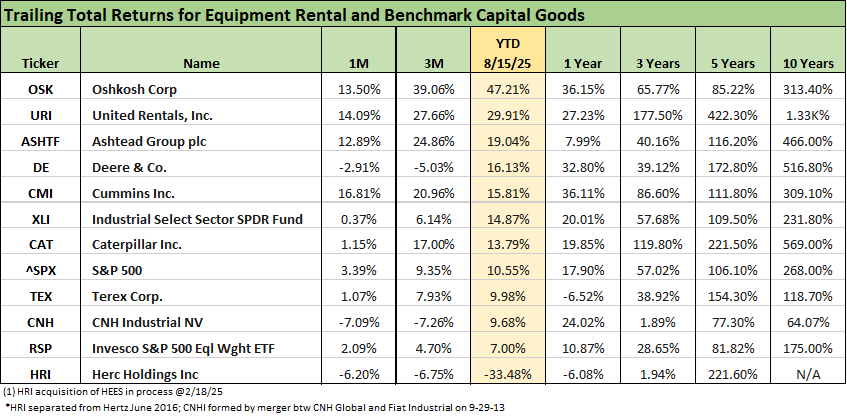

The above stock chart highlights the healthy run for the leading equipment rental leaders across the COVID crisis, into the cyclical rebound, and then on across the inflation spike and tightening cycle that brought more than its share of volatility. Equipment leasing companies outperformed the broader market benchmarks over the post-COVID time horizon. The recent weakness of HRI has been notable but also unusual. Doubts around the H&E Equipment (HEES) integration process will need to be eased in 3Q25 and 4Q25.

Outbidding United Rentals for HEES was no small victory given HRI’s need to expand, but the aggressive move and the price tag raised questions on overpaying given the strategic importance of making a move. The HEES deal dwarfs anything that Herc has attempted since the June 2016 separation from Hertz, and the execution risk is not a small factor for shareholders.

The above time horizon table updates how Herc (HRI= Herc Holdings) has performed over multiple time horizons from very recent timelines back to 10 years. We line up the companies in descending order of total return YTD 2025. United Rentals and Ashtead are well ahead of HRI.

As the earlier stock chart has underscored since the end of 2019, HRI has been a solid performer and beaten the S&P 500 and Ashtead but fallen well short of United Rentals as the industry leader and juggernaut of M&A across the cycles. We see HRI really taking a beating YTD 2025 in its stock performance at -33% in the chart above and in the red zone for the trailing 1-year period.

The more recent periods have shown some backtracking for the industry after a very solid multiyear run. Even URI had faded from its 2024 peaks before regrouping and getting back on track. The multiyear megaprojects, steady industrial investment, and the cash benefits of the tax bill for equipment investment still carry the day when taken in tandem with the secular trends and a lot of scenarios for reshoring in the future – even if it takes a while.

The core customer markets across major projects (infrastructure, data centers, LNG, semis, utilities/power, healthcare, EVs/batteries, etc.) make for a story that always will get stock players back in the game on weakness. Free cash flow generation, flexibility in capex, and consistent shareholder enhancement and favorable capital allocation is just such an obvious part of the industry history at this point. The challenge for HRI is showing that they are a cheaper alternative in debt and equity and not just a struggling M&A story.

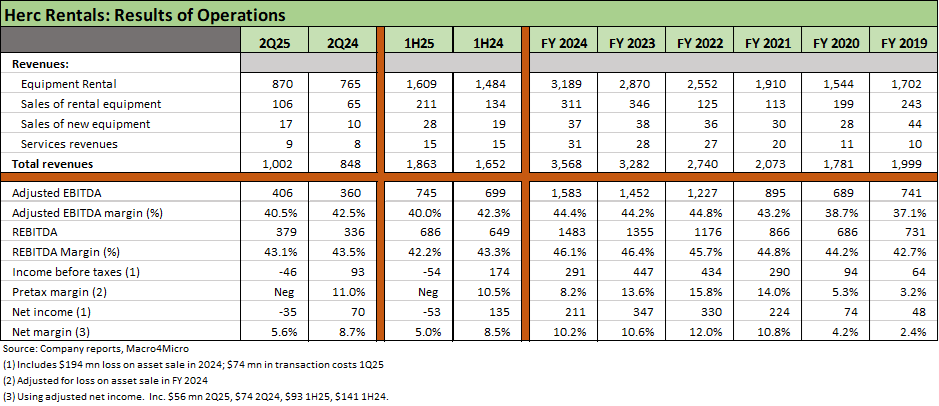

As we see with the other leasing issuers, the EBITDA margins are quite high but that also leaves room for replacement capex to sustain revenues and growth capex to expand the operations. One of the useful exercises in reviewing the equipment leasing operating results is they always come equipped with substantial information on end markets in their detailed slide packs (note: heavy on Dodge Analytics data).

From a top-down macro view, mega project starts are impressive in 2025 at over twice the level in 2024. Nonresidential starts are slated to climb each year from 2025 to 2028. Industrial spending will also be higher than 2024 in each year from 2025 to 2028. The same is true of infrastructure starts. That is a lot of activity.

We have covered the core operating profiles of equipment leasing operators in prior commentaries. Disciplined fleet management (supports pricing) and sustained growth in the business from so many expansion programs in mega projects are the main themes. That fits in well with the secular increase of leasing vs. owning in the “lease vs. buy” decision. Local accounts have been under pressure, but national accounts have been strong. The project pipeline is solid. As of 2Q25, Local was 53% of revenue and national 47%.

As noted in the chart above, operating results have posted solid numbers in terms of revenue growth and EBITDA margins as well as Rental EBITDA (“REBITDA”) and rental margins. Like the June quarter, the 3Q25 period will have more than a few underlying distortions with integration costs and some mixed results from the HEES side as customer disruptions and personnel changes unfold. There will also be some mix shifting as HRI pushes ahead on its specialty fleet adds while selling off a material amount of fleet in the merger.

For 2Q25, HRI posted +14% in rental revenue including the June 2 merger results but was -2% pro forma with Herc legacy branches at +4% and legacy H&E at -14.1% YoY. Mergers can be disruptive and that was clearly the case here. The systems will be integrated in 3Q25, so “legacy rollup data will no longer be available.”

The balance sheet realignment was certainly busy for Herc during 2Q25 with the HEES deal closing on June 2. By the book (literally), the net assets acquired totaled $4.83 billion including $2.2 bn of goodwill in the price tag. Since the end of 2024, total assets grew by $6.14 bn (including $1.8 bn of rental equipment) and total debt grew by $4.2 bn. The leverage of 3.8x is quite high for what we have seen in recent years for BB tier leasing companies, but HRI expects to be back in the 2x to 3x range by 2027. The rating agencies have given HRI a considerable amount of latitude.

The deal funding was multitiered to pay the price tag in cash and stock but also included some major refinancing demands of HEES debt and refinancing of the ABL lines that are actively used by equipment leasing companies. The funding checklist included $2.75 billion of new unsecured bonds, a $750 million term loan, $584 million in HRI equity, and $2.5 bn in new ABL borrowings that included $1.6 bn that needed to be refinanced.

The bonds came at a level that carried 7% handle coupons as part of M&A refinancings priced to sell, and those are good opportunities for HY investors. As we have covered in our Herc commentaries, we viewed the financial trend line for HRI as negative after this deal, and we believe that HRI presented more of a single B tier profile vs. the low BB tier composite assigned by the rating agencies. That said, Herc has the financial risk cushions and cash flow stabilizers that have come to be recognized in the equipment leasing issuer base. URI is the leaders of the pack with Ashtead at #2 and Herc a distant #3. A fund manager and income seeker was not going to let the 7.0% coupon pass by on the $1.65 bn 2030 notes or the 7.25% on the $1.1 bn 2033 notes.

The downside scenario for Herc bonds is a deep economic downturn and setback on valuation where HRI ends up owned by one of the Big 2 (notably URI are #1). The end markets for now remain steady as covered in our recent work on the major leasing issuers, but a cyclical contraction could wreak havoc in HEES’ integration and slow the deleveraging process. We don’t see that as likely. Confidence in the integration seems to be struggling as highlighted by the weak performance of HRI stock in recent periods.

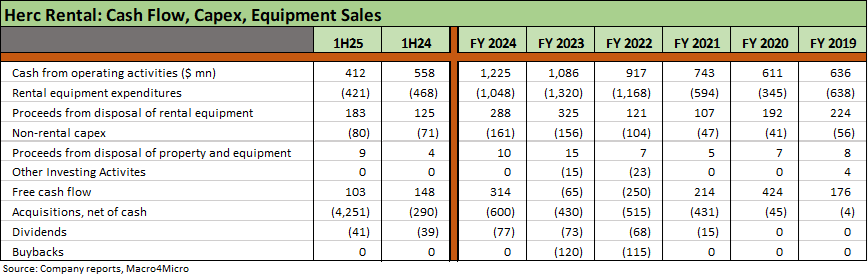

The moving parts of capex and fleet planning across various locations and equipment types and managing new capex vs. equipment sales dominates what these equipment leasing companies do. Gross capex and net capex are moving quickly. HRI will see materially lower net capex this year as the integration continues and HRI rolls up the operations.

Incremental gross capex for 2025 guidance calls for $900 million to $1.1 bn. Net rental capex (gross capex less equipment sales) is estimated at $400 mn to $600 mn vs. $760 mn above. That is a reduction by almost 1/3 on outsized equipment sales and fleet integration focus. The increased spending on specialty is consistent with peers.

The 2025 free cash flow guidance calls for $400 mn to $500 mn. HRI already had started to significantly increase its equipment sales in 2Q25 in anticipation of integrating the HEES fleet for additional realignment. As of 2Q25, the fleet composition includes specialty (18%), aerial (26%), material handling (22%), earthmoving (14%), and a diverse bucket under “other” at 20%.

See also:

United Rentals: Cyclical Bellwether Votes for a Steady Cycle 7-29-25

Credit Snapshot: Ashtead Group 7-21-25

Credit Snapshot: Herc Holdings 4-23-25

Credit Snapshot: United Rentals 4-1-25

Herc Rentals: Swinging a Big Bat 2-18-25

United Rentals 4Q24: Strong Numbers Set the Table 2-2-25

United Rentals: Bigger Meal, Same Recipe 1-14-25

Credit Crib Note: Herc Rentals 12-6-24

Credit Crib Note: United Rentals 11-14-24