Retail Sales Jul25: Cautious Optimism in the Aisles

Another steady month of retail sales reflects a propensity to spend even as inflationary pressures emerge.

Just try to stay on pace…

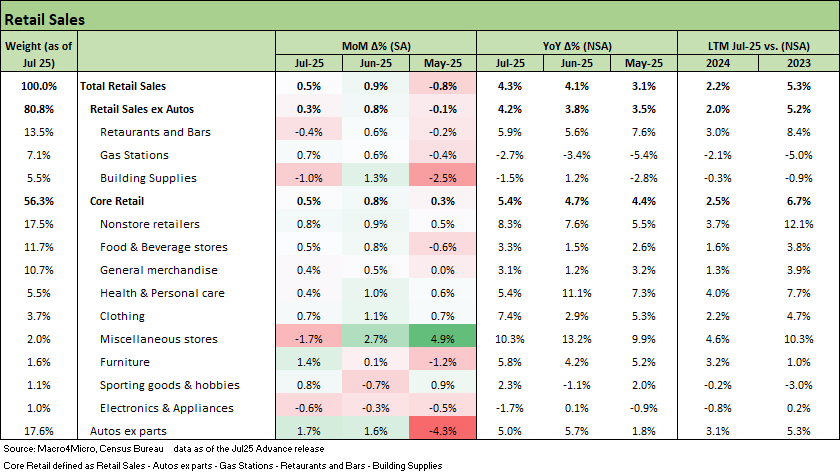

The headline retail sales figure rose +0.5% for July, building on last month’s momentum of +0.9% and reflecting a reassuring state of the consumer after the immediate reaction to tariffs saw some weakness. The breadth of increases underlying this month showed 9 of the 13 categories we track growing with Autos leading at +1.7%. Core retail sales saw similar growth at +0.5%.

The timing of this report comes after receiving mixed to negative news across payrolls , CPI, PPI, and import pricing this morning that together signal labor softness and inflationary pressure. The slow process of working capital turnover and pass-through of tariff costs started to show this month and the coming months are likely to confirm that trend. At least the financial health of the consumer broadly remains positive and that has meant spending patterns in this morning’s release still signal a willingness to spend on discretionary goods even as building supplies still reflect the weak housing data and sensitivity to rates.

A resilient and healthy consumer continues to remind the market how hard it is to slow down broader consumption, but consumer sentiment still remained low this morning. Consumer sentiment can reflect the uneasiness around a potential softening labor market combined with the anticipation of inflation to come. Earnings season has brought good news on consumer health across credit metrics, but some behavioral patterns seen in fast food commentary reflect where some habits are changing.

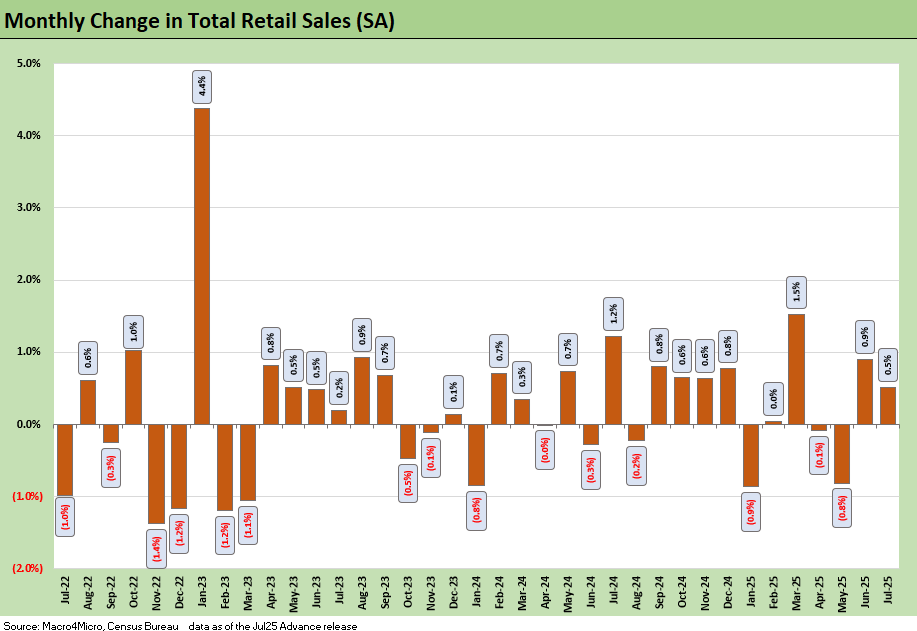

The above month-over-month changes for headline retail sales highlights a second month of stabilization after the uncertainty of tariffs led to a temporary pull-forward effect causing volatility in consumer demand. As the initial tariff noise and uncertainty eased somewhat in the headlines, consumer spending looks to normalize more as the past two months signal.

The twist is that after the above reaction to the tariff headlines and initial anticipation of inflation impacts, we are just now seeing the materialization of inflationary pressures in the data (see PPI: A Snapshot of the Moving Parts 8-14-25, CPI July 2025: Slow Erosion of Purchasing Power 8-12-25). The PPI data yesterday confirms upstream cost pressures, and those costs do not disappear or get paid by other countries. Instead, as pre-tariff inventory build runs down, we are likely to see that low-margin retailers will necessarily have to pass those costs along. Tracking changes in behaviors the next few months will reveal how consumers react to these pressures as we expect shifts in the discretionary vs. nondiscretionary mix.

Consumer health remains steady with credit metrics from major card issuers pointing to stable or improving delinquencies and net charge offs hovering near pre-COVID levels. The disconnect from the still weak consumer sentiment numbers remains but for now, that looks tied to the uncertainty rather than immediate signs of distress. However, when adding a potentially softening labor market, the fragility reflected in sentiment leaves one wondering how susceptible consumer demand is to any further shocks. Though the Trump team can maintain the “seller pays” façade, consumer wallets will not lie as the year continues. We are still in early innings and how these preliminary signals evolve and flow through to the consumer demand patterns. Shifts in consumption patterns will be important variables to track.

The above chart shows the line item details underlying the headline retail sales number as well as the key ‘ex-Autos’ and Core retail lines. The takeaway this month is that the momentum after last month’s recovery was broad though the more discretionary, service-linked areas of restaurants and bars and building supplies contracted. The largest winners this month were Autos at +1.7% followed by Furniture at +1.4%.

As we look across the relatively strong report above, we see some moderating factors given that CPI is showing select increases simultaneous to this. Gas likely looks even better given energy disinflation across this month but items like food away from home, used vehicles pricing, furniture and sporting goods saw simultaneous inflation in July that offset some of the stronger categories.

Aside from inflationary effects, July also saw a slew of promotional activity across Amazon’s Prime day and several other sale events that bolstered the nonstore retailers this month. Even with the seasonal adjustments made in the data above, the takeaway points to a more value and price-sensitive consumer, which leaves a lot of tough decisions to make in passing on costs for retailers. We will get a slew of retailer color ahead from the July quarterly earnings period for retailers.

See also:

Industrial Production July 2025: Capacity Utilization 8-15-25

PPI: A Snapshot of the Moving Parts 8-14-25

CPI July 2025: Slow Erosion of Purchasing Power 8-12-25

Footnotes & Flashbacks: State of Yields 8-10-25

Footnotes & Flashbacks: Asset Returns 8-10-25

Mini Market Lookback: Ghosts of Economics Past 8-9-25

Macro Menu: There is More Than “Recession” to Consider 8-5-25

Mini Market Lookback: Welcome To the New World of Data 8-2-25

Happiness is Doing Your Own Report Card 8-1-25

Payrolls July 2025: Into the Occupation Weeds 8-1-25

Employment July 2025: Negative Revisions Make a Statement 8-1-25

Employment Cost Index 2Q25: Labor in Quiet Mode 7-31-25

PCE June 2025: Prices, Income, and Outlays 7-31-25

2Q25 GDP: Into the Investment Weeds 7-30-25

2Q25 GDP: First Cut of Another Distorted Quarter 7-30-25

United Rentals: Cyclical Bellwether Votes for a Steady Cycle 7-29-25

JOLTS June 2025: Lower Openings and Hires, Higher Layoffs YoY and Flat MoM 7-29-25

Mini Market Lookback: Mixed Week Behind, Big Week Coming 7-26-25

Durable Goods Jun25: Air Pocket N+1 7-25-25

Taylor Morrison 2Q25: Resilient but Feeling the Same Macro Pressure 7-25-25

New Home Sales June 2025: Mixed Bag 7-24-25

Existing Home Sales June 2025: The Math Still Doesn’t Work 7-23-25

PulteGroup 2Q25: Still-Lofty Margins see a Mild Fade 7-23-25

D.R. Horton 3Q25: Material Slowdown Still Good Enough 7-22-25

Mini Market Lookback: Macro Muddle, Political Spin 7-19-25

Housing Starts June 2025: Single Family Slips, Multifamily Bounces 7-18-25