Avis Update: Peak Travel Season is Here

Stabilization of used cars and lower fleet costs support peak season run rates but with plenty of open questions for 2026.

Avis has delivered a steady financial performance in 2025 that still features considerable volatility from the 4Q24 earnings report in early Feb 2025 through the 2Q25 numbers. The critical 3Q25 peak travel season is now underway.

Avis presents the dilemma of high 9-handle leverage that could challenge the lofty equity valuation even as Avis offers the traditional anchor of solid free cash flow. It is easier to get comfortable with the stable credit profile of Avis than the stock valuation. The handicapping of “normalized” into 2026 is tricky as the market has been framing EBITDA in the $1 bn to $1.5 bn range. That would get leverage in a more reasonable range vs. expected EV multiples.

For those who did not catch the 2Q25 earnings call, Avis is now looking to shift the discussion back to the broader growth opportunities across integrated mobility and the expansion of service revenue streams in high profile areas such as “mega fleet management” (notably EVs and AVs). The focus was on the Waymo partnership in Dallas and how that could expand.

Avis is also jazzing up their product suite with Avis First as a de facto first class service to tap into the same demand (and more) for travelers that use premium offerings from airlines.

The fleet cost trend was favorable in 2Q25, and firm used car valuations support car rental earnings via depreciation per unit (reminder: vehicle depreciation is a cash cost in car rental). The potential for lower interest rates could flow into the financing costs in vehicle funding that need to be recovered in car rental pricing. Lower financing costs can fuel better margins.

The challenge of facing higher cost of new vehicle replacement and the potential for more tariff impacts raises a lot of risk issues as well. Car rental players can get better residual realization, but car rental companies still need to pay the piper (the OEM) for the flow-through impacts of rising material costs (steel, aluminum, copper, textiles, etc.), components, and the uncertain tariff impacts on imported vehicles.

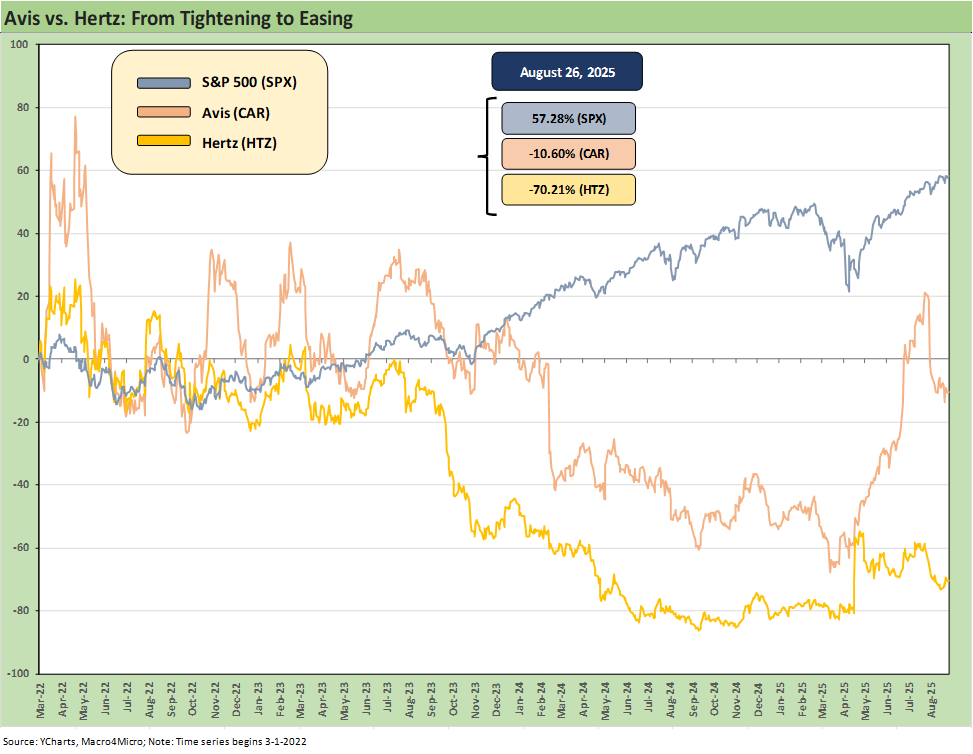

The above stock return comp chart covers a timeline from the start of the tightening cycle in March 2022 through the latest close. The history from 2022 (well after COVID) is volatile enough even at a glance. The equity valuation challenge is underscored by the expectation that EBITDA will double into 2026 and the EV multiple is looking to find the right range (8x? 9x? 10x?). Avis securities markets still face the current LTM reality of debt/EBITDA north of 9x. That demands a lot more EBITDA to support Avis stock and bonds.

The evolving car rental industry structure and service mix…

We have watched car rental operators and the auto sector for a long time (anyone remember the Avis ESOP as a HY issuer in the1980s?), and the decades of morphing ownership profiles (the OEMs took minority and majority stakes long ago to protect their major customer volumes), industry consolidation, and changes in the OEM fleet sales policies (no more guaranteed buybacks in the US and full residual vehicle risk needs to be managed by Avis and Hertz).

The recent years after the wave of legacy Detroit 3 financial stress gave way to the challenge of technology and new services that were more promises than reality after COVID. Those other services with growth potential are now getting prioritized again. The Avis earnings call tagged the focus on traditional car rental metrics as “myopic.” That was a strange choice of words to describe metrics that frame volume, pricing, and unit cost and thus earnings, cash flow and leverage.

On the call, they focused on opportunities to leverage their personnel, infrastructure and market knowledge to be fleet mega managers as the market will see (in their view) explosive growth in robotaxis, autonomous vehicles broadly and electric fleets. The key term was “structural growth” to distinguish from recurring macroeconomic trends and opportunities in “cyclical growth.” The Waymo partnership and Dallas was the focal point. Those are topics for another day.

The idea is that infrastructure is the key. Even with EV under siege and being undermined by Team Trump, they pointed out that they continue to invest in charging capabilities and not increasing EV fleet share (a subtle dig at Hertz?). The question will be how quickly these fleets will see that scale and pace of growth. Waymo and Dallas is on the table now, but among notable comments from Avis was the willingness to commit balance sheet. With expertise in service, infrastructure and personnel, the mobility ecosystem expansion is realistic, and the experience in vehicle funding also could play a role. That will be an area to monitor into 2026.

The used car market vs. fleet replacement costs…

Among the more notable line items that every car rental securities holder and lender had to immerse themselves in since the Hertz adventure and COVID was how the used car market impacts car rental cash flow and the profit margins of car rental operators.

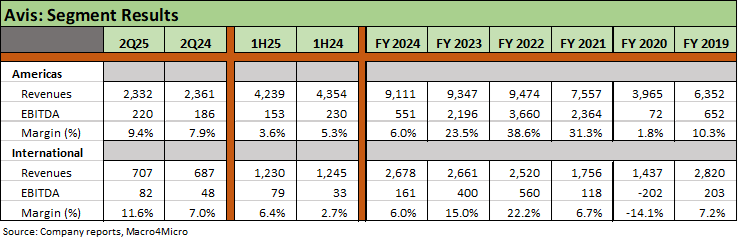

The Avis EBITDA margin Hi-Lo range was “other worldly” this past cycle as used cars went through the inflation spike to a peak in 2022 (see CPI Wrap for 2022: Beginning of the End? 1-12-23). Avis showed plenty of peaks and valleys in the 2021-2022-2023 timeline above, and the markets realized that car rental was about a lot more than leisure and corporate travel volumes and fleet size.

The ability to predict residual values of the fleet is an important core strength where Avis traditionally had done well before COVID when Hertz really fell down. Post-COVID, Avis took a major hit in 4Q24 in their fleet acceleration plan. As we covered in our credit snapshot earlier this year:

A $2.47 billion impairment charge was taken in 4Q24 as Avis accelerated its fleet rotation on higher cost vehicles purchased in 2023 and 2024. The impairment charge was a stark reminder of the importance of used car values and how sharp moves in new and used pricing can create costly fleet decisions.

The fleet negotiations for 2026 and next seasonal peak are still underway, and this is a very challenging variable to handicap. The OEMs clearly want to succeed with all their legacy customers, but a big variable is who will share the “tariff cost pain.” The OEMs will make maximum effort not to undermine their retail franchises and core retail base. Those dealers have become very involved in the used car business in recent years led by Lithia (see Credit Snapshot: Lithia Motors 5-20-25, Credit Crib Note: Lithia Motors 9-3-24) and AutoNation (see Credit Snapshot: AutoNation 4-4-25, Credit Crib Note: AutoNation 6-17-24). It is a major focus along the chain.

Tariff flow-through effects are going to unfold at a lag and largely based on the customer strategy of the OEMs. The idea that somehow the “jury is now in” on tariff economics or are on a game clock is rooted in the political desire to defend tariffs. The tariff costs are going higher, and that was clearly in evidence in the 2Q25 auto earnings calls. Where that goes from here on fleet costs for the car rental players will only be played out in the 2026 earnings reports.

The broader and morphing economic effects of capacity changes (less Mexico and Canada), the supply vs. demand by product segment, currency trends, or any trade partner pushback is going to take quarters – not months and certainly not weeks. The fact that the USMCA is up for review in mid-2026 (and could be terminated even earlier) is just one of numerous wildcards in the tariff debate. We still cannot even get Trump to admit that the “buyer writes the check to customs.”

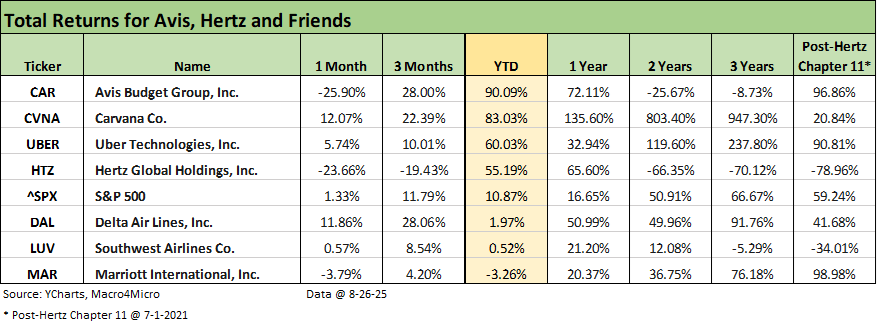

The major car rental players in public markets – Avis and Hertz – do not have an easy peer group. We assembled this group in the chart above as comps to get some signals on travel (hotels and lodging, airlines), mobility (Uber) and used cars (Carvana). The main goal was to look at material moves across various time horizons. We mix in Southwest with Delta with Southwest such a major factor in the US short haul and business markets.

For Avis, the YTD period has been dazzling in stock returns and the same for 1 year. In contrast, the trailing 2 years and 3 years come up negative after the residual value bounce and mega buyback programs drove Avis numbers. The running returns since the Hertz collapse and Chapter 11 emergence at the end of June 2021 shows good numbers for Avis.

For Hertz, they squandered a very strong financial profile at exit from Ch 11 to derisk their major private equity shareholders. Then they dropped a pile of chips on EV fleet expansion in a disproportionate reshaping of the fleet. Hertz equity remains deep in negative range since emerging. With such a low stock price ($5.73 midday 8-27-25), it does not take much to ring the % change bell. They also may have broken a record for the number of CEOs in less than a decade.

Avis looking for some growth buzz…

The financial risk profile of Avis is still a juggling act between capital allocation to shareholders from free cash flow in FY 2025 (after the usual first half cash burn on fleet building and the 1Q seasonal low) and core business investment. For Avis, the goal is changing the discussion of what the company could be in the age of AVs and EVs. Avis is taking a fresh run at investment to tell a growth story. This is not a new angle and was big part of the Hertz buzz when the bidding war broke out during the Chapter 11 process.

The above table looks at the operating results since 2019 as the pandemic and collapse of travel approached in March 2020. We have looked at profit margin drama in detail in earlier commentaries (see Credit Crib Note: Avis Budget Group 5-8-24 ). The normalized margin in this business when looking back even further into the pre-COVID cycle show EBITDA margins more in the 10% area. The 2021 to 2024 margins detailed above saw 25.9% (2021) to 34.5% (2022) and then down to 20.7% (2023) before the industry struggled to find its “new normal” in 2024 and 2025.

If we assume 10% can be regained, and costs can be kept in check, free cash flow will remain very healthy. The question then is capital allocation and how financially committed Avis is to building out and investing in the new structural changes it is discussing and whether they will pay down debt.

When you look at the numbers generated by Avis and Hertz long enough, you need to remind yourself that the absence of a horrible year does not make it a good year. Avis has been a case study in predictability and execution only when framed vs. Hertz. Hertz has been on a crazy journey since 2016 that we have covered in other work (see Credit Crib Note: Hertz 5-14-24).

The travel volumes are mixed relative to what was expected for the travel sector, but pricing has been more of a challenge. Unit costs have been supportive. The seasonal 3Q period is always the peak season for car rental and travel patterns, so the year is shaping up well with FY guidance of $900 mn to $1 bn after $184 mn in adjusted EQBITDA for 1H25. That underscores how crucial the summer travel period is to annual EBITDA. That Sept quarter is typically well over half EBITDA in car rental names.

The exposure to massive swings in residual values are part of the history as cash effects as well as noncash fleet impairment charges such as Avis saw in 2024. The 2021-2022 period was one for the ages in how swings in residuals can cause dramatic moves in profit margins and cash flow. We have looked at those periods in detail in past commentaries (see links).

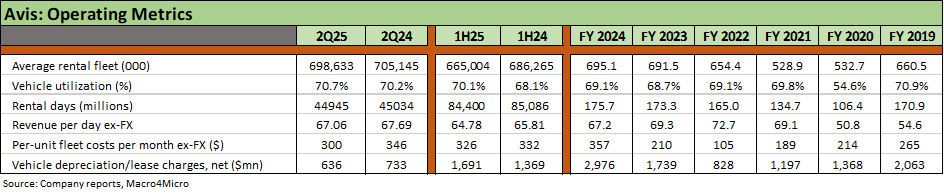

The above table details the main operating metrics of Avis. The good news on fleet costs per month saw the company get back to the $300 line on per unit fleet costs per month. Average fleet is modestly smaller in 1H25 vs. 1H24 after some slight growth in FY 2024 vs. 2023.

Fleet costs are the dominant line item that needs to be recovered in car rental rates with the main costs being the depreciation of the vehicle plus the financing costs of the vehicles in the funding structures. The prospects for lower interest rates thus looms large, and any interest rate movement lower on the short end of the curve would be a major win for Avis and Hertz.

The residual value risk factor for used cars has been picked over across prior commentaries and in used car commentaries on CarMax and Carvana. Generally, rising used car prices are perceived as positive by rewarding the sellers (car rental fleets) during seasonal downsizing. At the very least, the car rental operators do not want negative surprises on the estimated costs they sought to recover in rental pricing. They then get hit with a depreciation markup that is in substance a cash cost.

The tariff and vehicle cost issues are still being sorted out as OEMs make decisions on how much “to eat” on behalf of retail customers and how much to “cost share” (tariff cost share that is) with major fleet customers.

The above table highlights the trend line in fleet size, which is the core earning asset base that is generally funded separately by funding entities and securitization structures. Avis fleet size was growing again from 2021 to 2024 but has downsized YoY in 1H25. The Americas segment has grown from its size in 2019 while International has shrunk vs. 2019.

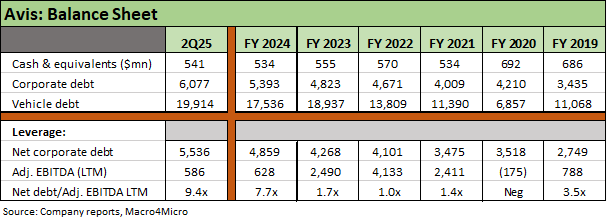

The framing of corporate debt (i.e. ex-vehicle funding entities) vs. car rental EBITDA is the critical metric for EV multiples and gauging where the equity valuation could be framed. The running 9.4x Net debt/EBITDA is not helping the current story, and Avis did not give leverage much airtime for obvious reasons.

The desire to see EBITDA at a minimum of $1 bn could get the company back into a more reasonable range for stockholders and lenders alike. As the table shows, the high margins of 2021-2023 placed Avis in a very different leverage zone with 1-handles for 3 years running.

The refi and extension activity has continued for Avis, who issued $600 mn of 8.375% bonds due June 2032 in May to repay the $500 mn floating rate term loan (drawn Feb 2025, due Dec 2025). During June 2025, Avis also repaid $100 mn of the 5.75% notes due July 2027.

With the unsecured debt issuance and refi of secured loans, Avis reduced structural subordination. At the very least, that reduction of asset encumbrances supports Avis by mitigating “rainy day contingency” risks of the sort Avis and Hertz discovered in 2020. Avis had ample room for refinancing and LOC support for vehicle funding in 2020. In contrast, Hertz ran out of lien room and ended in Chapter 11.

The vehicle funding structural nuances are something we addressed in earlier Avis and Hertz commentaries. Vehicle debt totaling $19.9 bn at 2Q25 is overcollateralized by a mix of vehicles, capital contributions, and letters of credit. The LOCs of $1.6 bn fall under the $2 bn senior revolving credit facility due 2028. Lower rates in the short end of the curve will be a blessing in the fall and into 2026 if those scenarios do play out. It is easier to be optimistic on the short rather than the long end.

The above table underscores the low capex intensity and tech-centric service nature of the core rental business. The commentary from Avis on their desire to invest in growth marks a change from the massive buybacks seen from 2021 to 2023 and the special dividend paid in 2023 after the residual value boom and record margins (see Credit Snapshot: Avis Budget Group 4-9-25).

The running tally of stock buybacks from 2021 to 2023 totaled $5.74 billion. If we add in the special dividend in 2024, we reach $6.1 bn in distributions to shareholders. That is where the total corporate debt stands at 2Q25. That offers a reminder of the cash flow generating power of Avis even if those 3 highly profitable years were not remotely normal.

See also:

Avis:

Credit Snapshot: Avis Budget Group 4-9-25

Credit Crib Note: Avis Budget Group 5-8-24

Avis: Gearing Up for a Transition Year in Fleet Costs 5-2-24

Avis: Credit Profile 8-3-23

Avis: Cash Flow Boom and the Swing in Car Rental 2-17-23

CPI Wrap for 2022: Beginning of the End? 1-12-23

Hertz:

Credit Snapshot: Hertz Global Holdings 6-12-25

Credit Crib Note: Hertz 5-14-24

Not Your Father's Hertz 2-7-23