Footnotes & Flashbacks: Asset Returns 5-11-25

The market saw a mixed return week on busy trade and tariff news on the way into the China-US talks.

Ahh…the good old days.

With the equity markets getting tossed around by trade information (and disinformation and side trips to delusion), the timeline to transaction impacts on tariffs is knocking on the door ahead of a summer of adjustments in Goods pricing.

We see some headlines streaming out on Sunday as to how great the China-US talks went in Switzerland, but we will see soon enough what is real and what is simply more sentiment management at a critical juncture in inventory risks for many businesses. We have a hard time expecting, “I was just playin’. We are good at 10%. Let’s call It a day. Peace in our times.”

The recent initiation of more Section 232 and national security actions (e.g., commercial aircraft and parts) and theories around more to come (pharma and semis on the way, etc.) is not reassuring even if the 100% tariff on movies took on the nature of the absurd (100% of what?). The range of major trade partner tariff risks are setting the stage for a very challenging summer.

We still see tariff revenue maximization and commitment to elimination of the trade deficits as the Trump mission statement. Among questions are whether the murky goal of annexing Canada and Greenland and breaking up the EU (unstated ambition?) needs high tariffs to achieve those ends. We also need to wonder about the ability of the USMCA to even last until the mid-2026 review date.

With the measurement period shifting away from “hell week” when Liberation Day shocked the markets, we finally see a return to all-positive for the 1-month time horizon (with one 0% for UST) for the high-level debt and equity benchmarks we monitor. The positive numbers in 2025 for debt show the benefits of a modest bull steepener that has supported duration for now. That said, the “inflation watch” continues as investors brace themselves for the pricing impact of tariffs in the summer. The inflation vs. stagflation debate will get some more variables from actual tariff transaction flows in goods, consumer reactions, and any employer offsets (layoffs?). We get another CPI release this coming week.

Looking back at the trailing 3-months and 6-months, we still see all negatives across the equity benchmarks with small caps notably pounded over the 3-month period at -10.9%. For 6-months, we see -15.1% for the Russell 2000 in what is a dismal reflection on how US-centric small caps will deal with tariffs.

The rolling return visual

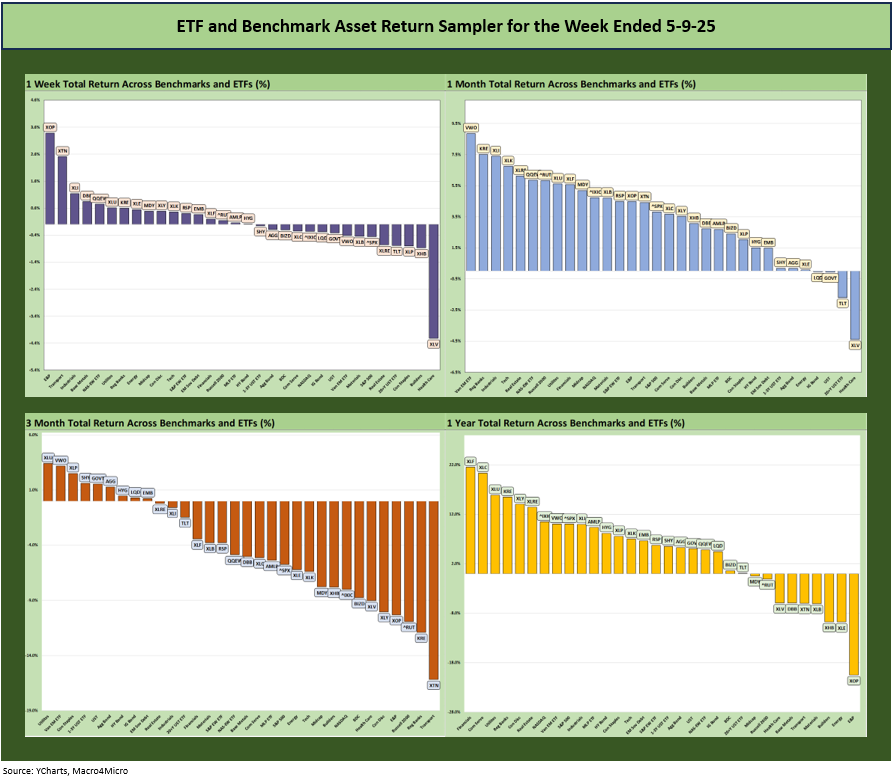

In the next section, we get into the details of the 32 ETFs and benchmarks for a mix of trailing periods. Below we offer a condensed 4-chart view for an easy visual on how the mix of positive vs. negative returns shape up. This is a useful exercise we do each week looking for signals across industry groups and asset classes.

We see a big shift in the 1-month symmetry this week as the pain of “Liberation Day” drops out of the measurement period. The 3-months chart gives a better view on how the 2025 experience has played out in stress and volatility for many. We also have a YTD chart in the mix below (not shown above). The YTD was 17-15 with all bond ETFs positive.

The Magnificent 7 heavy ETFs…

Some of the benchmarks and industry ETFs we include have issuer concentration elements that leave them wagged by a few names. When looking across some of the bellwether industry and subsector ETFs in the rankings, it is good to keep in mind which narrow ETFs (vs. broad market benchmarks) get wagged more by the “Magnificent 7” including Consumer Discretionary (XLY) with Amazon and Tesla, Tech (XLK) with Microsoft, Apple, and NVIDIA, and Communications Services (XLC) with Alphabet and Meta.

We looked at the tech bellwethers already in Mini Market Lookback: When in Doubt, Get Forcefully Ambiguous (5-11-25). The assets above are lined up in descending order of 1-week returns with a more typically mixed picture across the Mag 7. The 3-month and 6-month timelines are more reflective of the very rough ride in recent months.

We already looked at the 1-week numbers in Mini Market Lookback: When in Doubt, Get Forcefully Ambiguous (5-11-25). The score of 17-15 showed balance but with the large cap equity benchmarks (S&P 500, NASDAQ) in the red but small cap Russell 2000 and Midcaps in positive range.

The Health Care ETF (XLV) will remain a key focal point for speculation as the administration moves closer to its national security tariff plan for pharma and what it might mean to global restructuring of pharma company operations. Then comes the question of what it might mean to medical care inflation and trade war risks – notably with the EU. There is also an extraordinary amount of political uncertainty in medical reimbursement programs that could flow into revenue and earnings risks in health care broadly and pharma narrowly.

There is every reason to expect qualitative trade headlines will be the main event this coming week with the post-China meeting evaluation of where the most daunting tariffs might go next. There is clearly a strong desire in the market to assume rational, thoughtful consideration as part of some double-secret guiding light wrapped around a brilliant game theory disguised as economic incoherence and almost unbelievable inconsistency. We don’t see it that way. No one is that good at acting.

The market is in a “pause” with a few more major actions the past week (commercial aircraft, engines, and parts now under a national security review). We still face a few critical product reviews in the queue with pharma and semis. We even saw a 100% tariff threat on movies and films with no one quite able to fill in the blank on “100% of what?”

Canada annexation is still on the other side of the candles he will blow out after his military parade (the one that Milley derailed in Trump 1.0). The Copper and Lumber Section 232s were underway before the latest one recommended on commercial aircraft, engines, and parts. The latest one on aircraft and parts will be seen as a direct attack on the EU and Japan as well as Canada again and perhaps Brazil.

The 1-month period rebounded dramatically with the Reciprocal Tariff week and Liberation Day body slam effects dropping out of the numbers (see Mini Market Lookback: A Week for the History Books 4-5-25). The 28 positive and 4 negative include 3 bond ETFs in the red along with Health Care (XLV).

The running 3-month returns weigh in at 9-23 with the top quartile including 5 bond ETFs and the remaining 2 bond ETFs in the second quartile. That adds up to 6 of the 7 bond ETFs positive. Only the long duration UST bond ETF (TLT) was negative.

Of the 3 equity ETFs that made the top quartile, we see the Utilities ETF (XLU) at #1, EM Equities (VWO) at #2, and Consumer Staples (XLP) at #3.

Over on the right in the bottom performers, we see Transports (XTN) in dead last at -16.2% with Regional Banks (KRE), the Russell 2000 (RUT), E&P (XOP), and the Consumer Discretionary ETF (XLY) rounding out the bottom 5.

The YTD return mix in the group of 32 was 17-15 with the 7 bond ETFs all positive. We see more defensive equity benchmarks winning as we have covered along the trail. The worst of the lot are those with major tariff fallout or cyclical exposure such as Transports (XTN), E&P (XOP), Consumer Discretionary (XLY), and Russell 2000 with its heavy US centric mix. The weakness in oil prices has multiple factor from OPEC supply to materially weaker cyclical expectations.

The trailing 1-year time horizon posts a score of 23-9 after a long stretch into early 2025 with typically 29 to 32 in the positive column. We see E&P (XOP) on the bottom at -20.5% at a material distance from Energy (XLE) who sits in 2nd to last at -9.8%. Rounding out the bottom 5 is Homebuilders (XHB), Materials (XLB), and Transports (XTN).

The winners are Financials (XLF), Communication Services (XLC), Utilities (XLU), Regional Banks (KRE), and Consumer Discretionary (XLY). The consumer had been doing well until the tariff nerves but still put up respectable numbers in 1Q25 (see PCE March 2025: Personal Income and Outlays 4-30-25, 1Q25 GDP Advance Estimate: Roll Your Own Distortions 4-30-25).

The healthy view of the banks is a good reminder that this is a very different world than 2007, 2000, or 1989 when other key transition periods had very real risk of credit contraction and material asset risk exposure. The US market is at a healthier starting point now as it enters the real tariff turmoil.

For the rolling LTM period, a sub-6% median return in the mix of 32 asset lines is nothing to brag about when coming off two banner years for broad equity benchmarks in 2023-2024 (see Footnotes & Flashbacks: Asset Returns for 2024 1-2-25). During 2024, the median return across the 32 was around 10% while for the trailing 2-year period was over 20%. That won’t come up in the current White House briefings.

See also:

Mini Market Lookback: When in Doubt, Get Forcefully Ambiguous 5-11-25

Credit Snapshot: PulteGroup (PHM) 5-7-25

Credit Snapshot: Toll Brothers 5-5-25

Footnotes & Flashbacks: Credit Markets 5-5-25

Mini Market Lookback: Inflated Worry or Slow Train Wreck? 5-3-25

Payrolls April 2025: Into the Weeds 5-2-25

Payroll April 2025: Moods and Time Horizons 5-2-25

Construction: Singing the Blues or Tuning Up for Reshoring? 5-1-25\

Employment Cost Index 1Q25: Labor is Not the Main Worry 5-1-25

1Q25 GDP: Into the Investment Weeds 4-30-25

PCE March 2025: Personal Income and Outlays 4-30-25

1Q25 GDP Advance Estimate: Roll Your Own Distortions 4-30-25

JOLTS Mar 2025: No News is Good News 4-29-25

Credit Snapshot: D.R. Horton (DHI) 4-28-25

Mini Market Lookback: Earnings Season Painkiller 4-26-25

Existing Home Sales March 2025: Inventory and Prices Higher, Sales Lower 4-24-25

Durable Goods March 2025: Boeing Masking Some Mixed Results 4-24-25

Equipment Rentals: Pocket of Optimism? 4-24-25

Credit Snapshot: Herc Holdings (HRI) 4-23-25

New Home Sales March 2025: A Good News Sighting? 4-23-25

Mini Market Lookback: The Powell Factor 4-19-25

Home Starts Mar 2025: Weak Single Family Numbers 4-17-25

Credit Snapshot: Service Corp International (SCI) 4-16-25

Credit Snapshot: Iron Mountain (IRM) 4-14-25

Credit Snapshot: Avis Budget Group (CAR) 4-9-25

Credit Snapshot: AutoNation (AN) 4-4-25

Credit Snapshot: United Rentals (URI) 4-1-25

Recent Tariff Commentaries:

US-UK Trade: Small Progress, Big Extrapolation 5-8-25

Tariffs: A Painful Bessent Moment on “Buyer Pays” 5-7-25

Trade: Uphill Battle for Facts and Concepts 5-6-25

Tariffs: Amazon and Canada Add to the Drama 4-29-25

Ships, Fees, Freight & Logistics Pain: More Inflation? 4-18-25

Tariffs, Pauses, and Piling On: Helter Skelter 4-11-25

Tariffs: Some Asian Bystanders Hit in the Crossfire 4-8-25

Tariffs: Diminished Capacity…for Trade Volume that is…4-3-25