1Q25 GDP: Into the Investment Weeds

We detail the strong contribution of the Fixed Investment lines to 1Q25 GDP. Tech related investments provide cover for some otherwise mixed results.

A tricky dance for the bulls from here…

With so many distortions leading to a negative 1Q25 GDP print, the rolling policy changes around tariffs will be picking up pace from here as tariffs get registered more quickly at the transaction level. Market dynamics and the impact of higher all-in costs will then test the various theories on price impact and “cost sharing.”

For 1Q25, framing which investment lines were bolstered by defensive buying ahead of trade war scenarios is tricky and gets into the handicapping of what will overcorrect to the downside in 2Q25/3Q25

Inventory build contributed to the surge in GPDI of 21.9% QoQ growth tied to Fixed Investment in Equipment growing 22.5% QoQ led by tech and information processing growth. Whether this reflects sustainable infrastructure program growth or pull-forward ahead of tariffs remains a key question. Aircraft demand was also strong.

Fixed Investment in Structures came up lackluster but at least positive at 0.4% QoQ growth even as tariff policy squarely aims at bolstering activity in this space. As one of the major targets for growth under Trump’s trade policy, we will see if erratic tariff-based trade “incentives” are the right tools for the job. A more business friendly tax regime will complicate that analysis on timing.

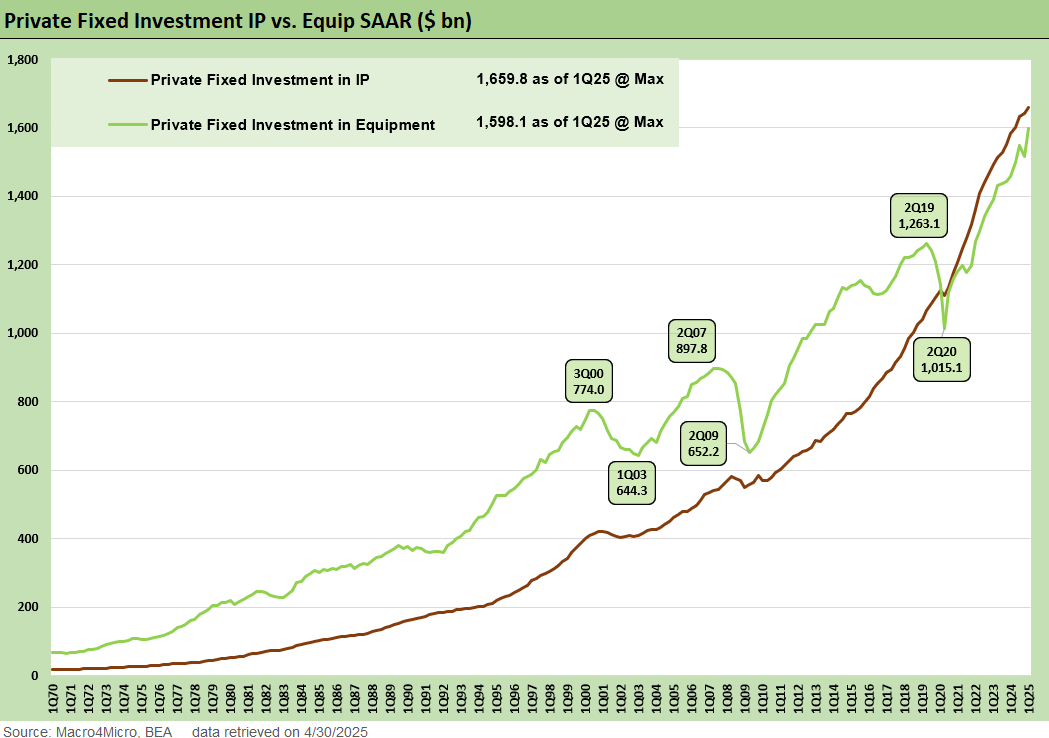

The above chart breaks out the long-term history of private investment in Structures and Equipment under the GPDI lines in the GDP release. For context, GDPI overall is about 18.5% of total GDP and these two above are representative of the capex trends. They total around 8.4% of GDP.

The 1Q25 release shows increases for both of these but on different scales as Equipment investment surged $81 bn higher and Structures gained just over $3 bn. The main driver for the Equipment investment is unsurprisingly $73 bn in growth of information processing equipment given both the fervent demand for AI and database infrastructure and growth. The major question from this morning remains how much is pull-forward in anticipation of semiconductors and chips possibly getting caught in another round of Section 232 or other tariff actions. Ongoing trade tensions could slow investment and delivery cycles.

On the other hand, Structures investment remained low growth but at least at elevated run rates. As the Trump team continues to target previous incentives and fiscal support, policy actions will be the main driver of incremental capex programs for structures. The heavy tilt toward tech-driven equipment investment and relative weakness in structures points to a preference for short-cycle assets over long-horizon infrastructure. With tariff effects unfolding over time, firms are hesitant to commit to those large, multi-year programs amid persistent uncertainty. That clarity remains a major hurdle for now even if some announcements get made for political points.

This chart frames the Fixed Investment in Equipment line vs. the Intellectual Property investments. The lead taken by IP investment run rate since 2Q20 reflects the importance of digital infrastructure and highlights how intangible assets now dominate capital planning for firms navigating supply chain and labor cost volatility.

Under uncertain tariff and supply chain conditions, IP investments have the advantage of less disruption and provide an investment avenue that has a few less policy question marks. As labor and inventory costs are set to increase, robust IP capex programs at least set the stage to utilize those resources more effectively.

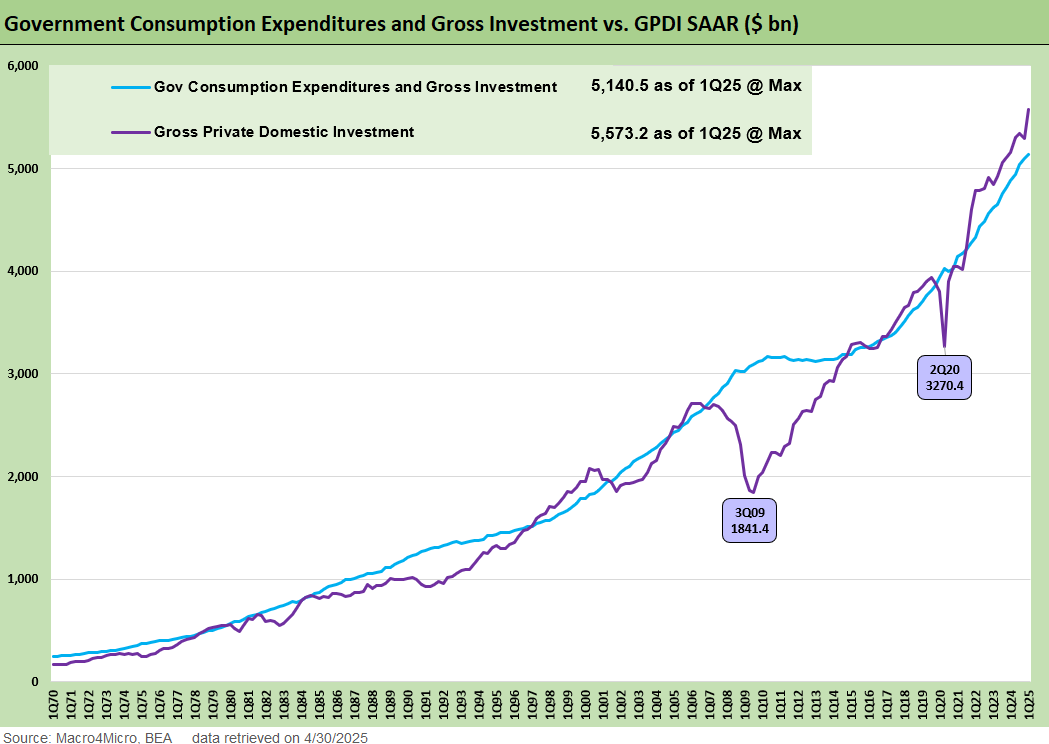

The above chart zooms out and looks at the overall balance between Public and Private investments. While the chart shows government spending at a nominal all-time high, its real contribution to GDP was negative due to defense spending cuts. Trump’s team has committed to lowering this figure one way or another, but the reported $160 bn slashed away by DOGE is a small drop in the bucket here.

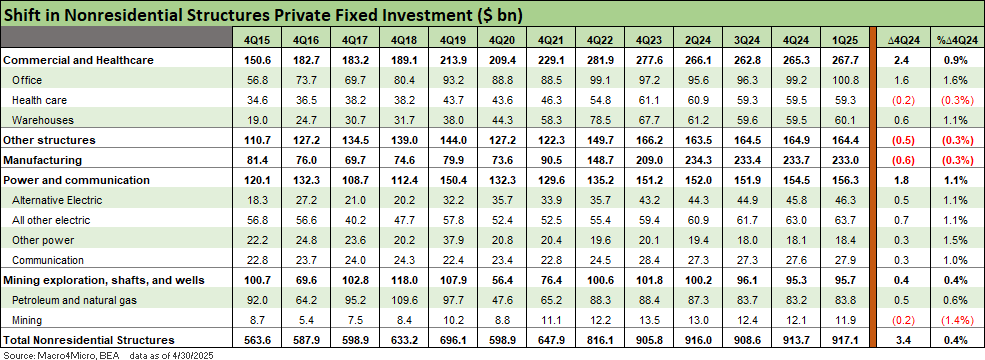

In the above chart and the following charts, we detail the private investment line items and their history to demystify the Equipment and Structures spending. We’ve previously looked at this from a Biden centric, Post-COVID investment shift but now change the comparison to 4Q24 to start framing the immediate impacts of Trump policy and business response. We leave in the medium-term history for those who want to see the path up to today. As a reminder, these tables use the nominal dollar amounts, and the derived percentages are thus different than those in Table 1 of the GDP release.

We have already commented on the surge in Information Processing Equipment and the outsized contribution to the fixed investment growth in 1Q25 overall, but the 14.3% QoQ nominal growth is the largest single period growth on record. It remains difficult to disentangle how much of this reflects genuine, long-term AI infrastructure buildout versus short-term tariff-related pull-forward. The run rates in the next quarter’s GDP will clarify the main drivers of the action above. Aircraft investment, which is typically volatile, drove most of the 2.5% increase in the transport category, masking declines in other subsectors.

On the structures side of the ledger, there are minor variances with mixed results. Manufacturing activity notably notched slightly down after a very positive trend under Biden-era policies (IRA, CHIPS, Infrastructure bill) that saw Manufacturing climb from $79.9 bn up to $233.7 bn. We will now get a look at how the tectonic shifts in global trade practices can drive similar results (or not).

We worry about the lack of strength in the Structures numbers above as reflecting hesitation in longer cycle bets, especially as trade policy shifts have been struggling with consistency. The investment time horizons need a more coherent message. The lack of growth in Mining/E&P does not reflect confidence in the economics of higher investment at current oil prices. A harder line on Russia and their oil supply might have helped.

The above chart narrows the focus to the Equipment categories for granular details. The short story is that besides a select few lines of Computers, Communication, Medical, and Aircraft Equipment investment, the results were quite mixed. Notably, we see declines in Agricultural Machinery, Trucks, and Autos that missed possible opportunities to front-run some capex.

The last chart runs a similar exercise for the Structures subcategories. We see the Power and Communication and Office lines as main contributors to the small growth on the quarter.

See also:

PCE March 2025: Personal Income and Outlays 4-30-25

1Q25 GDP Advance Estimate: Roll Your Own Distortions 4-30-25

JOLTS Mar 2025: No News is Good News 4-29-25

Tariffs: Amazon and Canada Add to the Drama 4-29-25

Credit Snapshot: D.R. Horton (DHI) 4-28-25

Footnotes & Flashbacks: State of Yields 4-27-25

Footnotes & Flashbacks: Asset Returns 4-27-25

Mini Market Lookback: Earnings Season Painkiller 4-26-25

Existing Home Sales March 2025: Inventory and Prices Higher, Sales Lower 4-24-25

Durable Goods March 2025: Boeing Masking Some Mixed Results 4-24-25

Equipment Rentals: Pocket of Optimism? 4-24-25

Credit Snapshot: Herc Holdings (HRI) 4-23-25

New Home Sales March 2025: A Good News Sighting? 4-23-25

Footnotes & Flashbacks: Credit Markets 4-21-25

Footnotes & Flashbacks: State of Yields 4-20-25

Footnotes & Flashbacks: Asset Returns 4-20-25

Mini Market Lookback: The Powell Factor 4-19-25

Ships, Fees, Freight & Logistics Pain: More Inflation? 4-18-25

Home Starts Mar 2025: Weak Single Family Numbers 4-17-25

Credit Snapshot: Service Corp International (SCI) 4-16-25

Retail Sales Mar25: Last Hurrah? 4-16-25

Industrial Production Mar 2025: Capacity Utilization, Pregame 4-16-25

Credit Snapshot: Iron Mountain (IRM) 4-14-25

Mini Market Lookback: Trade’s Big Bang 4-12-25

Tariffs, Pauses, and Piling On: Helter Skelter 4-11-25

CPI March 2025: Fodder for Spin 4-10-25

Credit Snapshot: Avis Budget Group (CAR) 4-9-25

Payroll March 2025: Last Call for Good News? 4-4-25

Payrolls Mar 2025: Into the Weeds 4-4-25

Credit Snapshot: AutoNation (AN) 4-4-25

Credit Snapshot: United Rentals (URI) 4-1-25