Mini Market Lookback: Inflated Worry or Slow Train Wreck?

A busy macro week nears the end of earnings season, but markets are still turning on the qualitative and subjective.

They forgot about the tariff switch.

The week was jammed with macro data and earnings reports that included a decidedly low level of confidence displayed by many management teams on what comes ahead from tariffs. Consumer confidence hit the lowest since Oct 2011 (the peak period of sovereign panic and HY spread wides), and the week saw 1Q25 GDP numbers that were treated more like a Rorschach test (see 1Q25 GDP Advance Estimate: Roll Your Own Distortions 4-30-25, 1Q25 GDP: Into the Investment Weeds 4-30-25).

Payrolls were above expectations, but increases were concentrated in the usual low multiplier effects sectors (see Payroll April 2025: Moods and Time Horizons 5-2-25, Payrolls April 2025: Into the Weeds 5-2-25). The payroll news was celebrated, but the payroll impact of tariffs will be a lagging indicator with the market only now crossing into the early stages of the potential 2Q25 price impact of tariffs and a period of inventory liquidation and higher goods prices. With the “pause clock” ticking, the questions around “Who else retaliates?” also hang in the background.

Any hint of new trade talks with China gets the market excited and China needs to be responsive to any overture. As the process drags on, however, we get close to “empty shelf” days with container activity currently parked next to Davy Jones’s locker. Ports are seeing a lot of empty space with the potential duration of freight and logistics dislocations already under scrutiny since the recent port fees against China (see Ships, Fees, Freight & Logistics Pain: More Inflation? 4-18-25).

As the pro-tariff crowd celebrates the return of a post-Liberation Day rally, the above chart offers some context with YTD returns for some broad market benchmark ETFs from Europe, Canada, and China set against the S&P 500 ETF (SPY). The US is dead last and in the red. We were actually kind to the US by using the best performing major index in the US with the S&P 500 ETF. The returns on the NASDAQ, the Russell 2000, and Midcaps all performed worse than the SPY.

These markets are intrinsically volatile and are likely to stay that way. Volatility means “higher and lower.” We saw a lot of celebration by tariff fans as many of the losses since Liberation Day were erased with solid 1Q25 earnings (which was not a surprise) and some headlines around potential trade talks and renewed negotiations (let’s not forget back at the tariff announcements that the phrase from some parties was “permanent” and “not a negotiation”). Before the pro-tariff crowd goes into their Mick Jagger turkey strut, they might want to consider the US is the worst performer YTD in early May. That is not a great statement on economic policies.

The above chart updates the 1-week and 1-month spread deltas with the adverse OAS delta variance down to +10 bps for IG and only +18 bps for HY. As we cover in more detail in our Footnotes publications to be published later, the credit risk premiums are inside the long-term median again and the world awaits a better angle on how quickly (or how badly) the forward-looking tariff scenarios will play out.

For now, we see both IG and HY generating negative YTD excess returns with positive total returns on the favorable UST variance. The UST curve has been a friend YTD 2025 with risky asset pricing in the US still under pressure as the crow flies from the end of 2024. It takes a lot of pain and low deal quality to cause a default cycle, and the industry backdrop is in fact steady at this point even if we see numerous GDP lines slowing.

The GDP results were weaker but better than the headline -0.3%. The -4.8% contribution to GDP from declining “goods imports” alone was quite an anomaly as was the +2.25% inventory build in 1Q25. Next quarter in 2Q25, those inventories will start getting drawn down and new inventories subject to tariffs. Then we will see what imports do and what that means for growth and corporate earnings. For 1Q25, “contribution to GDP” (Table 1) showed PCE down, PCE Goods down, PCE Services down, Nonresidential Fixed Investment higher, and Federal government lower.

The wild Liberation Day price action is getting put further back into the rear view mirror with the pause being slowly worked through to its eventual end game for some major trade partners. The tariff process lost credibility early and often, first with the embarrassing formula for reciprocal tariffs, which in fact had nothing to do with trade partner tariffs and everything to do with trade deficits (see Reciprocal Tariff Math: Hocus Pocus 4-3-25, Reciprocal Tariffs: Weird Science Blows up the Lab 4-2-25 ). Then we had the repeated assertions from Trump that he had been talking to Xi when he in fact was not speaking with him at all. Game theory should not include lying to voters and markets. Then again, it depends on who you are “gaming.”

From here, there will be talks with China (Xi unlikely until unilateral tariffs come off) as they push for a good faith rollback of the unilateral tariffs (and presumably the port fees). That would be very embarrassing for Trump, so that goes in the “sentiment ebb and flow column.” One major misfire welcomes back the other side of volatility.

We have Trump-Carney meetings ahead, and we will at some point get a read on where the EU is headed with its retaliation. With Germany now #3 in the world economic GDP rankings (a distant #3 behind China but ahead of Japan), and a slew of UST holdings across Europe and the EU, a more severe trade clash there would be another problem. It does not take a lot of imagination to see how retaliation escalation from the EU and Canada (Mexico mostly MIA in the headlines of late) at the same time China is battling would be a major risk pricing event. It will be a volatile summer unless this tariff mess can get cleared up. Confidence is a subjective vote.

The 1-week score for our group of 32 benchmarks and ETFs was 22-10 with the 10 negative returns including 6 bond ETFs. We see HY (HYG) just across the line at the bottom of the 22 positives. We see Transports (XTN) at #1 for the week on trade talk hopes, but XTN is in dead last YTD and negative for the trailing year.

The breadth of the rally for the week is impressive with Industrials (XLI) at #2, Regional Banks (KRE) at #3, Tech (XLK) at #4, Homebuilding (XHB) at #5 followed by Financials (XLF), Midcaps (MDY) and EM Equities (VWO) rounding out the top quartile.

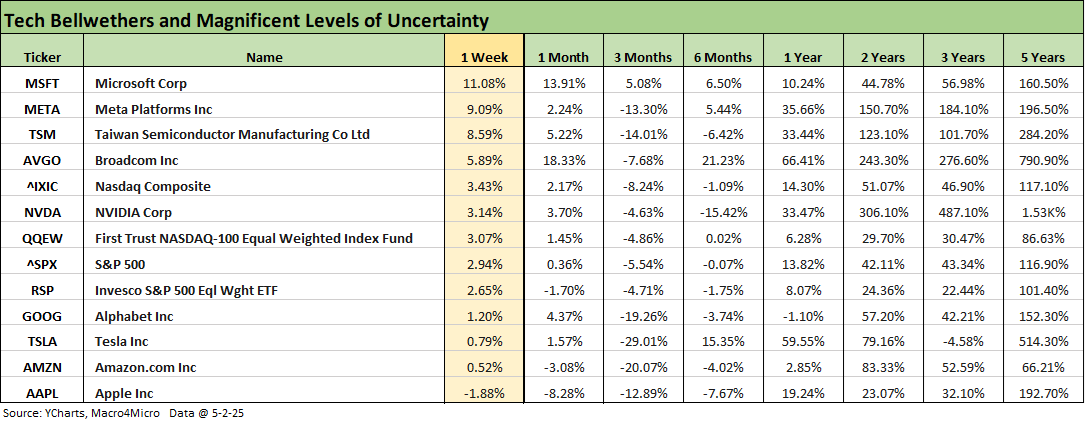

The Mag 7 reporting ended a decent week for tech performance after a relative beatdown YTD 2025 as covered in earlier Footnote editions. In the above 1-week numbers, we see 4 of the Mag 7 underperform the S&P 500 and NASDAQ on the week with Microsoft on top after very good numbers and Apple on the bottom after this week’s earnings report.

Looking back 3 months, the NASDAQ and Equal Weight NASDAQ 100 ETF are both in negative range. The same is true for the S&P 500 and the Equal Weight S&P 500 ETF (RSP). There is not a lot of “exceptionalism” in those numbers.

The 1-week UST deltas worked against bond returns this week with the 2Y to 10Y reshaping a bit. The week saw good PCE numbers (see PCE March 2025: Personal Income and Outlays 4-30-25), numerous positive lines in the GDP accounts (not the headline number of -0.3% but along the PCE and Fixed Investment lines), solid payroll numbers (see Payrolls April 2025: Into the Weeds 5-2-25, Payroll April 2025: Moods and Time Horizons 5-2-25), and a very constructive earnings season (looking backwards) winding down with around 80% of the S&P 500 having reported.

One immediate takeaway from the week of releases was that the FOMC has absolutely no reason to ease. In fact, the FOMC has reason to stand fast since the Fed has mastered the fact that the “buyer pays” the tariff. That is a factual framework that has escaped Trump, his various spokesmodels, and some critical GOP committee heads such as House Ways and Means, who explicitly stated on CNBC that the “seller pays.” Facts are usually not a partisan issue (Ayn Rand called them “absolutes”), but this is the world we live in now. Trump went to town on that very topic in his Time Magazine interview. “Seller pays” in Cloud Cuckoo Land.

The above chart captures why bond funds are all positive YTD in total returns. The 2Y to 5Y has been the most supportive.

The above time series updates the running 10Y UST and Freddie Mac 30Y benchmark as mortgages saw some very slight relief. The Freddie Mac benchmark is released on Thursday at noon, and we saw some other surveys closer to 6.9% by the end of Friday after some more releases.

We saw HY OAS tighten by -7 bps the past week and is back to around 100 bps inside the long-term median.

The “HY OAS minus HG OAS” quality spread differential tightened by -9 bps as HY tightened and IG widened slightly.

The “BB OAS minus BBB OAS” quality spread differential narrowed sharply by -13 bps as BBs moved -10 bps tighter and BBBs moved wider by 3 bps.

See also:

Payrolls April 2025: Into the Weeds 5-2-25

Payroll April 2025: Moods and Time Horizons 5-2-25

Construction: Singing the Blues or Tuning Up for Reshoring? 5-1-25

Employment Cost Index 1Q25: Labor is Not the Main Worry 5-1-25

1Q25 GDP: Into the Investment Weeds 4-30-25

PCE March 2025: Personal Income and Outlays 4-30-25

1Q25 GDP Advance Estimate: Roll Your Own Distortions 4-30-25

JOLTS Mar 2025: No News is Good News 4-29-25

Tariffs: Amazon and Canada Add to the Drama 4-29-25

Credit Snapshot: D.R. Horton (DHI) 4-28-25

Footnotes & Flashbacks: Credit Markets 4-28-25

Footnotes & Flashbacks: State of Yields 4-27-25

Footnotes & Flashbacks: Asset Returns 4-27-25

Mini Market Lookback: Earnings Season Painkiller 4-26-25

Existing Home Sales March 2025: Inventory and Prices Higher, Sales Lower 4-24-25

Durable Goods March 2025: Boeing Masking Some Mixed Results 4-24-25

Equipment Rentals: Pocket of Optimism? 4-24-25

Credit Snapshot: Herc Holdings (HRI) 4-23-25

New Home Sales March 2025: A Good News Sighting? 4-23-25

Mini Market Lookback: The Powell Factor 4-19-25

Ships, Fees, Freight & Logistics Pain: More Inflation? 4-18-25

Home Starts Mar 2025: Weak Single Family Numbers 4-17-25

Credit Snapshot: Service Corp International (SCI) 4-16-25

Retail Sales Mar25: Last Hurrah? 4-16-25

Industrial Production Mar 2025: Capacity Utilization, Pregame 4-16-25

Credit Snapshot: Iron Mountain (IRM) 4-14-25

Mini Market Lookback: Trade’s Big Bang 4-12-25

Tariffs, Pauses, and Piling On: Helter Skelter 4-11-25

CPI March 2025: Fodder for Spin 4-10-25

Credit Snapshot: Avis Budget Group (CAR) 4-9-25