Credit Snapshot: Service Corp International (SCI)

We summarize the credit fundamentals of Service Corp.

Credit Trends: Stable

Summary credit profile:

Since abandoning its aggressive debt-financed global expansion program back in 2000, Service Corp (SCI) has posted a very clean credit track record of growth and successful execution as the leading funeral services and cemeteries consolidator (“death care”) in North America in what remains a highly fragmented industry with a patchwork of state and federal regulations. High margins, healthy discretionary free cash flow, disciplined leverage policies, and consistent shareholder friendly capital allocation have supported both equity returns and stable credit quality (see Credit Crib Note: Service Corp International 9-19-24). SCI is a Top 50 BB index tier issuer and in the Top 80 for HY in total.

SCI is a name we have watched on and off since the 1980s when it was a Lehman client in commercial paper and medium-term notes. SCI dropped further down the credit tiers into HY in the late 1990s when it overexpanded its global platform and saw risk pricing spike ahead of a broad overhaul of its international scale. SCI has been stable and rock-solid since then for over 2 decades. SCI outperformed the S&P 500 over 5 years and 10 years, lagged after COVID and is back ahead over the trailing 1-year and YTD.

Relative value:

SCI clearly offers differentiated, diversified cyclical exposure in the “death care” business. The business line has reliable volumes and a proven track record. The relative cyclical resilience is clear enough vs. many BB tier industries and issuers. Low organic growth and steady small-ticket acquisitions drive even higher free cash flow with SCI bonds qualifying as a defensive HY lite exposure. SCI has no reason to seek IG ratings, but the bonds should be rated higher based on the balance of risks. It is not a large universe of companies that can choose their own leverage year-in, year-out.

SCI offers steady volumes, reliable financial metrics, and a proven ability to keep growing the business as many small private operators seek to monetize their local brand value and assets whether in estate planning or based on opportunistic sales. SCI can pay lower multiples than the SCI entity and can extract more value for its shareholders as the new funeral homes are rolled into the consolidated entity with its synergies and purchasing power. Impressive discretionary free cash flow generation and the demonstrated ability of management to adapt to consumer preference changes (cremation, celebrations of life, etc.) and crises (COVID) have made SCI a winner in equities and a rock-solid predictable name in debt. Death and taxes implies reliable volumes on basic demographics and life expectancies.

Business risk:

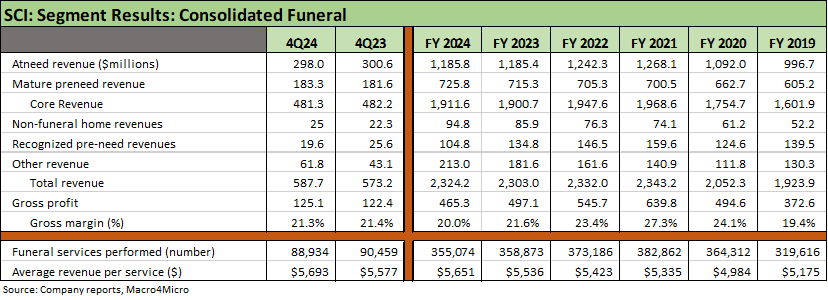

We rate the business risk as low. Steady volumes and diverse customer preferences offer volumes that are more secular than cyclical. The baby boom turns 80 years old in 2025 (CDC life expectancy almost 78 years) and demographics favor steady growth in demand even if “we boomers” would like to push those expiration dates further out into the future. The business is discretionary in nature with a wide range of services, product selection and price range. The average funeral service revenue in FY 2024 was $5,651.

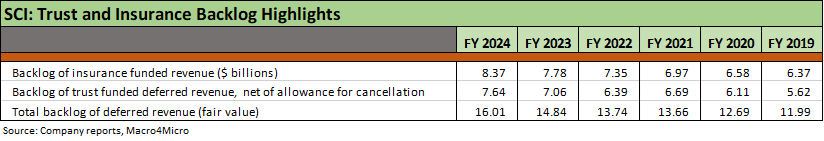

Competitive advantages include captive infrastructure (1,493 funeral homes, 496 cemeteries at FY 2024, cremation facilities, the Neptune brand). SCI has some complex offerings in terms of insurance and trust products and has successful sales and marketing capabilities to support the top line and deferred revenue growth, in turn reducing business risk. Digital investments have proven very successful as evidenced during COVID. The SCI product mix in preneed has generated a backlog of $16 billion, which is almost 4 years of revenue based on the FY 2024 revenue.

SCI has adapted its service mix and operations based on consumer needs. The long-term strategy of keeping well-known local brand names intact as part of community traditions has been quite successful from the most affluent markets (including some Manhattan flagship names) to modest working-class towns. SCI excels across a range of ethnic brand names and religious affiliations.

Tariffs:

The main pressure from tariffs is materials (a broad range in the supply chain), which in the broader context of BB tier risk issuers is a small threat for SCI given the product and service mix faced by manufacturers and the secular rise in cremation. Even then, SCI is not the manufacturer of those goods and service packages can still be priced based on the “consumer” menu, which is a discretionary decision. The capital markets fallout from tariffs on trust portfolios is a risk, but that has been a factor across the cycles including the tech bubble of the late 1990s, the systemic crisis of 2008, COVID, the inflation spike, and the tightening cycle.

Our punchline on the scale of capital markets risk for the SCI trust assets is that such a scenario matters if the capital markets crash and everyone dies at the same time (this was from a real conversation). First, the atneed revenue line will be soaring. In that scenario, you might also want to map that set of risks into broader portfolio context of your holdings (you have a lot to worry about). People will still get buried.

In substance, this Trust risk is low and 95% of trust assets are managed by 5 large financial institutions with mutual funds being the primary asset selection. The goal of the trusts is to outpace inflation. The SCI trusts returned +12.3% in 2024. The SCI trusts are 59% equities, 27% fixed income, 10% alternatives, 4% money markets. The trusts are closely regulated and have stood the test of some very strange times.

Profitability:

High gross margins and operating margins north of 20% dovetail with the favorable demographic realities as the baby boom generation turns 80 years old in 2025. The company has low 30% EBITDA margins, but its favored metrics include gross margins, operating margins, net cash flow from operating activities, and free cash flow. SCI has proven its ability to adapt its product suite and range of offerings to a “celebration of life” and the steady rise of cremation rates (63.8% rate for SCI in 2024). SCI guides investors to long-term EPS growth of 8% to 12% (the last 10 years was 12% to 13%). The 2025 operating cash flow guidance points to a high single digit % increase. Among trends the company cites was the “pull-forward effect” of the COVID crisis and how that played out in the aftermath.

The accounting issues can seem tricky given the mix of preneed business combined with the insurance and trust aspects of the business. The easy part in revenue recognition is cemetery sales (recognized at sale) vs. preened services and related transactions. Those can get more complicated. SCI even includes useful guides to preneed accounting and a full “Deathcare Accounting Guide” on their investor site. The accounting treatment makes intuitive sense from a financial concept standpoint and the legal and financial risks. The nature of how the customer pays for services and what SCI owes in service or other liabilities can vary (including by state for the trusts). The accounting also has been proven over time in some wild markets.

Balance sheet:

Leverage remains within the target range of 3.5x to 4.0x, supported by highly stable earnings and free cash flow. SCI is an unsecured borrower but has structural subordination exposure to unsecured bank lines with subsidiary guarantees. SCI made $181 mn in acquisitions in 2024 (26 funeral homes 6 cemeteries) and expects another $75 mn to $125 mn in 2025. SCI issued $800 mn 5.75% of Oct 2032 bonds in Sept 2024 with proceeds used to refinance revolver borrowings. Bond maturities are light until a number of maturities from 2027 to 2032 with Jan 2028 a key date when the term loan maturity and credit agreement mature. SCI has $1.34 bn of available borrowing capacity under its revolver at FY 2024. In other words, SCI is a good credit banking client for loans and bonds.

SELECT CHARTS

Steady, high margins in a narrow range help when cycles are uncertain.

Funerals in a narrow range of 20% margins with steady volumes.

Cemeteries offer the highest margins and favorable revenue recognition.

Slow and steady growth on both sides of the balance sheet, disciplined leverage.

Capital allocation balanced across growth, buybacks and leverage.

Trust and Insurance vehicles are key supporters of revenue backlog.