Construction: Singing the Blues or Tuning Up for Reshoring?

We update construction trends as markets brace for capital budget planning in the “new world.”

Is the construction thrill gone?

The monthly scrutiny of what the tariff game plan means for the economy will include a lot of focus on construction markets given the scale of the economic multiplier effects the projects bring. The fact that industries expected to return to the US can only happen with a lot of construction means this monthly release gets back on the front burner. Much of the construction that is in theory going to happen will be of a multiyear nature.

We saw a “lot of red” and negative numbers in March 2025 MoM deltas across numerous categories as we detail below. The real impact will roll in over time in “slow and steady” fashion in coming months as projects get reevaluated, the shifting cost and demand impact from tariffs gets more reliable inputs for assessing the updated economics of projects. Those considering expansion in the US need to get a better read on trade war risks and the lurking retaliation alternatives of some very angry trade partners.

Whether steel or aluminum or other important construction materials such as cement and concrete get tariffed to high heaven, the cost of construction will be rising. Where rates will go remains a question with the various stagflation scenarios, and the ability to play the “pause card” cuts both ways.

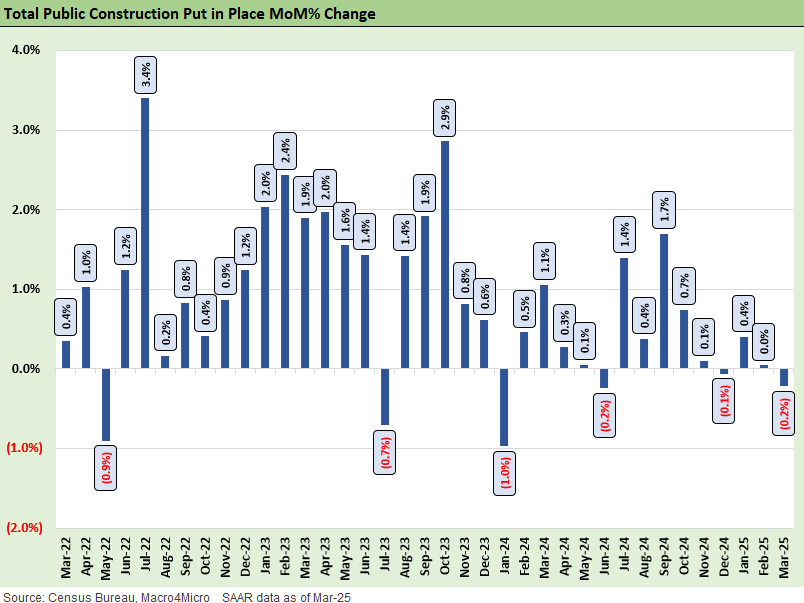

The above chart updates the trend line from the Census report on Monthly Construction Spending for March 2025. This is going to be a metric to monitor every month for numerous reasons. First, construction had a great few years across numerous buckets and notably in Manufacturing with considerable fiscal support for various markets (see links at bottom).

Second, construction is a critical multiplier effect sector that cuts across a wide range of goods and services industries and anchors employment in skilled and semi-skilled labor pools with solid pay scales. If construction markets are not doing well as 2025 proceeds, there are problems with the reshoring theme as well as the broader economy.

For Trump 2.0, the promise of tariffs to bring manufacturing home via reshoring or relocation for non-US companies in major industries such as autos. The supplier chains come with them and then a new “golden age” will spring across many industrial and manufacturing verticals. Team Trump has made a daunting list of tariffs that affect many industry groups. Some are in process and some are already in place hammering many numerous construction materials sectors already – starting with steel, aluminum, and basically anything from Mexico and Canada.

After the early wave of tariffs (notably on Canada and Mexico), there are many more to come that are expected to set off a wave of homecomings (autos, pharma, semis, metals/steel, etc.). The costs of major construction projects are rising fast, and that means the economics of the projects are deteriorating and are thus riskier. The other wrinkle that many do not discuss is that building in the US will give you access to the US, but the trade partner retaliation might cut off some markets. Speculative scenarios rule.

Meanwhile, the supplier chains for many types of critical equipment (notably construction equipment) are going to see pressures on price for contractors and on the services side. Many of those equipment manufacturers had built out global supplier chains not only for lower component costs (and the labor arb) but also for dollar risk and currency hedging in the event exports get hit by a strong dollar. The theory is the supplier chains offered somewhat of a natural hedge on finished good export risk by using nondollar suppliers. I remember Caterpillar talking about that in the early 1990s as they were addressing their global plan with Komatsu breathing down their neck. CAT then proceeded to crush Komatsu. They also did not make many friends back then with the UAW.

The willingness of more industrial and manufacturing operators to get shovel ready when staring at deeply uncertain cyclical times will get a test from now through summer as the tariffs roll in. If the tariffs get paused again, the stock market may rally but that pause in planning could turn some 2025 potential construction projects into 2026 “maybes.”

Trumps Golden Age pitch will face numerous economic releases from current activity to future orders. When you toss the old global trade model out the window with extreme confidence, that will justifiably get an empirical gut check every month. Then again, based on Project 2025’s view of the Department of Commerce, his team might gut the data services if they don’t like the economic releases (Seriously, Project 2025 has a chapter on that topic).

The above chart breaks out the top-down mix across major categories. The big buckets were all negative MoM and low single-digit increase YoY.

On the cost side, we know steel will cost a lot more this year for major projects. Lumber tariffs/duties are already high with more in process. So lumber, steel, and aluminum (appliances etc.) will see higher costs on tariffs in residential projects. Cement and concrete do not get a lot of airtime, but we include some background information below from a trade group (Portland Cement Association “PCA”). Cement and concrete are important in all construction markets.

A few items from PCA:

Canada and Mexico account for 27% of U.S. cement imports and nearly 7% of U.S. cement consumption.

The U.S. imported 5 million metric tons (MMT) of cement from Canada and 2 MMTs from Mexico in 2023.

Texas and Arizona each represents roughly 30% of Mexican imports’ port of entry followed by California and Florida (20% each), reflecting 5% of cement consumption in these states.

Canadian imports enter through New York (28%), Washington (14%) and New England (11%) with the remaining 20% spread across Montana, North Dakota, and other Great Lakes states.

Canadian imports may account for up to 36% of cement consumption in these combined states.

Materials and resources were one of the reasons for NAFTA and the later USMCA rework. Natural Resources and downstream processed materials (Cement, Steel) were supposed reduce costs of finished goods and lead to competitive prices for customers. The political twist on steel tariffs for years was that steel tariffs were tied to carrying Pennsylvania and Ohio in elections. George W Bush pulled out the steel tariff playbook in his first term during 2002 at midterm elections after the infamous 2000 “hanging chad” election. The current tariffs in place now hit Mexico and Canada on a range of fronts and are stacked. Cement will just be one of the many moving parts ahead.

The above chart details the recent trend line in private construction. This breaks out the details from the end of ZIRP and tightening cycle from March 2022 on through March 2025. This MoM trend will be one to watch as 2025 proceeds with heavy tariffs.

The above chart breaks out some major categories in the monthly release. That is “a lot of red” in March 2025. Manufacturing will be a key line to watch.

The above chart frames public sector spending over the same timeline. While there will be no shortage of political eloquence on how great things will be in the future, the question of “Is construction higher or lower?” will cut through the noise this year.

The above chart breaks out the categories for public sector spending. Power has a remarkably compelling need and yet is a long way from satisfied. The recent attacks on education could raise some questions on the direction there. Residential is biased lower at this point.

See also:

Construction Spending: Stalling Sequentially at High Run Rates 6-4-24

Construction Spending: Timing is Everything 12-1-23

Construction: Project Economics Drive Nonresidential10-2-23

Construction Spending: Demystifying Nonresidential Mix 5-9-23

Useful bellwethers for construction markets:

Credit Snapshot: Herc Holdings (HRI) 4-23-25

Credit Snapshot: United Rentals (URI) 4-1-25

Credit Crib Note: Herc Rentals (HRI) 12-6-24

Credit Crib Note: Ashtead Group plc (AHT) 11-21-24

Credit Crib Note: United Rentals (URI) 11-14-24