Mini Market Lookback: Earnings Season Painkiller

A good week for returns as 1Q25 earnings show steady fundamentals before “Liberation Day” derailed the world.

Don’t worry. Just tell them the seller pays.

For the week, we saw a 31-1 score for our 32 asset lines, the 11 S&P 500 sectors posted 10 of 11 positive, tech soared, spreads tightened, and the UST put together a modest rally. The Mag 7 all rebounded during the week in a range of +18% weekly return for the highest (Tesla) to +6.2% for the lowest of that group (Apple). Chips had a big rebound with NVIDIA and Broadcom in double digits.

Tariffs are tough to hide from even if pauses and jawboning can jockey the markets around. The price increases and the empty shelf risks are approaching as the massive dislocations of the freight and logistics markets are starting to work their way into the headlines (see Ships, Fees, Freight & Logistics Pain: More Inflation? 4-18-25).

The Time Magazine Trump interview revisited the theme of “billions and billions and billions collected from the seller” in Trump 1.0 and again in Trump 2.0, but there is still the reality that the “buyer pays” to complicate that sales pitch. At some point, the world will know that better from the aisles and showrooms as the “tariff pause” clock ticks away and more product tariffs drop in. It is tough to build credible policies on a basic, foundational falsehood. There is a debate to have but not on that simple fact.

This week brings PCE inflation (income and outlays), the 1Q25 GDP advance estimate, JOLTS/payroll, and some notable indicators for factory orders and durables that carry more weight than usual as a tariff prism.

The above chart shows the rally week in credit spreads across the tiers in a standard quality spread tightening wave from BB to CCC in HY. The trailing 1-month period is still a bad stretch, but the pain has eased dramatically from the post-reciprocal tariffs fiasco with its subtext of “let’s destroy the Fed and crush the dollar.” IG Corporate and HY bonds are both still in negative excess return range YTD while total returns YTD have moved back into positive range with the UST curve support led by the 2Y to 5Y shift, lower rates in 7Y to 10Y, and a slight rally on 30Y (detailed below).

The score of 31-1 for 1-week returns is a welcome respite with the caveat that there is a pause in tariff battles with the clock ticking. The US-China drama has been reduced to a “who is lying” standoff on whether there are even trade talks underway. The game theory breaks down to Trump managing market turmoil and Xi using select exemptions (e.g. aircraft parts) to manage through the stand-off.

The idea that China wants the US consumer (aka voter) to feel (price) and see (empty shelves) the results of tariffs is a scenario that calls for them to dig in. That way, tariffs as a policy can get relegated to the dustbin of extreme failures and they won’t have to keep revisiting it. They also can stall long enough to see the EU, Canada, and Mexico potentially turn the heat up and make a real mess of the whole concept.

On the flip side, Trump can make some unilateral gesture to reassure the markets. Taking China’s stalled tariffs down to 50% would be offering China the choice between limb amputation and the guillotine. So that would be a strategy more geared to domestic sentiment in the US and not a real breakthrough. It would give them the optics of good faith even it is like the arsonist saying he would dial back his matchbook count.

Of course, lumber, copper, semis, and pharma are on deck with semis adding to a war footing with Asia and pharma a guaranteed trade war with the EU. That promises room for more surprises, more volatility, and more disinformation on who pays the tariffs and what the costs are to the economy.

We put our chips down on China wanting to see the price pain and empty shelves show up in the US before they concede anything. After the reciprocal tariff chaos and recurring false statements on “collecting billions and billions from the sellers” it is hard to have confidence in rational outcomes.

A few troubling "not facts” from the Time interview…

The interview in Time magazine (“100 days”) was not reassuring for progress on tariffs. We include a few quotes and comments that flag the recurring “fact” problem.

Trump: “I mean, you take a look at what's going on, and this is, we're taking in billions of dollars of tariffs, by the way. And just to go back to the past, I took in hundreds of billions of dollars of tariffs from China, and then when COVID came, I couldn't institute the full program, but I took in hundreds of billions, and we had no inflation.”

Our comment: False. Buyer pays the tariff. Fact.

Trump: “We took in billions of dollars, we had no inflation. Now, if you take a look, the price of groceries are down. The price of energy is down.”

Our comment: Same as the prior one on “buyer pays.” Do you notice he never mentions Putin invading Ukraine and sending the energy markets into shock in late Feb 2022? Back in late 1973, we had the Arab Oil Embargo. In 1979 the Iranian Oil crisis. Facts matter. Energy dislocations are major factors in US inflation spikes.

Trump: “And we had the highest inflation we've ever had as a country, or very close to it. And I believe it was the highest ever. Somebody said it's the highest in only 48 years. That's a lot, too, but I believe we had the highest inflation we've ever had. I've been here now for three months. And three months, we are taking in billions and billions of dollars from other countries that we never took in before. And that's just the start.”

Our comment: To quote Ronald Reagan: “There you go again.” On inflation being the highest ever, I guess he missed the Nixon/Ford years and Carter/Reagan CPI numbers (see Inflation: Events ‘R’ Us Timeline 10-6-22, UST Moves 1978-1982: The Inflation and Stagflation Years 10-18-23, The Inflation Explanation: The Easiest Answer 11-8-24).

The story vs. the reality will get proven in the marketplace...

There is a legitimate debate to have on how tariff costs are absorbed in the economy broadly and various subsector ecosystems. Those revolve around topics that are subjective and case specific:

Did the seller cut the price in part or in whole?

Did the buyer eat the expense and not pass it on?

Did the buyer pass it on in higher prices?

Did the buyer see a combination of those factors?

What is not true is that the “seller pays the tariff” or the “selling country pays the tariffs.” Tariffs are a border tax paid by the importer. Trump lost credibility on this topic back in 2018-2019. He does not help his case now by repeating what will soon be proven to be false in prices. His team has not been able to get him off this practice. He will always get his 30% to buy that story, but it is pure fiction.

The above chart updates the tech bellwethers with the asset lines in descending order of returns for the trailing 1-week. NASDAQ returns rang the bell at +6.7% even if still -4.8% for the trailing 1-month and -12.7% for 3-months. The trailing 1-month sees only Broadcom in positive range. For 3-months, we see all lines negative. For 6-months, we see 10 of 13 lines negative.

The 1-week UST deltas are broken out above as the UST curve showed some modest relief.

The above breaks out the YTD UST deltas with a bull steepener in evidence with the 2Y to 5Y showing the biggest move.

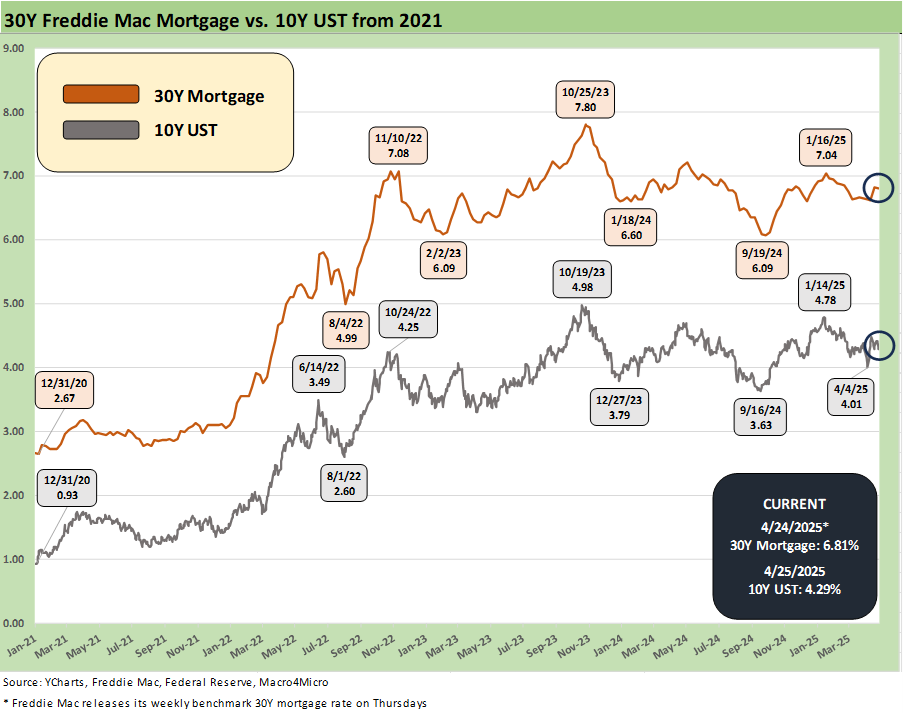

The above chart updates the rolling 10Y UST vs. the Freddie Mac 30Y mortgage benchmark. As we covered this past week, the housing market is limping along with existing home sales feeling it more than new home sales and starts (see Existing Home Sales March 2025: Inventory and Prices Higher, Sales Lower 4-24-25, New Home Sales March 2025: A Good News Sighting? 4-23-25).

The compression wave as detailed in the first chart at the top of this piece saw HY OAS move from +402 bps to +367 bps for a -35 bps tightening to levels well inside the long-term median as noted.

The “HY OAS minus IG OAS” quality spread differential is back in compression mode and moved from +291 bps to +263 bps, which is also well inside the long-term median.

We wrap with the “BB OAS minus BBB OAS” quality spread differential, and that tightened also from +119 bps to +102 bps. That is proportionately still a long way from the Feb 2025 low of +56 bps.

See also:

Existing Home Sales March 2025: Inventory and Prices Higher, Sales Lower 4-24-25

Durable Goods March 2025: Boeing Masking Some Mixed Results 4-24-25

Equipment Rentals: Pocket of Optimism? 4-24-25

Credit Snapshot: Herc Holdings (HRI) 4-23-25

New Home Sales March 2025: A Good News Sighting? 4-23-25

Footnotes & Flashbacks: Credit Markets 4-21-25

Footnotes & Flashbacks: State of Yields 4-20-25

Footnotes & Flashbacks: Asset Returns 4-20-25

Mini Market Lookback: The Powell Factor 4-19-25

Ships, Fees, Freight & Logistics Pain: More Inflation? 4-18-25

Home Starts Mar 2025: Weak Single Family Numbers 4-17-25

Credit Snapshot: Service Corp International (SCI) 4-16-25

Retail Sales Mar25: Last Hurrah? 4-16-25

Industrial Production Mar 2025: Capacity Utilization, Pregame 4-16-25

Credit Snapshot: Iron Mountain (IRM) 4-14-25

Mini Market Lookback: Trade’s Big Bang 4-12-25

Tariffs, Pauses, and Piling On: Helter Skelter 4-11-25

CPI March 2025: Fodder for Spin 4-10-25

Credit Snapshot: Avis Budget Group (CAR) 4-9-25

Payroll March 2025: Last Call for Good News? 4-4-25

Payrolls Mar 2025: Into the Weeds 4-4-25

Credit Snapshot: AutoNation (AN) 4-4-25