Credit Snapshot: Herc Holdings (HRI)

We summarize the credit fundamentals of Herc Holdings.

Credit Trend: Negative

Summary credit profile:

The “negative” credit trend we assigned comes with the asterisk of a pending strategic acquisition with a heavy debt component. Herc Holdings (HRI) is near closing on the acquisition of H&E Equipment Services (HEES) for $3.8 bn (excludes ~$1.4 bn HEES debt). The deal brings a material increase in HRI leverage but with a plan to deleverage to 3.0x within 2 years (see Herc Rentals: Swinging a Big Bat 2-18-25). When announced, the deal was 75% cash/25% stock.

HRI’s pre-merger balance sheet is solid for its rating tier with leverage at 2.5x. Pro forma for the HEES deal, the leverage number was initially estimated at 3.8x (before synergies). That is more in line with single B tier leverage, but HRI made their case with the agencies to hit the 3.0x line on a timeline. On the 1Q25 earnings call, pro forma leverage was cited as “just north of 3.5x” (we assumed that was with synergies). We view a BB tier unsecured rating as generous with the pro forma metrics. They will need to move quickly on leverage in an uncertain market.

EBITDA margins are high (44% area FY 2024), cash flow is resilient. and the favorable secular demand trends in leasing vs. owning equipment is a major positive factor. The discretionary nature of fleet capex is tied to shorter lead times to order fleet while a deep used equipment market allows HRI to adjust the fleet size and free up liquidity as needed. This translates into intrinsic financial flexibility that we always found attractive in this industry (see Credit Crib Note: Herc Rentals 12-6-24). Herc has migrated from B tier credit ratings to the BB range since its spin-off. The current unsecured composite bond rating for HRI is low BB for its $2 bn face value across two bonds ($1.2 bn 5.5% of July 2027, $800 mn of 6.625% of June 2029).

Relative value:

The inevitable HRI bond offerings to fund the HEES deal will set the bar on Herc bond relative value. The need to combine the acquisition funding with a material HEES debt refinancing could make for a major transaction. A healthy credit spread will be needed to clear what might be north of $4.5 bn in supply between ABL and bonds to fund the new money piece of the deal as well as the HEES debt refinancing.

Pricing will come down to how much HRI wants to term out in the bond market, the mix of layers (1L, 2L, unsecured), and where the economic cycle and HY risk pricing stands at midyear when the deal is expected to be completed. The HY backdrop is fluid to say the least. Another layer of liens would hit unsecured ratings. We would assume that this issuer profile with this mix of fundamentals would be very well received. HRI offers a distinctive set of favorable attributes in relative terms on the way into a period of extreme uncertainty for the cycle and capex budgets. There is no perfect comp since the equipment rental subsector has basically three major issuers (Ashtead in IG, URI as mixed IG/HY, and HRI in HY).

The attraction of HRI in the pending acquisition financing is that Herc has defensive credit attributes during a period of cyclical uncertainty and rising trade war risk. That will make it an attractive name on the menu to consider even if the stock market has a different set of metrics and considerations than credit. HRI sold off by over -8% after earnings on weaker margins and a cyclical outlook that remains biased toward the negative side.

The credit story has been very different than the equity volatility. Equipment rental as an industry is seen as a capex bellwether and was seeing very strong equity performance in 2024 (notably URI and HRI, Ashtead had some issues in later 2024). The equities of all three are selling off in 2025 vs. 2024 as cyclical proxies, but HRI stock has been materially weaker.

HRI equity reflects the fact that it will be heading into a leveraged deal where the assumptions used in beating the URI bid came before “Liberation Day” and it was partially equity financed (dilution). The irony of the aggressive tariff theories that are espoused by policy makers is that reshoring supports equipment rental but is seen as damaging to the economic cycle. As of now, the equipment rental equities are not buying the near-term reshoring theme.

Business risk:

We see the equipment leasing business risk as low with some wild cycles and “real world stress testing” in the new millennium to support that view. HRI is the #3 player behind United Rentals (see Credit Crib Note: United Rentals 11-14-24) and Ashtead (see Credit Crib Note: Ashtead Group plc 11-21-24). HRI has accelerated its operational evolution since the 2016 spin-off from Hertz (technically the car rental unit was spun off but not for accounting purposes), and now HRI is making an effort to close the gap with the leaders. Equipment rental shareholders reward growth, so the HEES deal was crucial for HRI if it was to see multiple expansion in its equity valuation while reaping the benefits of a broader mix of fleet equipment types, customers, and geographic breadth.

Tariffs:

Herc downplays the threat of tariffs since a significant majority of equipment is domestically sourced. Despite that, they highlight that local customer accounts are feeling cyclical anxiety and are under pressure tied to trade war threats. Large national accounts and those with mega-project or infrastructure exposure still have good prospects. Reshoring (semis, tech, pharma, manufacturing, etc.) is a wildcard.

More mix shifts could play out with tariff and budgeting uncertainties. The big ticket customer markets (LNG, semis, data centers, clean energy, and EVs) are mixed, but the overall demand side still promises “more” even if some face setbacks (e.g. EVs). Managing fleet scale and pricing is the challenge. We would flag the indirect tariff exposure of equipment costs since HRI suppliers also have supplier chains with tariff-related cost pressure (e.g. components, steel, aluminum, and eventually copper). Among mitigating factors is that equipment leasing companies will still prove to be a cost-effective way to meet customer equipment needs.

Profitability:

With the 1Q25 report, HRI affirmed its guidance for +4% to +6% rental revenue growth and just over $1.6 bn (midpoint) adjusted EBITDA. United Rentals also reaffirmed its guidance the next day, so that shows optimism from their extensive branch system and sales team intel. Record equipment rental revenue in 4Q24 (+12%) and FY 2024 (+11%) came with +15% adjusted EBITDA growth in 4Q24 and +9% in FY 2024. Favorable pricing and volume variances in 4Q24 and FY 2024 were partially offset by an unfavorable mix. The $194 mn “loss on asset held for sale” in 2024 is part of the protracted process of selling the Cinelease operation (studio equipment/grips, etc.) and marking it to net realizable value after the strike damage and the changing business models in that space. Rental EBITDA (“REBITDA”) has its own set of metrics as detailed in the chart below.

The 1Q25 period is the seasonally slow quarter and includes some HEES deal costs of $74 mn (including URI termination fee). Rental revenue rose slightly by +2.8%. The earning asset base rose with fleet Original Equipment Cost (OEC) higher YoY. Rates improved but mix was unfavorable. OEC declined sequentially. Adjusted EBITDA margins compressed modestly to 40.0% (ex-Cinelease) in 1Q25 from 42.5% in 1Q24.

National accounts and megaprojects are performing well at ~47% of revenue, but local accounts at ~53% of revenue are feeling cyclical pressure. HRI offers detailed quarterly presentation materials, and the slides highlight favorable growth expectations in nonresidential, mega project starts, and infrastructure with industrial spending potentially past peak and seeing more downside. The usual checklist such as data centers, LNG, and infrastructure get cited as favorable. The diversity of end markets allows flexibility in deployment of earning assets and fleet mix realignment. That supports credit quality.

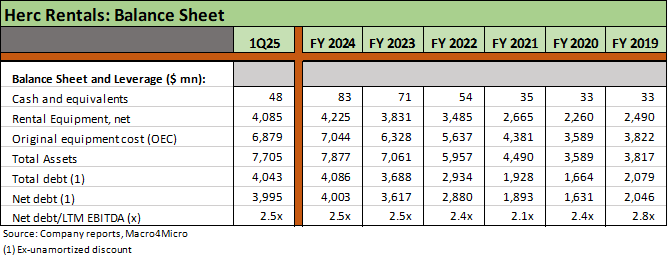

Balance sheet:

HRI has migrated from its past reliance on 2L bonds to unsecured refinancing with its 2027 and 2029 bonds. ABL funding in the equipment leasing space is well established and easily arranged. The secured ABL facility is $3.5 bn (subject to borrowing base, matures July 2027) at 1Q25 while the Accounts Receivable facility of $400 mn was extended to Aug 2025. The ABL had $1.85 bn of borrowing availability at 1Q25 and the AR facility $41 mn. HRI has a leverage target range of 2.5x to 3.0x. Leverage will cross well above that range with the HEES deal. HRI has committed HEES acquisition financing.

The free cash flow strengths in equipment leasing companies extend to HRI with high margins, capex resilience and numerous alternatives to stabilize credit quality across a range of economic backdrops. Unlike URI, the next stage of its growth plan requires HRI to focus on the integration of HEES, debt reduction, and a healthy mix of replacement capex. That is, the room will not be there for share buybacks in contrast to its big two peers (URI, Ashtead). Despite being the oldest operators of the peer group, HRI is in a different stage of development than URI and Ashtead and has a long way to go before it can boast a wide range of free cash flow alternatives. First it had to escape Hertz, which it did in mid-2016.

SELECT CHARTS

Margins face some pressure and are below peers.

Balance sheet trends will soon look a lot different with H&E acquisition funding.

Equipment rental is all about capex and M&A with buybacks not a factor at Herc.