Mini Market Lookback: The Powell Factor

The holiday-shortened rally week saw fresh attacks on Powell by Trump and more trade actions against China on port fees.

Two deep-thinking emerging market leaders pondering currencies and monetary theory.

Trump went off the rails on Fed Chair Powell again for having the audacity to cite inflation risk as a potential side-effect of Trump’s massive, sweeping and chaotic tariffs. Powell also recognized a challenging balancing act across the dual mandate of jobs and inflation with the risk that they go in irreconcilable directions, i.e. stagflation risk exists.

With payrolls essentially at full employment levels, Powell would be negligent to ease without a read on the tariff impacts on pricing, which are only now rolling into transaction level effect.

An attempted seizure of direct Fed control by Trump would signal an aggressive authoritarian move beyond just fed fund rates and constitute a grab for more direct intervention in bank lending practices that could trigger systemic worries and a bigger concern around long rates and the USD.

If Trump does pull a subjugation move on the Fed, bank lending practices could be weaponized along with tariffs and lending rules to reel in even more economic sectors under his control along with broader swaths of the investment community in the counterparty ranks. The IRS has already been aimed at elite educational institutions (e.g. Harvard), so it is a fair question to ask “What is next?” Tariffs have already cowed the corporate C Suite. Would lending to climate initiatives or minority businesses be politically targeted (DEI Derangement Syndrome)? Political enemies? “You can’t make this sh*t up” doesn’t apply because we’re already seeing it.

The ghosts of Burns and Miller (the stagflationary pre-Volcker years) will haunt the Fed in the next few months (see Fed Funds vs. PCE Inflation: Peaks and Valleys Across Time 2-7-24), FOMC: Hail Powell the Consistent 3-20-24). As the 90-day pause ticks off, we will see even more tariffs get announced (pharma, semis, more tech, lumber, copper) and more retaliation will inevitably arrive as Trump attacks trade partners. At some point, the trade partners run out of excuses not to act (see Ships, Fees, Freight & Logistics Pain: More Inflation? 4-18-25).

The above chart updates the credit spread deltas for 1-week and 1-month across IG and HY and from the BBB to CCC tiers. As in equities, the credit markets saw a rally week in the absence of horrible news. 1Q25 earnings season has been mixed but banks offered some support on current conditions in consumer spending and asset risks even if the real story lies ahead.

The major banks wrapped up a good earnings season with the biggest players feasting on the volatility. The 1Q25 period will be the last quarter where transactions were in minimal tariff mode while 2Q25 will be feeling the tariffs at sea level with the burden fully in the numbers for “buyer pays” pain in 3Q25 and 4Q25. The pauses and some temporary exceptions along the way have fed some relief rallies, but the worst lies ahead on the tariffs already announced and a lot more ahead that border on tectonic (notably semis and pharma).

More China retaliation is a certainty and the port fees this past week did not help (see Ships, Fees, Freight & Logistics Pain: More Inflation? 4-18-25). Pharma tariffs will be a major “throw-down” with the EU, and that could be the move that brings in Tech Services retaliation and the Anti-Coercion Instrument (Mini Market Lookback: Fed Gut Check, Tariff Reflux 3-22-25). On pharma trade, we cut and paste a line from our port fee commentary:

Dr. Scott Gottlieb (Pfizer board, Former FDA Commissioner, and leading expert) was on CNBC the other day delivering a scary set of scenarios around how China could disrupt the supply of intermediates in a materially damaging way to supply-demand and price trends and notably in generic drugs. That is not a new war game scenario, but that would most definitely be highly inflationary for the health care commodities line of CPI.

That all lies ahead. There is a long tough road of negotiations and battles to come.

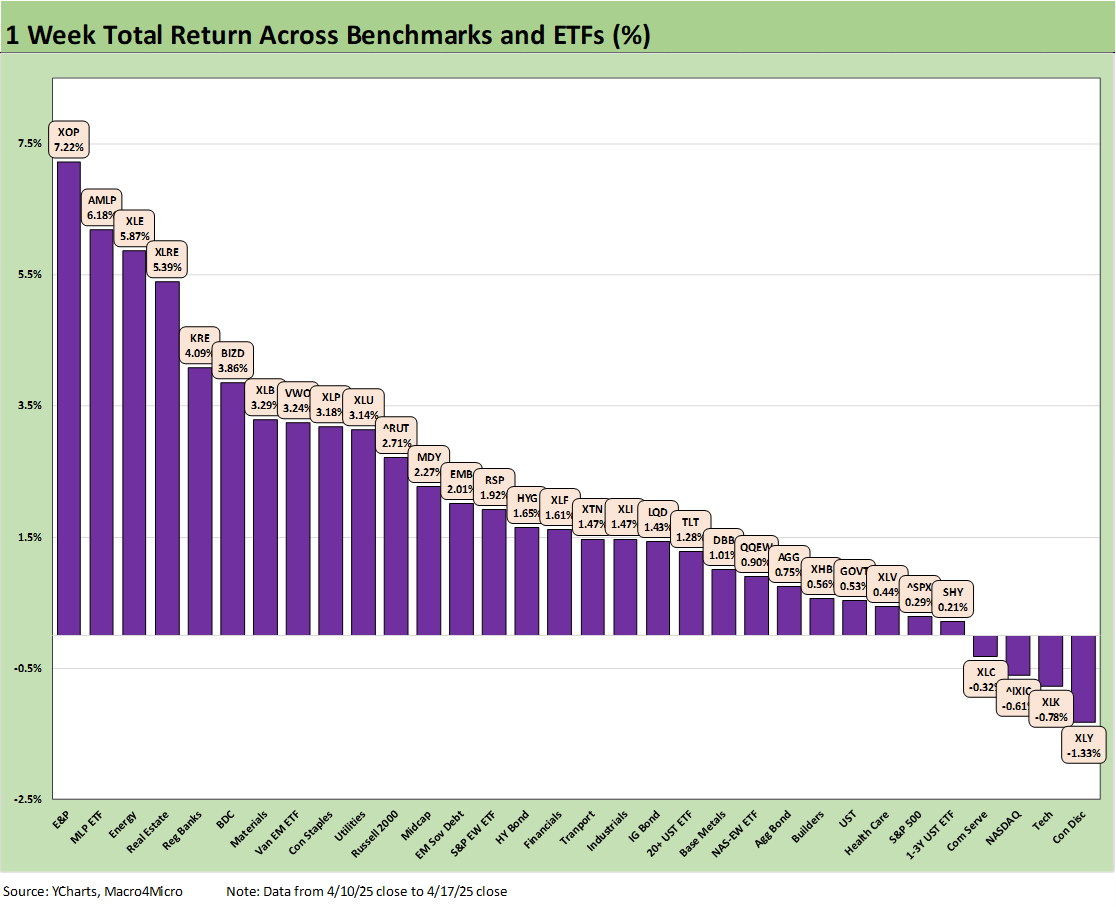

NOTE: The above chart is for 4/10/25 to 4/17/25 for the 1-Week increment. We will also include the shortened week (4/11-4/17) in full Footnotes Asset Returns commentary to be posted tomorrow. The equity markets had a rougher time when narrowing returns to just the four days of the shortened holiday week.

The 1-week score of 28-4 was a respite from a lot of recent trailing return pain. Energy got a nice rally this week after some beatdowns of late (see Footnotes & Flashbacks: Asset Returns 4-12-25). Regional Banks (KRE) and Real Estate (XLRE) mounted a comeback and the income-heavy Midstream Energy ETF (AMLP) and high dividend BDC ETF (BIZD) were back in the upper tier.

We see 4 of the Mag 7 or tech-heavy benchmarks in negative range with so much confusion being sowed around what the plan will be for semis and various tech. Bond ETFs were spread around the 2nd, 3rd, and bottom quartile.

We will update more time horizons in our Weekly Footnotes on asset returns to be published later this weekend.

The above chart updates the tech bellwethers, and we see a diverging performance for the week. The trailing 1-month, 3-months, and 6-months horizons are still grim.

The above chart shows a rally week for the UST deltas and notably from 2Y to 10Y. The 5Y UST had the biggest move at -20 bps.

The above chart updates the YTD UST deltas. The 2Y to 5Y shift leads the way on the bull steepener YTD.

The above chart updates the 10Y UST vs. the Freddie Mac 30Y mortgage benchmark with the Freddie 30Y rising to 6.83% this week from 6.62% last week (the benchmark is posted at noon on Thursdays.) We should highlight that a broader range of mortgage benchmarks since last Friday actually ticked lower with all the recent UST volatility.

The above chart shows another week of HY OAS compression after HY ended last week on Friday at +426 bps vs. +402 bps on this week’s Thursday close.

The “HY OAS minus IG OAS” quality spread differential narrowed from +308 bps last Friday to +291 bps Thursday during the holiday-shortened week.

The “BB OAS minus BBB OAS” quality spread differential narrowed to +119 bps from +132 bps last Friday. That differential has still more than doubled off the Feb 2025 lows.

See also:

Ships, Fees, Freight & Logistics Pain: More Inflation? 4-18-25

Home Starts Mar 2025: Weak Single Family Numbers 4-17-25

Credit Snapshot: Service Corp International (SCI) 4-16-25

Retail Sales Mar25: Last Hurrah? 4-16-25

Industrial Production Mar 2025: Capacity Utilization, Pregame 4-16-25

Credit Snapshot: Iron Mountain (IRM) 4-14-25

Footnotes & Flashbacks: Credit Markets 4-13-25

Footnotes & Flashbacks: State of Yields 4-13-25

Footnotes & Flashbacks: Asset Returns 4-12-25

Mini Market Lookback: Trade’s Big Bang 4-12-25

Tariffs, Pauses, and Piling On: Helter Skelter 4-11-25

CPI March 2025: Fodder for Spin 4-10-25

Credit Snapshot: Avis Budget Group (CAR) 4-9-25

Payroll March 2025: Last Call for Good News? 4-4-25

Payrolls Mar 2025: Into the Weeds 4-4-25

Credit Snapshot: AutoNation (AN) 4-4-25