Durable Goods March 2025: Boeing Masking Some Mixed Results

Surging Boeing orders in March warped the headline number but core demand lacks momentum.

Net new Boeing aircraft orders of 163 in March led to a +27.0% increase in Transport equipment and a +9.2% headline number for the month.

Looking down below the headline, the ex-Transport Orders number is flat this month ahead of further broad tariff implementation. The biggest drag on the month was Computers and Electronic Products at -1.2% which are squarely in the US-China trade crosshairs.

The stagnation comes ahead of uncertainty from the rapidly changing cost environment that is challenging capex planning. As the tariff policy continues to (d)evolve, incremental spending and capex could get pared back to maintenance levels in aggregate even if there is clearly growth in some industry groups and others underinvesting.

The above chart covers the monthly changes in Durable Orders which include a third outsized spike in 2 years driven by aircraft. Boeing again reminds us of its status as an 800-pound gorilla by leading the +9.2% MoM change. This outlier increase mirrors the last previous 9%+ month in July 2024 with on a Boeing aircraft order driven surge.

While 2025 has begun with three consecutive positive durable goods orders prints, the likelihood of further growth diminishes as tariff uncertainty derails planning for many potential buyers. There will be more whipsaws on the back of aircraft results, but the chaos of shifting tariff costs and supply chain negotiations could lead to heightened uncertainty and a marginal pullback in core capex. That is a logical outcome with tariff retaliation hard to gauge and policies inconsistent and undermining capital budgeting reliability.

We expect demand overall to soften in the coming months and like most it is hard to see a viable exit strategy for the Trump Tariff regime with such a high starting point. What Trump finds reasonable in the current “stacked” tariff strategy is likely to still be seen as outrageous to many trade partners even if the opening demand is cut in half. The lack of a deal with Japan is a setback and overnight China denied that there is any discussion on a trade deal at all while demanding that the current unilateral tariffs be rescinded.

As we look forward to the next few months, clarity around the real impacts of tariffs and adjustments to supply chains will work their way into the numbers here. The erratic shifts and changes lend themselves to a “wait and see” approach where possible as the whims of Trump trade policy do not mesh with multi-year budget planning. We saw that strategy already tested in 2018-19, but this time it is a much larger scale.

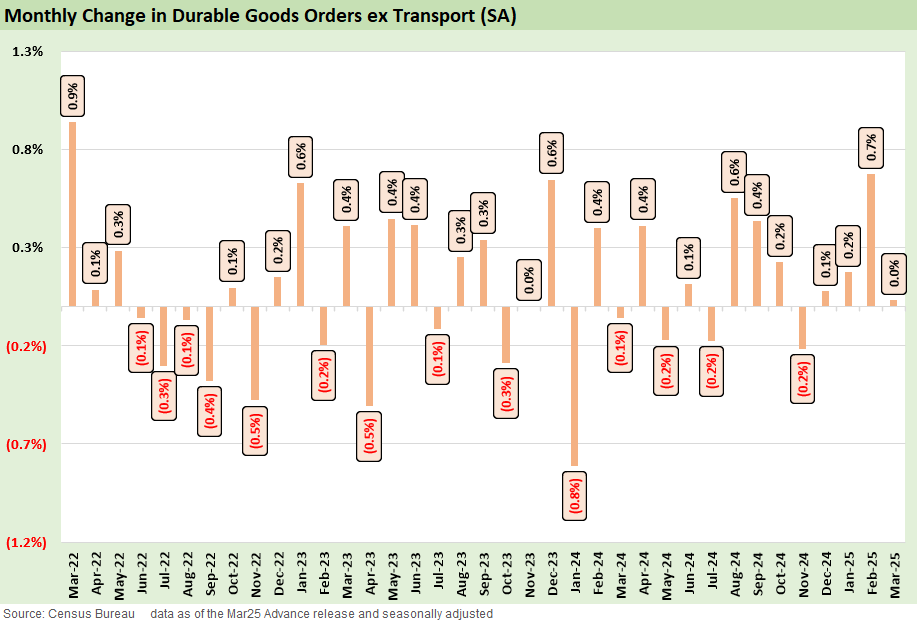

We include the chart above where the missing transport line has a particularly outsized effect on the numbers. Stripping out the transport sector reveals how concentrated the strength was this month with +9.2% headline print disappearing to 0% ex-transport. Where last month’s numbers lent themselves to some pull-forward given the telegraphing of trade policy shake up coming into the year, this one reflects where some of that may have occurred. The window of opportunity for pre-ordering and inventory building has passed and we await what color is given amidst this earning’s season as they tip-toe around anything Trump can target in a Truth Social post.

The above table frames the underlying details and the key ‘ex-defense’ and ‘ex-transport’ cuts. The Transport line at +27.0% and related 139.0% increase in Nondefense Aircraft and Parts are eye-catching when scanning the lines. Boeing reported 192 gross orders in March with 29 cancellations, netting 163 orders. Though promising, that is now set against escalating US-China trade tensions where China has ordered its airlines to suspend deliveries of Boeing jets.

Below the transport lines is where the rest of the story lies, and where we saw an increase in activity this month. Only the Primary metals line saw continued order demand growth in March. The flat ‘ex-Transport’ results are largely driven by -1.2% in Computers and Electronic Products and smaller reductions of -0.5% from the Electric Equipment line. Spending limits and cutbacks from government agencies contributed to this pullback and drove some of the action in March. However, these lines will continue to be in focus given the exposure to any supply chain disruptions as was already experienced across COVID.

See also:

Equipment Rentals: Pockets of Optimism? 4-24-25

Credit Snapshot: Herc Holdings (HRI) 4-23-25

Footnotes & Flashbacks: Credit Markets 4-21-25

Footnotes & Flashbacks: State of Yields 4-20-25

Footnotes & Flashbacks: Asset Returns 4-20-25

Mini Market Lookback: The Powell Factor 4-19-25

Ships, Fees, Freight & Logistics Pain: More Inflation? 4-18-25

Home Starts Mar 2025: Weak Single Family Numbers 4-17-25

Credit Snapshot: Service Corp International (SCI) 4-16-25

Retail Sales Mar25: Last Hurrah? 4-16-25

Industrial Production Mar 2025: Capacity Utilization, Pregame 4-16-25

Credit Snapshot: Iron Mountain (IRM) 4-14-25

Mini Market Lookback: Trade’s Big Bang 4-12-25

Tariffs, Pauses, and Piling On: Helter Skelter 4-11-25

CPI March 2025: Fodder for Spin 4-10-25

Credit Snapshot: Avis Budget Group (CAR) 4-9-25

Payroll March 2025: Last Call for Good News? 4-4-25

Payrolls Mar 2025: Into the Weeds 4-4-25

Credit Snapshot: AutoNation (AN) 4-4-25

JOLTS Feb 2025: The Test Starts in 2Q25 4-2-25

Credit Snapshot: United Rentals (URI) 4-1-25