Footnotes & Flashbacks: State of Yields 4-27-25

Yields had a favorable move for duration, but it was a quiet week on tariffs other than Trump and Xi not reading the same fact sheet.

“I hear ya, let’s keep him dangling. He can just make stuff up.”

The UST curve posted a modest rally for the week with a very big macro release stretch ahead (PCE, 1Q25 GDP, JOLTS/payroll and more) while the earnings flood picks up with more Mag 7 and a rush of bellwethers including GM and UPS among cyclical indicators.

The major negotiations in play run from Russia-Ukraine (and a potential flood of oil onto the markets) to the US-China trade war (and the potential for supply chain meltdowns and inventory shortages). As important as they are for the UST curve and systemic macro trends, no one quite seems to know where the process on these pivotal talks stand.

Tariffs remain by far the biggest topic as Trump scrambles to give the market confidence and Xi lets him twist in the wind and waits for some inflation setbacks in the US and more confirmation of macro weakness as some tariffs finally start to hit the April numbers in the May release dates.

The above chart plots some key cyclical transition periods from the Carter inversion of 1978 across the Volcker years, the credit cycle peak in 1989, the TMT cycle in 2000, and the housing bubble in 2006. We then jump beyond the crisis period and the ZIRP years with the QE and normalization distortions to the Oct 2023 UST peak date on the 10Y UST. The UST rates now are very low by any historical standard but well off the Sept 2024 lows.

In his “100 Days” Time Magazine interview, Trump was citing how bad the US inflation cycle was in 2022 and how it was the highest of any in US history. Away from being completely wrong on the facts around inflation (see Inflation: Events ‘R’ Us Timeline 10-6-22, UST Moves 1978-1982: The Inflation and Stagflation Years 10-18-23, The Inflation Explanation: The Easiest Answer 11-8-24), he made the mistake of repeating more than a few times how the selling country pays the tariffs (see Mini Market Lookback: Earnings Season Painkiller 4-26-25).

Trump probably should take a peek at the UST curve whipsaw of 1980 above and the stagflation pain of the 1980-1982 double dip. The 2022 inflation cycle did not even have a recession or setbacks on the PCE line with strong payrolls and sustained consumption levels. What the market remains worried about now is that 1980 UST curve above. Inflation is death to a President’s reelection chances (ask Ford, Carter, and now Biden). That was the main reason for Biden not to run regardless of age. He was trying to buck history even if he was a decathlete in the Master’s Division.

Trump needs to get the joke that his potential stagflation threat is far greater than Biden’s inflation threat. Just look back to the stagflation double dip and the UST curve above. We don’t see that scenario playing out, but the tariff and systemic US debt levels and ongoing deficit problem is doing a good job of keeping the fear alive. An upper single digit inflation and unemployment rate cannot be ruled out.

At the very least, Trump should already know where inflation was in past cycles and where UST rates were at prior peaks if he is going to attempt to talk about the past. Higher education tends to allow that study to take place early and often. Maybe the elite schools he’s attacking can provide some tutors.

The above replays our weekly chart detailing the migration of the UST curve from 12-31-21 with a memory boxes detailing the tightening dates and magnitude and more recently the easing. The UST curve seems to intermittently mix bear steepening patterns and flattening rallies since the Sept 2024 lows, but fear is creeping into the shapeshifting at this point.

We had another rally this past week but there are some important numbers coming up as noted earlier and the tariff talks could not be more critical. The next few CPI and PCE releases will settle the tariff argument on inflation while the jobs and growth numbers will answer some cyclical questions. It could be a rough summer.

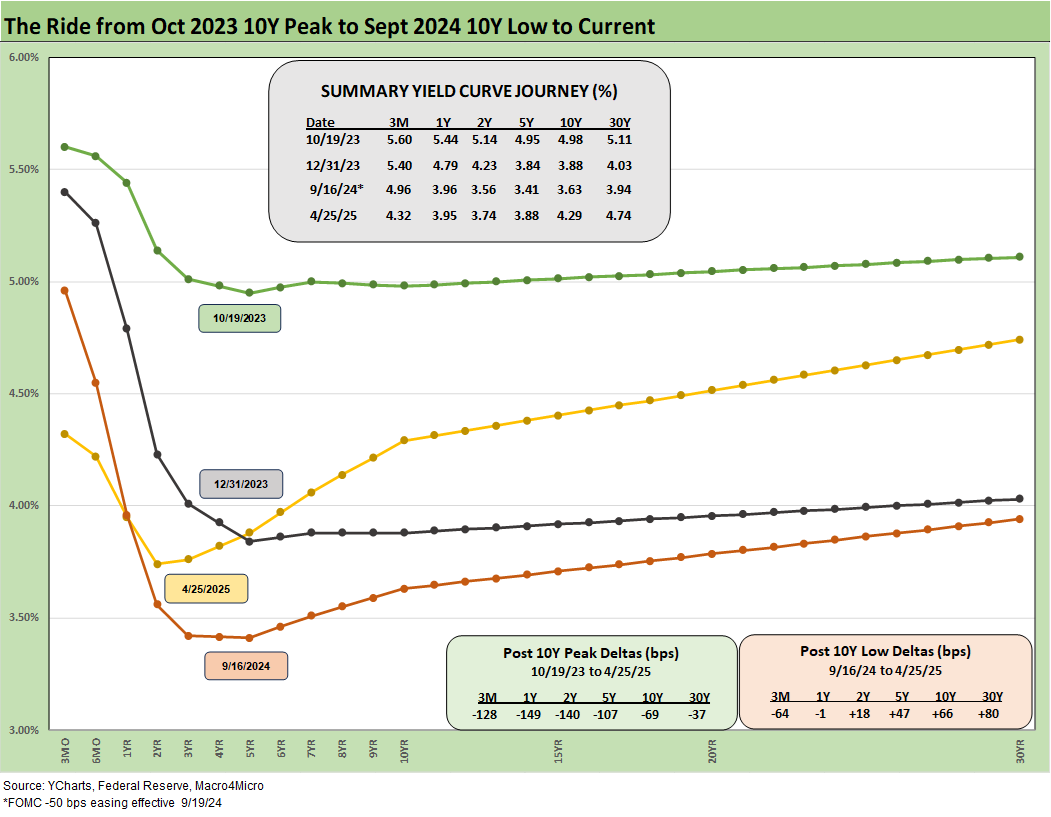

The above chart details the material move from the peak UST curve of 10-19-23 down into the UST bull rally of Nov-Dec 2023 and then eventually into the lows of Sept 2024. The Sept 2024 low tick only came after a bear steepener hit the curve through the summer of 2024. We then moved back into the bear steepener mode until the tariffs roiled the UST markets and initially sent 2Y to 30Y lower on cyclical fears.

Rate volatility moved materially higher with the tariffs and the policies sent the markets into fresh debates on UST supply-demand running alongside nerves around dollar weakness in the global market (see Footnotes & Flashbacks: State of Yields 4-13-25). The ensuing chaos and UST and USD volatility drove a Trump reciprocal tariff pause.

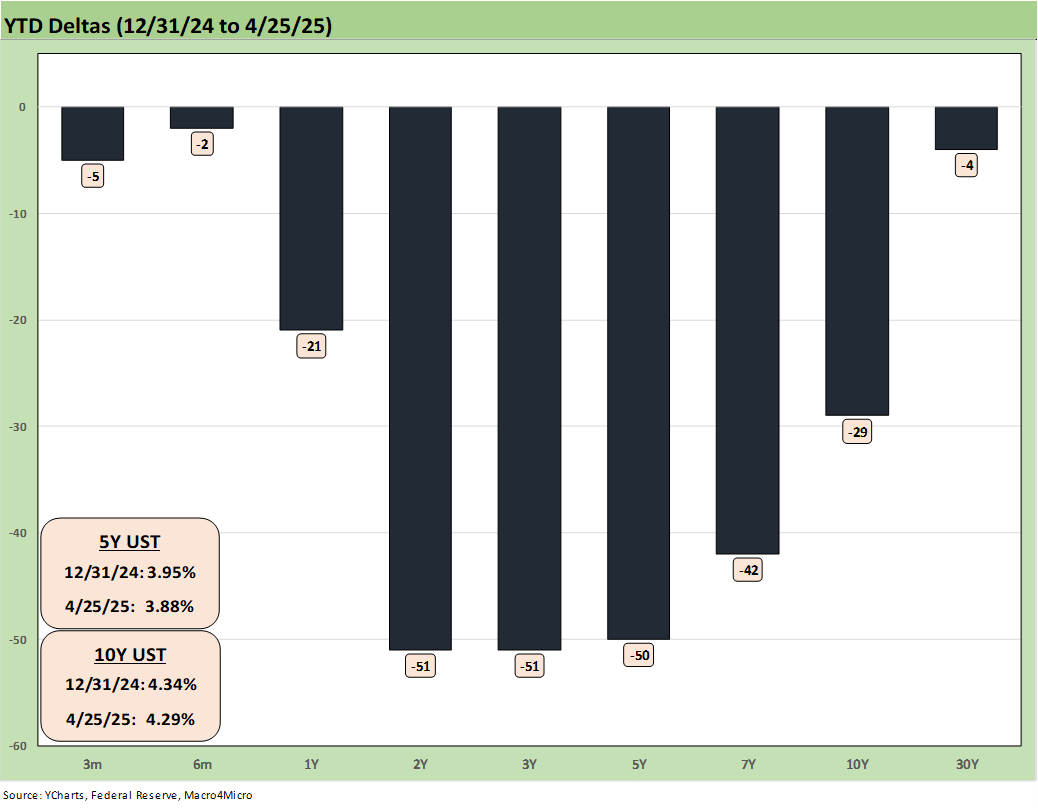

The above chart updates the UST weekly deltas as the 2Y to 30Y posted a modest rally. The catalysts for a fresh move this coming week will be PCE and Payrolls as well as the 1Q25 GDP advance estimate. Tariff headlines could get generated by Trump or any trade partners at any time. The fact that Bessent indicated on Sunday that he did not know if Trump had spoken with Xi is less a sign of incompetence and more one of confirmation that Trump has not spoken with Xi. Bessent could not in substance call his boss a liar.

The most recent action on US-China tariffs was the port fees levied against China, which begs a China response (see Ships, Fees, Freight & Logistics Pain: More Inflation? 4-18-25). There is a lot of action still ahead in tariffs, and retaliation risk remains daunting.

We have a major wave of Mag 7 earnings reports teed up across a range of bellwether names (Meta, Microsoft, Apple, and Amazon). In addition, we have a number of energy/chem releases and across pharma, diversified industrials, freight (notably UPS), and insurance. We also will hear from GM, which should be an interesting Q&A on tariffs given their massive Mexico exposure and material Canada risks.

The above chart updates the YTD bull steepener with the 2Y to 10Y supporting duration even if recent volatility and the inevitable upward pressure on goods prices is on its way as we wade further into the tariff transaction cycle.

The post-Sept 2024 bear steepener is broken out above. The pressure of the FOMC to ease needs a bad jobs report at the very least to even allow FOMC to navigate toward the other side of the dual mandate. JOLTS and payroll this week thus loom large.

The inflation side of the Fed mandate vs. the payroll threat is turning into a bit of a game with Trump the only one playing. He wants support from Powell before the market sees that tariffs actually do cause price increases and lower earnings. If Powell moves too early, Trump will get amnesia and blame him anyway for “moving too late.”

Same old blame deflection.

That makes for a tough job for Powell, but the clock is ticking on tariffs, and those are not tariffs set by the FOMC. If trade deals break down, there will be no “dot plot” from the White House handicapping inflation. After all, Trump says “the seller pays” as he clearly stated in his Time Magazine interview (see Mini Market Lookback: Earnings Season Painkiller 4-26-25).

The above chart updates the mixed steepener since the end of 2023 through today with a big rally on the front end and more restrained modest upward move in rates beyond 5Y. The end of 2023 had seen an impressive rally of the UST curve and combined duration and credit risk home run in Nov-Dec 2023 as detailed often in past commentaries. The longer end of the UST curve has been stubborn as the crow flies despite the fall 2024 rally.

The above chart breaks out the running UST deltas since the peak date of the 10Y UST (10-19-23). Wiping out that 10Y UST delta of -69 bps since the peak in Oct 2023 would take some bad news on inflation or a more sustained erosion of confidence in the US macro picture (weak dollar, erosions of buyers, net sellers of UST, etc.). The weaker dollar is not helping any more than the record deficits and soaring interest bill and UST supply needs.

The above chart updates the UST curve for this past Friday and the Freddie Mac 30Y Mortgage benchmark rate (noon Thursday release). We include two useful historical periods including the peak homebuilder year end of 2005 and mid-2006 when RMBS quality concerns were catching headlines as the housing bubble was peaking. We post UST curves for each period in the chart. The past week was 6.81% for Freddie’s noon Thursday pricing.

We recently added a column detailing the differential between the Freddie Mac 30Y and the 10Y UST. That differential moved higher this week to +252 bps. The year 2005 at a differential of +100 bps makes a statement on what the mortgage market was like in 2005 in terms of how “hot” (i.e. excessive and risk blind) it was during that homebuilding peak year.

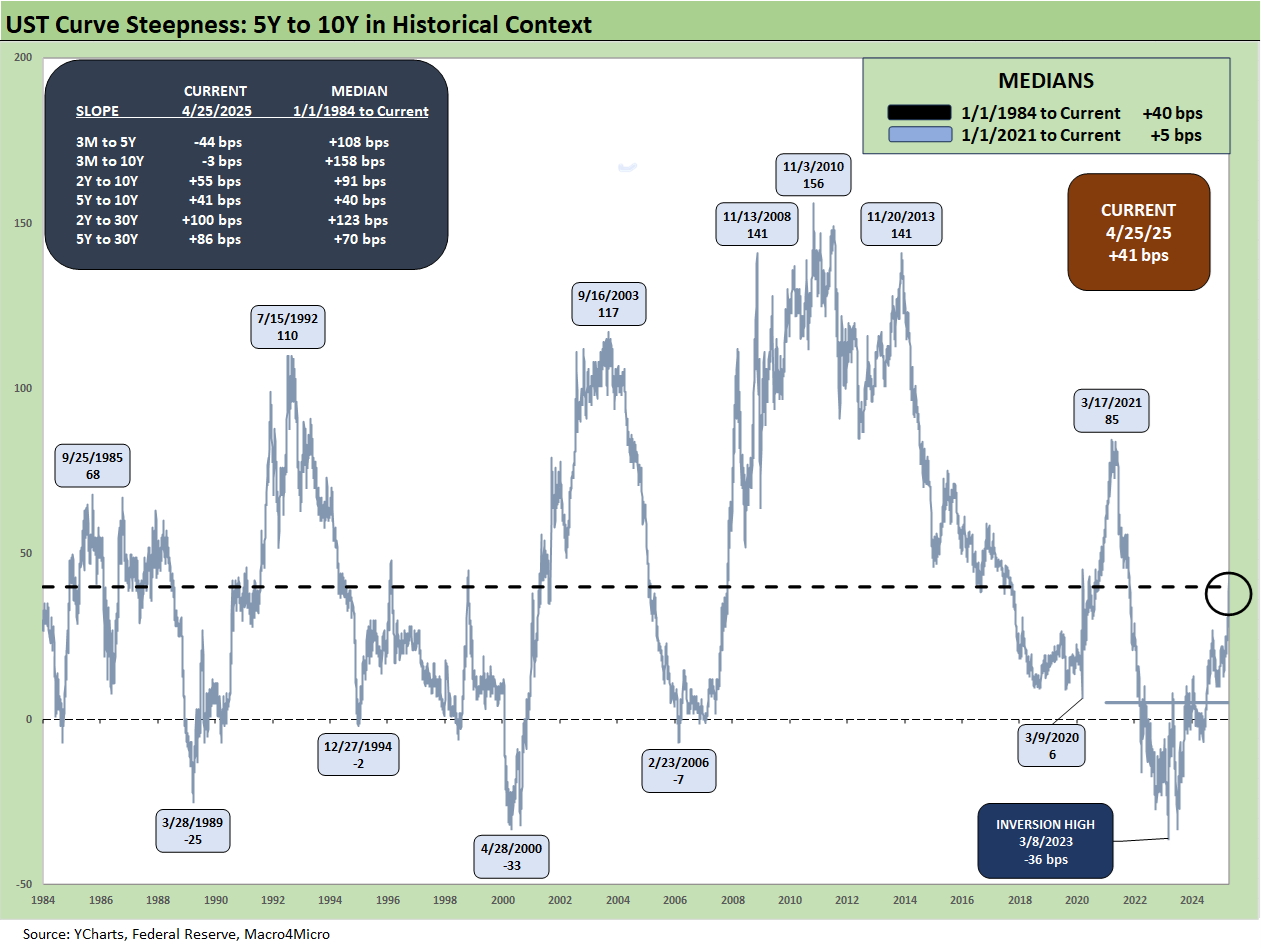

The above time series updates the 5Y-10Y UST slope since 1984. The upward slope of +41 bps is right in line with the long-term median of +40 bps. In other words, there is a rational term premium in the UST market from the mid to long end. We also see that in the 5Y to 30Y.

The above chart shortens up the 5Y-10Y timeline to a start date in early 2021 during ZIRP ahead of the sharp steepening to +85 bps in March 2021. With the tightening cycle starting in March 2022, we see the peak inversion of -36 bps in March 2023.

We wrap this week’s State of Yields with an update of the running UST deltas since March 1, 2022 just ahead of the end of ZIRP (effective 3-17-22). We include the 12-31-20 UST curve and 10-19-23 peak UST curve as frames of reference.

See also:

Footnotes & Flashbacks: Asset Returns 4-27-25

Mini Market Lookback: Earnings Season Painkiller 4-26-25

Existing Home Sales March 2025: Inventory and Prices Higher, Sales Lower 4-24-25

Durable Goods March 2025: Boeing Masking Some Mixed Results 4-24-25

Equipment Rentals: Pocket of Optimism? 4-24-25

Credit Snapshot: Herc Holdings (HRI) 4-23-25

New Home Sales March 2025: A Good News Sighting? 4-23-25

Footnotes & Flashbacks: Credit Markets 4-21-25

Footnotes & Flashbacks: State of Yields 4-20-25

Footnotes & Flashbacks: Asset Returns 4-20-25

Mini Market Lookback: The Powell Factor 4-19-25

Ships, Fees, Freight & Logistics Pain: More Inflation? 4-18-25

Home Starts Mar 2025: Weak Single Family Numbers 4-17-25

Credit Snapshot: Service Corp International (SCI) 4-16-25

Retail Sales Mar25: Last Hurrah? 4-16-25

Industrial Production Mar 2025: Capacity Utilization, Pregame 4-16-25

Credit Snapshot: Iron Mountain (IRM) 4-14-25

Mini Market Lookback: Trade’s Big Bang 4-12-25

Tariffs, Pauses, and Piling On: Helter Skelter 4-11-25

CPI March 2025: Fodder for Spin 4-10-25

Credit Snapshot: Avis Budget Group (CAR) 4-9-25

Payroll March 2025: Last Call for Good News? 4-4-25

Payrolls Mar 2025: Into the Weeds 4-4-25

Credit Snapshot: AutoNation (AN) 4-4-25