Industrial Production: Capacity Utilization Soft, Comparability Impaired

We look at Industrial Production and how it flows through to Capacity Utilization with a Boeing strike and hurricanes. Not pretty.

A major Boeing strike flows into thousands of suppliers…

While we are not expecting much strength in manufacturing sector metrics any time soon, this latest round of headline data has the Boeing strike and two hurricanes to keep the pressure on and add the twist of “impaired comparability.”

The Fed flagged a negative variance for Industrial Production of -0.6% for the combination of the Boeing strike and the hurricanes with -0.3% for each as Industrial 1production continues to struggle.

For Manufacturing capacity utilization, the sequential decline of -0.4% to 76.7% is just below the 3Q24 average and -1.6 points below the long-term average from 1972-2023.

We see Durables capacity utilization off by -0.8% sequentially but Nondurables was flat at 78.8% with Utilities higher and Mining lower.

The manufacturing challenge has been a recurring theme and the recent events from outside “normal” cyclical dynamics only made the situation worse with Boeing and its massive supplier chain and brutal hurricanes. We are down from the 80.0% peak in April 2022 as tightening was kicking into gear. How “normal” such frequent hurricanes hitting land will be from here is not a light debate.

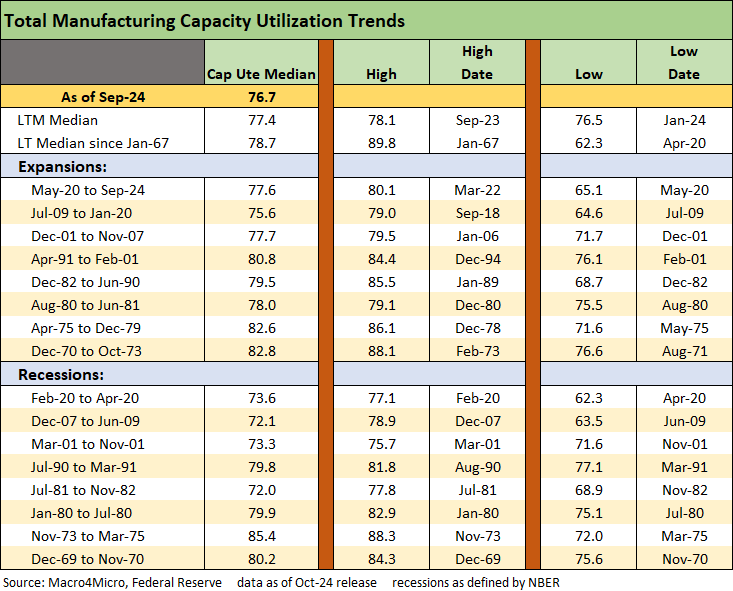

We show the long-term median for select time horizons within the box in the chart, and the current 76.7% is running below all the medians except for July 2009 (recession ended June 2009) through Jan 2020 with its median cap ute of 75.6%. Thay July 2009 to Jan 2020 period was part of the longest expansion in history but one that had a very slow, steep climb back in recovery to normalcy in the immediate post-crisis years on the way to the COVID crisis, which saw another collapse ahead of a rebound.

The above chart details the broader sector and subsector trends as Total Industry capacity utilization ticked lower along with Total Manufacturing. Total Durables was lower as it declined to 74.5% from 75.3%. Mining at 88.7% was down from 89.1%. Utilities cap ute rose to 71.2% from 70.9%. There will be no shortage of attention on the power grid and capex and project planning in 2025. Mining is comfortably above its long-term average while Utilities are materially below.

The above chart flags the largest of the manufacturing sectors as a frame of reference. For the lines we track in the largest Manufacturing sectors, we see all 7 lower sequentially.

We see Aerospace down to 66.3%, which is below the 2009 low of 72.0% as Boeing and its supplier chain have had a very rough go after so many disruptions, groundings, program delays, and now a strike. The problems are nowhere near over with Boeing reporting earnings next week and in the midst of a period of soaring debt and a need to issue equity while a strike unfolds. Strikes do not relieve Boeing from paying its supplier bills, so the cash flow pressure requires more credit lines and more equity issuance.

The above chart plots the capacity utilization levels for the expansions and recessions going back across the cycles. The most recent cap ute level for Sept 2024 is plotted on the left at 76.7%. As we cover after the next slide, the context of profitability, pricing, product mix, and cost structures all come into play in interpreting what the trends mean in aggregate and for select subsectors and industries.

The above table offers a more complete set of numbers on the capacity utilization metrics across the expansions and recessions. As we cover in many past commentaries, the issue of pricing power flow out of the cap ute levels since high utilization implies pricing power.

On the issue of breakeven volumes for a given price structure and product mix, the leaning of the manufacturing chain since the credit crisis and across years of supplier chain evolution lowered unit costs. The topic du jour (and every “jour” from now until the election) is the impact of tariffs and protectionism.

Tariffs bring a likely effect among many: higher costs and lower breakeven volumes for many companies and even for those that buy onshore as pricing power is increased domestically. Companies that have strengthened their earnings, margins and cash flow flexibility by establishing global “lowest cost sourcing” will face weaker earnings or need to raise prices.

There is always some partisan idiot to trot out some idea that defy some Newtonian laws of economics (they call it “dismal science” for a reason) and the realities of double-entry accounting. Higher costs will need to be eaten or passed on. In MAGA world, neither applies and cash flow does not decline. The view is that US manufacturers will seize the new politically driven set of economics to invest their lower cash flow in as much capex as possible to grow their less economic business.

The alternative for those facing tariff pressures is to hold the line or even shrink and wait for the experiment to play out before the “next guy” in the White House pulls the plug on some of the tariffs. Biden mostly let them ride on the grounds that it is tough to take away what has been given.

Investing in long-term plant and equipment when the tariffs might last one Presidential election cycle can be a major mistake. You also can size your business to the new reality since the diminished supply just gives you more pricing power. We got a taste of lower corporate investment and weaker exports back in 2018 and 2019 when stocks got crushed (2018) and the Fed had to ease multiple times in weaker capex and exports in 2019. It was not that long ago! Too many partisans fail to bring it up (see HY Pain: A 2018 Lookback to Ponder 8-3-24, Histories: Asset Return Journey from 2016 to 2023 1-21-24).

Contributors:

Glenn Reynolds, CFA glenn@macro4micro.com

Kevin Chun, CFA kevin@macro4micro.com

See also:

Footnotes & Flashback: Credit Markets 10-14-24

Footnotes & Flashbacks: State of Yields 10-13-24

Footnotes & Flashbacks: Asset Returns 10-12-24

CPI Sept 2024: Warm Blooded, Not Hot 10-10-24

HY OAS Lows Memory Lane: 2024, 2007, and 1997 10-8-24

Footnotes & Flashbacks: Credit Markets 10-7-24

Footnotes & Flashbacks: State of Yields 10-6-24

Footnotes & Flashbacks: Asset Returns 10-6-24

Mini Market Lookback: Cracking the 300 Line in HY 10-5-24

Payroll Sept 2024: Rushing the Gate 10-4-24

CarMax: Why Do We Watch KMX as a Bellwether? 10-3-24

Credit Returns: Sept YTD and Rolling Months 10-1-24

JOLTS Aug 2024: Openings Up, Hires Down, Layoffs Down, Quits Rate Down 10-1-24

Footnotes & Flashbacks: Credit Markets 9-30-24

Footnotes & Flashbacks: Asset Returns 9-29-24

Footnotes & Flashbacks: State of Yields 9-29-24

Mini Market Lookback: PCE Tailwinds, GDP Holds Serve 9-28-24

State Level Economic Reality Check: Employment, GDP, Personal Income 9-28-24

PCE Prices Aug 2024: Personal Income & Outlays 9-27-24

KB Home: Steady Growth, Slower Motion 9-26-24

Durable Goods Aug 2024: Waiting Game 9-26-24

2Q24 GDP: Final Estimate and Revision Deltas 9-26-24

New Home Sales Aug 2024: Waiting Game on Mortgages or Supply? 9-25-24

Lennar: Bulletproof Credit Despite Margin Squeeze 9-23-24

Mini Market Lookback: FOMC Week 9-21-24

Credit Crib Note: Service Corp International (SCI) 9-19-24

Existing Homes Sales Aug 2024: Mortgages Still Rule 9-19-24

FOMC Action: Preemptive Strike for Payroll? 9-18-24

Home Starts Aug 2024: Mortgage Rates to Kickstart Hopes Ahead? 9-18-24

Retail Sales: Down to the Wire? 9-17-24

Credit Crib Note: United Rentals (URI) 9-16-24

Industrial Production: Aug 2024 Capacity Utilization 9-17-24