Mini Market Lookback: FOMC Week

We look at an unusual week with a -50 bps cut that saw risk rally, the curve steepen with the 10Y higher, and a delayed reaction in equities.

The 10Y is coming my way. I feel it. Then again…

The week brought a -50 bps cut and joy to those who wanted to see some progress in whittling down the “Mother of all Inversions” that stands out across the cycles as extraordinary with inflation in check (see FOMC Action: Preemptive Strike for Payroll? 9-18-24, Footnotes & Flashbacks: State of Yields 9-15-24).

The FOMC cut of -50 bps came despite a 3.0% GDP print for 2Q24 (one more revision to go next week), the payrolls high, and job openings plentiful despite rising unemployment rates (see August 2024 Payrolls: Slow Burn, Negative Revisions 9-6-24, 2Q24 GDP 2nd Estimate: The Power of 3 and Cutting 8-29-24).

The toggle in the dual mandate prioritization shift to payrolls sent the Dow and S&P 500 to records and credit spreads notably tighter while the 10Y fought the tide with a slight uptick in the aftermath.

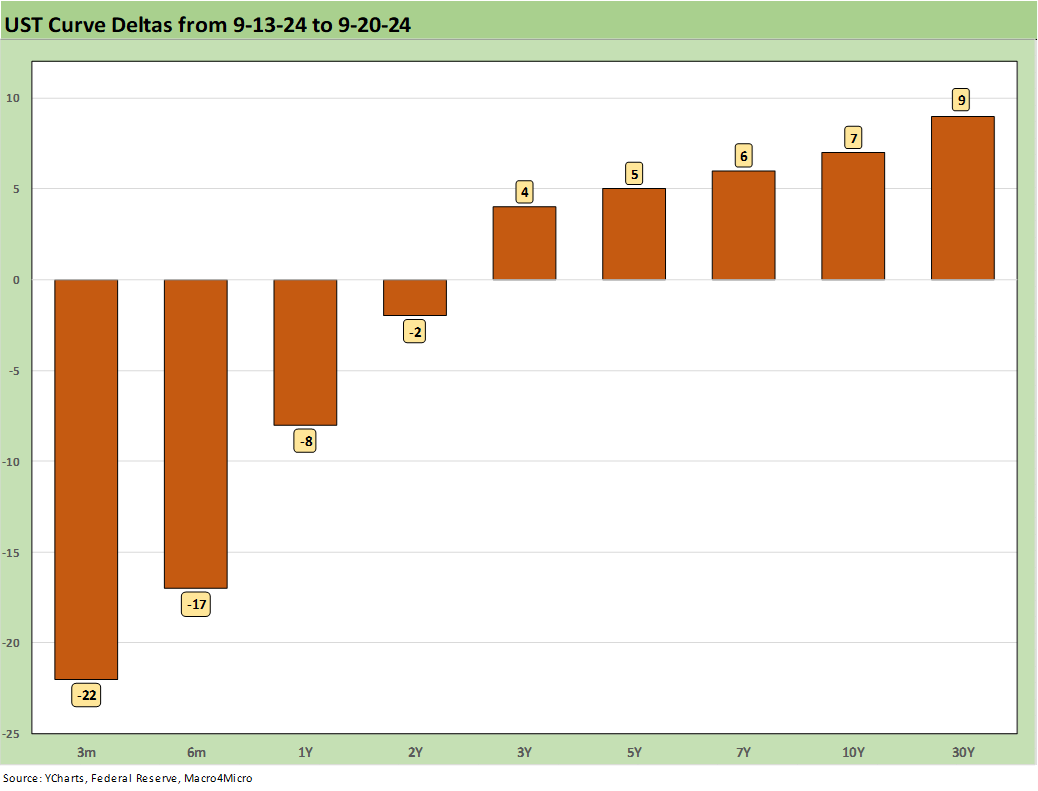

The above chart breaks out the 1-week UST deltas, and we see the sharper move lower on the short end while the 10Y UST pushed back with a move higher. There was no shortage of debate on the dynamics of the yield curve with some talking heads citing the theoretical risks of a premature declaration of victory (which Powell disavowed as the rationale). The worries around deficits are tied to the need for funding from a massive base of demand onshore and offshore even with some dollar concerns elevated and rates (and relative income attraction) exposed to a fade.

“Supply and demand” is on the Newtonian list no matter where it is applied, and the embrace of sustained record deficits (and interest bills) is showing in force around the Promises ‘R’ Us presidential campaigns. We hear about tax cuts, tax free benefits (social security, tips, uncapped SALT, etc.), IVF “on the house,” a massive housing initiative, and a defense budget that needs to go in one direction (higher).

The above chart plots the path of the 10Y UST and Freddie Mac benchmark 30Y mortgage, which dipped down this week to 6.09% or the lowest since May 2023. The 10Y UST is still the key driver but mortgage spreads matter also.

The decline from the 8% area peaks (Freddie was lower than many other loan offerings) is good news for housing and evident in homebuilder equities but not yet enough to move the needle much in existing home sales (see Existing Homes Sales Aug 2024: Mortgages Still Rule 9-19-24, Home Starts Aug 2024: Mortgage Rates to Kickstart Hopes Ahead? 9-18-24).

The above chart breaks out the 1-week returns in the group of 32 benchmarks and ETFs we watch. We see E&P (XOP) and Energy (XLE) in a comeback as oil climbed back above the $70 line. Right behind energy names we see Regional Banks (KRE) and Financials (XLF) in the top tier on the support for short-term funding costs.

A notable feature of the week’s returns in an FOMC decision week bringing a -50 bps cut is that the bottom quartile was half comprised of bond ETFs with the long duration UST 20+ year ETF (TLT) in dead last. GOVT and AGG joined the bottom quartile in the red with the 1Y-3Y UST ETF (SHY) at the top of the bottom quartile but only very slightly positive. Tighter IG credit spreads of -5 bps supported LQD in the tradeoff vs. duration while HYG led the pack on sharp tightening (-22 bps for ICE).

The above table updates the tech bellwethers we frame each week in descending order of 1-week total returns. We include the Mag 7 plus Taiwan Semi and Broadcom. We list them along with the S&P 500, the NASDAQ, the Equal Weight S&P 500 ETF (RSP), and Equal Weight NASDAQ 100 ETF (QQEW). We see only 1 in the red this week (NVDA) after all were positive last week following a shutout of all negatives the week before that (see Another Volatile Week: Mini Market Lookback 9-7-24).

From here, there will be no shortage of debates around sector rotations, growth vs. value, and the improving value of income stocks with rates lower on the front end. There will also be discussions of what all this means for the floating rate exposed asset base (BDCs, leverage loans) vs. the support leveraged issuers get from a lower interest expense bill.

The structural seniority of floating rate assets and how that compares to HY bonds for allocation will be back in action. The BDC market has been faltering in ETF groupings (BIZD) and was just behind the HY bond ETF this week as we break out above. High cash dividends still have a lot of allure for the right names since the dispersion of performance in that group has been material.

The above chart shows the material move in HY OAS on the week with some giveback on Friday. The+315 bps for HY OAS (ICE) to end the week is in from +337 bps last week. This is in line with cyclical lows of prior cycles and dramatically inside the long-term median of +466 bps.

The above chart updates the quality spread differential for the “HY OAS minus IG OAS” metric. The +222 bps tightened from last week’s +238 bps and is much lower than the long term median of +328 bps.

The BB vs. BBB tier quality spread differential is back down again this week to +74 from +82 bps last week and well inside the long-term median of +135 bps. Compression still rules as the market rebounded from the widening to +112 bps during the early August VIX spike. Even that brief gap was well inside the medians.

See also:

Existing Homes Sales Aug 2024: Mortgages Still Rule 9-19-24

Home Starts Aug 2024: Mortgage Rates to Kickstart Hopes Ahead? 9-18-24

FOMC Action: Preemptive Strike for Payroll? 9-18-24

Retail Sales: Down to the Wire? 9-17-24

Industrial Production: Aug 2024 Capacity Utilization 9-17-24

Footnotes & Flashbacks: Credit Markets 9-16-24

Footnotes & Flashbacks: State of Yields 9-15-24

Footnotes & Flashbacks: Asset Returns 9-15-24

A Strange Policy Risk Week: Mini Market Lookback 9-14-24

Consumer Sentiment: Inflation Optimism? Split Moods 9-13-24

CPI Aug 2024: Steady Trend Supports Mandate Shift 9-11-24

Facts Matter: China Syndrome on Trade 9-10-24

Tariffs: Questions that Won’t Get Asked by Debate Moderators 9-10-24

August 2024 Payrolls: Slow Burn, Negative Revisions 9-6-24

Construction Spending: A Brief Pause? 9-3-24