Credit Crib Note: Service Corp International (SCI)

We update the Service Corp Int’l Crib Note that frames the financial and operating fundamentals of a major BB tier issuer.

CREDIT QUALITY TREND: Stable.

Our favorable view on credit quality of SCI is tied to low volatility, predictable revenue and earnings, and stable leverage metrics easily managed by its high base of discretionary cash flow after capex. SCI has a proven business model and market leadership position in its core business.

Revenues, earnings and cash flow are supported by baby boom demographics that will translate into steady growth in volume as the late 2020s and early 2030s push more boomers past the life expectancy line (earnings calls are always a hoot.) The oldest baby boomer (1945) will turn 79 in 2024, and that is slightly above CDC life expectancy (all races).

High margins, consistent and telegraphed leverage management, high discretionary free cash flow, and a flexible shareholder enhancement program mitigate downside risks for SCI credit quality and its low BB tier unsecured composite bond rating in the HY index. The low business risk goes along with the usual punchlines around guaranteed, steady business (i.e., death) driving the SCI revenue base. We believe SCI’s predictable cash flow across cycles and leadership position in its core markets deserve more weighting than is awarded in the current ratings.

SCI has been active in the credit markets from IG to HY for decades and recently ranked just below the Top 60 issuers in the BB tier bond index prior to this latest $800 million bond deal (5.75% of 2032). Prior to this week, the most recent large bond deal was in 2021 with the $800 million 4% due May 2031. SCI has a minimal maturity schedule until 2027 with $137 million of 7.5% bonds and $550 mn of 4.625% bonds maturing that year. The unsecured revolver and term loan matures in 2028.

The tiers of structural subordination penalize the bond ratings for unsecured lenders since unsecured bank loans are senior vs. parent holding company bonds based on the subsidiary guarantees to the bank debt. SCI also has $211 million of secured debt obligations as of 2Q24. SCI chose to maintain those strong bank relationships even though they could have cleaned up all that bank debt with unsecured low coupon bonds during the various HY and crossover credit market peaks.

The company could migrate to IG ratings by debt reduction and cleaning up structural subordination haircuts in the ratings, but the steady and reliable financial performance has rewarded SCI equity holders and not generated any unpleasant surprises for lenders or bondholders. The formula works and the strategy has been successful.

OPERATING PROFILE

As by far the #1 player in the North American funeral and cemetery services business, SCI has established a highly successful operating strategy. The market confidence in SCI’s low volatility and favorable financial risk profile is supported by consistency across some turbulent capital market backdrops and two deep economic contractions over the past two decades.

Creative branding strategies, development of a very successful sales model with increased digital operations, and ongoing expansion of its diversified services offerings keep SCI in slow growth mode while building a book of record deferred revenue for the future. Services including cremation, where SCI is the industry leader, and increased multicultural and ethnic market penetration (Hispanic, Chinese, etc.) are part of a favorable operating history.

As of 2023, SCI has a 28% to 30% share of the cemetery market based on revenue with almost 500 cemeteries (many quite large) and 12% of the funeral market with almost 1500 funeral homes. As of 2024, SCI had a 16% revenue share in deathcare as broadly defined.

With respect to branding, the lead brand is Dignity Memorial, but many people attend funeral homes across all price tiers where the funeral homes carry their own legacy name. Families and those paying their respects at that location may not even be aware of SCI ownership. Branding in funeral homes can be about tradition and family names (including ethnic flavor), and that has been an integral part of the SCI game plan. An example of SCI ownership in Manhattan serving the high price crowd of different faiths is Frank E. Campbell on the Upper East Side and Riverside Memorial on the Upper West Side.

Concentrations by geography across the US reflect the population mix with California, Texas, and Florida leading the ranks in funeral home and cemetery count. In New York, SCI has funeral homes only and no cemeteries. Some states explicitly ban co-ownership or investment across the combined funeral home and cemetery business (MI, WI). Some other states have barriers that essentially prevent such cross-ownership and marketing. If you look at the SCI 10-K for the locations of funeral homes and cemeteries, you can see where that is the case with the tri-state area of NY-NJ-CT seeing a good funeral home market for SCI but no cemeteries. The same is the case for New England and MA.

FINANCIAL CONDITION

The anchor for SCI financial strength is grounded in its balance sheet policies, exceptional free cash flow before shareholder rewards, ample asset protection (including real estate), and a demonstrated ability to manage its leverage to its target range of 3.5x to 4.0x while balancing the needs of credit and equity stakeholders. SCI has been in the debt markets for decades and has been a solid story for two decades after some problems in the 1999-2001 period after overexpansion. The company is in a very different market now at a time after the “baby boom” turned 65 in 2010.

The only black mark across SCI’s history of stability was some problems way back in 1999-2001 during a period of industry overexpansion and financial aggression. SCI had to retrench on its global ambitions and dial back its very active M&A program, sell assets, and narrow its focus to North America. After that ordeal, SCI maintained strong relationships with bank lenders (addressed below) as evident in their unsecured revolver and term loans that are guaranteed by key subsidiaries. The holding company bonds are not guaranteed by the key subsidiaries.

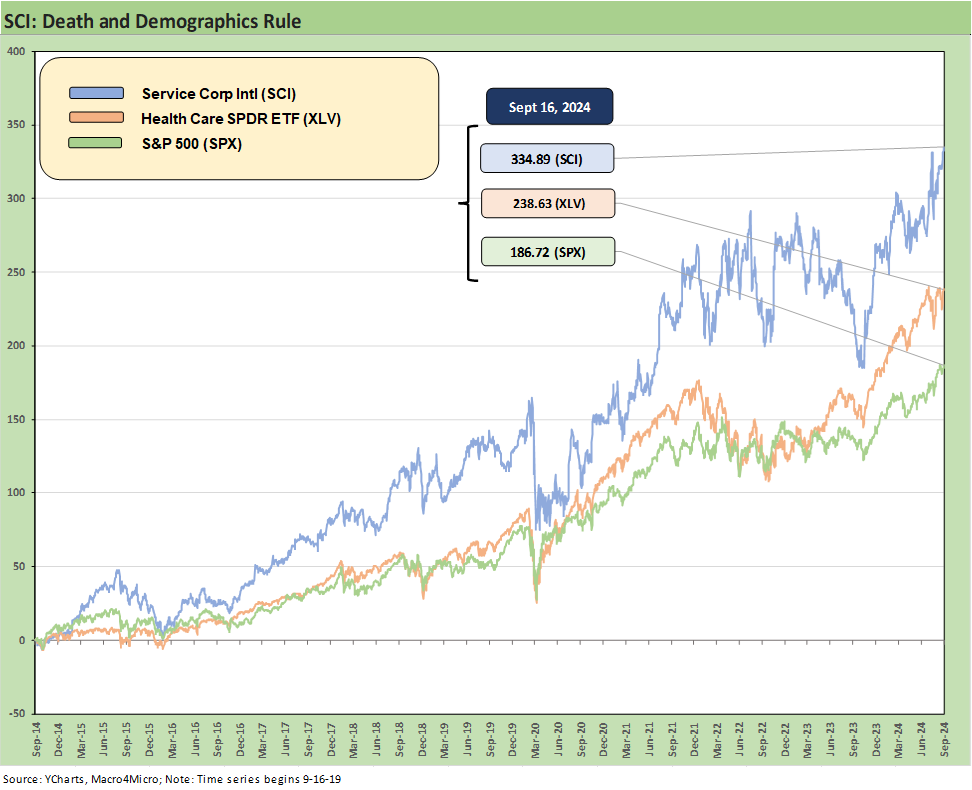

Over the past 10 years, SCI equity has materially outperformed the S&P 500 in total returns. Using 9-16-24, the 10Y total return was +336% for SCI vs. +184% for the S&P 500. Looking back 20 years, SCI posted +1,629% vs. the S&P 500 at +399%. That’s why they say, “death and taxes.”

The above table details the consolidated results of SCI since 2019 across the COVID crisis of 2020 and into what has been an unusual period that has made gauging the COVID pull-forward effects a challenge in forecasting.

SCI successfully navigated a pandemic in 2020 and its related aftereffects and drove record revenues and operating profits in FY 2021 with gross margins crossing into the 30% range before settling back into the upper 20% handles for gross margins and low 20% range for operating margins.

The mix of residual pull-forwards from COVID and calendar timing has been more difficult for SCI in this post-pandemic aftermath. No matter how you look at it, however, those are still very healthy consolidated margins even if down from the peak periods.

The overriding theme for the Service Corp income statement is that the business is low growth on the top line, high margin in profitability, and SCI can execute on a steady stream of small bolt-on acquisitions in funeral homes. The acquisition trail in funeral homes requires a look at “comparable” revenue and profit metrics to find any major departures from the trend in reported line items.

When looking at the reported GAAP numbers, it is also useful to respect the deferred revenue lines and the variances of cash collection across time and how they can depart from revenue recognition.

Overall, it is fair to look at the business from a “price x volume” perspective in funerals and cemeteries but also with a look at the trust and insurance reporting and what that means for the very healthy backlog.

The ability to recognize cemetery plot sale revenue upon the transaction occurring (vs. preneed funerals and services/merchandise) in the higher margin cemetery segment is a big part of the mix analysis in any given year. Basically, plot sales get up-front recognition while other preneed services and merchandise await delivery.

The baby boom demographic trends are moving toward the peak years of late 2020s even as recent years have tested the ability of the management team to adapt to the secular shifts in the consumer markets (including steady cremation rate increases).

The traditional mantra of longer term 8% to 12% earnings growth trends for EPS are now back in place for 2025 after a timeout for the COVID disruptions and the lower single digit increases may be more likely in 2024 before a resumption in promising the traditional long-term target.

SCI presents its long-term plan with overall organic growth of 5% to 7% anchored by preneed Cemetery sales growth combined with more modest growth in Funeral revenues while building up the base of deferred revenue in Funerals.

SCI also cites goals for 3% to 5% capital deployment for reinvesting in the business, growth planning, and managing share buybacks in tandem with “debt management.”

Funerals faced some major problems as the pandemic struck. With the shutdowns of public gatherings in many locations, SCI management reacted quickly (we were following them at the time), and the COVID crisis offered securities holders a display of the management team’s strategic and operational dexterity.

SCI adapted to the conditions with a range of alternatives (online, drive-through etc.) and aggressively accelerated preneed services and product selling efforts as it invested in digital solutions in sales to leverage its labor force. That process in turn has grown their deferred revenue base as we cover further below. Investment in digital operations and its omnichannel approach to marketing has paid off for sustained growth.

Funerals is a “price x volume” business, and the average prices and volumes are detailed in the table above.

For 2024, funeral margins have been under pressure vs. 2023 based on volume, lower preneed merchandise revenue, and higher compensation costs. Revenue per service rose by +2.5% in 1H24.

Theories on what rising cremation rates mean have been tested, and SCI has proven its service packages and catering to the transition to more consumers shifting to a “celebration of life” approach to funerals and cemetery choices.

For FY 2023, the cremation rate was up by +160 bps to 62.9% while overall funeral services decreased by 5.6%, partially offset by a small +2.8% increase in revenue per service. For 2Q24, comparable cremation rates rose to 63.8% from 63.2% in 2Q23.

The funeral home business hit record sales in FY 2021 for some obvious reasons with the pandemic fallout and the lag times in services that were postponed from COVID lockdowns into later periods.

The timing differences in “death vs. services timing” overlapped with the COVID vaccine launch of Nov 2020 and the varied approaches by states in reopening local economies.

SCI has the locations and asset base, local name recognition and brands, the market share, the marketing skills, and the scale of business model that have been proven across multiple economic cycles, the slow and steady force of demographic trends, a range of capital market backdrops (and crises), and most recently was tested in a pandemic. Hard to top that streak for a real-world stress test on their credit resilience.

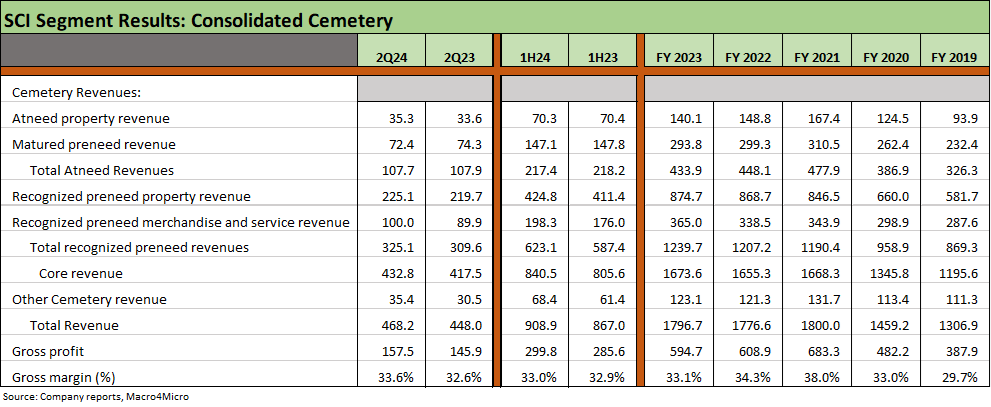

The cemetery segment is the highest margin business with 30% handle gross margins from 2020 to 2024. The cemetery business posted higher revenue as preneed revenue growth exceeded the decline in atneed revenues.

Cemetery gross margins in FY 2023 were almost 5 points below the 2021 peak and a point below FY 2022 but materially ahead of 2019 run rates.

The year 2023 ended on a better note with margins trending up YoY in 4Q23 vs. 4Q22. The upward margin trends continued in 2024.

Preneed cemetery sales are key drivers of GAAP performance since revenue is recognized at the time of sale (of plots) while cemetery services and merchandise are part of the deferred revenue stream that await delivery of the products and services.

In its presentations, SCI makes frequent reference to “pull-forward” sales effects in terms of its ability to forecast volumes on timing to get back to normal cadence on preneed and atneed demand. Visibility has been murkier after such a chaotic COVID period. The expectation is that 2025 would be the likely timeline to get back to normal trends.

The business and financial risk overall at SCI is tied into a high fixed cost structure (70% to 80% fixed) with very favorable incremental margins on higher volumes. That dovetails favorably for financial performance with more volume improvements ahead tied to demographics and increased preneed business.

One of the more distinctive aspects of the SCI business line activities is the use of trusts and insurance in the “preneed” revenue mix.

The accounting issues include some modestly intimidating disclosure items on deferred revenues and some nuances across preneed products in trust-funded vs. insurance backlog numbers. Accounting quality has stood the test of time at this point and is backed up by the close regulatory scrutiny of trusts.

The main takeaway is that the unusual profile of the long-term preneed revenue flow is one more factor lowering the business risk profile of SCI and reduces prospective volatility.

We simplified the table above when in fact there is quite a bit of line-item activity and footnote disclosure in deferred revenue and “preneed receivables, net and trust investments” under the accounting treatment excluding the insurance contracts.

The disclosure gave me flashbacks to my CPA audit days of the early 1980s, but it made intuitive sense and has held up well across time. I first looked at SCI when it was a Lehman commercial paper and medium term note issuer in the late 1980s.

The insurance and trust-funded backlog of funeral and cemetery contracts totaled over $15.4 billion at the end of 2Q24. That backlog is over 3.5 years of revenue at recent revenue run rates.

Backlog is distinct from deferred revenue and deferred receipts since trust-funded backlog can be in deferred revenue while insurance-funded backlog is not a GAAP deferred revenue item (insurance is a customer-insurance contract).

There are numerous legal and regulatory requirements that vary by state on trusts and how the cash buildup is treated in preneed contracts as well as the asset mix that can be used in the trusts for the long-term deployment to pay for the deathcare services.

The use of trusts can be debated as a risk factor. Along the way, we have come across some that ask about the scenario of assuming mass deaths (i.e. waves of services and merchandise see a spike in immediate delivery demand for funerals and cemeteries) that are accompanied by a securities market crash. The idea is that blows up trust assets and there is a shortfall of cash flow to fund the delivery of services and merch. We might argue that we had a brief brush of that in 2020 as the Fed came to the rescue.

Such extreme scenarios on trust-funded commitments still need to be put in portfolio context across other industries, issuers, and securities. The reality is that also brings a lot of atneed business, but chances are all your line items in equities and credit are in trouble at that point.

High margins and very strong cash flow and the ability of SCI to “pick its leverage” is the anchor to the credit story. Operating cash flow is its guiding metric and the midrange guidance for 2024 is $960 million and $930 million adjusted. Maintenance capex guidance is $325 million.

The combination of stock buybacks and dividends lead the rankings of the uses of cash, and that is how SCI has generated a strong following on the equity side.

SCI is also capex-intensive given the investment in land, cemetery development, and real estate and property investment.

We break out the lines above showing the high investment demands in the Cemetery segment with preneed cemetery revenues an important driver of current revenue recognition.

The SCI segment capex mix for FY 2023 was 59% Cemetery, 35% Funeral Homes, and 6% Corporate. Cemetery is intrinsically more capex intensive in the development stages where expansion is supported, but the roll-up process in funeral homes typically brings demand for capital improvements as well.

Investment in digital even gets its own detailed line item in recent years in a sign of how SCI has been able to grow its total of digitally generated revenues with a materially smaller sales force coming out of the pandemic. As SCI adapted its operating strategy under demanding COVID conditions, SCI developed an array of productivity-enhancing approaches to sales and marketing.

Capex weighed in at a lofty 8.8% of revenues, but that is still dwarfed by 23% operating margins and over 13% net margins.

The funeral home business acquisitions are routine and offer exit strategies or liquidity events for legacy funeral home business owners (some family businesses don’t always appeal to “the kids.”). SCI routinely looks at all those opportunities.

For larger ticket M&A, there are no more big acquisitions in the space to chase since SCI bought the #2 player (Alderwoods, formerly Loewen, was purchased by SCI in 2006). Antitrust watchdogs have always been focused on SCI given the local market risks.

SCI has impressive flexibility to pick its own balance sheet leverage by virtue of its discretionary deployment of free cash flow. SCI has room to maneuver in its investment programs above and beyond maintenance and growth capex (land purchases and cemetery development, digital investment).

The balance sheet history of SCI is remarkably stable as noted in the table with the outsized earnings move of FY 2021 pushing leverage into a 2-handle.

SCI has the luxury of strong cash flow and highly discretionary acquisition and investment planning to effectively target a balance sheet profile within its current leverage target range of 3.5x to 4.0x.

SCI can boast a 16% CAGR in dividend growth from 2005 to 2023 and from mid-2004 through 2Q24 has returned almost $7 bn to shareholders set against SCI’s current $11.6 bn market cap (9-19-24). That reflects an almost 60% reduction in shares outstanding since mid-2004. Off a 2019 base, earnings per share CAGR has been 10%.

SCI was just under the Top 60 of BB tier bonds in the HY bond index as of the end of 2023. With the bond deal priced this past week (5.75% of 2032), SCI will move up into the Top 40 issuers of BB tier bonds after refinancing its credit agreement with the unsecured bond and further reducing structural subordination (subsidiary guarantees on credit agreement).

SCI entered into a new credit agreement in Jan 2023 that extended the maturity to Jan 2028 and expanded the line from $1.65 billion to $2.175 bn, including a $1.5 bn bank facility plus the term loan. At 6-30-24, SCI had $649.7 million outstanding under its term loan and $855 million under its Jan 2028 bank facility.

The unsecured bonds and unsecured credit agreement come with structural subordination for the holding company debt. Per the bond prospectus: “Our subsidiaries are not guarantors of the notes and do not have any obligation to pay amounts due on the notes or to make funds available for that purpose.” That has been the case across the years, so any action to reduce structurally senior debt is a positive action for bonds.

Beyond high margins and the strong cash flow of its core business lines, SCI is asset-rich with respect to real estate and owned approximately 90% of the real estate and buildings used in its facilities.

On the real estate intensity, SCI was pitched by bankers years ago about breaking off a REIT business (when REIT conversions were the rage for many real estate intensive companies), but that was ruled out at the time on the execution complexity and perceived inability to run a services-dominated business operationally under such a structure and stay in line with tax rules.

HIGHLIGHTS AND HISTORY

SCI has long been the leading consolidator in Funeral and Cemetery services (vs. equipment such as caskets, etc.). SCI estimates a 16% market share in North America as of 2023 including both Funerals and Cemeteries.

“Deathcare” combines an unfortunate industry sector moniker with a distinctive set of variables to look at across baby boom demographics, the complexities of product/service mix analysis (e.g., cremation rates, patterns in event planning) and how that all flows into demand across the Funerals and Cemetery segments for preneed and atneed.

SCI co-brands with local brands using the Dignity Memorial trademark in a strategy that allows SCI to leverage the brand value of local service providers including brands to broaden the ethnic range of its customer base such as Funeraria del Angel,

SCI is also the leader in cremation with such brands as Neptune Society and National Cremation Society.

The funeral home and cemetery business is much more heavily regulated at the Federal and State level than many in the market may realize from the “Funeral Rule” issued by the Federal Trade Commission back in 1984 (periodically updated).

During the late 1980s, SCI was a rock-solid investment grade issuer operating on a global scale, but the 1990s saw industry leaders (SCI, Loewen) expand aggressively by acquisition with Loewen ending up in Chapter 11 (litigation was a big part of the Loewen story). SCI saw its stock crater in early 1999 from a high of $46 in July 1998 to $1.56 in Jan 2002 that also saw pressure on debt ratings and credit spreads during that protracted credit market default cycle and credit market turmoil of 2001-2002.

After the setback of 1999-2001, SCI needed to retrench and retreat from its global strategy, divest assets to reduce debt, narrow its strategy focus to North America, and took an accounting charge of $909 mn in 2000 and $823 mn of restructuring charges in 1999-2000. Obviously, they lived to fight another day.