Durable Goods Aug 2024: Waiting Game

An uneventful durable goods release saw orders come in flat as the effects of the FOMC cuts will start to filter into budgets and spending.

This has to get easier…

The volatility in transport the prior two months had some headline moments but this past month at flat will be quickly overlooked as clarity around monetary policy gives capex budgets renewed focus at a time of constant tariff headlines.

Durable goods orders remain negative on a YTD basis vs. 2023 but excluding the transport line shows minor growth at +1.0% YTD. Manufacturing overall has been soft, but at least we are not seeing overall contraction across the board.

With a -50 bps rate cut now on the books midway through this month and the next leg of FOMC policy moves underway, project economics and capex budgets will see a fresh set of economic assumptions rolling into decisions that likely spur more orders into the last quarter of 2024.

Inventory trends will be key swing factor based on restocking decisions tied to sales expectations, and it will be hard to divorce durables spending plans from expectations on tariff threats and mass deportation follow-through on longer term projects vs. short term restocking moves.

The month-over-month changes for durable goods orders are shown above. The overall number rides heavily on Transport lines that make up just over a third of all durable goods orders. That aircraft dynamic is unavoidable with such massive supplier chains, but the last year has seen an uptick in transport related volatility that led to headline making months in June and July.

As we look across the year, this August print is less than 1% above where it started this year. Given the bearish commentary on manufacturing that hit the headlines, uneventful is a good outcome in context.

With the rate cut cycle a vigorous debate over the past few months, we see the timid growth in durable goods orders as disciplined. Treading water and not overextending spending when monetary policy is in such restrictive territory was exactly what Powell had in mind for the most part. Now the Fed is in policy shift mode (see FOMC Action: Preemptive Strike for Payroll? 9-18-24). We do not expect that the recent 50bps will drive a flood of activity, but previously unused capex planning should start to come off the shelf and see incremental adds in the coming months.

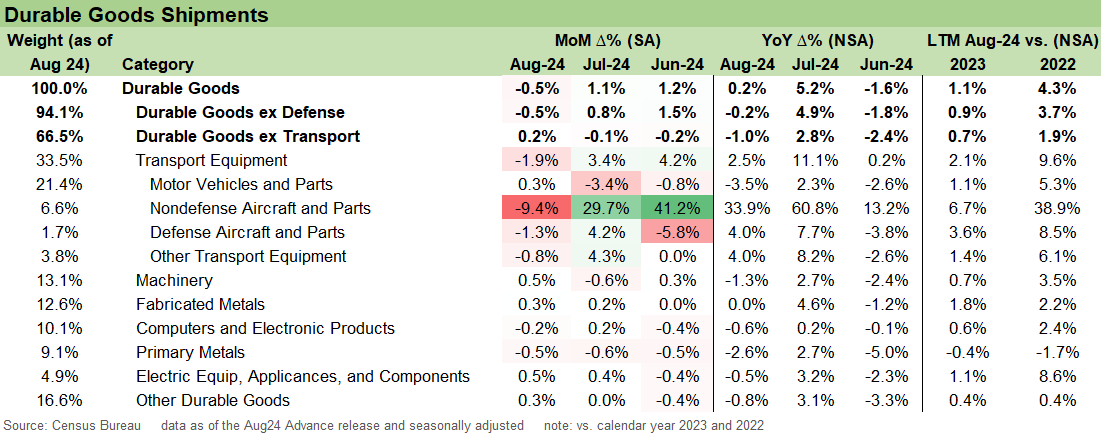

The table above covers the line items for the Durable Goods releases and the major subgroups of ‘ex-Defense’ and ‘ex-Transport’. The ‘ex-Transport’ line is the bright spot in the release showing positive MoM at +0.5% and +0.8% LTM vs. 2023. As covered already, that is much more like a holding pattern than anything to get excited about.

Looking across the headline and ‘ex-Defense’ lines, we see negative YoY comps vs. Aug 2023 and down on an LTM basis compared to 2023. Looking away from the transport related lines, there is broad strength down the list with a notable +1.9% at the electric equipment line that has been performing in line with the overall index this year.

Lastly, we include the Durable Goods shipments above given that these directly impact the GDP calculations. This has a similar story of volatility due to transport lines, and this month that falls to the downside overall Durable Goods shipments down -.5% as the previous Orders weakness flows down.

See also:

Footnotes & Flashbacks: Credit Markets 9-23-24

Footnotes & Flashbacks: State of Yields 9-22-24

Footnotes & Flashbacks: Asset Returns 9-22-24

Mini Market Lookback: FOMC Week 9-21-24

FOMC Action: Preemptive Strike for Payroll? 9-18-24

Consumer Sentiment: Inflation Optimism? Split Moods 9-13-24

Construction Spending: A Brief Pause? 9-3-24

PCE July 2024: Inflation, Income and Outlays 8-30-24

2Q24 GDP 2nd Estimate: The Power of 3 and Cutting 8-29-24