CarMax: Why Do We Watch KMX as a Bellwether?

The used car space continues to limp along with hopes of improved affordability and easier sourcing. We frame CarMax in industry context.

We update the financial and operating trends at CarMax as used car deflation and diminished affordability on higher borrowing rates remain a headwind for used car retail.

KMX is an old-fashioned “price x volume” operation at its core, but its role as an omnichannel used car leader in a fragmented industry helps in crafting scenarios around the strategic direction of auto retail broadly and the blurring of traditional auto retail with growing digital operations.

The efforts of KMX to build out a CarMax Auto Finance captive operation with full spectrum capability is useful to monitor as we also see leading franchised auto leaders such as Lithia (#1) and AutoNation (#2) building out their finance balance sheets and lending practices.

There is no shortage of activity in used car retail across Certified Pre-Owned vehicles (CPOs), late model used cars coming off lease or out of rental fleets, or older cars at better price tags. Used cars can be financed and retailed through a range of business models including franchised dealers, used car incumbents (KMX), or by a range of e-commerce channels including the emerging digital used car kingpin Carvana.

The above chart shows a wide range of equity performances for the various business models in auto retail from the late 2019 period when the Fed was easing, across the COVID period and the return to ZIRP, into the demand bounce of 2021, the tightening cycle and supplier chain OEM slowdown of 2022, the used car erosion of calendar 2023, and into the eventual favorable UST shift and Fed easing of 2024. We see CarMax as the used car incumbent ending up as the weakest equity performer across that period.

The trailing 5 years shows Carvana’s wild ride across a boom, then a dive, and an ensuing debt restructuring before a fresh monster rally was made possible by the bondholder group (see Carvana: Counterattacking in Style 5-6-24). For the #1 and #2 franchised auto dealers, we see the aggressive buybacks of AutoNation carrying the day over the M&A heavy strategy of Lithia but both performing well for that stretch.

The above chart shows more timelines for the total returns of auto retail and related equities. We include the Big 6 public franchise dealers plus the used car retail and services chain (including KMX and CVNA). The volatility of the market backdrops over 5 years have been the craziest since the wild swings and industry restructuring and credit crisis of the 2006 to 2011 period with their combinations of credit and equity bubbles and macro stress testing.

The current post-2019 period had a pandemic, ZIRP, an inflation spike, and a daunting but rapid tightening cycle. The 2006 to 2011 stretch saw a credit bubble, a systemic crisis, and a mini sovereign meltdown with a long stretch of ZIRP. The current bear inversion in the UST markets has not been seen since Volcker 1.0.

It is safe to say that auto retailers showed resilience across those periods with the franchise dealers better positioned with their business models and asset mix. CVNA was extremely volatile (and bondholders saw a haircut and stock range of $370 in 2021 to $3 handle in 2022). KMX has been a painful laggard now playing the longer game waiting to get back into bigger stock buyback mode and testing its digital expansion (omnichannel) and captive finance game plan.

Why CarMax?

Before we get into the latest quarterly disclosure and financial and operating trends of KMX, we thought it was worth revisiting the “Why?” of covering KMX as a useful bellwether. The company sheds light on the consumer sector but also offers an interesting angle on the evolution of the auto retail industry.

Given our history over the decades watching the auto sector, the evolution of auto retail ties directly into the consumer sector (thus GDP growth) at the macro level but also highlights some of the secular trends around consumer preferences (more appetite for late model used vs. new vehicle). KMX shows why the used car business has been growing as a major P&L for the dealers and for stand-alone used car operations whether within the dealers, on their own (KMX) or in digital pure plays (or almost pure).

We have a few reasons for watching KMX and doing regular updates:

KMX tells a consumer story: There is direct connection to a broad swath of the consumer sector (the used car buyer) that offers color on durables demand and sheds light on consumer credit quality trends at its captive finance unit (“CAF”). The availability of consumer credit is important to the growth of the auto OEM and auto retailer revenues (and GDP) that are tied to credit expansion. We now see more retailers taking matters into their own hands to tap that F&I value chain for used vehicles while the OEM captives are more focused on dealer inventory financing and new retail sales and leasing.

KMX highlights growth of new “captives” in auto retail as a finance subsector: Investors, lenders, and Wall Street underwriters love seeing new, competitive finance business lines launched that they can work with as lenders or in ABS underwriting. Auto retail expansion in financial services is the gift that goes on giving for banks working with them (and rating agencies on new issue fees). We see expansion in captive finance operations at Lithia as the #1 franchised dealer (see Credit Crib Note: Lithia Motors (LAD) 9-3-24) and also at AutoNation as the #2 franchise dealer (see Credit Crib Note: AutoNation (AN) 6-17-24). We would note those rankings for used vehicle volumes in the franchise dealer space exclude non-franchised retail names such as KMX and CVNA.

KMX is a growing credit counterparty even without public bonds: As someone more locked in on credit markets, KMX does not have rated public bonds in the market. However, KMX is a major issuer of ABS and significant borrower in securitized financing with almost $18 bn in managed receivables and $17 bn in total non-recourse notes.

A good indicator for inflation: The COVID dynamics around supplier chains, the consumer experience in COVID, and the supply-demand imbalances for new and used vehicles generated an inflation shock that saw used car CPI top 40% in 2022 (see Automotive Inflation: More than Meets the Eye 10-17-22). While deflating now, used car average prices remain starkly higher than pre-COVID. That creates a lot of room for handicapping price trends and affordability if rates keep coming down. For now, contract rates are still very high.

Monitor structural changes in auto retail: The rise of KMX to incumbent leader in used car retail with just under 4% of the used car market (0 to 10 Years old) speak to how fragmented the market is. Meanwhile, the franchised dealers have expanded in used car operations. That makes for some interesting scenarios around how the auto retail consolidation could evolve. The major public dealers boast high margin Parts and Services operations and F&I opportunities, and those have overlap with the KMX operations and areas where all of them could expand. A store-heavy operation who is an omnichannel player like KMX has much in common with large public dealers.

Sheds light on auto OEM cycles: Used car trends shed light on the auto manufacturing sector cycles who generate the vehicle supply, drive transaction volumes (and trade-ins), and provides financial incentives and floorplan financing for the dealers. In the end, the OEMs drive fleet growth, transaction activity, demand, and affordability. Those dealers will also be in the vanguard of any EV transition outcomes – success or failure – critical on the other side of the aftermarket.

Monitoring car rental risks: The used car remarketing dynamics are crucial to car rental fleet management and earnings with used car depreciation essentially serving as a cash expense to major HY debt issuers as Hertz (see Credit Crib Note: Hertz (HTZ) 5-14-24) and Avis (see Credit Crib Note: Avis Budget Group (CAR) 5-8-24). CVNA’s direct relationship with Hertz has been an easy example of the ties.

Watching the rise of digital: Looking across the range of auto retail players, KMX is the incumbent leader in used car sales with its omnichannel model and Carvana is next at #2 but #1 in dedicated digital used car retail with a growing presence in the physical asset space as it expanded its base of reconditioning assets (see Carvana: Counterattacking in Style 5-6-24).

We look at the time series for KMX retail prices above since the end of 2018, and we look at wholesale price levels further below. In looking at the chart, please remember that FY 2022 is mostly comprised of calendar year 2021. Similarly, FY 2023 was primarily calendar year 2022 when prices peaked. Those two fiscal years saw used vehicle prices soar as the pent-up demand kicked into gear after used vehicle inventory was scarce. While prices have dialed back from the peaks, the used retail and wholesale prices are still materially above COVID and pre-COVID prices.

The bigger challenge for KMX is how it can recapture its “growth mojo” and fortify its relative stock performance until rates decline more and monthly payment affordability improves and drives a strong rebound in new and used car transaction volume.

While the secular shift toward used from new on affordability has been a trend, the supply of used gets bolstered by higher trade-ins, more lease returns, and more fleet activity. The market has had a tough few years across most of those volume categories with COVID, supplier chain pain, car rental meltdowns, a recession-level new vehicle market in the 2022 calendar year in the tightening cycle, and consumer pressures.

Wholesale price levels are important along the retail chain from dealers (franchised or independent) to online players. KMX uses the term “wholesale” to refer to vehicles that are typically 10 years old and have 100K miles on the meter. Such cars would not meet their retail inventory criteria. They can be easily sold in a used car world that includes tens of thousands of non-franchised independent auto dealers and a growing base of digital retail channels.

The wholesale price history also underscores the inflation history of used cars in the post-COVID cycles with the above being actual transaction prices from the industry leader. Inflation for used vehicles peaked in calendar 2022 over 40% (see Automotive Inflation: More than Meets the Eye 10-17-22).

The rollup of auto retail operations and various “other” revenue lines are captured above and offer a reminder of the low margin profile of auto retail with sub-2% net margins in FY 2023, FY 2024, and into 1H25. Gross margins are down from the 12% and 13% handle peaks in FY 2021 (mostly a COVID year) and FY 2020 (mostly calendar 2019).

The above chart gets down into the next layers of margin analysis in terms of GPUs at the retail and wholesale revenue level. The good news was total gross profits rose in 2Q25 and 1H25. GPUs were net favorable.

The primary generator of profit margins is used Retail with Wholesale and “Other” serving as material contributors. The “Other” segment is heavily influenced by Extended Protection Plan products and ancillary business lines such as Advertising and Subscription revenues and Labor/Parts income for repair services.

CarMax Auto Finance (CAF)

Within its finance operation, CAF is growing its presence as a credit counterparty by expanding its origination volumes and funding alternatives in the ABS market. CAF is looking to expand over time as a full spectrum lender.

Meanwhile, the #1 franchised auto retail player, Lithia, is also building out a captive finance business after a stretch of debt-heavy M&A (see Credit Crib Note: Lithia Motors (LAD) 9-3-24) with the #2 (former #1) retailer, AutoNation, also expanding in captive auto finance with the entire auto retail industry getting busier in the ABS space (see Credit Crib Note: AutoNation (AN) 6-17-24).

We summarize some of the key aspects of CAF performance below in bullet format since there is a lot going on here. The easy summary is asset quality is eroding, and the company was only dipping its toe into higher risk origination. KMX expanded in riskier credit in 2022 and quickly dialed it back in 2023. The net credit losses are creeping higher vs. history and edged above 2% in 2Q25, so provisioning is at risk on the income statement.

For now, the reserve balances are adequate using the provision run rate vs. net charge-offs (charge-offs net of recoveries), but the trend is unfavorable and should be a headwind as calendar 2024 (FY 2025) rolls on. Contract rates of 11.5% are at a high in 2Q25 (vs. 8.4% in FY 2020 and FY 2021) The interest rate backdrop and the “monthly bite” in the household budget is a problem for both volume and asset quality.

A summary of moving parts at CAF:

CAF core lending activities: We detail a range of financial trends and portfolio metrics above, but it is worth stressing that CAF has traditionally run a high-quality portfolio with a weighted average credit score currently at 725 for 2Q25, which is up from 721 in 2Q24.

Managed receivables, asset quality, and credit losses: Origination volumes dipped very slightly along with the penetration rate while the managed receivables base continued its slow and steady rise. KMX posted higher sales volumes, so the room to grow was there but did not happen at those contract rates. Such trends always come with the asterisk of the customer credit quality balance. We cited the high weighted average FICO scores above, but asset quality is weaker nonetheless with 2% range net credit losses after years in the 1% range.

Provisioning vs. reserves: Provisions climbed to reflect new origination and revised provisioning on the current portfolio. The reserve decline to 2.82% from 3.08% in 2Q24 will raise eyebrows at a time of higher losses, rising delinquency rates, and lower recovery rates tied to weaker used car prices.

Delinquencies: Delinquency rates serve as a leading indicator, and the rise in “past dues” to over 5.5% is material in the context of rates below 3% in FY 2021. The 2017 to 2019 time horizon would be considered more “normalized” in terms of economic conditions (with 8% contract rates) and those delinquency rates were in the low to high 3% range across 2017-2019.

Loan-to-value vs. recovery rates: The LTV levels are down from the 90% range seen from FY 2021 and pre-COVID years (94.8% in 2019, 95.0% 2018) with some of that explainable by the spike in used car values in 2021-2022 that were not going to be sustainable (and prices declined since). The sliding recovery rates make the loan riskier after peaking at over a 70% recovery rate at the end of FY 2022 (ended Feb 2022) just ahead of the tightening cycle. With recovery rates now down to under 48% at 2Q25, that raises the loss exposure risk on repossession.

Overall, the CAF business is a good profit generator and a critical business to capture more value from its leading franchise and leverage its technology investments in digital retailing (buy and sells). KMX is also developing/utilizing an array of AI tools and credit scoring analytics that are getting rolled into its core operations.

Whether using its own balance sheet or those of third parties for a fee, the income line should benefit as rates move lower on the front end and CAF continues its journey along the full spectrum learning curve. KMX has taken tangible action to support the view that it is not barreling into higher risk tiers but is moving deliberately.

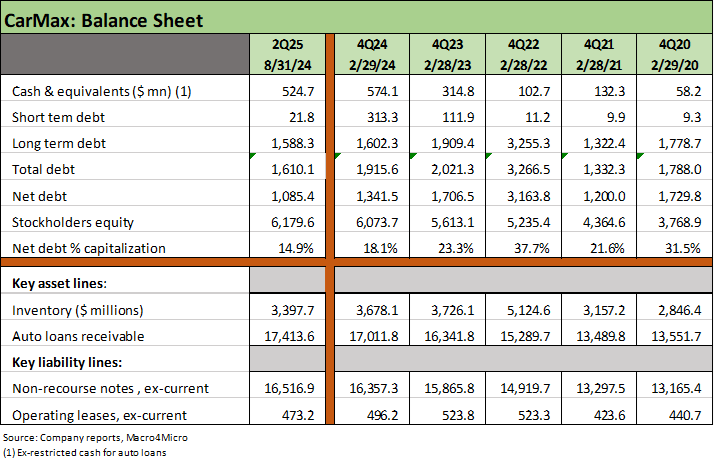

Balance sheet and cash flow trends at CarMax…

The direction of the balance sheet at KMX is clearly favorable with total debt declining by over $1.6 bn since FY 2022. We have seen even more debt reduction this current fiscal year (FY 2025), in turn leaving net debt leverage at multi-year lows. With Net Debt % Cap down by almost 23 points since FY 2022 to under 15%, the health of the balance sheet is clear enough. KMX has an investment grade caliber financial profile.

KMX does not pay a dividend and relies on share buybacks to reward shareholders (see links at bottom for more KMX background. We noted the trailing equity performance at the top of this commentary, and the near-term focus is likely to remain on buybacks and capex with KMX sticking to its “long game” on building out its CAF business and digital footprint and store locations.

The capital allocation as detailed above shows the focus on buybacks with KMX not paying a dividend by choice. KMX has ample earnings and cash flow flexibility but has used buybacks as its main allocation plan. The buyback numbers were very aggressive in 2019 (FY ended Feb 2019), 2020 (Feb 2020), and FY 2022. FY 2021 was dominated by COVID and KMX tapped the brakes. Then ZIRP and a pent-up durables boom and vehicle demand sent used car demand soaring.

See also:

CarMax:

CarMax F1Q25: Ringside Update on the Used Car Market 6-26-24

CarMax FY 2024: Secular Neutral? Or Cyclical Gear Shift? 4-16-24

Credit Crib Note: CarMax (KMX) 2-21-24

CarMax: Credit Profile 7-9-23

CarMax 4Q23: Wacky Market, KMX Stays Steady 4-11-23

Other Auto Retail and Car Rental:

Credit Crib Note: Lithia Motors (LAD) 9-3-24

Auto Sector Equity Performance Update: The Dealers 6-17-24

Credit Crib Note: AutoNation (AN) 6-17-24

Credit Crib Note: Hertz (HTZ) 5-14-24

Credit Crib Note: Avis Budget Group (CAR) 5-8-24

Carvana: Counterattacking in Style 5-6-24

Avis: Gearing Up for a Transition Year in Fleet Costs 5-2-24