Mini Market Lookback: PCE Tailwinds, GDP Holds Serve

We look back at a week with good news on inflation but steady, constructive macro news leaving the UST curve perplexed.

The power of PCE compels you…

We update a short list of key market trends in credit and equities this week after a good PCE report, a steady set of numbers for the final 2Q24 GDP growth stats, and some useful color from Harris on her econ game plan as she tacks toward the center.

The run rate on PCE over the last few months is close to target but history has not shown the 2.0% target to be easily reached or sustained outside of problem markets such as the post-crisis period.

The expectations for the long end of the UST curve going much lower from here has more than its share of doubters with two candidates vying for bigger deficits on the other side of Inauguration Day.

The final 2Q24 GDP and the PCE Price, Income & Outlays release are still showing soft landing odds with revisions upward in savings rates one of the more notable takeaways (see PCE Prices Aug 2024: Personal Income & Outlays 9-27-24).

The above chart highlights what a quiet week it was for the UST curve with the longer end of the UST inclined to be indecisive and wait for the next round of employment indicators. The coming week brings JOLTS and then monthly payroll numbers, so they will get more attention with the Fed’s “toggle” to more focus on the employment side of the duel mandate.

The PCE lines were very agreeable this past week for lower UST (see State Level Economic Reality Check: Employment, GDP, Personal Income 9-28-24), but the mix of macro releases is not telling adverse stories at this point. We will get the latest round of ISM reports this week after a mixed report from Durables following a long stretch of mediocre manufacturing data that has partially offset the healthy consumer indicators (see Durable Goods Aug 2024: Waiting Game 9-26-24).

The state level data released on Friday pushes back on the gloom and doom scenarios and politically motivated descriptions of the health of the economy from many political talking heads (see State Level Economic Reality Check: Employment, GDP, Personal Income 9-28-24).

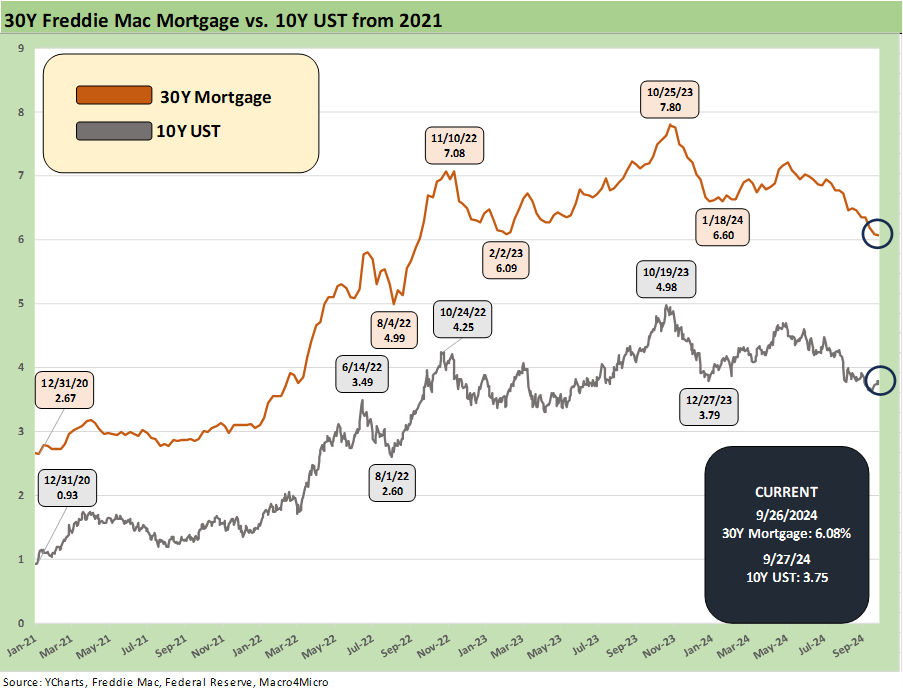

The above chart updates the path of the 10Y UST vs. the 30Y Freddie Mac mortgage benchmark. The Freddie 30Y is down near lows and close to knocking on the door of 5% handles.

The housing sectors saw some bellwether earnings reports this week with Lennar (see Lennar: Bulletproof Credit Despite Margin Squeeze 9-23-24) and KB Home (see KB Home: Steady Growth, Slower Motion 9-26-24). The expectations for FY 2024 homebuilding are solid. We also got the final numbers for August new single family home sales this past week (New Home Sales Aug 2024: Waiting Game on Mortgages or Supply? 9-25-24). We see little room for downside for economic activity in housing for the near term, but we will need to reevaluate after the election on potential tariff risks and chaos caused by mass deportation disruptions for the cycle.

The sense from the homebuilder earnings calls was that investors might be stalling in anticipation of more favorable mortgage rates later. That means delay is prudent for some if they want to see a wider range of alternatives from existing home inventory moving lower in price and better mortgage rates. In the meantime, the builders have their usual array of mortgage incentives they can use to drive business whether at current levels or in the event of a slower migration of the UST 10Y that drives the 30Y mortgage rate.

The above chart updates the 1-week asset returns on the 32 benchmarks and ETFs we track each week. We will be out with the full asset return review later this weekend, but the 1-week numbers show a score of 21 positive and 11 in negative range.

Despite good PCE numbers, we see weak bond ETF returns with 3 of 7 bond ETFs in negative range and 4 barely in positive range. The long duration 20+Y UST ETF (TLT) was on the bottom of the bond ETF return rankings. Interest rate sensitive financials weakened with Regional Banks (KRE) on the bottom and broad Financials (XLF) not far ahead. With macro commentary not telling a bearish story, the payroll color could be a big driver this coming week if it surprises.

Energy ETFs across E&P (XOP), broad Energy (XLE) and Midstream (AMLP) were all in the red as Saudi comments on supply and market share ambitions trumped the bullish news from China on more aggressive stimulus. The China chatter pushed EM equities (VWO) and Base Metals ETF (DBB) to the top of the weekly return list.

The above chart updates the Tech bellwether list with the Mag 7 plus Broadcom and Taiwan Semi framed against some broad market benchmarks. We line them up in descending order of 1-week returns.

Tesla and NVIDIA got a big bounce on the week. TSLA is still sitting as the only bellwether on the list with a single-digit return YTD of the Mag 7 and on the bottom of the bellwethers. NVDA is by far the #1 YTD despite being negative for 1 month and 3 months. Alphabet is the only other bellwether at negative for 1 month and 3 months.

The above chart updates the HY OAS, which barely moved and is still at levels more in line with cyclical low ranges seen across the cycles at +314 bps. The week saw minimal action. We will frame the histories in the full Footnotes piece later, but HY continues to hang in at very compressed levels (see Footnotes & Flashbacks: Credit Markets 9-23-24).

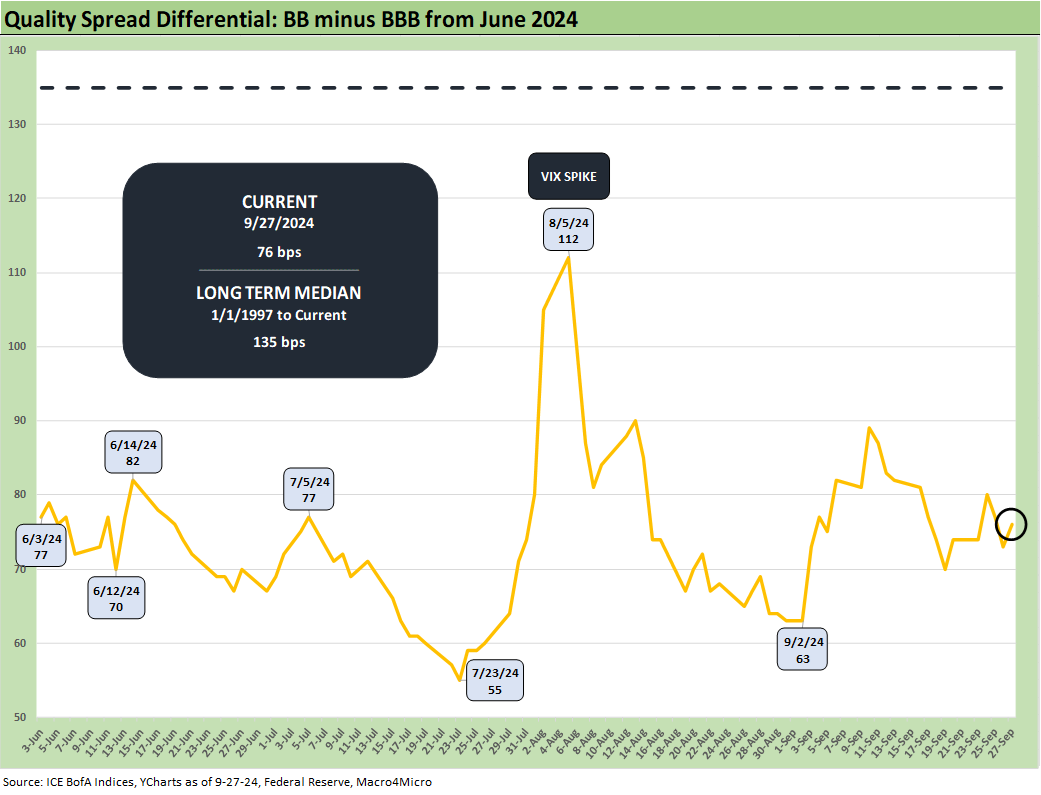

The update on the quality spread differential between IG and HY is flat on the week with minimal movement on each side.

The above chart updates the quality spread differential along the speculative grade divide with again almost no meaningful action at +76 bps vs. +74 bps last week.

See also:

State Level Economic Reality Check: Employment, GDP, Personal Income 9-28-24

PCE Prices Aug 2024: Personal Income & Outlays 9-27-24

KB Home: Steady Growth, Slower Motion 9-26-24

Durable Goods Aug 2024: Waiting Game 9-26-24

2Q24 GDP: Final Estimate and Revision Deltas 9-26-24

New Home Sales Aug 2024: Waiting Game on Mortgages or Supply? 9-25-24

Lennar: Bulletproof Credit Despite Margin Squeeze 9-23-24

Footnotes & Flashbacks: Credit Markets 9-23-24

Footnotes & Flashbacks: State of Yields 9-22-24

Footnotes & Flashbacks: Asset Returns 9-22-24

Mini Market Lookback: FOMC Week 9-21-24

FOMC Action: Preemptive Strike for Payroll? 9-18-24

Home Starts Aug 2024: Mortgage Rates to Kickstart Hopes Ahead? 9-18-24

Retail Sales: Down to the Wire? 9-17-24

Industrial Production: Aug 2024 Capacity Utilization 9-17-24

Consumer Sentiment: Inflation Optimism? Split Moods 9-13-24