Home Starts Aug 2024: Mortgage Rates to Kickstart Hopes Ahead?

We look at starts with the mortgage rates down last week as FOMC stirs hope for 2025 and expanding new and existing home supply.

New housing starts in total weigh in higher sequentially (+9.6) and were up YoY (+3.9%) with single family up a robust +15.8% from July and a more muted but positive +5.2% YoY.

For single family, the critical #1 South region posted +18.9% sequentially while down -6.3% YoY with the #2 market in the West was at +2.8% sequentially and +10.7% YoY.

With the Harris housing sector plan in need of more infill on the details, the supply side of the equation remains by far the most important for easing shelter inflation whether actual rents, implied/derived shelter inflation (OER), and actual home transaction prices that are not used in CPI (see Harris Housing Plan: The South’s Gonna Do It Again!? 8-28-24).

Permit activity for all housing was muted relative to starts at +4.9% from revised July numbers but -6.5% YoY on plunging multifamily (-16.8%) with single family permits YoY only down -0.5%.

Before we get into the starts and permits detail for single family and multifamily, the above chart updates where the major homebuilder stocks are running across various time horizons. We line them up in descending order of YTD total returns. It is safe to say that the market likes what it is seeing around the fundamentals of the industry and what it sees ahead for rates as mortgages dipped down again this past week and await FOMC news today (see Footnotes & Flashbacks: State of Yields 9-15-24).

The market will need a lot more information from Harris on her housing plan to make an assessment on what it all means at this point (see Harris Housing Plan: The South’s Gonna Do It Again!? 8-28-24). For now, skeptics will write her plan off as politics and that her goal of offering financial support on the demand side will just feed the inflation and price resilience of single family homes in the low end that are already under the most strain based on mortgage rates and monthly affordability when framed vs. income.

The complexity of housing is not in having votes to give down payments and offer tax incentives but in offering incentives to drive supply. We cover that topic in the Harris housing comment link above. The idea of saying you want affordable housing while waving in attacks on builders who build and sell single family homes for rent (the predatory investing theme) is a good way to fail out of the chutes just to placate some of the more extreme progressives in the Senate (Warren et al). If there is not a viable supply angle that brings the builders, contractors, and subcontractors into the game, the plan will be an attempt that will not address both sides of the problem (supply and demand).

In defense of Harris on the attempt (so far thin on the supply side details) is that Trump has offered no plans and continues to deliver his usual economic incoherence other than slapping tariffs on the builder supply chain. In terms of housing policies, he has no policy with his usual serving of “jack with a side order of squat” on the topic.

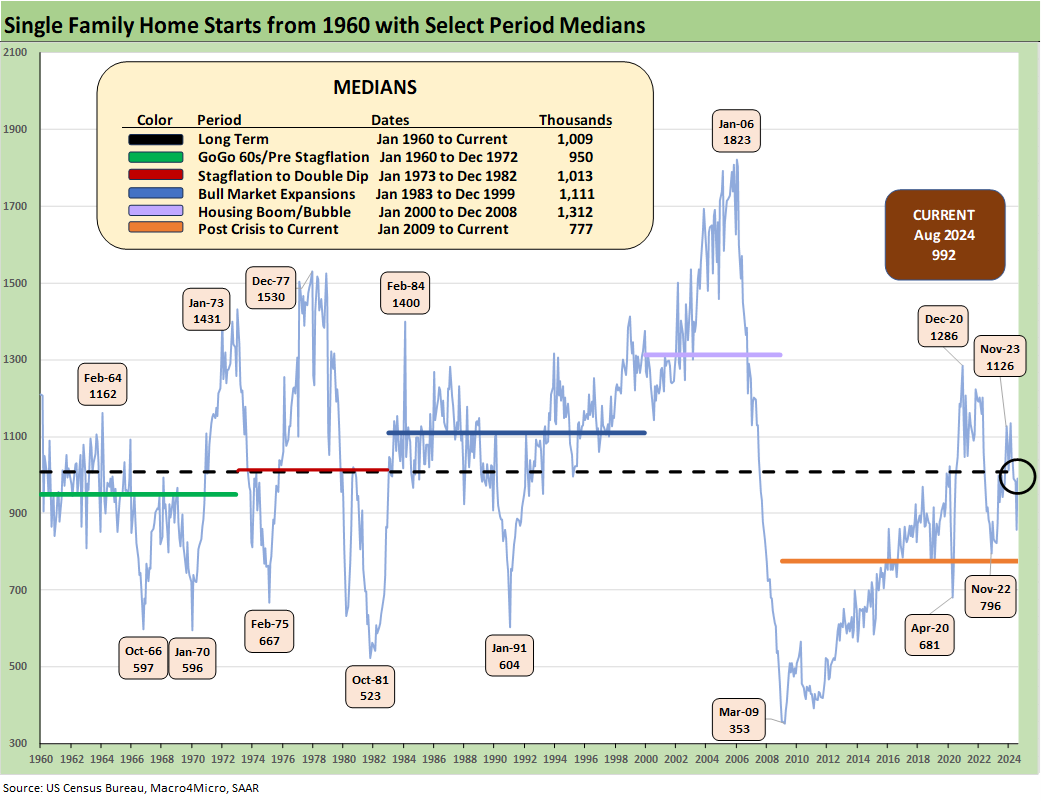

The above chart plots the long-term time series of single family housing starts (we address multifamily further below). The current 992K is inside the long-term medians, so that is not very impressive given the demographics and net excess demand.

Mortgage rates need to come down and at least that has finally started to unfold. The market could be knocking on the doorstep of 5% handles soon (even if high 5%) and that will still play to the builder advantage given the arsenal of incentives they have at their disposal as highlighted across a tough tightening cycle.

Builders can push those mortgage rates down further with buydowns and fee relief. Whether they will go that route is a question and especially if rates do in fact keep moving lower. After all, Trump’s tariffs will raise the builders’ unit costs, and that needs to be factored into pricing strategies. In other words, incentives on financing are one angle. Lower ASPs are quite different on a same-mix basis.

Whether the Harris housing plan will swim upstream against progressive orthodoxy by looking to give builders incentives to push supply chains and take more risk on development and permits remains to be seen. In historical context, 992K in starts is not reassuring on whether shelter inflation will be pressured lower or average selling prices on a same-product basis will get pushed lower.

The above chart updates the starts and permits lines for total housing and for single family homes on a not seasonally adjusted basis (NSA). The NSA numbers take you down closer to the “trenches” that are on the ground “where builders live.” The uptick in volumes is clear enough for single family starts with permits remaining muted in their move.

The above chart gives some sense of the scale and the trend line for starts by region. Like the prior chart, the above is on an NSA basis. The South (anchored by Texas and Florida) is by far the largest single family market at almost 59% of YTD single family starts on an NSA basis.

The above chart updates multifamily starts. We see 333K for August or just below the long-term median. That marks a -6.2% decline YoY for multifamily on a SAAR basis and -6.7% sequentially. Using YTD NSA numbers for 5+ units, we see a running YTD decline of -32.6%.

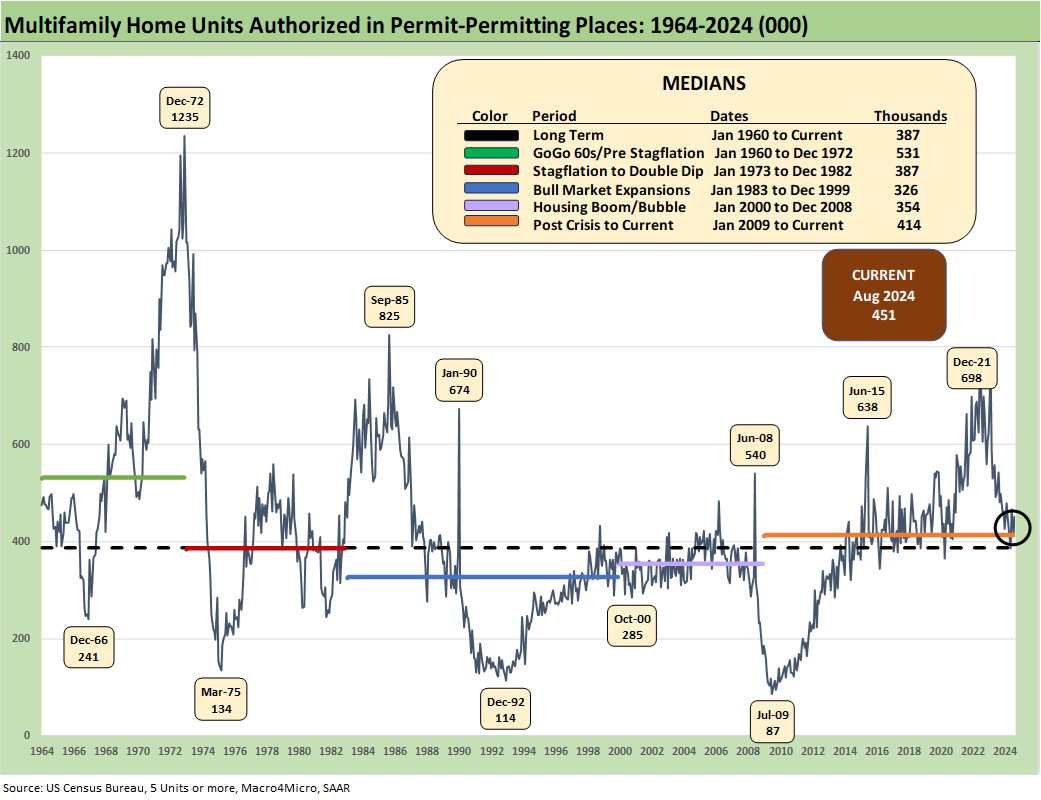

The above chart updates multifamily permits. Multifamily permits of 451K were down -16.8% YoY but up by +8.4% sequentially. For the YTD run rates on 5+ units permits on an NSA basis, we see permits down by -22.4%.

See also:

For housing:

Harris Housing Plan: The South’s Gonna Do It Again!? 8-28-24

New Home Sales July 2024: To Get by with a Little Help from My Feds? 8-25-24

Existing Home Sales July 2024: Making a Move? 8-23-24

Housing Starts July 2024: The Working Capital “Prevent Defense” 8-16-24

Credit Crib Note: PulteGroup (PHM) 8-11-24

Credit Crib Note: D.R. Horton (DHI) 8-8-24

New Homes Sales June 2024: Half Time? Waiting for Mortgage Trends 7-24-24

Existing Home Sales June 2024: Supply Up, Prices Up, Volumes Down 7-23-24

Housing Starts June 2024: Still All About the Deliveries 7-17-24

Homebuilder Equities: “Morning After” on Rate Optimism 7-12-24

Homebuilders: Equity Performance and Size Rankings 7-11-24

Credit Crib Note: KB Home 7-9-24

Lennar: Key Metrics Still Tell a Positive Macro Story 6-20-24

Credit Crib Note: NVR, Inc. 5-28-24

Toll Brothers: A Rising Tide Lifts Big Boats 5-23-24

Credit Crib Note: Taylor Morrison 5-20-24

Recent market related:

Footnotes & Flashbacks: Credit Markets 9-16-24

Footnotes & Flashbacks: State of Yields 9-15-24

Footnotes & Flashbacks: Asset Returns 9-15-24

A Strange Policy Risk Week: Mini Market Lookback 9-14-24

Consumer Sentiment: Inflation Optimism? Split Moods 9-13-24

CPI Aug 2024: Steady Trend Supports Mandate Shift 9-11-24

Facts Matter: China Syndrome on Trade 9-10-24

Tariffs: Questions that Won’t Get Asked by Debate Moderators 9-10-24

August 2024 Payrolls: Slow Burn, Negative Revisions 9-6-24