KB Home: Steady Growth, Slower Motion

KB Home saw equity markets wrestle with their valuation on earnings day (-5.3%), but steady growth in revenues, stable margins, and solid leverage help.

Built-to-order back in fashion…

We look at KBH results for more signals as one of the names with an August reporting period. The big question of late is, “Who is waiting for better mortgage rates after the FOMC actions?”

Growth in orders have faded in pace into a flattish quarter YoY but are up double digits YTD for this built-to-order operator.

KBH ranks towards the middle of the pack in size and average selling prices (ASPs) but offers a good vantage point on the high price West Coast markets (see Homebuilders: Updating Equity Performance and Size Rankings 7-11-24).

KBH is guiding to the area of post-crisis highs in revenues similar to the FY 2022 peak along with steady gross margins vs. 2023 as KBH leverage is down 10 points from 2020.

KBH is in a good position for IG status in 2025 if mortgage rates and the economic cycle meet optimists’ expectations, but there are plenty of moving parts in the cycle and rate picture.

Weight S&P 500 ETF (RSP). We looked at a broader range of homebuilder equities across more time horizons in our earlier Lennar commentary (see Lennar: Bulletproof Credit Despite Margin Squeeze 9-23-24).

KBH has been making a comeback vs. the peer group over the past year but looking back 5 years it is only in line with a homebuilder group that has done well and demonstrated its financial and operating resilience across a pandemic, supplier chain turmoil, and a tightening cycle.

The irony of the tough rating agency criteria on the builder industry risk penalty in credit ratings is that the builders held up better than most banks/brokers across the housing crisis. The builders sure held up better than the quality and validity of the RMBS criteria that fueled the mortgage crisis. The same is true vs. the excesses of more than a few securities firms that are “no longer with us.”

The variable cost structures and stabilizing working capital dynamics of builders and their inventory make homebuilder credits safer in periods of cyclical uncertainty than leveraged financials and high fixed cost manufacturers.

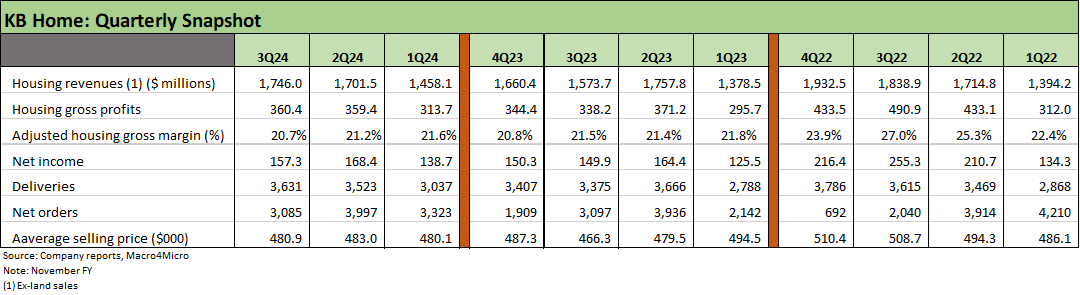

The above table gives the headline income statement numbers for KBH. Revenues and profits keep climbing, and KBH is guiding to a $6.9 billion top line for 2024 (fiscal year 11/30) with the expectation of 21% margins. Those would be solid numbers even if below the crazy revenue lines seen in the peak of the housing bubble.

For a very brief walk down a painful memory lane, KBH posted $9.36 billion in homebuilding revenues in 2006 on deliveries of over 32K units and an average price of around $288K. Times change – in price and volume and certainly in the quality of the buyer getting a mortgage.

The above table updates the timeline for Housing revenues and housing gross profits. While gross margins are down from the 2022 peak of over 24%, the 21% gross margins expected for FY 2024 are ahead of pre-COVID margins of 2019 and consistent with YTD and FY 2023 levels.

The above table shows the quarterly timeline from 1Q22 (note: 1Q22 ended in Feb 2022 or just before the end of ZIRP in March 2022). We break out each quarter since then through 3Q24 (8/31). We see peak gross margins of +27.0% in 3Q22 (8-31-22) for this built-to-order operator. The built-to-order model shows the effects kick in at a lag. We see peak deliveries posted in the 4Q22 quarter (11/30) after the peak net orders of 1Q22 for this 2022-2024 timeline.

The above chart gets into the old school “price x volume” framework as FY 2022 posted the peak annual deliveries during the transition from ZIRP and low mortgage years into the tightening cycle. The mix of deliveries has a lot of bearing on the next chart given the wide range of ASPs across the geographic operating regions.

The above chart frames the range of ASPs from the high-price West to the lower ASP Central region. The increased activity in the West in 2024, as detailed in the delivery chart, flowed into the higher total ASP line at $480.9K in 3Q24 vs.$466.3K in 3Q23. Overall, KBH is toward the middle of the public homebuilder pack in ASP ranking. We see the West ASP at almost 2X Central.

The balance sheet trend has shown impressive progress across the period from pre-COVID into the bullish housing cycle expectations seen in the builder rally of 2024 (see Footnotes & Flashbacks: Asset Returns 9-22-24, Lennar: Bulletproof Credit Despite Margin Squeeze 9-23-24).

Leverage has trended higher YTD but is still well down from the 2019 to 2022 period and the starting point of 35.2% detailed in the table. Asset coverage as defined by inventory or “cash + inventory” to total debt has trended favorably with inventory well over 3x total debt.

See also:

Footnotes & Flashbacks: Credit Markets 9-23-24

Footnotes & Flashbacks: State of Yields 9-22-24

Footnotes & Flashbacks: Asset Returns 9-22-24

Mini Market Lookback: FOMC Week 9-21-24

FOMC Action: Preemptive Strike for Payroll? 9-18-24

Consumer Sentiment: Inflation Optimism? Split Moods 9-13-24

Construction Spending: A Brief Pause? 9-3-24

PCE July 2024: Inflation, Income and Outlays 8-30-24

2Q24 GDP 2nd Estimate: The Power of 3 and Cutting 8-29-24

Housing and Homebuilders:

New Home Sales Aug 2024: Waiting Game on Mortgages or Supply? 9-25-24

Lennar: Bulletproof Credit Despite Margin Squeeze 9-23-24

Existing Homes Sales Aug 2024: Mortgages Still Rule 9-19-24

Home Starts Aug 2024: Mortgage Rates to Kickstart Hopes Ahead? 9-18-24

Harris Housing Plan: The South’s Gonna Do It Again!? 8-28-24

New Home Sales July 2024: To Get by with a Little Help from My Feds? 8-25-24

Existing Home Sales July 2024: Making a Move? 8-23-24

Housing Starts July 2024: The Working Capital “Prevent Defense” 8-16-24

Credit Crib Note: PulteGroup (PHM) 8-11-24

Credit Crib Note: D.R. Horton (DHI) 8-8-24

New Homes Sales June 2024: Half Time? Waiting for Mortgage Trends 7-24-24

Existing Home Sales June 2024: Supply Up, Prices Up, Volumes Down 7-23-24

Housing Starts June 2024: Still All About the Deliveries 7-17-24

Homebuilder Equities: “Morning After” on Rate Optimism 7-12-24

Homebuilders: Equity Performance and Size Rankings 7-11-24

Credit Crib Note: KB Home 7-9-24

Lennar: Key Metrics Still Tell a Positive Macro Story 6-20-24

Credit Crib Note: NVR, Inc. 5-28-24