Footnotes & Flashbacks: Asset Returns 3-23-25

A recovery week for asset performance despite negative news flow and some bellwether blues.

Say “the seller pays the tariff” or I take the other hand!

A broad rally week in both equities and debt does little to change the main event ahead as the countdown to reciprocal tariffs is getting shorter.

Reverse engineering of “tariff equivalents” under the reciprocal methodologies will have some dark magic in the assumptions as otherwise reputable business leaders and pedigreed economists will cut off their right hand to make a case for the numbers.

The ability to generate a list of non-tariff barriers could run from VAT taxes to franchise laws, rafts of local regulations, market access (e.g. media, financial services, etc.) and buyer traditions to create market penetration problems for US companies that will make a lot of noise and lead to more retaliation.

In the meantime, the market is bracing for the rollout and using current run rate data and rear-view mirror econ releases. All the action in tariffs is forward-looking and are leaning on assumptions.

· Our tariff prediction, to quote the reputed economist, Clubber Lang: “PAIN.”

The above chart updates the running returns for the high-level debt and equity asset classes we track each week. The debt side of the world has seen an easier time in 2025 than the equity world, but that duration edge in total returns has been more about unfavorable macro news than high confidence in lower inflation or meeting the 2.0% target.

Looking back across the 1-month time horizon, we see all negative returns for the equity benchmarks from small caps to large caps and for both growth and value. For the 3-month time period, only the Russell 3000 value index was positive at 1.0% with the rest negative.

The next leg of the journey will be facing reciprocal tariffs. The market will likely be moving into the next round of hand-to-hand retaliation combat if the recent pattern holds true to form. With the EU soon stepping into the fray in a bigger way with Canada adding some drama with an election where the theme will be “who will stand up against Trump.” That means a tough guy contest. And of course, Trump will weigh in and the noise will get louder.

Canada has the 51st state and economic coercion while the EU has the Ukraine betrayal, Musk’s AfD fanboy status, and Trump’s full embrace of Putin as an incentive for the EU to stay aggressive - even if for domestic politics alone. We looked at the EU’s anti-coercion instrument and those dark economic overtones in the Mini Market Lookback: Fed Gut Check, Tariff Reflux (3-22-25). The range of potential outcomes ahead in tariffs is a wide one with Trump still repeating the words “rip-off” and “subsidy” over and over with not much else of substance.

The quality of the Trump cabinet tariff marketing has struggled, and this past week brought a new low. Bessent approaches it from 30,000 feet and it has not sold well. Meanwhile, Lutnick has not delved into the sea level topics and did not help his credibility with his (paraphrased) “old people won’t complain about not getting their social security checks” pitch. For anyone seeking an updated social security card (e.g., for new drivers’ license requirements) or dealing with Medicare, good luck. The idea of gutting staffing, phone service, and locations for Social Security and Medicare will come back to haunt the GOP at the ballot box since they will be blamed for every problem that is experienced.

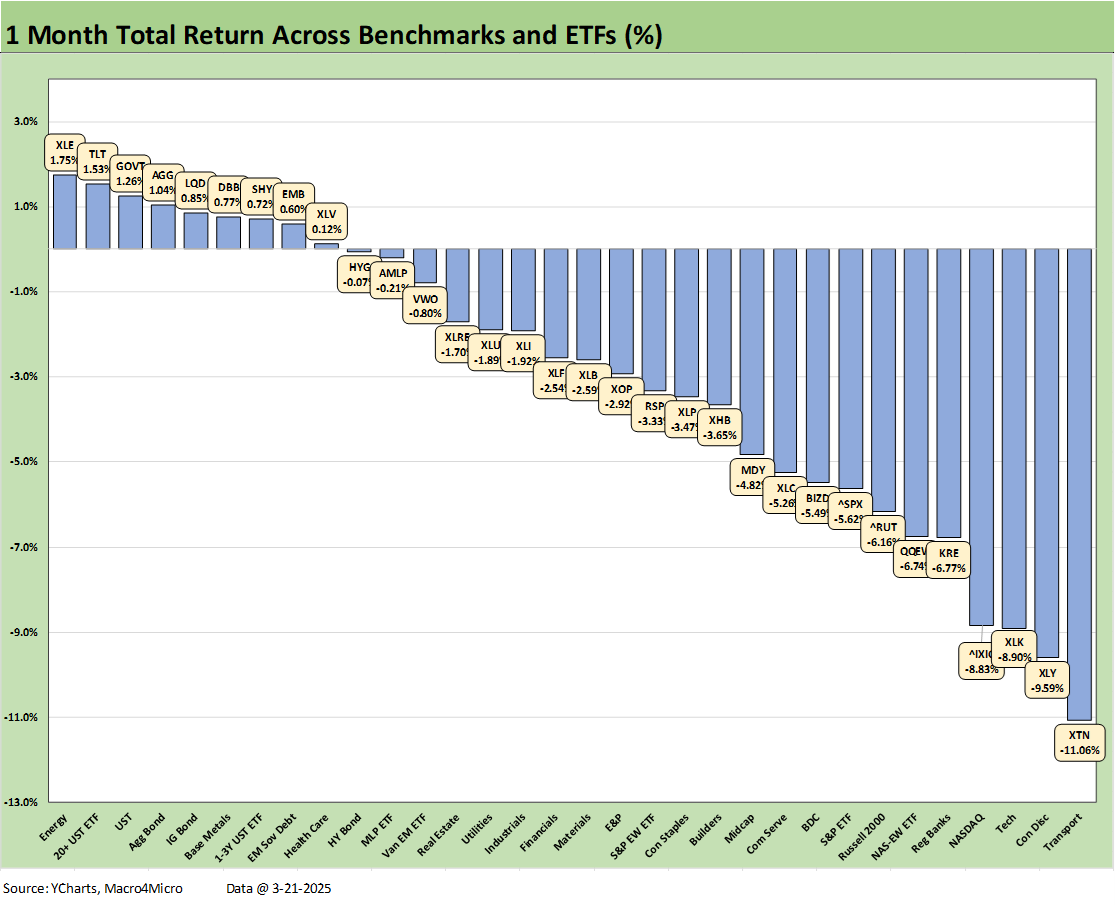

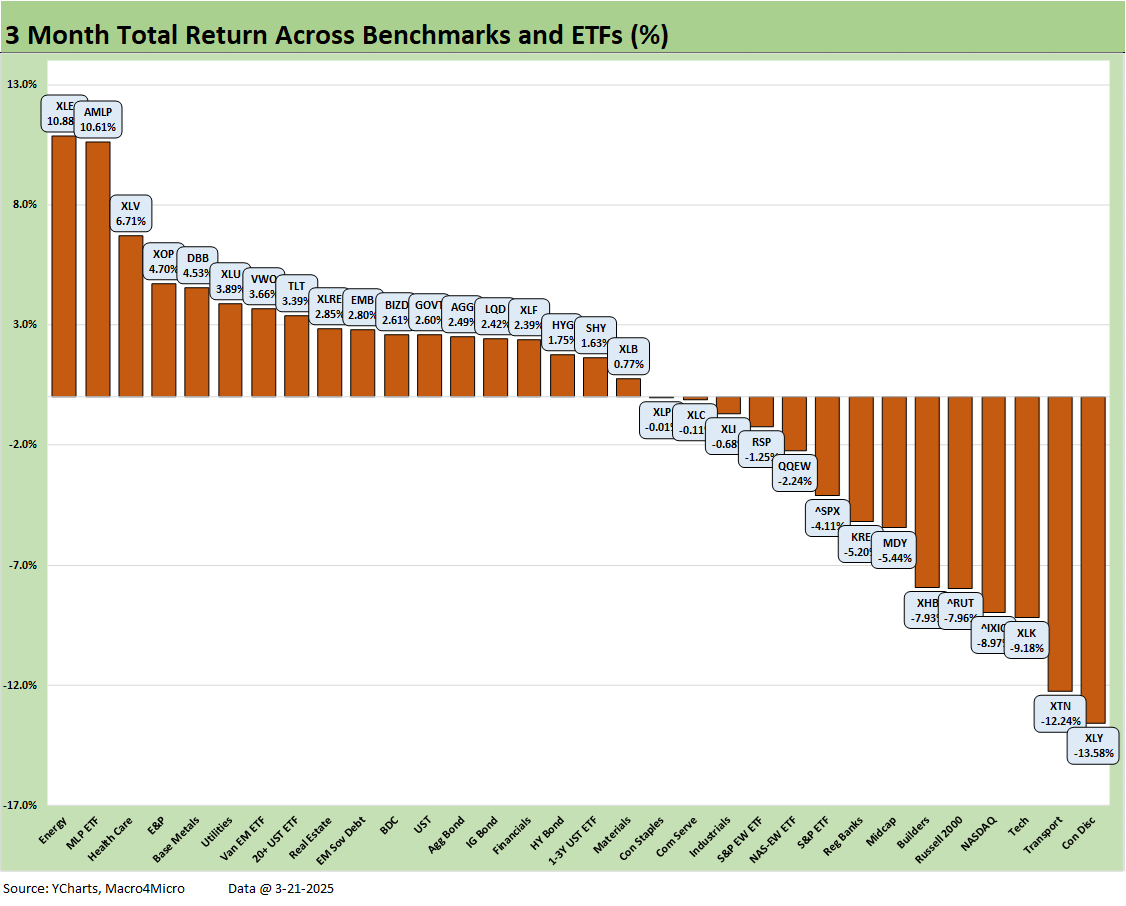

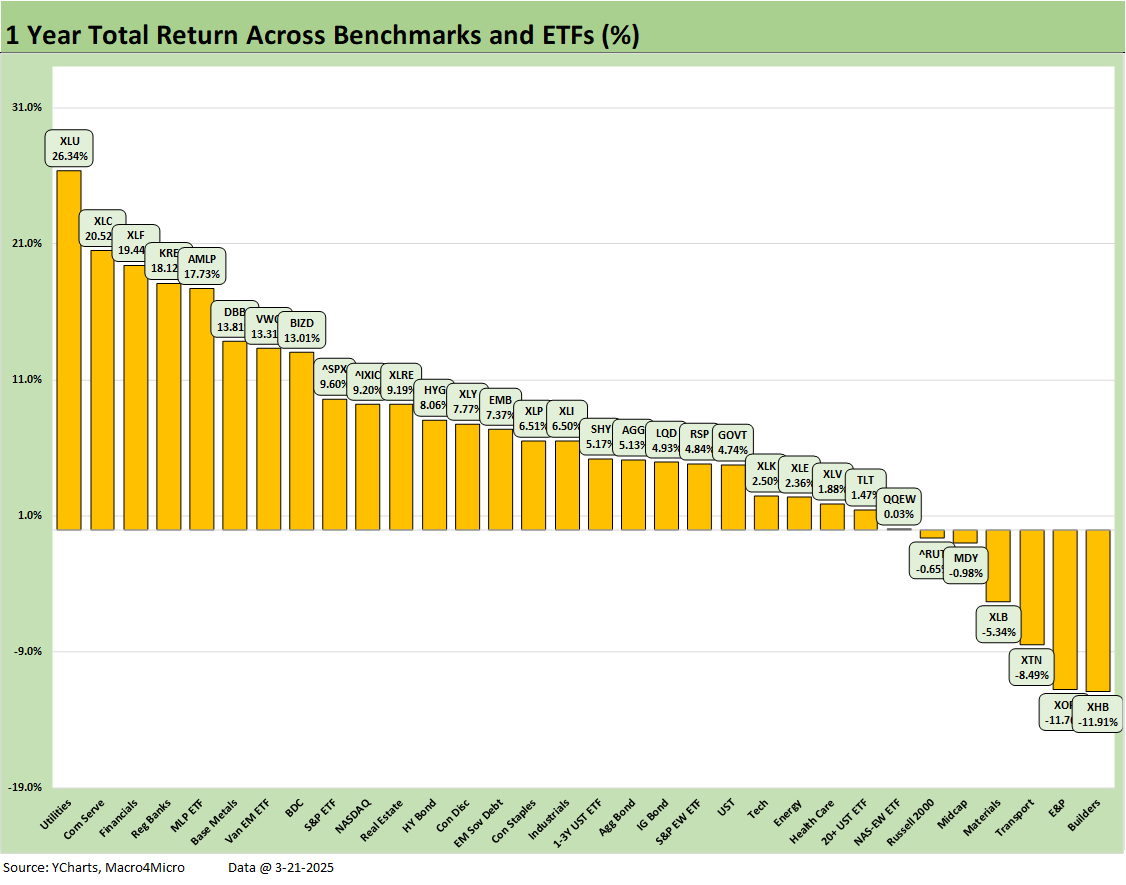

The rolling return visual

In the next section, we get into the details of the 32 ETFs and benchmarks for a mix of the trailing periods. Below we offer a condensed 4-chart view for an easy visual on how the mix of positive vs. negative returns shape up. This is a useful exercise we do each week looking for signals across industry groups and asset classes.

The shiny results in the 1-week mix of returns does not change the high-anxiety challenges ahead in the tariff battles. Headline fatigue might set in with respect to hair trigger market reactions, but the clock ticking on tariffs will bring sea-level microeconomic impact that can’t be ignored. We are getting to the point where all the border costs require transaction level decisions that will finally start flowing into economic releases, choices by consumers, and company-level decisions on capex, supplier chain adjustments/negotiation, cost mitigation measures (layoffs? paused hiring?), and capex planning. In other words, this is about to get real and measurable.

The need for many parties to hit “pause” will be no surprise, and that risk has been getting more visibility lately. The 2018-2019 experience offers ample history even at much lower and less sweeping tariff actions. The 1Q25 earnings season will bring pressure on management teams to articulate the impacts. The “we won’t speculate on tariffs” commentary won’t fly at that point since they presumably will have real numbers in hand by then. Then the street equity research players have to weigh revised guidance (or suspended company guidance). The assumption is earnings will be revised lower with another question being whether the market will also start to see valuation multiple compression.

This week the market gets PCE inflation and income and outlays after last month’s decline in consumption was an outlier (see PCE Jan 2025: Prices in Check, Income and Outlays Diverge 2-28-25). Everything lags the headline and this coming week we only get the final GDP numbers for 4Q24.

Among notable news this past week was the downward revision of median GDP growth for 2025 by the Fed to only 1.7%. Trump had always misstated his economic performance during Trump 1.0 (see Gut Checking Trump GDP Record 3-5-25, Trump's “Greatest Economy in History”: Not Even Close 3-5-25 ), but a 1% handle expectation begs some more commentary from Bessent and Lutnick than what they give from their recent 30,000 foot ambiguities. Which GDP lines are vulnerable and why? The tariff multiplier effects can never get enough focus. They talk around the topic.

The Magnificent 7 heavy ETFs…

Some of the benchmarks and industry ETFs we include have issuer concentration elements that leave them wagged by a few names. When looking across some of the bellwether industry and subsector ETFs in the rankings, it is good to keep in mind which narrow ETFs (vs. broad market benchmarks) get wagged more by the “Magnificent 7” including Consumer Discretionary (XLY) with Amazon and Tesla, Tech (XLK) with Microsoft, Apple, and NVIDIA, and Communications Services (XLC) with Alphabet and Meta.

We already looked at the tech table in Mini Market Lookback: Fed Gut Check, Tariff Reflux (3-22-25). We line the group up in descending order of weekly returns. We see 5 of the Mag 7 in the red for the week with a split decision on Taiwan Semi vs. Broadcom with TSM positive and AVGO in the red. The 1-month returns are all negative for all lines with 2 of the Mag 7 – NVDA, META – and AVGO on the bottom with -12% handle returns.

Looking back 3 months, we see just Meta in positive range with a 1% handle. TSLA is at -41% for 3 months. We see 6 of 7 Mag 7 names with negative double-digit returns over 3 months. That said, we see 6 of the Mag 7 with positive double-digit returns in a wide range over the trailing 1-year with only MSFT in the red. Over the past 1-year horizon, 6 of the Mag 7 have outperformed the S&P 500, the NASDAQ, the Equal Weight S&P 500 (RSP), and the Equal Weight NASDAQ 100 ETF (QQEW).

The 1-week numbers certainly look good in the positive return symmetry and broke the losing streak of late. That said, under the hood came some disappointing expectations from the Fed dot plot in inflation, GDP growth, and employment, which all saw negative revisions from the Dec 2024 projections.

The market saw some negative headlines and stock hiccups this past week with more guidance warnings or qualitative discussions of weaker fundamentals from names such as FedEx, Nike, and Lennar. That comes after the prior week saw some more retail and airline warnings. The consumer sector will get a temperature check this Friday with PCE outlays numbers, but the consumer sector is showing more symptoms of a fade.

Watching the consumer sector for purchase plans from big (houses, autos) to small (Walmart, Nike) is sending more bad news. Retailer warnings have been the most common, but builders have echoed the sentiment that the incentives are not working like they did in 2023 and 2024. The fallout for autos from the raw material piece of the puzzle across a tariff-influenced supplier chain to higher rates lingering on auto loans were enough on their own. The auto tariffs – as discussed to this point – will decimate the industry on costs and production disruptions while also severely constraining new auto supply.

Homebuilding is no party in equities. Lennar is essentially in a tie for the rank of #1 homebuilder in sales and assets at the most recent quarter (DHI has a much larger market cap). The builder reports have signaled continued pressure on builder margins, and that has been undermining builder equities since the 2024 homebuilder equity boom that came to a screeching halt in 4Q24. Lennar is a very strong company financially and has a distinctive strategy of sacrificing margin for steady production volumes and high inventory turnover (see Credit Crib Note: Lennar Corp (LEN) 1-30-25). That does not change the reality of what will be multiyear lows in gross margins for LEN in 2025. We will update Lennar in a separate note for its 1Q25 earnings (Feb 2025 fiscal quarter).

The DOGE carnage and sense that the asylum is issuing chainsaws at the door to the inmates is not helping the mindset. The steady hand in the White House is flipping the bird to the justice system (judges) and NATO allies (Canada, EU). The response of Europe and Canada is now moving into the zone of a total makeover of sovereign borrowing and fiscal priorities (defense, infrastructure) with European defense equities hot for a good reason.

Geopolitics wags fiscal plans and some very big supplier chains…

Numerous countries are reevaluating their plans in US defense procurement from a nation behaving not only like one who isn’t an ally but for some nations taking on the profile of a nation operating like an enemy. More countries are evaluating alliances and considering their budgets in the context of the battles they could face rather than the theories around NATO and the nuclear umbrella. The defense trade rags are lighting up with ideas around what the priorities should be for Europe and Canada.

The trailing 1-month period weighed in at 9-23 with bond ETFs comprising 6 of the 9 that generated positive returns and 6 of 8 in the top quartile with the broad Energy ETF (XLE) and the distinctive Base Metals ETF (DBB) also in the top tier. HY (HYG) and AMLP in the income asset bucket are in the upper end of the second quartile.

The bottom ranks show Transport (XTN) dead last after the airline earning warnings and continued weakness expected in freight and logistics as tariffs could weigh on total trade in 2025. The Consumer Discretionary ETF (XLY) with its Amazon and Tesla concentration and the Tech ETF (XLK) and NASDAQ were in the bottom 4 with Regional Banks (KRE) rounding out the bottom 5. An interesting divergence to watch will be Regional Banks (KRE) relative to broad Financials (XLF).

The 3-month timeline posted a score of 18-14, but that comes with the asterisk (a big asterisk) of the 4 major equity indexes from large cap to small cap that we include above all in negative range. From the bottom up, we see NASDAQ, Russell 2000, and Midcaps clustered in the bottom quartile with the S&P 500 just across the line in the bottom of the third quartile.

In the top quartile, Energy (XLE) ranked #1 with the high income Midstream Energy ETF (AMLP) next on the list with E&P (XOP) and Base Metals (DBB) in the top 5 as well. We see the long duration UST ETF (TLT) near the bottom of the top quartile as duration has been a winner. Health Care (XLV), EM Equities (VWO), and Utilities (XLU) round out the top tier.

The trailing 1-year is still riding a great 2024 with the score now at 26-6 with the Russell 2000 and Midcaps sitting in the red and the Equal Weight NASDAQ 100 ETF (QQEW) essentially at zero but on the positive side slightly behind the long duration UST ETF (TLT).

Homebuilders are now sitting on the bottom after racing ahead into the lead by early fall with a +64% total return for 1 year at that point (see Footnotes & Flashbacks: Asset Returns 9-29-24). The post-easing decline in mortgages to just over 6.0% in Sept 2024 got the market very excited but it did not last.

The bottom quartile includes E&P (XOP), Transports (XTN), Materials (XLB) plus the US-centric Small Caps and Midcaps that also include a lot of financial names. Those industries on the low end are not offering a vote of confidence on the cycle or the consumer.

See also:

Mini Market Lookback: Fed Gut Check, Tariff Reflux 3-22-25

Existing Homes Sales Feb 2025: Limping into Spring 3-20-25

Fed Action: Very Little Good News for Macro 3-19-25

Industrial Production Feb 2025: Capacity Utilization 3-18-25

Housing Starts Feb 2025: Solid Sequentially, Slightly Soft YoY 3-18-25

Retail Sales Feb 2025: Before the Storm 3-17-25

Footnotes & Flashbacks: Credit Markets 3-17-25

Footnotes & Flashbacks: State of Yields 3-16-25

Footnotes & Flashbacks: Asset Returns 3-16-25

Mini Market Lookback: Self-Inflicted Vol 3-15-25

Credit Spreads: Pain Arrives, Risk Repricing 3-13-25

Trade: Betty Ford Tariff Wing Open for Business 3-12-25

CPI Feb 2025: Relief Pitcher 3-12-25

JOLTS Jan 2025: Old News, New Risks in the Market 3-11-25

Credit Spreads Join the Party 3-10-25

Mini Market Lookback: Tariffs Dominate, Geopolitics Agitate 3-8-25

Payrolls Feb 2025: Into the Weeds 3-7-25

Employment Feb 2025: Circling Pattern, Lower Altitude 3-7-25

Gut Checking Trump GDP Record 3-5-25

Trump's “Greatest Economy in History”: Not Even Close 3-5-25

Asset Returns and UST Update: Pain Matters 3-5-25

Mini Market Lookback: Collision Courses ‘R’ Us 3-2-25

PCE Jan 2025: Prices in Check, Income and Outlays Diverge 2-28-25

Tariff links:

Tariffs: Strange Week, Tactics Not the Point 3-15-25

Trade: Betty Ford Tariff Wing Open for Business 3-13-25

CPI Feb 2025: Relief Pitcher 3-12-25

Auto Suppliers: Trade Groups have a View, Does Washington Even Ask? 3-11-25

Tariffs: Enemies List 3-6-25

Happy War on Allies Day 3-4-25

Auto Tariffs: Japan, South Korea, and Germany Exposure 2-25-25

Mini Market Lookback: Tariffs + Geopolitics + Human Nature = Risk 2-22-25

Reciprocal Tariffs: Weird Science 2-14-25

US-EU Trade: The Final Import/Export Mix 2024 2-11-25

Aluminum and Steel Tariffs: The Target is Canada 2-10-25

US-Mexico Trade: Import/Export Mix for 2024 2-10-25

Trade Exposure: US-Canada Import/Export Mix 2024 2-7-25

US Trade with the World: Import and Export Mix 2-6-25

The Trade Picture: Facts to Respect, Topics to Ponder 2-6-25

Tariffs: Questions to Ponder, Part 1 2-2-25

US-Canada: Tariffs Now More than a Negotiating Tactic 1-9-25

Trade: Oct 2024 Flows, Tariff Countdown 12-5-24

Mexico: Tariffs as the Economic Alamo 11-26-24

Tariff: Target Updates – Canada 11-26-2